Andres Jacobi

Introduction

At Conservative Income Portfolio we do a lot of analytical work to find the most undervalued fixed-income securities. We constantly are doing studies of the various sectors within fixed-income to locate securities that provide low risk but also outsized yields. In other words, good risk versus reward securities. We recently did an analysis of all banking preferred stocks and believe that WTFCP and WSBCP are clearly the best values in the banking sector and also top picks among all preferred stocks.

Personally, I don’t generally own bank preferred stocks because their yields tend to be relatively low and they are usually not undervalued according to my work. But I do own positions in WTFCP and WSBCP because they sharply stand out as undervalued.

Company Annual Report

Wintrust Financial Corp

Wintrust Financial (NASDAQ:WTFC) is a regional bank holding company offering a number of financial services. Here is what Yahoo Finance has to say about Wintrust.

Wintrust Financial Corporation operates as a financial holding company. It operates in three segments: Community Banking, Specialty Finance, and Wealth Management. The Community Banking segment offers non-interest bearing deposits, non-brokered interest-bearing transaction accounts, and savings and domestic time deposits; home equity, consumer, and real estate loans; safe deposit facilities; and automatic teller machine (ATM), online and mobile banking, and other services. It also engages in the retail origination and purchase of residential mortgages for sale into the secondary market; and provision of lending, deposits, and treasury management services to condominium, homeowner, and community associations, as well as asset-based lending for middle-market companies. In addition, this segment offers loan and deposit services to mortgage brokerage companies; lending to restaurant franchisees; direct leasing; small business administration loans; commercial mortgages and construction loans; and financial solutions. It provides personal and commercial banking services primarily to individuals, small to mid-sized businesses, local governmental units, and institutional clients. The Specialty Finance segment offers commercial and life insurance premiums financing for businesses and individuals; accounts receivable financing, value-added, and out-sourced administrative services; and other specialty finance services, as well as data processing of payrolls, billing, and cash management services to temporary staffing industry. The Wealth Management segment provides trust and investment, asset management, tax-deferred exchange, securities brokerage, and retirement plan services. The company operates 173 banking facilities and 228 ATMs in the Chicago metropolitan area, southern Wisconsin, northwest Indiana, and Florida. Wintrust Financial Corporation was founded in 1991 and is headquartered in Rosemont, Illinois.

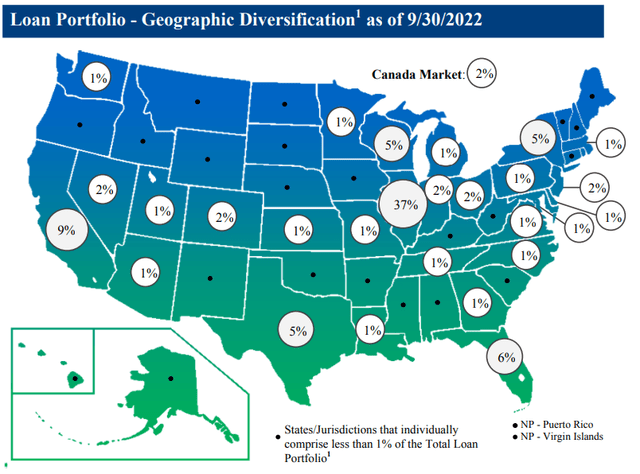

Although focused on Illinois, its loan portfolio has loans from all over the country providing some diversity.

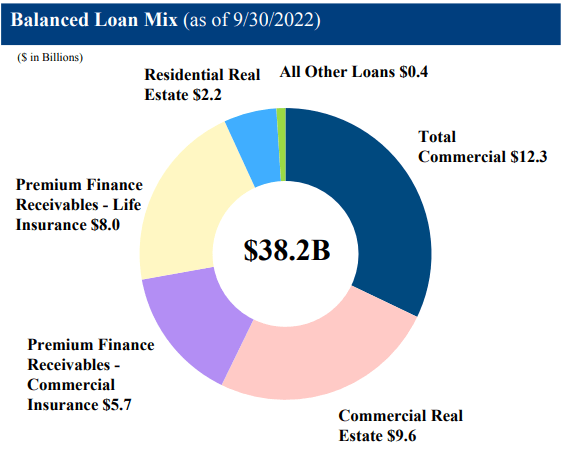

And below is a look at the type of loans they have made.

