Scott Olson/Getty Images News

Investment Thesis: Investors are likely to expect significant improvement in overall earnings and stronger performance across the North American market before we see upside in the stock once again.

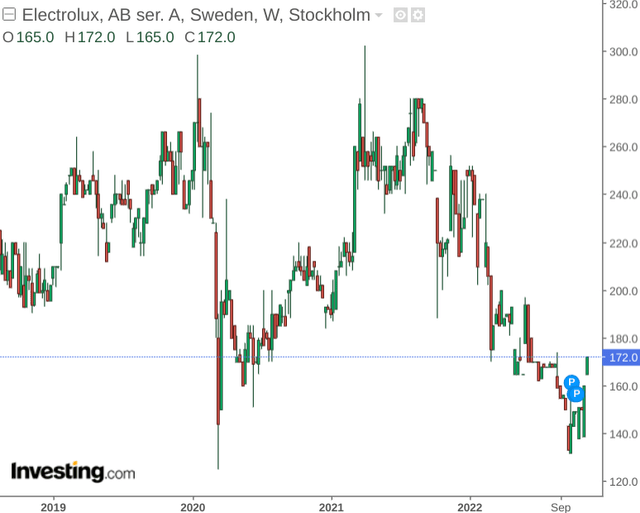

AB Electrolux (OTCPK:ELUXY) is one of the world's leading suppliers of household appliances. While the company saw significant upside following the March 2020 COVID-19 stock market crash - the stock has since reverted downwards to levels we saw during that period.

The purpose of this article is to investigate why Electrolux has seen such a significant drop - and whether the stock could have the potential to rebound from here.

Performance

When looking at the company's balance sheet, we can see that the quick ratio for Electrolux (calculated as total current assets less inventories all over total current liabilities) has decreased - indicating that the company is in less of a position to fund its current liabilities with liquid assets:

| Sep 2021 | Sep 2022 | |

| Total current assets | 65740 | 71164 |

| Inventories | 21337 | 31300 |

| Total current liabilities | 70635 | 80131 |

| Quick ratio | 0.63 | 0.50 |

Source: Figures sourced from Electrolux Q3 2022 Interim Report. Figures provided in millions of SEK except ratios. Quick ratio calculated by author.

Additionally, we can also see that the company's long-term borrowings to total assets have increased slightly over the past year:

| Sep 2021 | Sep 2022 | |

| Long-term borrowings | 10172 | 17614 |

| Total assets | 109100 | 128260 |

| Long-term borrowings to total assets ratio | 0.09 | 0.14 |

Source: Figures sourced from Electrolux Q3 2022 Interim Report. Figures provided in millions of SEK except ratios. Long-term borrowings to total assets ratio calculated by author.

When looking at Q3 2022 results, we can see that earnings saw negative growth - with the company citing a higher cost base due to supply chain issues as well as lower than expected performance across the North American market.

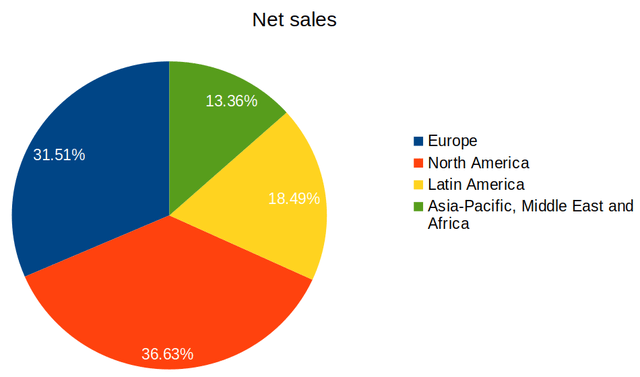

Moreover, the North American market accounted for the biggest portion of net sales for Q3 2022 - and thus it will be pertinent for the company to improve performance across this region going forward:

Q3 2022 net sales figures sourced from Q3 2022 Interim Report. Percentage calculations and pie chart created by author.

While North America saw a particular downturn in consumer demand in the face of rising inflation - the European market has also been affected. Emerging market growth was more encouraging - but as we can see from the above - Europe and North America account for nearly 70% of the company's total net sales.

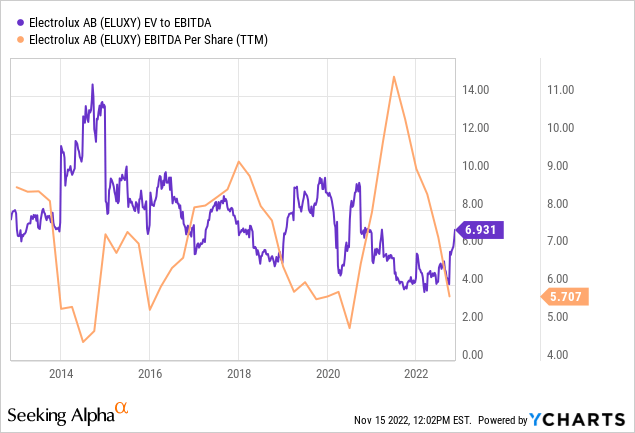

Additionally, we can see that while EBITDA per share had hit a 10-year high in 2021, this has fallen sharply to near a 10-year low:

ycharts.com

In this regard, investors are likely to demand significant earnings growth before we see the stock tick upwards once again.

Looking Forward

Going forward, Electrolux is banking significantly on an improvement in the North American market to lift overall growth - with a group-wide cost reduction and North America turnaround programme being implemented to lift earnings once again.

Particularly, Electrolux will focus on eliminating present cost inefficiencies in the company's supply chain along with enabling efficiency gains through organizational changes. Additionally, the company also seeks to optimise its R&D and marketing investments, by leveraging the highest ROI-opportunities. It is hoped that these initiatives, along with implementing cost efficiency in the new Anderson and Springfield facilities, will ultimately return the North American market to profitability.

With that being said, I take the view that investors will also be keeping an eye on short and long-term balance sheet metrics. For instance, if short and long-term debt loads continue to increase in spite of these initiatives, then this could mean further downside for the stock.

Conclusion

To conclude, Electrolux has seen significant pressure on earnings as a result of under-performance across the North American market.

While it remains possible that the company could turn this situation around through implementation of cost reduction initiatives - I take the view that investors will remain sceptical of the stock until the company can demonstrate significant earnings improvement across this market.

As such, I do not take a bullish view on Electrolux at this point in time.