Craig Barritt

Investment Thesis

Thryv Holdings (NASDAQ:THRY) operates two separate businesses: telephone directories, commonly known as Yellow Pages, and its own SaaS platform. And if the best days of Yellow Pages are already behind, the potential of Thryv Platform is not even half-revealed yet. As part of the SaaS segment, the company operates in a large and promising market, providing significant room for expansion. Thryv has a strong competitive position and actively strengthens it through continuous innovation and new solutions. According to our estimates, Thryv trades at a significant discount to its fair value. We rate shares as a Strong Buy.

From Traditional Marketing to SaaS

Formed from the merger of Dex Media and YP Holdings in 2017, Thryv Holdings owns and operates the Yellow Pages, a well-known telephone directory in the United States that lists the numbers and addresses of local small service businesses such as dry cleaners, plumbers, repair crews, dentists and so on.

In 2019, the company focused on developing its software for small and medium businesses. The SaaS segment provides a one-stop platform that allows small businesses to manage customer relationships (CRM), social media, and reputation, schedule appointments, issue invoices, accept transactions, and request documents.

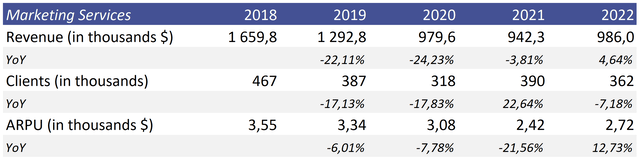

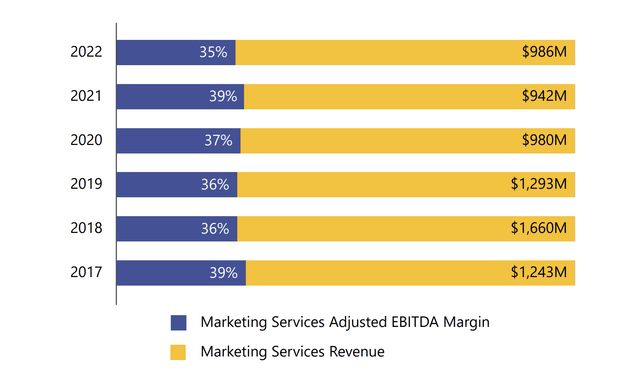

The best times for Yellow Pages are over. The marketing services segment's (YP business) financial and operating performance has steadily declined over the past years. In 2022, excluding the takeover by Vivial Media, the segment's revenue decreased by approximately 4.8% year-over-year.

However, Yellow Pages are the foundation for business transformation. Marketing services generate solid cash flow and deliver impressive profitability with an Adjusted EBITDA margin of 35%.

While other enterprise software developers are forced to dilute capital to finance their growth, Thryv is able to independently finance a loss-making but extremely promising segment. The lack of need for external capital is one of the fundamental factors in the attractiveness of Thryv over other SaaS developers in the face of tightening monetary policy and a shrinking liquidity window.

In addition, Thryv serves more than 360,000 small businesses within the marketing segment, which are highly loyal to the company, as they have been with the firm for more than a decade on average. By accessing a cohort of loyal SMBs, Thryv gains a deep competitive advantage in the distribution of its software. Today, about a third of new SaaS customers come from Yellow Pages, and another third comes from referrals. It is impossible to determine exactly what the CAC of such customers is because the company does not provide a breakdown of sales and marketing expenses by segment. However, according to CEO Joseph Walsh, "cost of acquisition is super, super low."

SaaS Potential

According to Technavio, the SMB software market will increase by $52 billion by 2025. According to Thryv, there are about 4 million SMBs in the US that could become customers of the company, and the global addressable market is estimated at 8 million businesses.

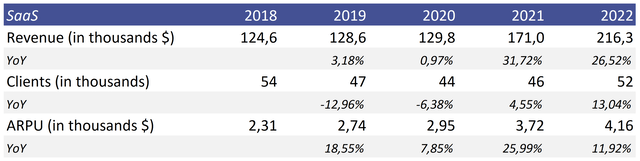

Today Thryv serves only 52,000 customers. In other words, the company's penetration rate is negligible and the runway is huge. It is worth noting that the SaaS segment shows a double-digit growth rate in the customer base and average revenue per user. The decrease in 2019/2020 is due to the abandonment of cheap subscription levels, which stimulated ARPU growth.

