Feverpitched

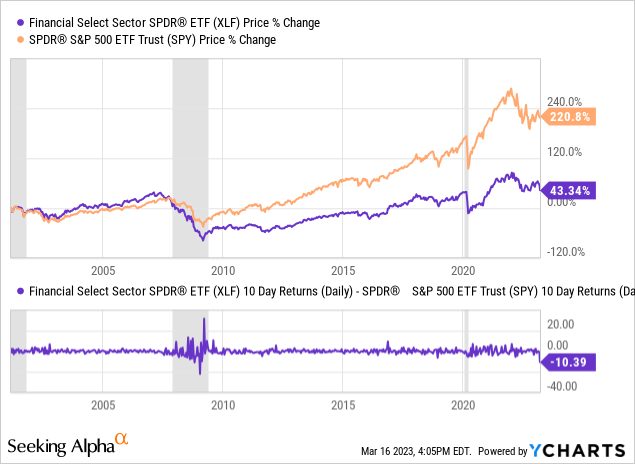

Truly rotten losses during March in the smaller caps and financials on Wall Street are very concerning. Basically, the degree of relative weakness in both concurrently have only happened during recessions and liquidity crises since 2000. And, the last three instances of sizable underperformance vs. the S&P 500 (SP500) have quickly led to lower Federal Reserve interest rate policies, even emergency money printing.

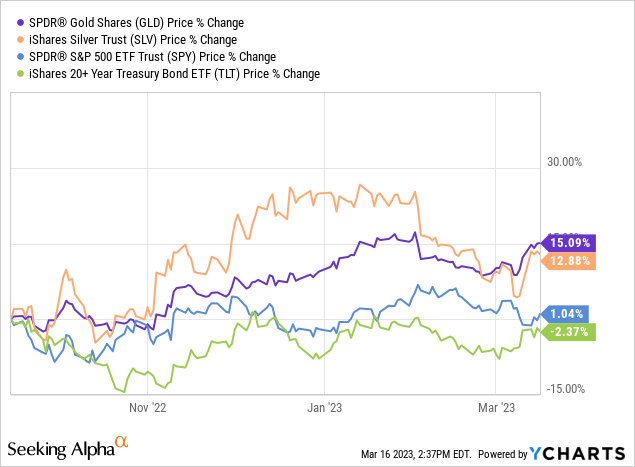

Regular readers know my macro view of trading direction on Wall Street has not been very optimistic since late summer. My main trading account has only been 10% invested in regular stocks, with the rest in cash, intermediate and long-term bonds, plus a heavy weighting in gold/silver assets since the middle of 2022. It's difficult for me to avoid being more invested in equities, but prolonged bear markets put you in survival mode, where limiting losses is paramount.

This year, I have been trying to explain to readers that the Fed is stuck raising interest rates until the stock market swoons significantly lower in price, a recession in GDP activity is reality, or something else breaks in the markets. A new banking crisis and confusion over saver/deposit guarantees over the last week may qualify as forcing all of the above on America in coming months. In fact, bearish trading in less liquid small-capitalization companies represented by the iShares Russell 2000 ETF (NYSEARCA:IWM) and a sharp drawdown in banks/financials represented by the Financial Select Sector SPDR ETF (XLF) could be signaling the start of a wider liquidity crisis in the U.S.

I have been warning for years that all of the money printing and government spending thrown into the 2020-21 COVID economy would create high inflation, and eventually a recession as the Fed tries to reign in cost increases on businesses and consumers. Interestingly, only a limited number of readers agreed with my coming inflation rants during the depths of the 2020 pandemic, and even fewer believed my 2021 view that much higher Fed-controlled interest rates would become the new normal sooner or later. So, if you don't want to believe a recession (perhaps a deep one) is possible in 2023, I fully understand.

