tiero/iStock via Getty Images

Author’s note: All figures listed in Canadian currency unless otherwise noted.

Investment Thesis

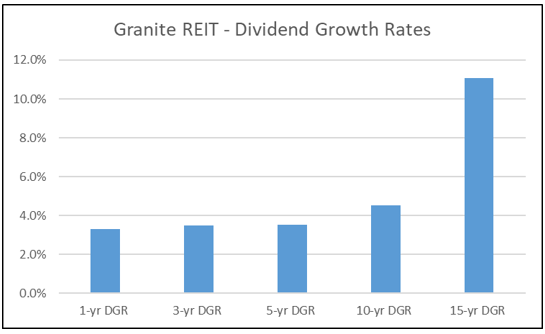

Granite Real Estate Investment Trust (GRP.U) (TSX:GRT.UN:CA) is a first class operator of premium industrial and warehouse properties that offers a strong total return opportunity. The company has an impressive record of consecutive annual distribution increases averaging 4.5% over the past decade.

GRP.U REIT's unique access to low cost debt has allowed it to build a significant portfolio in some of the most important logistics hubs in North America and Europe. Granite REIT has demonstrated stability throughout varied market conditions and boasts a best-in-class 99.1% occupancy ratio across its 128 warehouses and logistics properties.

The REIT will benefit from strong tailwinds in the industrial space, including low availability and strong leasing demand. Units of Granite should continue to see NAV appreciation as the company diversifies its portfolio and adds scale in its largest markets.

Company profile

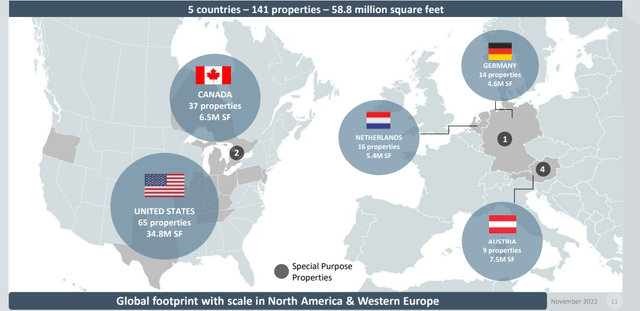

Granite REIT is an investment grade REIT that owns and operates a portfolio of industrial properties in North America and Europe. Founded as MI Developments Inc. in 2003, the company was spun out of auto-parts maker Magna International Inc. (MGA). Since its inception, the Canadian-based REIT has developed a substantial industrial real estate portfolio with interests in 141 investment properties encompassing 59 million square feet of GLA. The property portfolio consists of e-commerce, distribution, warehouses, and logistics centres located in Canada, the United States, Germany, the Netherlands, and Austria.

Granite Operations Map (Granite REIT)

With a market cap of $5.3B and an enterprise value of $7.4B, Granite is the third largest REIT by market cap listed Canada. Granite trades on both the S&P/TSX and NYSE under the symbols “GRT.UN” and “GRP.U” respectively.

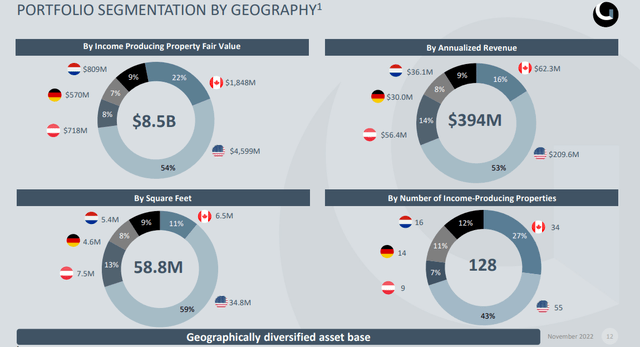

Granite Portfolio Segment by Geography (Granite REIT)

Property Portfolio

Accounting for 73% of the portfolio, Granite’s 88 e-commerce and distribution properties are the core of the portfolio. Supplementing this are 33 industrial/warehouse properties, seven special purpose properties and three flex/office sites. Granite has an industry-leading 99.1% occupancy rate across its 128 income-producing properties. This portfolio has a weighted average lease term of 5.7 years and an asset value of $8.9B.

The company also holds 13 land and development sites, largely concentrated in the U.S. Midwest and Southwest. This development pipeline is a source of organic revenue growth and a means of adding scale in strategic locations. Development sites are centred around major logistics hubs and transportation infrastructure in markets with strong demand. Granite has been able to pursue a number of smaller expansion projects on existing sites that have lower capital spends per GLA than greenfield sites.