Company Investor Presentation

Over the last 10 years, WTFC has seen its stock price grow from around $36.50 to $88.50 despite the recent bear market. So they have been operating very successfully with an excellent track record.

But what I am focusing on here is the credit rating of WTFC. WTFC is rated by one of the top 3 ratings agencies, Fitch, as having a “BBB+“ rating. I think many investors just look at Quantumonline.com for ratings but Quantum doesn’t show Fitch ratings. It is worth checking Fitch’s website. Anyway, Fitch uses the same scale as S&P and this is a strong investment grade rating. With preferred stocks rated 2 notches lower than the bond rating, which is standard, WTFCP preferred stock has an investment grade rating of “BBB-“. As you will see shortly, WTFCP preferred stock is a much better value than all “BBB-“ preferred stocks with the exception of WesBanco’s WSBCP which is similar.

Company website

WesBanco

WesBanco (NASDAQ:WSBC), like WTFC, is a regional bank holding company. It is centered in West Virginia but has locations in surrounding states as well. Here is what Yahoo Finance has to say about WSBC.

WesBanco, Inc. operates as the bank holding company for WesBanco Bank, Inc. that provides retail banking, corporate banking, personal and corporate trust, brokerage, and mortgage banking and insurance services. It operates in two segments, Community Banking, and Trust and Investment Services. The company offers commercial demand, individual demand, and time deposit accounts; money market accounts; interest bearing and non-interest bearing demand deposits, as well as savings deposits; and certificates of deposit. It also provides commercial real estate loans; commercial and industrial loans; residential real estate loans, including loans to purchase, construct, or refinance borrower's home; home equity lines of credit; installment loans to finance the purchase of automobiles, trucks, motorcycles, boats, and other recreational vehicles, as well as home equity installment loans, unsecured home improvement loans, and revolving lines of credit; and commercial, mortgage, and individual installment loans. In addition, the company offers trust and investment services, as well as various investment products comprising mutual funds and annuities; and securities brokerage services. Further, WesBanco, Inc., through its non-banking subsidiaries, acts as an agency that specializes in property, casualty, life, and title insurance, as well as benefit plan sales and administration to personal and commercial clients; provides broker dealer and discount brokerage services; holds investment securities and loans; and holds and leases commercial real estate properties, as well as acts as an investment adviser to a family of mutual funds. As of December 31, 2021, it operated 206 branches and 203 ATMs in West Virginia, Ohio, western Pennsylvania, Kentucky, southern Indiana, and Maryland, as well as seven loan production offices in West Virginia, Ohio, western Pennsylvania, Maryland, and northern Virginia. WesBanco, Inc. was founded in 1870 and is headquartered in Wheeling, West Virginia.

While WSBC is not rated by the top 3 ratings agencies, the preferred stock WSBCP (NASDAQ:WSBCP) is rated “BBB-“ by the Kroll bond rating agency. Since I am not very familiar with Kroll, I looked into WSBC myself and I really like it. If I was rating it, I would consider it at least “BBB-“ and probably a “BBB” due to it being a strong operator with an exceptionally good balance sheet for a regional bank. It has lower leverage than “BBB-“ rated WTFCP and I also did a comparison to KeyBank (KEY) which also has “BBB-“ rated preferred stocks. One of KEY’s preferred stocks is also a 5 year reset rate preferred like WTFCP and WSBCP and thus makes for a great comparison. Stunningly, the liabilities of KEY are 13 times their equity while the liabilities of WSBC are only 6 times equity. So WSBC has a great balance sheet.