The silver lining in a recession is the world's central bank can begin easing again as the whole financial system is rebalanced back toward normality (overcoming COVID disruptions, complications, and reactions). Major dislocations in asset flows, capital allocations, confidence in the economy, and our full employment picture may be 2023's consequence of extremely tight monetary policy, as expressed by the 40-year record spread in the Treasury yield curve months ago.

Unfortunately, if you own stocks, 2023 may be another down year just like 2022. That's the price we are all paying for an overly aggressive Fed reaction to the pandemic, and the huge policy mistake of waiting too long to increase interest/borrowing costs with spiraling inflation rates during 2021. If you want an example of how "there are no free lunches" in the world of economics, our pandemic response and aftermath will be the new textbook writeup standard, studied for years and generations to come.

Liquidity Crisis Warning

The amazing underperformance selloff in both the Russell 2000 and banks/financials during March is quite uncommon. In modern trading, they only take place at the same time during recessions.

Russell 2000 Weakness - 10 Days

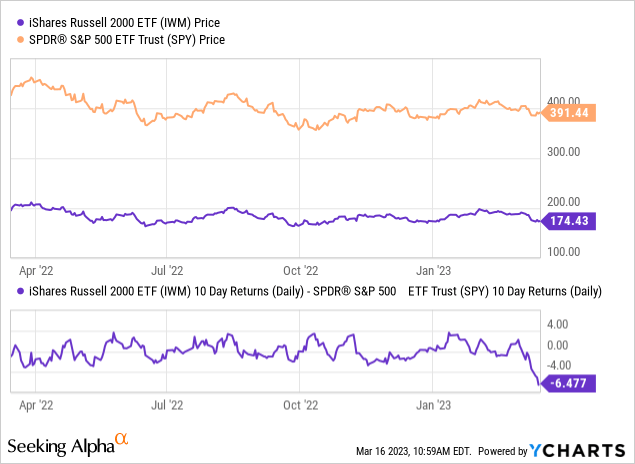

On the 1-year chart below, you can review the massive implosion in less liquid names on the smaller company side of the equity spectrum. Over the last 10 trading days, the IWM product has fallen -6.47% faster than the leading large-cap index, popularly traded through SPDR S&P 500 Trust (SPY). On top of this shocking decline, the 15-day relative number is greater than -8.5%!

YCharts - Rolling Relative Performance, IWM vs. SPY over 10 Days, 1 Year

For a rolling 2-week relative decline greater than -6%, you have to go back to the worst days of the March 2020 pandemic dump in stocks. Before that, we have to travel back to the horrible reaction in October-November 2008 over the Lehman Bros. failure and Great Recession credit crunch. Before that circumstance, the original Technology Dotcom Bust and aftermath of the 2001-02 recession provided another IWM underperformance span near the final months of this bear market. So, to say current trading activity is in a select group of horrible outcomes for investors is an understatement.

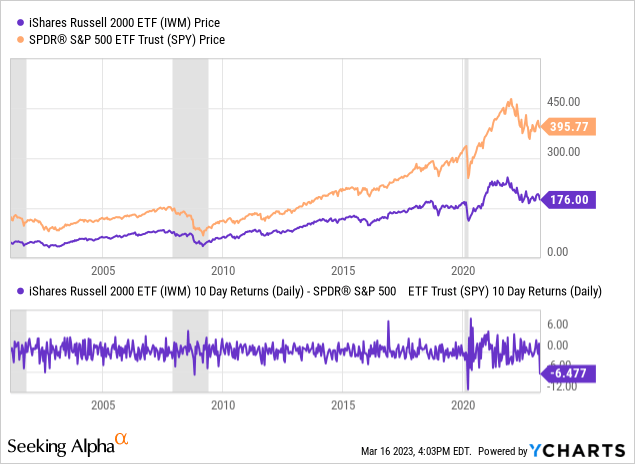

YCharts - Relative Performance, IWM vs. SPY over 10 Days, Recessions in Grey, Since 2001

