Drew Angerer

Macy's (NYSE:M) is gearing up to report Q4 earnings on March 2, ahead of the opening bell. This report should be particularly important for the New York-based retailer as nearly 40% of its annual revenues are generated during the holiday shopping period.

The expectation is for yet another leg lower in revenues and EPS compared to a previous year of pandemic recovery that was strong for Macy's. Sales should drop by nearly 5%, according to consensus, while per-share earnings could decline by a more pronounced 35%.

What could move the stock on earnings day, however, may not be printed on the earnings report. I will be more interested in hearing about the outlook for 2023 and the narrative that supports it during a year that could prove challenging for consumer spending and the retail space.

Macy's: Likely EPS Beat

On the headline numbers, I believe that Macy's will top EPS expectations. The company sharply lowered its guidance back in August to a mid-point of $4.10 for the full year and only increased it to $4.17 in November to account for relatively minor items, including credit card revenues and interest expenses. This was despite the lavish 33-cent EPS beat delivered in Q3. The full-year EPS consensus estimate is set at exactly $4.17 today, which looks conservative.

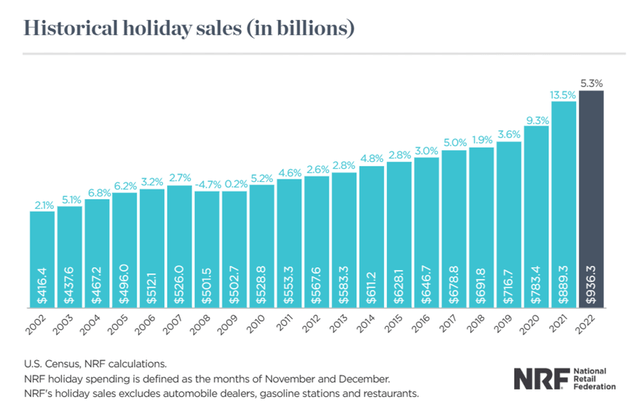

In addition to the management team having kept the bar low, a fairly healthy holiday quarter of sales across the US retail space (see chart below) may have benefited Macy's as well. I expect to see the retailer's higher-end nameplates, Bloomingdale's and Bluemercury, continuing to perform well above "Macy's proper" - the latter of which I estimate to account for 85% of the company's total revenues.

Pay Attention To The Outlook

But the most likely candidate to move the stock on earnings day will be the outlook for the new year.

During the most recent earnings call, the management team disclosed an "unexpected slowdown in sales" in mid-October that had barely begun to turn around in mid-November and had not yet formed a positive trend. That, coupled with remarks about softening conversion in the digital channel, makes me wonder if weakness in consumer activity may be surfacing and dampening expectations for 2023 results.

Beyond top-line guidance, it will be interesting to gauge the executive team's take on the direction of margins. Gross margin took an expected YOY hit of 230 basis points in Q3, in great part driven by seasonal headwinds associated with inventory management. I'm also curious to assess the direction of operating expenses, which have climbed substantially in 2022 as the retailer has been able to fill job openings and the impact on operating margin.

Macy's Is A Speculative Stock

I believe that Macy's has done a decent job at regaining its footing after the COVID-19 crisis - keep in mind that, since well before the pandemic, some signs already pointed at the ultimate demise of the traditional US retail chain.

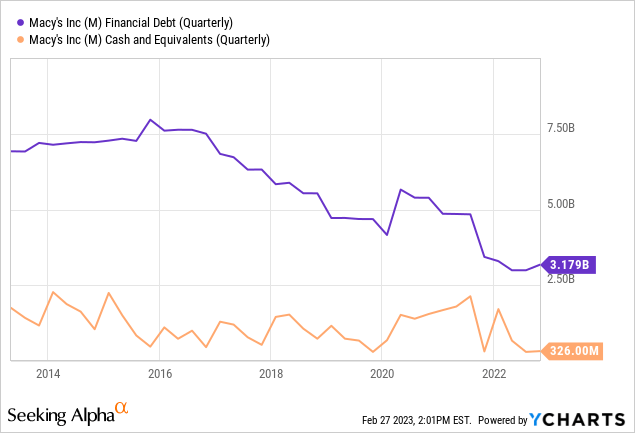

Sales are roughly back to pre-pandemic levels, with recent initiatives like Market by Macy's and the digital marketplace looking successful. The company has put a dent in its debt load (see below), although more work is needed to reduce interest expenses that approached one-fourth of operating income last quarter.

However, none of the above matters to me as much as the risky nature of this stock. From a historical price behavior perspective, Macy's has been more than three times as volatile as the S&P 500 (SPY) in the past 10 years, and even more so since the dawn of the COVID-19 crisis.

In addition, Macy's business model is highly procyclical, which could be bad news in a year of aggressively tight monetary policy, lingering inflation, and a potential economic slowdown. The composition of the balance sheet and the high debt level makes a long-term bet on this stock even more speculative.

This is not to say that I see Macy's share price tanking. Instead, it means that the stock is likely to amplify the movements of the broad market, including substantially higher in the case of a bullish run. But since we do not seem to be anywhere near the beginning of an expansion phase in the economy, I believe that the odds do not favor Macy's investors at this moment.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.