According to the fourth quarter results, seasoned net dollar retention amounted to 91%. In comparison, Bill.com (BILL), a provider of software for dealing with accounts payable and receivables for SMBs, has a rate of 131%; Asana (ASAN), a project management solutions provider, has a retention rate of over 115%. In other words, Thryv doesn't have best-in-class retention rates. However, it's too early to jump to conclusions as Thryv dropped cheap subscription levels two years ago, which could have affected the figure.

The company has a strong positioning. Trust Radius users rate Thryv Platform 8.8 out of 10, while G2 users rate it 4.6 out of 5 stars. User loyalty is largely driven by the platform's integrated nature. If you're a small business owner, you don't need to look for different providers for each operation. Thryv provides a full range of services within one platform.

In addition, Thryv is constantly introducing new solutions to improve user engagement. In the third quarter of 2022, the company launched TeamChat, a solution for internal communication with employees, a direct analog of the well-known Slack. Already in the fourth quarter, Teamchat was connected to 10% of customers. In the fourth quarter, the company launched the Signatures App, thereby eliminating the need for customers to connect a solution from DocuSign (DOCU).

Most intriguing, however, is ThryvPay, a payment solution that allows customers to get paid with credit cards and ACH payments, launched in 2020. In the fourth quarter, payment volumes exceeded $140 million, up 114% year-over-year. In addition, in the fourth quarter, Thryv launched mobile card readers, thereby entering the market that at one time became the basis for the explosive growth of Square (SQ).

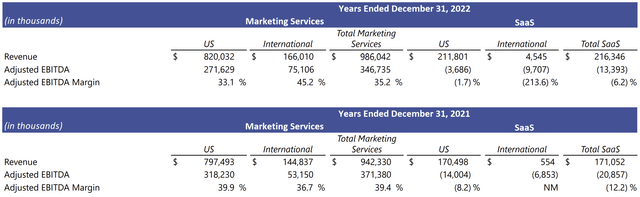

It is worth noting that the SaaS segment in the US has already overcome the break-even point on EBITDA. The company is actively developing its presence in Australia and Canada. Thryv has already successfully established itself in these regions, which indicates the potential for further international expansion.

On the last investor day, Thryv revealed ambitious goals that SaaS revenue should reach $1 billion in five years with an Adjusted EBITDA margin of 20%. It is assumed that for this the company needs 150,000 users. Ten-year plans look even more ambitious: $4 billion in revenue with 500 thousand users.

The long-term management targets must always be treated with a grain of salt. Even the five-year targets look bold, as they suggest that the company should grow its customer base at a compound annual growth rate of 23.6% and average revenue per user with a CAGR of 9.9%. In other words, the firm needs to accelerate. However, even if the goal is only half-fulfilled, Thryv will probably cost significantly more.

Financial Performance

The stagnating marketing services revenue was more than offset by the growth of the SaaS segment. As a result, the company's total revenue in 2022 amounted to $1.20 billion, 8% more than a year earlier.

Adjusted EBITDA was $333.3 million compared to $350.5 million a year earlier. The EBITDA margin decreased from 31.48% to 27.72%.

For 2023, SaaS revenue is expected to be between $257 million and $259 million, which implies 18-20% growth. Considering that this is roughly in line with the decline in billings in marketing services, total revenue is likely to be flat, or show little growth in the short-term.

Given the expected growth in the share of SaaS in total revenue, Thryv's margins will also be under pressure in the short-term. However, the long-term potential for profit growth is huge because the cost of scaling SaaS is very low.

Thryv has a strong balance sheet, with net debt of $526 million (including pension obligations on which the company incurs interest), just over 1.58x of 2022 Adjusted EBITDA. Thryv uses all excess cash flow to pay off debt. Debt is expected to be reduced by about $100 million during 2023, saving the firm more than $10 million in interest expenses.

THRY Stock Valuation

Our DCF model is built on several assumptions. We forecasted financial performance for each of the segments based on historical dynamics and management's forecasts. The forecast by segments is presented in the model on the "Segments" page.