Major Banks/Financials Decline - 10 Days

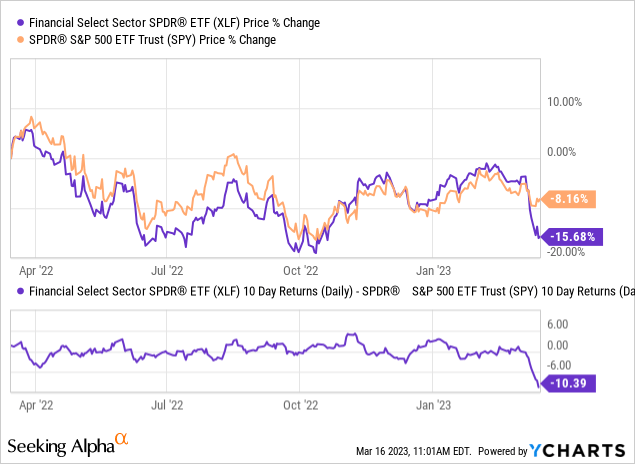

In a similar fashion, we can look at weakness in base credit-creation vehicles, America's biggest banks and financial institutions found in the XLF ETF. By definition, if the credit/loan machine is having issues, you can expect liquidity everywhere in the system to dry up. You can blame the FDIC and government regulators seizing a number of higher-risk, undercapitalized regional banks over the last week as a catalyst.

On a 1-year graph, you can review how extraordinary the -10.39% relative drop in banks has been over 10 trading days vs. the SPY's performance. This spread loss is also greater than -11% over 15 days.

YCharts - Rolling Relative Performance, XLF vs. SPY over 10 Days, 1 Year

Believe it or not, the March 2023 price drop in financials is WORSE than the pandemic selloff, and beyond anything seen over the last decade.

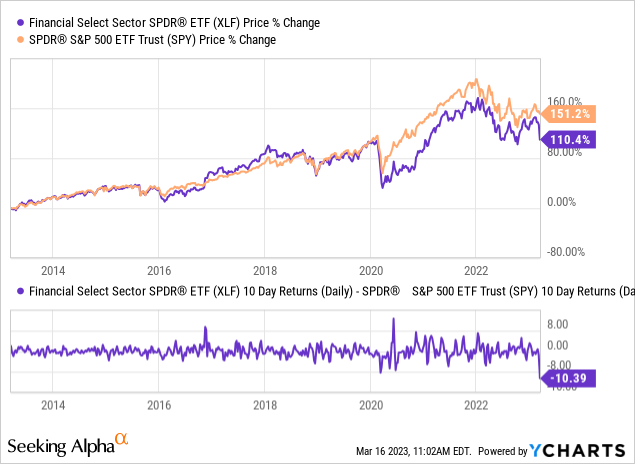

YCharts - Relative Performance, XLF vs. SPY over 10 Days, Since 2013

The cataclysmic drop is akin to the worst days of the Great Recession, if you want to find another relatable example. Before that situation, you have to go back to the Technology boom peak in late 1999 and early 2000 (not pictured).

YCharts - Relative Performance, XLF vs. SPY over 10 Days, Recessions in Grey, Since 2001

Liquidity Crisis & Recession Repeat?

Here's my research conclusion: a -8% XLF underperformance number vs. the SPY in combination with a -6% IWM relative dump over 10 days of trading is exceptionally rare. Really, the late 2008 to early 2009 occurrence, plus the pandemic panic are the only two before today. And, if you include slightly less underperformance from the banks in your calculations, the next closest circumstance would have been right after the 2002 recession ended.