I also want to mention that WSBC received an award as the #10 best bank in America from Forbes. They have been on the top bank list every year since the inception of this reward 12 years ago and have been in the top 12 each of the last 3 years.

This award is not about customer service but about the company as an investment. The article says:

“Forbes has worked with S&P Global Market Intelligence for 13 years on its America's Best Banks ranking, which is based on metrics related to growth, credit quality, and profitability through September 30, 2021. These metrics include operating revenue growth, return on average tangible common equity, return on average assets, net interest margin, net charge-offs as a percentage of total loans, nonperforming assets as a percentage of assets, reserves as a percentage of nonperforming assets, CET1 ratio (which compares a bank's capital against its risk-weighted assets), and risk-based capital ratio”

So although S&P hasn’t officially rated WTFC, S&P is saying here that the company has great metrics, strong credit quality, low nonperforming loans, etc... Only .21% of assets are non-performing.

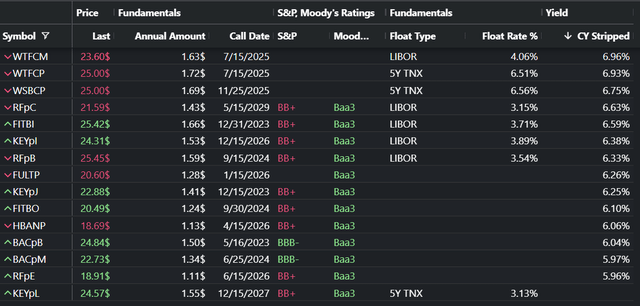

Documenting the Undervaluation of WTFCP and WSBCP

Below is a chart of bank preferred stocks with a Rating of “Baa3” from Moody's which is equivalent to a “BBB-“ rating from S&P and Fitch. Of course I included WTFC and WSBC preferred stocks because the software program that I used to create the chart only supports ratings from Moody's and S&P. I also screened out any preferred stock that had an S&P rating below “BB+”. Additionally, important information on these preferred stocks is in the chart like call date, annual dividend, current yield, current price and the reset and floating rates.

As can be seen from the chart above, WTFCP currently yields 6.93% and WSBCP currently yields 6.75%. So the WTFC and WSBC preferred stocks have the best yields relative to preferred stocks with the same credit rating. In fact, most of these peers to WSBCP and WTFCP have a lower S&P rating than “BBB-“, which makes WSBCP and WTFCP look even better.

One of the things that makes these 2 preferred stocks great is if you compare the current yield to those of the fixed-rate preferred stocks in the above chart. FULTP is the highest yielding fixed-rate preferred with only a 6.26% current yield, so WTFCP/WSBCP not only provide a much higher current yield than the fixed-rate preferred stocks but provide interest rate protection that doesn’t exist with FULTP and the even lower yielding Baa3 fixed-rate preferred stocks.

But what really makes WTFCP and WSBCP outstanding is their reset rate or floating rate. At around 6.5% plus the 5 year note, they will adjust to a much higher yield on its call date than the LIBOR floaters which will adjust at only around 3.5% plus LIBOR (and the 5 year note is generally higher yielding than LIBOR).

And when we look at WTFCP versus its sister preferred stock WTFCM, WTFCP looks just so much better due to a much higher reset/float rate.

And lastly, we have KEY.PL which is also a 5 year treasury note reset rate preferred stock. So it is a perfect comparison to our recommended preferred stocks. With a reset rate of the 5 year note plus only 3.13%, you can see that the WTFCP/WSBCP reset rates of 6.5% plus the 5 year note look extraordinarily good. And KEY.PL has a much more leveraged balance sheet than WSBCP and is also more leveraged than WTFCP and KEY has an S&P rating of only “BB+”. For some reason the current yield for KEY.PL did not print out from the software that created the above chart. It is 6.33%, so that is also inferior to WTFCP and WSBCP.