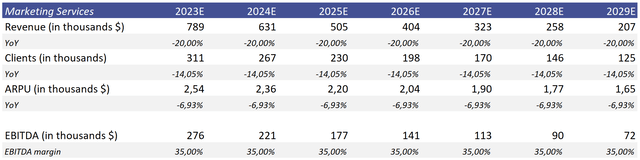

Marketing services

The company's management noted that the expected decrease in billings will be about 20% in the coming years. We assume that the segment's revenue will decrease by 20% annually until the end of the forecast period.

Although the five-year average Adjusted EBITDA margin is 36.60%, we assume that the ratio will remain at about the level of 2022 until the end of the forecast period - 35.00%.

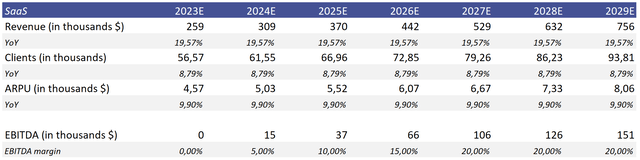

SaaS

The SaaS revenue forecast is based on expected ARPU growth at a CAGR of 9.90%, in line with management's long-term goals but below the four-year average of 16.08%. We assume that the customer base will grow at a CAGR of 8.79% annually until the end of the forecast period, in line with the 2021/22 average.

We expect the segment to break even on Adjusted EBITDA in 2023 and continue to improve operating leverage. We assume that the Adjusted EBITDA margin will reach 20% in five years, which is in line with management's long-term targets.

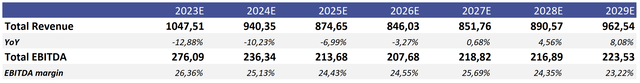

The forecast for total revenue and EBITDA is presented in the figure below:

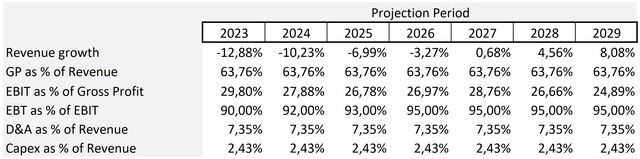

We expect DD&A expenses as a percentage of revenue to be at 7.4%, in line with 2022 figures. Capital expenditure as a percentage of revenue will be 2.4%, which is the same as in 2021 and 2022.

Our assumptions are presented below:

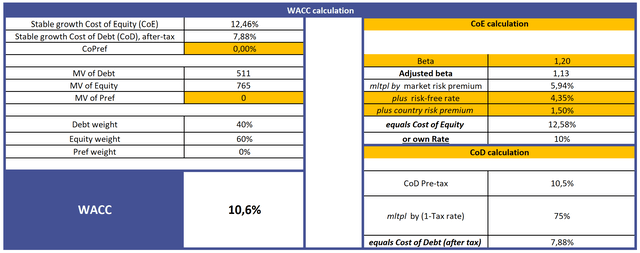

With the cost of equity equal to 12.46%, the Weighted Average Cost of Capital [WACC] is 10.6%.

With a Terminal EV/EBITDA of 8.23x, our model projects a fair market value of $1.24 billion, or $36 per share. The upside potential we see is about 62%.

You can see the model here.

Key Risks

- Our investment thesis is based on the assumption that Thryv can successfully transform itself into a fully-fledged SaaS company. However, if the company's solutions fail to establish themselves in the highly competitive enterprise software market and fail to gain any meaningful market share, Thryv could become a value trap.

- Thryv regularly introduces new solutions within its platform. Each new solution competes in its segment with large companies (TeamChat - Slack; Signatures - DocuSign/Adobe; ThryvPay - Square). There is a risk that the company loses focus and none of its additional solutions can become a full-fledged alternative to products of larger counterparts with narrow specialization.

Conclusion

Thryv is going through a fundamental business transformation. The company owns and operates a conservative and stagnant business, Yellow Pages. YP generates significant cash flow, which the firm directs to software development. In the SaaS segment, Thryv operates in a large and promising enterprise software market for small and medium businesses. The company's penetration rate is extremely low and the runway is huge. In our opinion, the market is underestimating the potential of Thryv Platform, and the company is trading at a significant discount to its fair value.