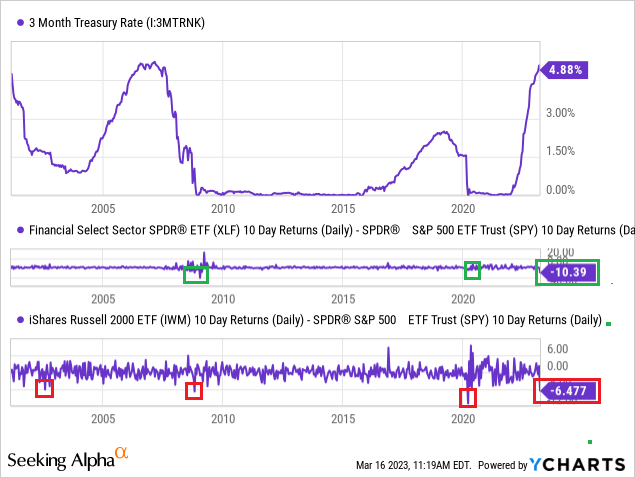

The interesting part of this conclusion is all three previous appearances took place during (around) recessions, which were in the beginning to middle stages of a massive easing policy move by the Federal Reserve. Sharply lower short-term interest rates would follow for an extended period. Emergency money printing in 2008-09 and 2020 were results, with abnormally low rates for years after 2002, each an outcrop of related liquidity crisis events signaled by the weakest possible relative performance in IWM and XLF.

The open questions in March 2023 are how fast will a recession materialize and when (also to what degree) will the Fed ease in response. The odds of both taking place soon are nearing 100% in my view. If you want to scare yourself, also contemplate the debate on easing has only just begun. The tightening noose on stock market price levels and the economy is now incredibly restrictive, meaning potential downside risk may be underestimated by investors over the next 2-3 months.

YCharts - 3-Month Treasury Rate, XLF & IWM 10-Day Price Change vs. SPY, Author Reference Points, Since 2001

Final Thoughts

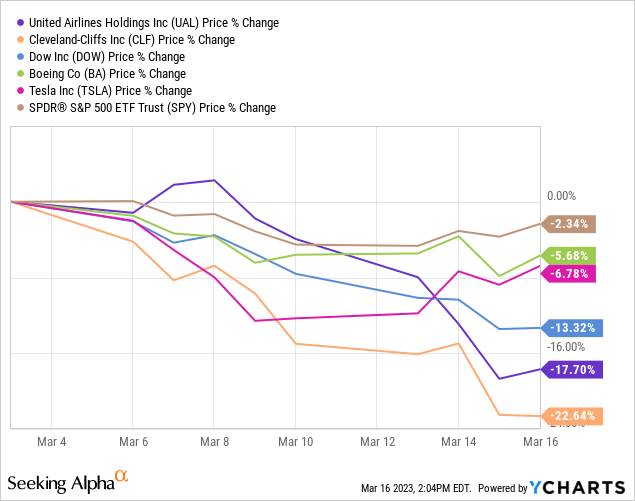

I have mentioned a number of industries and specific names since the autumn that should decline dramatically in a recession and continued bear market on Wall Street. Corroborating the ultra-weak small-cap sector and financial industry performance of March 2023, deep cyclicals, airlines, and steel companies in particular have cratered in recent sessions. Altogether this action is exactly what has played out in past recessions, including 2001-02, 2008-09 and the wicked early 2020 pandemic experience. Below is a sample list of stocks I have suggested to be leery owning because of high recession odds, with losses measured from March 3rd, 2023.

YCharts - Deep Cyclicals, Airlines, Steels Price Change, Since March 3rd, 2023

At the beginning of the year, I was targeting a March low in the stock market, and possibly a final bottom for the whole down move since late 2021. However, this may be wishful thinking, and would all but require a crash in prices over the next two weeks. More than likely, we may have to suffer until the summer or autumn, assuming the water-torture, slow-motion decline on Wall Street remains.