WTFCP and WSBCP were issued in 2020 after COVID when preferred stock prices were severely beaten down. Thus, these securities were IPOd at extremely favorable terms and they remain extremely undervalued versus similar preferred stocks that IPOd prior to COVID or in 2021 after preferred stocks rallied a lot and yields were very low.

I believe that WTFCP and WSBCP are so undervalued because they are not followed. There have been no Seeking Alpha articles analyzing these preferred stocks despite the fact that they have been around for over 2 years. At Conservative Income Portfolio, we like to look at under the radar stocks because that is often where the best values can be located.

Important Facts About WSBCP and WTFCP Before Buying

- Both of these preferred stocks are callable in 2025. If they are not called, their dividends will reset. If the 5 year note is where it is now, 4%, both of these preferred stocks will have their current yields adjusted from below 7% to around 10.5%. That is an extremely high yield for bank preferred stocks as this sector is considered quite safe. Just look at the yields on the fixed-rate preferreds which are around 6.2%.

- WTFCP/WSBCP will provide very generous yields regardless of the interest rate environment. Even if the 5 year note rate yield drops between now and 2025, these preferred stocks will have a yield that is 6.5% higher than the 5 year note which is an extremely high spread for an investment grade security versus treasuries. And of course, if the 5 year note yields 6% in 2025, our preferred stocks will reset to a 12.5% yield. These are winners in any interest rate environment.

- These preferred stocks pay a “qualified” dividend thus providing investors with a much lower tax rate on the dividends paid by these preferred stocks.

- The fact that there is a good possibility of a call on these preferred stocks in 2025 means that it is unlikely that these preferred stocks will trade much below their current price. Having this kind of price protection against a further drop in the market is another very nice feature of these preferred stocks.

- As a bank preferred stock, the dividend is non-cumulative.

- Less than a year ago, WSBCP traded as high as $29.00 and WTFCP as high as $28.52 when the 5 year treasury note was much lower than now. These preferred stocks have an even better future yield prospects than before yet they can be purchased at much lower prices.

- Whereas WSBCP can be called at any time after it resets its dividend in 2025, WTFCP has a nice feature. If they do not call WTFCP on its first call date, they must wait 5 more years before they can call it. So you get an additional 5 years of call protection which could work out very well if the interest rate falls on the 5 year note during the following 5 years. You will be locked into a yield that won’t go lower for 5 years even if interest rates go a lot lower.

Summary

Both WSBCP and WTFCP are flying under the radar with no Seeking Alpha articles discussing the merits of these 2 preferred stocks. We find that some of the best values are in little known preferred stocks and baby bonds that lack coverage.

Currently, our work shows that WSBCP and WTFCP are far and away the best preferred stocks in the banking sector, and 2 of the best preferred stocks in general. The current yield is very high relative to other bank preferred stocks of the same quality. But what makes these 2 preferred stocks stand out is their extremely high reset-rate that kicks in on their call date.

The reset rate on these preferred stocks is pegged to the 5 year note. If the 5 year note is 4% in 2025, as it currently is, the yields would reset on these 2 preferred stocks to 10.5%. For anyone who follows banking preferred stocks, you know that this a monster yield for this sector. And because the reset rate is 6.5% plus the 5 year note, the yield will always be attractive regardless of the future interest rate environment. For an investment grade security to have a 6.5% spread over treasuries is extremely good.

The fact that these preferred stocks have such a strong reset-rate should mean that the risk of these preferred stocks going much lower in price is small. In this treacherous market, being able to buy an undervalued security which also has strong protection against lower stock prices and higher interest rates is certainly worth considering.

Are you looking to start building a Fixed Income Portfolio?

Conservative Income Portfolio targets the best Preferred Stocks and bonds with the highest margins of safety. We strongly believe that the next decade will belong to fixed income irrespective of whether you are conservative or aggressive in your approach! Get in on the ground floor of our recently started Bond and Preferred Stock Portfolios.

If undervalued fixed income securities, bond ladder, “pinned to par” investments and high yielding cash parking opportunities sound like music to your ears, check us out!