piranka

Confluent (NASDAQ:CFLT) offers Apache Kafka as both licensed software and a hosted service, and aims to add value over the open-source software by providing a less complex and more scalable solution with a lower TCO and greater security. The company was an investor favorite after its IPO in 2021, based on both a high growth rate and strong narrative. The stock is now down significantly from its peaks, on the back of higher interest rates and in recent quarters, deteriorating performance. Despite this, the stock is still not particularly cheap given Confluent's low gross margins and high operating expenses.

Confluent believes data streaming can become a major new data platform that is as broad in scope as databases are, and that they can capitalize on this trend by offering significant value over the open-source Kafka software. Data streaming provides access to real-time data and the ability to react to it instantaneously. It also enables businesses to connect applications, data systems, and SaaS layers in real time.

Event streaming is likely to become ubiquitous in the future, with 90% of the Global 1000 expected to utilize event streaming technology by 2025. Of the companies that are already using event streaming technologies, 80% have plans to invest in new capabilities in the next 12-18 months. Apache Kafka is the most widely used data streaming software, with more than 75% of the Fortune 500 adopting it.

Data streaming is not new, but adoption in the past was hampered by legacy products that were limited in scope and capabilities. Flaws included:

- Slow and batch oriented

- Non-scalable

- Significant maintenance requirements

- Limited ability to work with more sophisticated data

Custom applications often utilized message queues, database change capture products, APIs, and enterprise service buses. These technologies were difficult to scale, labor-intensive and limited in their application. SaaS applications utilized tools like proprietary application integration platforms and bulk file transfers. These tools also had limited scalability and were unable to handle complex data transformations. Analytics systems utilized ETL / ELT tools, as well as preprocessing and data lakes. These tools support rich transformations but rely on slow batch processing. Modern systems rely on custom applications, SaaS applications and analytics systems, and data streaming technologies must be able to connect them at scale.

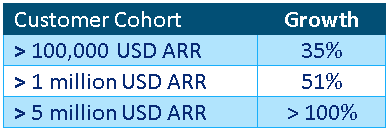

Confluent believes they have a 60 billion USD market opportunity, and this is supported by the widespread adoption of Kafka, which provides a large base of potential Confluent customers. This market opportunity is also supported by Confluent's ability to expand rapidly within existing customers to enormous scale. 22% of Confluent’s customers have an ARR in excess of 100,000 USD and Confluent believes there is still a significant expansion opportunity within these large customers, even those that already have ARR of over 10 million USD.

Stream Designer

In the past, Confluent has primarily been a programmatic tool, which has limited its use through organizations. Stream Designer offers a simple UI for building pipelines using Confluent’s data streaming platform. It is a drag-and-drop tool that allows less technical users to rapidly build and deploy streaming pipelines that can address ETL use cases. Stream Designer is integrated with Kafka Connect, Stream Processing and Governance. It is currently free, and rather than generating revenue directly it aims to accelerate usage of ksql and Kafka.

This move makes a lot of sense for Confluent, as their software is often used to feed data into databases like Snowflake (SNOW) and Databricks. It is also interesting as Snowflake's vision of eliminating data silos and bringing applications to the data rather than the other way around, could undermine Confluent's vision of data-in-motion to some extent.

Stream Governance

Stream Governance is a paid offering that helps customers to discover, understand, and implement data streaming pipelines. It helps customers to discover data, understand data relationships and ensures data quality. Stream Governance appears to be another solution largely targeted at increasing the adoption of data streaming and hence consumption by Confluent customers.

Immerok Acquisition

Confluent acquired Immerok in January 2023 for their cloud-native, fully managed Flink service. Apache Flink is used to build stream processing applications, which enables organizations to clean and enrich data streams. Stream processing allows customers to build applications on top of real-time data streams.

Confluent has already contributed to the stream processing ecosystem, with Kafka Streams, ksql, and some of the transactional capabilities in Kafka. Confluent plans on launching a version of Flink in Confluent Cloud later this year.

Immerok is currently pre-revenue and hence is not expected to make a meaningful contribution to Confluent in the near term. In time it should enable Confluent to expand the spend of existing customers and pull more workloads onto their streaming platform.