Magna Legacy

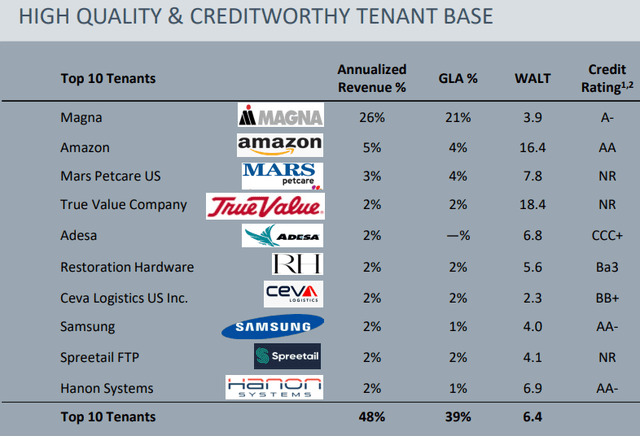

Granite’s most impressive achievement to date has been materially reducing its concentration to its corporate sponsor Magna, while simultaneously achieving organic growth. Today, Magna accounts for 26% of annualized revenue, down from 45% in 2019 and over 95% at the IPO. Reducing Magna’s prominence as a tenant has been achieved through the disposition of Magna-leased properties and a robust development program, especially of e-commerce and distribution sites. Magna currently occupies 28 Granite properties on a triple-net basis. The majority of these are special purpose and industrial/warehouse properties.

From a portfolio and risk management perspective, it has been important to diversify away from Magna. However, Magna is still an important client and a source of stable revenue. Granite recently announced that the leases with Magna at its special-purpose properties in Austria have been extended for ten years to 2034. These are Granite’s largest properties, comprising 5 million sf and accounting for approximately 8% of annualized revenue. As of Q3 2022, Granite’s top ten tenants account for 48% of revenue, with no tenant other than Magna accounting for more than 5% of annualized revenue. This diversification process is a substantial transformation for a relatively young firm that underscores a commitment to long-term value creation.

Granite REIT Tenant Mix (Granite REIT)

Constructive Outlook for Industrials

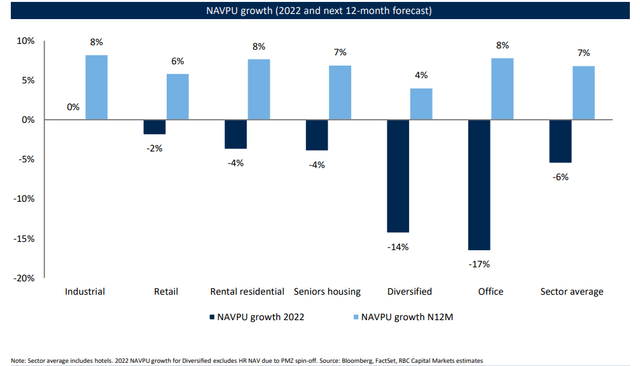

Industrial REITs have demonstrated considerable resilience throughout the pandemic and post-pandemic periods. Compared with office and residential REITs, industrial-focused REITs have had stable NAVs over the past few years. In 2022, industrial REITs maintained flat NAV’s, while all other sub-sectors lost ground.

Industrial REIT Outlook (RBC Capital Markets)

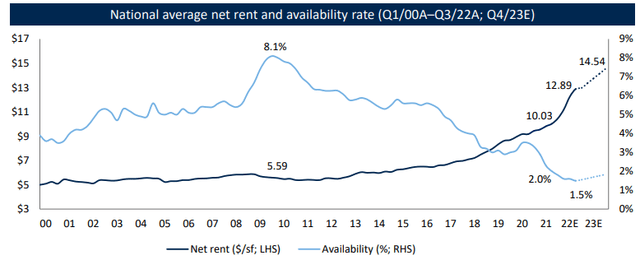

Strong fundamentals supported by low vacancy rates and strong leasing demand are pointing to a consecutive setup for 2023. Post-pandemic supply chain challenges have underscored the importance of logistics facilities and have spurred many retailers to invest in e-commerce capabilities. Demand for warehouses has been strong as a result of reshoring activities and better inventory controls for firms with complex supply chains.

According to a recent report from RBC Capital Markets, industrial vacancy in Canada is at a record low of 1.5%, below the 4.9% availability average since 2000. With limited new supply coming online in 2023, strong demand for high quality industrial space will support strong revenue growth for Granite and other industrial-focused REITs.

