mphillips007

Introduction

In my original article on Petróleo Brasileiro S.A. (NYSE:PBR), I rated the stock a "Sell" as I believed there was value destruction ahead under new management, who cut the size of the dividend payouts and intends to embark on return-dilutive capex. Since then, Petrobras stock has fallen 14.37% compared to the S&P 500 (SP500) fall of 5.04%; an alpha-generating move of 9.33%.

Unfortunately, the bad news does not stop for Petrobras. I believe dividend investors should be very wary of this stock. Total shareholder return is what matters to your net worth; and an investment in Petrobras means a high risk of capital losses in the stock that cannot be compensated by dividends.

Falling oil prices are a powerful blow to Petrobras' only trump card

Petrobras' trump card is its upstream O&G business, which makes up 63% of its overall revenues and 83% of its overall EBITDA. This business is positively correlated to oil prices.

Unfortunately, fears of an unstable financial sector have reignited fears of a recession, which is bad news for oil prices due to falling demand. Just this week, WTI oil prices (USO) are down almost 12% from last Friday's close of $76.61.

This is not very surprising to me, as I expected worsening supply-demand dynamics for oil a couple of months ago when I analyzed the Crude Oil ETF (OILK). Overall, I anticipate falling oil prices to trigger a sharp multi-quarter selloff in Petrobras.

A new $3.2 billion liability will hit cash flows and impair dividends

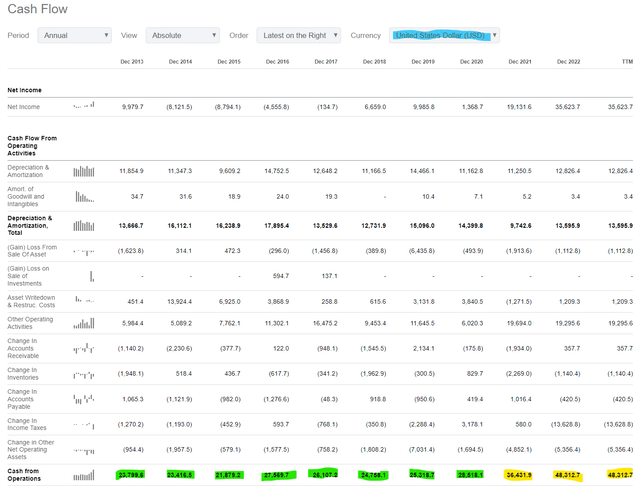

Today, Petrobras lost a decade-long tax tribunal. The company now has a $3.2 tax liability to pay. How much does this matter? Let's have a look at the cash flow statement:

Petrobras Cash Flow Statement (Seeking Alpha)

In FY22, Petrobras generated $48.3 billion of operating cash flow. However, this is not the right base of comparison since this figure is boosted by unusually high oil prices.

Taking a more normalized operating cash flow figure of $25 billion, the $3.2 tax liability implies a meaningful 12.8% hit to normalized operating cash flow levels. I believe this spells further disappointment for dividend-expecting shareholders, as the company is unlikely to prioritize dividend payouts given management's clear message indicating green energy priorities:

I reiterate our ambition to neutralize our operational emissions within a time frame compatible with that established by the Paris agreement.

- CEO Jean Paul Prates in Petrobras' Q4 FY22 earnings call.

Indeed, there are clear signs of lower free cash flow prospects as the company embarks on large ($35 billion commitment) green energy investments such as offshore wind projects. I reiterate my view that these projects will likely lead to value destruction for Petrobras considering the poor performance records of state-owned enterprises.

Valuation

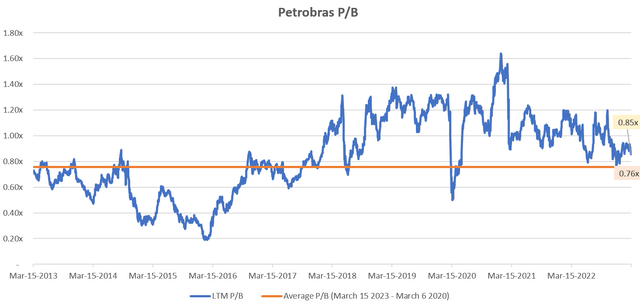

With Petrobras being a commodity stock, P&L-related multiples such as EV/EBITDA, EV/EBIT, and P/E will make Petrobras look artificially cheap, as the denominator is inflated due to high commodity prices. In such instances, P/B is a better valuation proxy:

Petrobras P/B (Capital IQ, Author's Analysis)

Petrobras is currently trading at a P/B of 0.85x, which is a 12.9% premium to the average P/B of 0.76x. I have taken this average during the last 10-year period encompassing normal oil prices, which I believe is more representative of the times going ahead.

Hence, by this measure, Petrobras is overvalued by at least 13%. In reality, given the global recessionary outlook that may be more likely given the sharp fall in oil prices this week, I believe the downside risk in Petrobras is greater than what this brief analysis suggests.

Be careful

With the sharp fall in oil prices putting pressure on its only trump card - the upstream O&G business, and a tax liability hit amounting to almost 13% of operating cash flows, Petrobras looks to be in even worse shape than before. I believe this accentuates my prior value destruction thesis on the stock. With at least 13% further downside, if not more, I maintain my bearish view on PBR stock and downgrade it from a "Sell" to a "Strong Sell" stance on the stock. I know Petróleo Brasileiro S.A. stock is a favorite of many dividend investors. I cannot emphasize caution enough; total shareholder return is what matters, and dividends cannot make up for sharp drops in capital value.