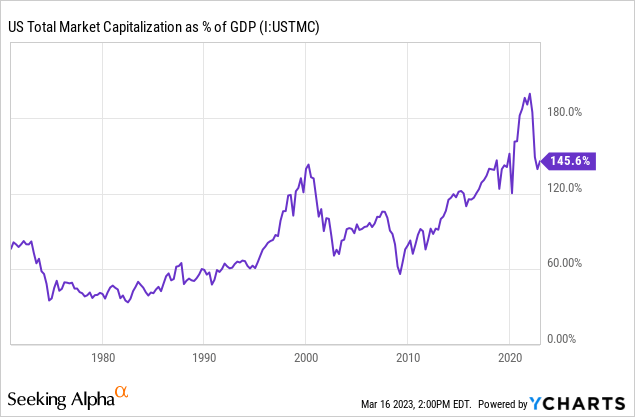

The underlying bearish argument I have been making is total market value vs. GDP is still abnormally high, which acts like a massive weight on prices. Reversion-to-the-mean thinking could be telegraphing another 20% to 30% drop in major U.S. index pricing, if a recession takes hold and does not let go easily. I do not believe far weaker corporate profitability, perhaps unable to rebound quickly (with near record aggregate U.S. debt to GDP output), has been entirely discounted by Wall Streeters hoping for a "soft landing" in the economy. (I do hope I am wrong in this assessment.)

YCharts - Total Wall Street Business Values vs. GDP Output, Since 1971

I am still expecting gold/silver to "lead" the stock market out of an eventual bottom. This is how each of the latest three recessions since 2000 have played out. Either gold/silver will rise during a monster slide lower in stocks (my preferred outcome), as money printing + dollar devaluation expectations skyrocket during a recession, or the monetary metals will rise much faster in the early months of a new bull market.

The tightening cycle by the Fed is pretty much over, in my view. Screams for help from investors and business leaders will only get louder in coming weeks, as a recession becomes move obvious in the data. My guess is the Fed will not raise rates again next week, after expectations of an outsized 0.5% funds increase several weeks ago. If they do raise by 0.25%, I firmly believe such would send Wall Street into a tailspin and prove to be the last increase for this cycle.

A clearer recessionary period, with declining stock prices alongside a jump in unemployment will be the ingredients for falling interest rates, and an "eventual" turnaround in equities. I have been talking about these prerequisites for the stock market bull to return since November. My January article linked here did a fair job discussing the Catch-22 position the Fed has boxed itself into.

I do not recommend a net short position currently, even with strong odds of an additional -10% to -20% in losses for the overall stock market between now and autumn. High short-selling costs (borrowing rates) and elevated premiums to create bearish positions in the options market are noteworthy negatives. Holding plenty of cash earning close to 5% for a risk-free annual return makes sense to me.

Then, intermediate and long-term bonds should witness better demand as money leaves risk assets like equities. Inflation rates already trending lower from a big drop in commodity pricing the last six months, could shrink further in a recession. As consumers and businesses pull back on spending, price competition heats up and will likely generate a period of disinflation, helping bond ownership logic. Absent a deep recession, however, I am not expecting YoY CPI to decline under +3% anytime soon.

The outlier negative I am trying to understand for bonds revolves around a potential spike in energy prices as Israel deals with Iran's nuclear development program, and Russia's war with Ukraine drags on. If we get US$100 crude oil per barrel again in coming months, such would surely send inflation rates higher and the global economy into a real quagmire. Anyway, I am targeting 10% annualized returns from bonds in 2023, which should soundly beat equities in decline.

Gold/silver are my go-to hedge ideas when a recession hits and new money printing approaches (think paper money devaluations). Both metals have been working higher since last summer. I am personally modeling US$2500+ an ounce gold later THIS YEAR. You can read my past articles on Seeking Alpha since summertime discussing all the reasons to own hard money right now.

An honest liquidity crisis that shocks the economy should lead to a new easing phase by the Fed, perhaps surprising in size for market participants now forecasting/focused on tightening during the next couple of U.S. central bank meetings. I have price targets for gold above $3000 and silver above US$40 an ounce in 18-24 months. If these gains materialize, gold/silver will dramatically outperform cash, bonds and equities.

YCharts - Gold/Silver Performance vs. Stocks/Bonds, 6 Months

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.