HeliRy

As expected by me for some time now, leading shuttle tanker operator KNOT Offshore Partners (NYSE:KNOP) or "KNOP" has become the latest partnership to succumb to ongoing, adverse market conditions:

Massive Distribution Cut

For the fourth quarter, the company's cash distribution will be reduced by 95% sequentially to a measly $0.026 per common unit.

While long-term shuttle tanker market fundamentals have improved considerably over the past year, the partnership continues to face a number of short-term challenges (emphasis added by author):

Gary Chapman, CEO and CFO of the Partnership, commented, “In this near-term period of heightened uncertainty for the shuttle tanker market, as we have previously set out, a top operational priority has been to secure additional charter coverage for our fleet at an acceptable rate that ensures the sustainability of our business. We have made progress in this regard and continue to believe that the medium-term market environment in the North Sea and Brazil should improve materially on the basis of significant committed growth capex in their respective offshore production sectors.

Nevertheless, as we approach another year with multiple drydocks, we currently lack the forward visibility on earnings that we have historically had. Although we expect to employ our open vessels in possibly a combination of short-term shuttle tanker and spot conventional opportunities, this is highly likely to lead to a temporary but material reduction in vessel utilization rates and income. Additionally, we have not yet finalized new charters for our four vessels operating on bareboat contracts in Brazil. In this context, and until such time as we have re-established a greater degree of forward visibility on earnings and liquidity, our Board has determined that a reduction in our quarterly distribution is prudent.

The Partnership continues to believe that a long-term, sustainable distribution is a key component of our strategy and value proposition. We believe that this reduced distribution level will position us not only to weather the challenging interim period and manage our 2023 drydocking schedule, but to take advantage of what we expect will be a strong medium-term market to the benefit of our unitholders.

With KNOP's main market Brazil remaining in considerably better shape than the North Sea, the company's apparent difficulties with securing follow-on work for the vessels Fortaleza Knutsen, Recife Knutsen, Dan Cisne and Dan Sabia come as a surprise. Particularly the Fortaleza Knutsen appears to be at risk of sitting idle sooner rather than later:

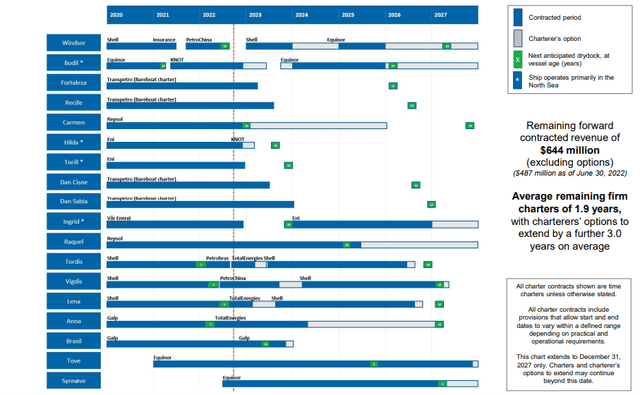

Company Presentation

Anyway, with the common unit distribution having been cut to a nominal amount now, the company won't have to worry about coverage ratios for the time being.

On an annualized basis, the move will result in cash savings of approximately $70 million which should help deleveraging the balance sheet and potentially enable the partnership to resume dropdowns from parent and general partner Knutsen NYK Offshore Tankers ("Knutsen NYK").

Parent likely to take advantage

That said, I would be surprised if KNOP remains a public company for much longer with parent Knutsen NYK likely to take advantage of the inevitable sell-off in a similar way like Höegh LNG last year.

At this point, I expect Knutsen NYK to let the dust settle over the next couple of quarters as it will take some time for the common unitholder base to turn over from disappointed income investors to more speculative market participants before proposing to take the partnership private later this year or in early 2024.

While management has reiterated its commitment to a long-term, sustainable distribution as a "key component of its strategy and value proposition", parent Knutsen NYK is highly unlikely to forego the opportunity to acquire the partnership on the cheap ahead of an anticipated multi-year upturn in the shuttle tanker market.

With KNOP locked out of the capital markets for the foreseeable future, there's simply no sense in keeping the partnership exchange-listed and share expected, strong future cash flows with outside equity holders, particularly not after the ultimate parent Nippon Yusen Kabushiki Kaisha (OTCPK:NPNYY) or "NYK" has pocketed billions of dollars in dividends from container shipping subsidiary Ocean Network Express or "ONE" in recent quarters.

Given NYK's vastly improved balance sheet and liquidity, there's simply no need anymore for its shuttle tanker subsidiary to refinance newbuild vessels in the equity markets at the expense of distributing the majority of contracted cash flows to outside unitholders.

How low can KNOP go?

Well, that's apparently the crucial question as the situation is somewhat different to Hoegh LNG Partners (OTCPK:HMLPF) eighteen months ago as a surprise contract dispute caught common unitholders completely off guard.

Moreover, the Floating Storage and Regasification Unit ("FSRU") market wasn't expected to pick up anytime soon at that time but Russia's assault on Ukraine clearly altered LNG market fundamentals last year.

In contrast, at least when reading between the lines of the recent Q3 report, KNOP management has been trying to prepare investors for a near-term distribution cut. Not surprisingly, shares sold off by approximately 30% following the release.

In addition, shuttle tanker market conditions are widely expected to improve meaningfully over time and with the parent likely to make a move for KNOP, speculative market participants might replace disappointed income investors much quicker than in case of Höegh LNG Partners.

Subsequently to the distribution cut in July 2021, Höegh LNG Partners' common units sold off by more than 70%.

As of the time of this writing KNOP's common units are down 20% in after-hours but I expect a much broader sell-off on Thursday as long-term unitholders start digesting the news.

In sum, I wouldn't be surprised to see the common units trading down to the $7 range on Thursday for an aggregate 50% loss since the release of the Q3 report in November.

What are the chances for a buyout offer to succeed?

With parent and general partner Knutsen NYK commanding approximately 30% of the partnership's voting rights (as compared to more than 45% in case of Höegh LNG), approval is not a given by any means but with the anticipated turnover in the equity holder base and depending on the proposed buyout price, odds might be in favor of the parent.

Also keep in mind that Knutsen NYK might have other options to increase ownership, for example by contributing vessels against newly issued equity.

Please note also that the general partner has a limited call right which may require common unitholders to sell their units at an undesirable time or price (emphasis added by author):

If at any time our general partner and its affiliates own more than 80.0% of the common units and Class B Units, our general partner has the right, which it may assign to any of its affiliates or to us, but not the obligation, to acquire all, but not less than all, of the common units held by unaffiliated persons at a price not less than the then-current market price of our common units. Our general partner is not obligated to obtain a fairness opinion regarding the value of the common units to be repurchased by it upon the exercise of this limited call right. As a result, our unitholders may be required to sell their common units at an undesirable time or price and may not receive any return on their investment. Our unitholders may also incur a tax liability upon a sale of their units.

Bottom Line

As projected by me six weeks ago, KNOT Offshore Partners finally succumbed to ongoing, weak shuttle tanker market conditions and reduced its common unit distribution by 95%.

That said, long-term shuttle tanker market fundamentals have improved in recent quarters and with ultimate parent NYK now in strong financial condition, I wouldn't be surprised to see general partner Knutsen NYK making a move for the partnership later this year or in early 2024.

Given my expectation for the units to sell off to the $7 area on Thursday and considering improved long-term business fundamentals as well as prospects for a potential buyout offer, I am upgrading the partnership's common units to "Hold" from "Strong Sell".

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.