Financial Analysis

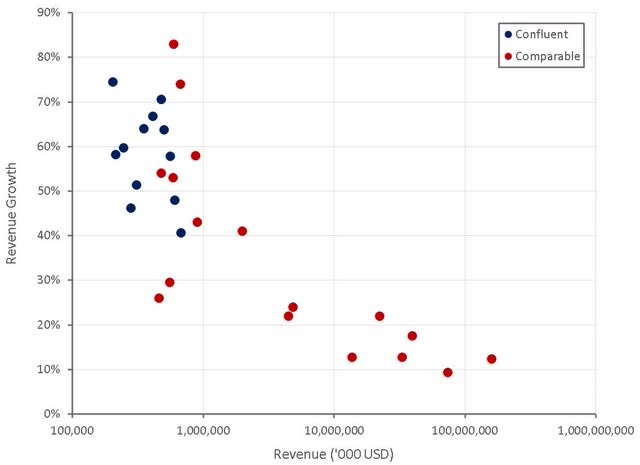

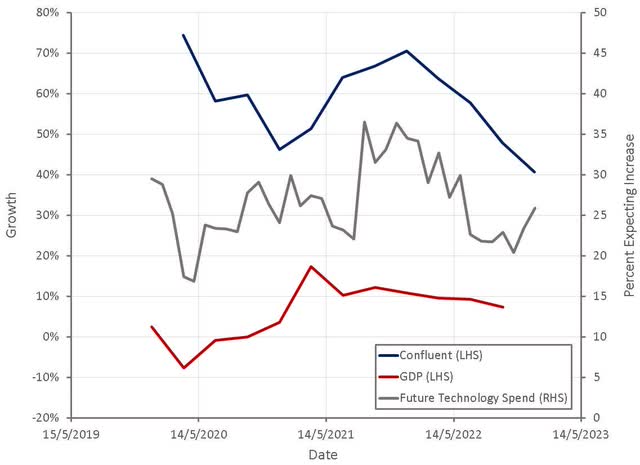

Macro conditions appear to have deteriorated in the fourth quarter, with deals continuing to receive more scrutiny and Confluent now expects this to be ongoing. While deal cycles are elongating and expansion rates moderating, Confluent’s win rates remain robust, pricing is steady and Confluent has been able to close a substantial number of the deals that pushed from prior quarters.

Headwinds have been most evident amongst Confluent’s enterprise customers and have been broadly felt across geographies. Confluent has stated that they have little exposure to crypto, fintech and start-ups, which has likely limited deterioration in growth relative to some peers, but also highlights how Confluent’s problems are broader than just a sub-segment of struggling customers.

Confluent Cloud continued to be the fastest-growing area of Confluent’s business with revenue up 102% YoY in the most recent quarter. Confluent Cloud as a percentage of new ACV bookings was also greater than 70% in Q4, which indicates that the Confluent Platform is really struggling in the current environment. Despite this, Confluent believes it is an important part of their business as it drives upsell and cross-sell opportunities for Confluent Cloud.

Revenue growth in the first quarter of 2023 is expected to be 32-33%. For the full year, revenue growth is expected to be approximately 30%. This includes a negative impact of 12-17 million USD stemming from increased scrutiny on deals. How this figure was calculated is not clear, but it suggests that absent headwinds, growth would only be approximately 3% higher. Confluent investors would probably prefer if a far greater dollar figure could be attributed to increased scrutiny on deals.

Figure 1: Confluent Revenue Growth (source: Created by author using data from company reports)

Confluent relies on a consumption-based business model, which has likely contributed to investor uncertainty and multiple compression. Confluent is not as exposed to transactions or analytics as companies like MongoDB (MDB) or Snowflake though. Rather, they are dependent on operational workloads which they believe are fairly resilient. Consumption is not immune to the macro environment though, as evidenced by the decline in NRR in the most recent quarter.

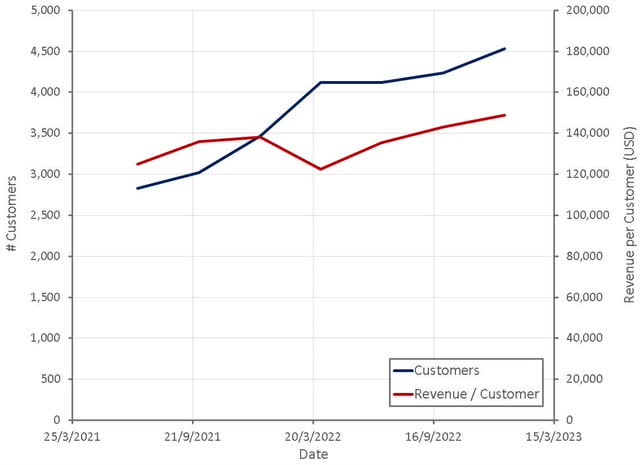

Confluent is trying to accelerate adoption amongst smaller customers by reducing friction. The decision to remove payment friction so that developers can more easily test the software, continues to have a positive effect on sign-ups but has had a negative impact on total customer count, which will take several quarters to resolve. The impact of this initiative on revenue is not significant though.