Rent and Availably for Industrial REITs (RBC Capital Markets)

Dividend Growth

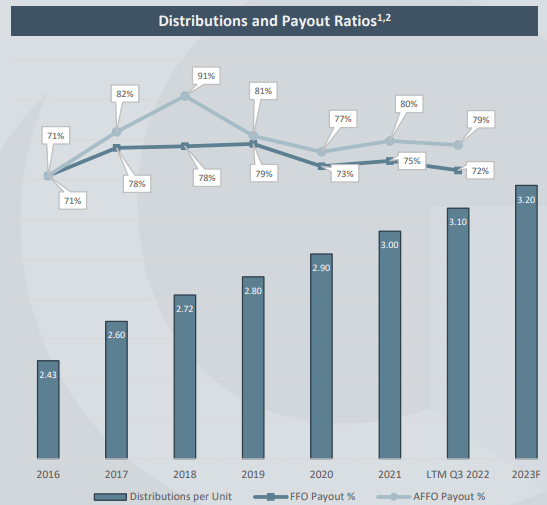

Granite has an annualized dividend of $3.20 paid in monthly distributions of $0.2667. At current levels, Granite offers a 3.7% dividend yield, a little below its 5-year average yield of 4.1%. The REIT has a 12-year dividend growth streak with a recent increase of 3.2% in December 2022, below its annualized 4-year AFFO growth rate of 4.8%. The company’s 12 years of consecutive dividend increases earns it the best dividend growth streak among any REIT listed on the Toronto Stock Exchange.

Granit REIT Dividend Growth Rates (Author)

Granite’s AFFO payout ratio was 80% in its most recent quarter and 77% over the last 12 months. Over the past 12 years of steady distribution increases, Granite has been able to maintain a consistent FFO and a fairly consistent AFFO payout ratio. As I value dividend/distribution stability, I gravitate to REITs and other dividend paying stocks that can demonstrate a steady dividend growth record that is supported by growing free cash flow. With this conservative and supported distribution growth record, investors can have confidence of continued annual distribution increases.

Granit REIT Payout Ratio (Granit REIT)

Risk Analysis

Granite has a healthy balance sheet and best-in-class costs of capital. Total debt of $3.05B and liquidity of $1.27B gives Granite a healthy liquidity ratio of 42%. Only Summit Industrial Income REIT (OTC:SMMCF) (SMU.UN:CA) with 45% has a better liquidity profile amount S&P/TSX listed industrial REITs. The average for the industry is less than 14%. The company also has a weighted average effective interest rate of just 2.3%. This compares favourably to the industrial/ office REIT sub sector average of 3.2%.

Granite has a modest 30% net leverage ratio and a reasonable Debt/EBITDA ratio of 7X. With a much lower debt load than peers, the company’s Debt/EV is 0.36. This is a very different capital structure than most REITs, with the Canadian average more like 0.54. This debt is 98% fixed rate with a WATM of 4.4 years. Along with SmartCentres REIT (SRU.UN:CA) (OTCPK:CWYUF) and Choice Properties REIT (OTC:PPRQF) (CHP.UN:CA), it's one of three with a DBRS credit rating of BBB [HIGH]. Granite’s cap rate is 4.9% making it one of the few TSX-listed REITs with a sub-5% cap rate.

In March of 2022, DBRS Morningstar confirmed Granite REIT’s senior unsecured debentures rating at BBB (HIGH), with stable trends:

The ratings continue to be supported by Granite's (1) institutional-quality industrial real estate portfolio; (2) financial flexibility provided by a sound balance sheet and low cost of debt; (3) strong lease profile with high-quality tenants including Amazon.com, Inc. (AMZN); and (4) unsecured debt capital stack and sizable unencumbered asset pool valued at $7.9 billion at December 31, 2021.

Areas of concern include the concentration of revenue within the top ten tenants and portfolio concentration solely focused on the industrial segment. The REIT has done a good job diversifying away from Magna; however, it is still a significant contributor to revenue. While Granite has a concentrated portfolio, it does have a degree of geographic diversification with a strong presence on both sides of the Atlantic. The company’s challenge will be to build scale in its key markets, while still maintaining geographic diversification.

Investor Takeaways

With a conservative balance sheet and stable business model that supports AFFO growth, investors can have confidence of continued annual distribution increases. Granite will benefit from a constructive set up for industrial REITs in 2023 spurred by low-vacancy rates and strong demand for leasing. Granite is one of the highest quality REITs on the S&P/TSX and offers a great total return opportunity through NAV appreciation and distribution growth.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.