THEPALMER

Introduction

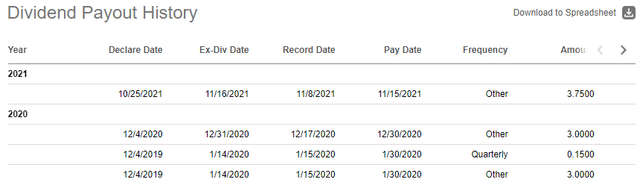

I like to write about companies that lack coverage on SA and today I'm taking a look at Patriot Transportation (PATI). It’s a small transportation company that distributed dividends of $9.90 per share over the past three years and it’s trading at just $7.99 as of the of writing. It managed to achieve this thanks to asset sales as normalized earnings over the past five years have been just $0.22 per share.

Overall, truck transportation is a competitive business with low margins, and I think this might be a bad time to invest in Patriot Transportation considering there are no asset sales on the horizon and the company plans to spend about $12 million on CAPEX in FY23. Let’s review.

Overview of the business and financials

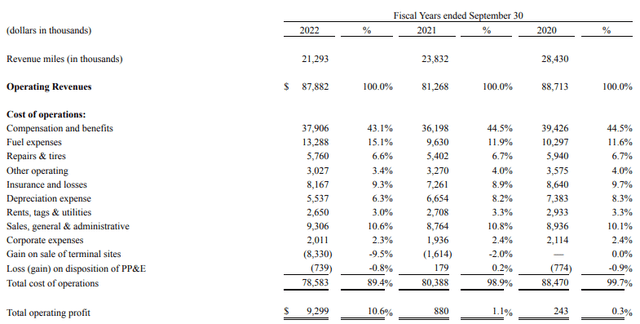

Patriot Transportation is a small liquids tank carrier that was spun off from FRP Holdings (NASDAQ: FRPH) in 2015. It currently operates as a premier bulk tank carrier in the southern United States through its subsidiary Florida Rock & Tank Lines (its history dates to 1962, when the Baker family owned an aggregate and mining business called Florida Rock Industries), and the financial performance over the past several years has been underwhelming. Overall, I consider trucking in the USA to be an uninvestable business as barriers for entry are low due to deregulation which means that the sector is characterized by strong bust periods. In addition, being a trucker is a lonely job and there are few promotion opportunities, which means that changing companies for a very small increase in compensation makes sense. Therefore, employee turnover rates are about 90-100% per year and margins are usually low.

What I like about Patriot Transportation is that the company has no debts and that it has been returning cash to investors after spending little on CAPEX and selling some terminals over the past few years as the business has been shrinking. I’ve already covered this company on my MP service, and I told my subscribers that I was expecting it to soon sell a terminal in Nashville which was closed in February. Patriot Transportation currently has 17 terminals and 6 satellite locations in Florida, Georgia, Alabama, and Tennessee.

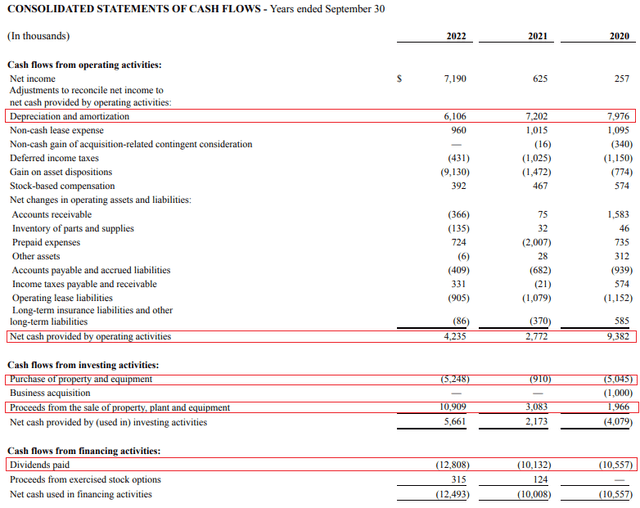

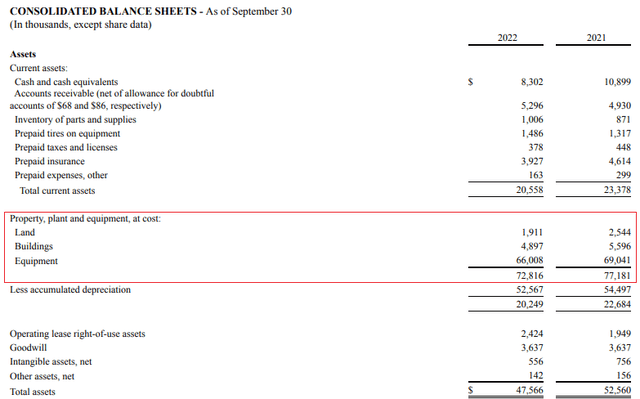

In FY22, Patriot booked a $6.3 million gain from the sale of a former terminal in Tampa. The sale price was $9.6 million. In FY20, there was a gain on the sale of land of $1.6 million as a result of the sale of terminals in Pensacola and Chattanooga. Also, big trucking companies usually have to replace their fleets between 3 and 5 years but Patriot Transportation was spending little on this front as the equipment at cost was shrinking by about $5 million on an annualized basis over the past few years.

I like the balance sheet as the company has no debts and cash stood at $8.3 million as of September. However, it seems impossible to tell how much the terminals are worth. As of September 2022, land and buildings at cost were just $6.8 million, which is lower than the sale price of the Tampa terminal alone. Overall, it seems Patriot Transportation has a habit of distributing large dividends when its cash balance surpasses $10 million. Unfortunately, I don’t expect the company to distribute another dividend in 2023 as it revealed in its FY22 financial report that it plans to spend about $12 million on CAPEX in FY23 (Page 30 here). It seems that the company has decided to finally modernize its fleet, but I view this as a negative development as this means that there will be little cash left after the CAPEX investment. In FY22, the company replaced 26 tractors and 5 trailers. The FY23 capital budget includes 73 new tractors and about 10 trailers.

The recurring operating income in FY22 was $2.05 million which I think is decent considering how tough the past few years have been. Yet, FY23 is looking challenging.

You see, Patriot Transportation has been complaining lately about a lack of viable applicants and it revealed in its FY22 financial report that it made pay increases in several key markets. The company expects to announce pay increases in the remaining markets in early 2023 and this could boost driver pay by up to 25% to 35% depending on the market (see page 29). In addition, Patriot Transportation said during its FY22 earnings call that the insurance markets are tight and that insurance rates are continuing to increase at single-digit percentage points at the lower levels and up to 15% to 20% on the excess layers. The company has so far managed to counter higher labor and insurance costs by raising freight rates but I doubt that this can be sustained for long. Overall, I expect the operating income to decrease significantly in FY23.

Investor takeaway

Patriot Transportation’s CAPEX has been low since FY17 and there seems to be a lot of value in its terminals. With the business shrinking, the company has been distributing significant dividends over the past few years, but I expect this to change in FY23 as CAPEX is expected to stand at about $12 million. There are no asset sales on the horizon as there is barely any mention of the Nashville terminal in the FY22 report. Even if this asset gets sold in the near future, I expect the proceeds to be used to cover the CAPEX. In my view, FY23 financial results will likely be underwhelming due to higher labor and insurance costs. I think it could be best for risk-averse investors to avoid this stock for the time being.

If you like this article, consider joining Bears and Resources. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys. Both long and short ideas.

So, what can you expect to get from this service?

- Exclusive articles

- Access to my portfolio and watchlist

- Interviews, ideas, portfolios, watchlists, and comments from other investors I've invited to the service

- A chat room with access to me and the other investors