Amongst larger customers, Confluent is competing primarily against DIY implementations of Apache Kafka. Kafka can be difficult to scale and Confluent believes they can reduce complexity and costs for these types of organizations. If this is the case, the current environment could be a catalyst for companies to swap. This is not clear though, as competition for talent has likely waned in recent months and companies may be reluctant to undergo large transformations in an uncertain environment. New Relic (NEWR) is probably the poster child for Confluent Cloud attracting large and sophisticated Kafka users. New Relic was a top 20 Kafka company in the world before becoming a Confluent Cloud customer.

Large customer growth continues to be robust with growth of each of the large customer cohorts outpacing total customer growth. Customers with over 100,000 USD in ARR contributed more than 85% of total revenue in the fourth quarter.

Table 1: Confluent Customer Cohort Growth (source: Created by author using data from Confluent)

Figure 2: Confluent Customers (source: Created by author using data from Confluent)

Confluent's performance appears to be closely tied to the macro environment, with growth exhibiting a large deceleration during COVID, followed by a rapid reacceleration in 2021. This broadly aligns with GDP growth and IT buyer behavior. Given this, it is not surprising that Confluent has struggled in recent quarters. It would also suggest that current difficulties are likely to prove temporary.

Figure 3: Macro Influencers of Confluent's Growth (source: Created by author using data from Confluent and The Federal Reserve)

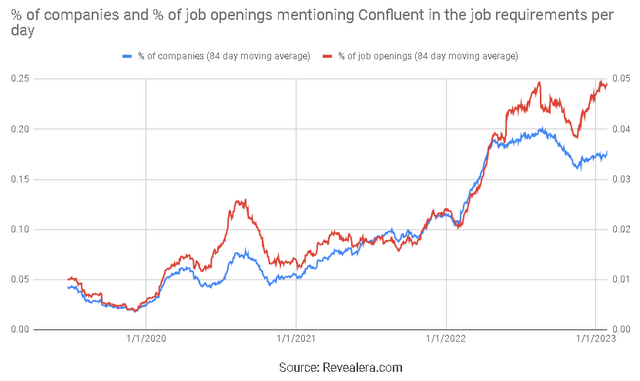

The number of job openings mentioning Confluent in the job requirements continues to increase, suggesting continued adoption by customers.

Figure 4: Job Openings Mentioning Confluent in the Job Requirements (source: Revealera.com)

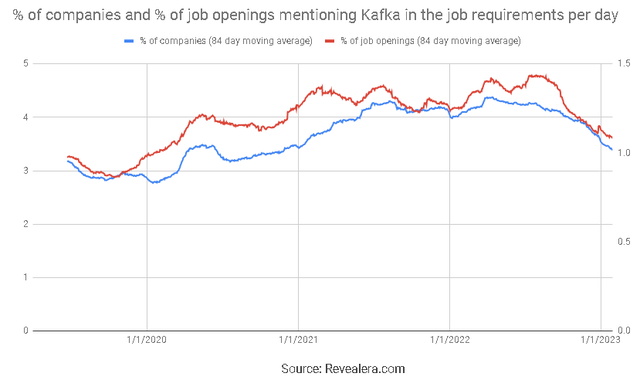

Job openings mentioning Kafka began to wane in the second half of 2022 though. This could be interpreted as the open-source software falling out of favor or customers choosing to delay investments in infrastructure.

Figure 5: Job Openings Mentioning Kafka in the Job Requirements (source: Revealera.com)

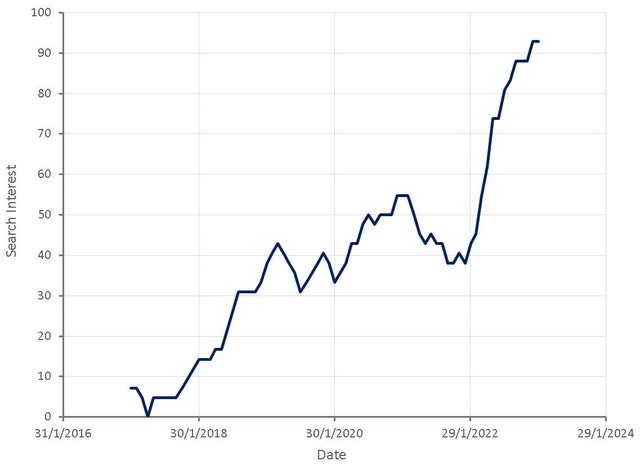

Search interest for "Confluent Pricing" has also been robust, again indicating robust demand for Confluent's services. Given Confluent's reliance on large customers, these types of indicators of broad based demand may not correlate that well with revenue growth in the short term.

Figure 6: "Confluent Pricing" Search Interest (source: Created by author using data from Google Trends)

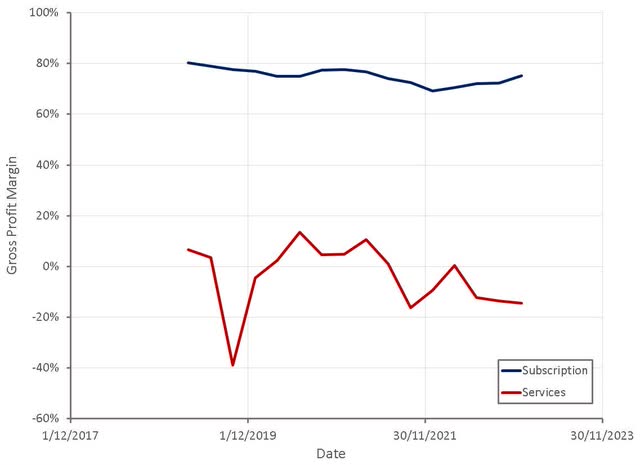

Gross margins have been an issue for Confluent, but the company appears to have turned a corner in recent quarters. Managed cloud services have significantly lower margins than software licensing, creating downward pressure as Confluent Cloud has grown in importance. This has been offset by efforts to improve Confluent Cloud margins, which have largely offset the increase in cloud revenue.

Figure 7: Confluent Gross Profit Margins (source: Created by author using data from Confluent)

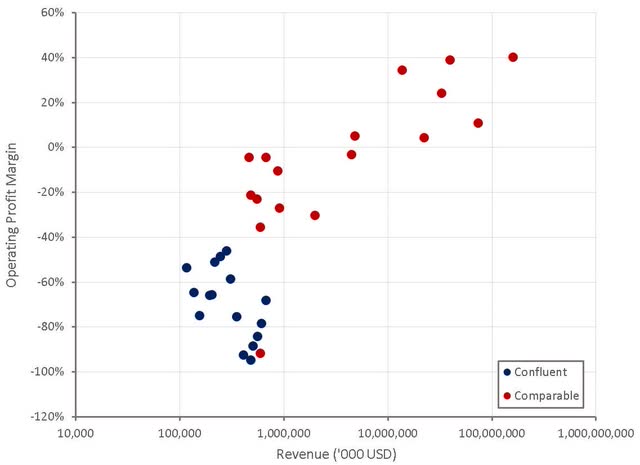

Confluent's operating profit margins have been poor for a company of their size and growth profile. They are taking steps to address their high-cost structure though, including a restructuring of their workforce, prioritizing investments, an 8% headcount reduction and a rationalization of discretionary spend and real estate footprint. This is expected to yield significant improvements over the next 12 months, but this is basically necessary just to bring the company into line with peers.

Figure 8: Confluent Operating Profit Margins (source: Created by author using data from company reports)

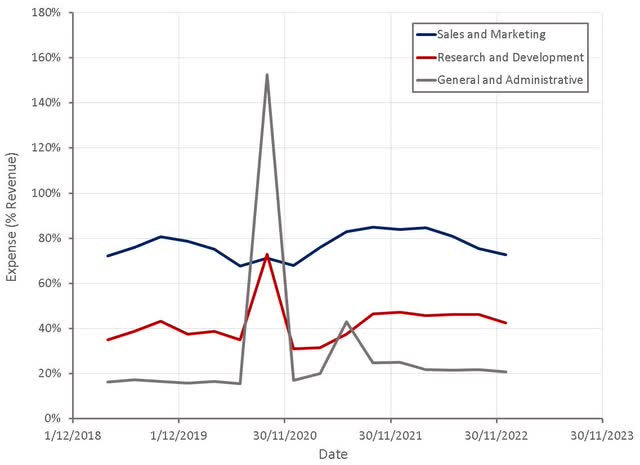

Confluent will streamline sales while preserving quota carrying reps and continuing to invest in customer acquisition. Some efficiency will also naturally come from a maturing salesforce, 50% of sales reps are now fully ramped and this is expected to be in the 55-60% range by the end of the year. R&D investments will also continue to support product development.

Figure 9: Confluent Operating Expenses (source: Created by author using data from Confluent)

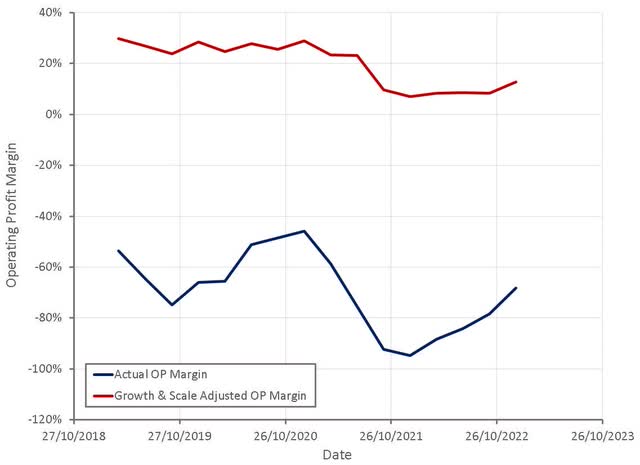

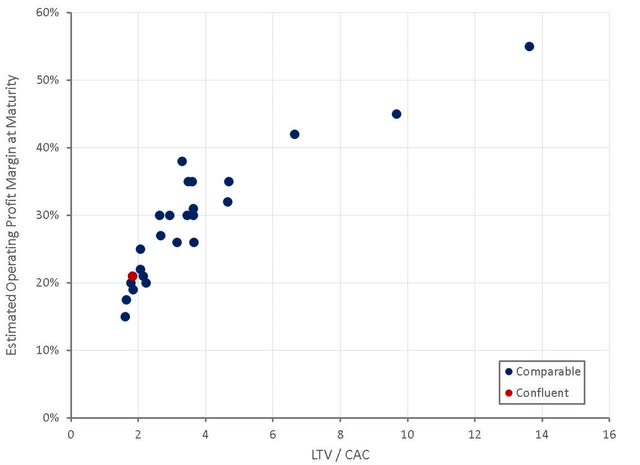

Confluent has faced declining returns on their investments in sales and marketing and R&D over the past two years, and unless this can be reversed their margins at scale are likely to be fairly low. Whether this deterioration is simply due to poor investments or reflects rising customer acquisition costs is crucial to Confluent's future value.

Figure 10: Confluent Adjusted Operating Profit Margins (source: Created by author using data from Confluent)

The company still has potential if acquisition costs can be reduced. Gross retention rates are high (> 90%) and the large average customer size should contribute to low sales and marketing expenses in time.

Figure 11: Confluent LTV/CAC Ratio (source: Created by author using data from company reports)

Valuation

Based on a discounted cash flow analysis, I estimate that Confluent's stock is worth approximately 35 USD per share. To create further upside Confluent needs to improve gross margins by reducing costs or moving into higher value add services. Confluent must also demonstrate an ability to expand their customer base and maintain revenue growth while moderating growth in overhead expenses.

Further downside could occur if growth continues to deteriorate or if Confluent is unable to demonstrate progress towards operating profitability. The stock's muted response to a fairly lackluster set of results and weak guidance could suggest that Confluent is nearing a bottom though.

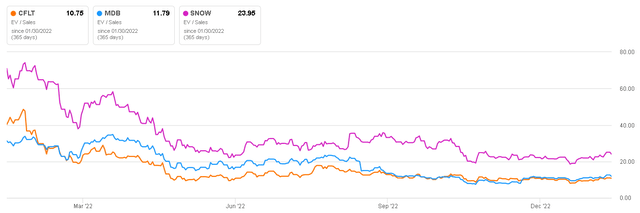

Figure 12: Confluent Relative Valuation (source: Seeking Alpha)