DNY59

Introduction

The InfraCap REIT Preferred ETF (NYSEARCA:PFFR) was launched by Virtus Investment Partners on February 7, 2017. The ETF holds preferred securities of mortgage and equity REITs as well as a few REIT baby bonds. The ETF is relatively small with $62M in net assets and carries a relatively low expense ratio of 0.45%. PFFR does not use leverage but because REIT valuations have been hammered over the last 18 months, PFFR currently yields a healthy 8.8%, paying a monthly dividend of $0.12 per share. Investors who have been holding PFFR have seen its share price drop by 17.6% over the last year. However, I believe that PFFR will likely see both its dividend income increase and its share price increase over the next two to three years. The balance of this article explains why.

Why Consider PFFR?

Almost all REITs have taken a thorough beating over the last year to 18 months including REIT preferred securities and baby bonds. The price of PFFR, year over year, has dropped 17.6%. Over the last 18 months, it has dropped 30.6%. That drop in price has resulted in the current $0.12 monthly dividend of PFFR yielding 8.8%. The current price and yield of PFFR will move back to more typical values when the Federal Reserve transitions from a tight monetary policy to stable or pivots to a loose monetary policy (lower rates). I'm quite certain this will happen with the only real question being "when ?".

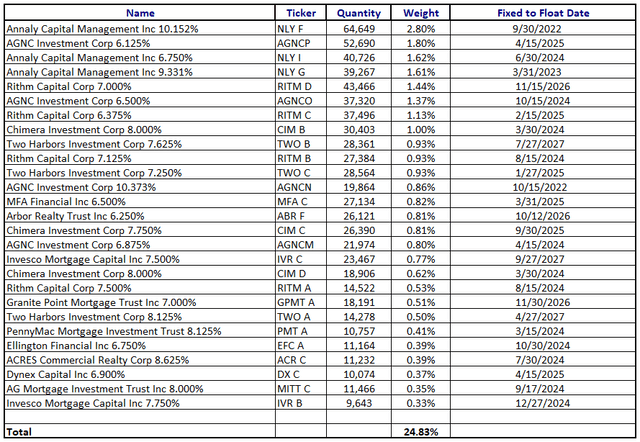

In addition to the Federal Reserve monetary policy stance driving the price and yield of PFFR, there is another driver in the PFFR holdings that will push PFFR dividends upward over the next 4 years. Approximately 25% of the value of the securities held by PFFR are fixed to floating (FTF) rate preferred securities. These FTF rate securities will reset to higher rates over the next roughly 4 years. The EXCEL table below shows the FTF rate securities held as a share of the total net asset value as of 5/26/2023. The entire list of securities held by PFFR can be downloaded from the Virtus website.

I already hold shares of NLY.PI, RITM.PA, RITM.PB, RITM.PC, AGCNM, AGNCN, and AGNCO individually in my own portfolio because of the FTF rate provision and the near term conversion to a floating rate. To date, this strategy of holding near term FTF securities has worked out well with the individual securities I hold that have already converted to a floating rate or will do so shortly. The FTF rate securities that I hold which have already converted to floating rate or will convert in the next 2-3 months have all tethered to their $25 par value giving me a healthy capital gain as well as an increased dividend. Those securities are ALL.PB, AGNCN, ET.PC, ET.PD, and WFC.PQ.

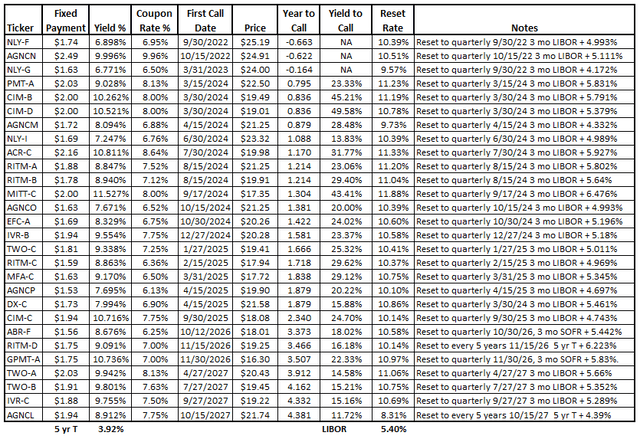

The EXCEL table below provides a summary of the important metrics for the FTF rate securities held by PFFR ordered by time to first call/conversion date.

Readers should note that the 5 yr Treasury rate and the 3 month LIBOR shown at the bottom of the table are current rates. Those rates will most likely change over the next 4 years. I should also emphasize that the pertinent rate comparison is the original Coupon Rate versus the Reset Rate. For example: The original Coupon Rate for CIM.PD (CIM-D) is 8% ($2.00/$25). The Rest Rate when the security converts to a floating rate would be 10.78% (5.40% + 5.379%) after rounding resulting in a new dividend rate of $2.70 ($25 x 10.78%). If 3 mo LIBOR, or the LIBOR replacement SOFR + 0.26%, drops by 50 basis points over the next 10 months, the CIM.PD Reset Rate would be 10.28%, still well above the 8% original Coupon Rate.

If it hasn't become clear at this point in the article, I believe PFFR's dividend rate will rise over at least the next two years and possibly the next 4 years depending on if, and how fast, the Federal Reserve lowers the Federal Funds Rate. Since my investing horizon is longer term, I don't mind at all if it takes 4-5 years as I'll be collecting an 8.8% (likely rising) yield from PFFR while I wait.

What Are The Risks?

Interest rate risk is still with us. It may be that the Federal Reserve will determine they need to continue to raise interest rates in the upcoming June meeting. If so, we could see another 25 basis point increase in short rates which could push REITs valuations down and the price of PFFR would drop a bit more. However, there is another effect to consider if the Fed again bumps short rates. The 3 mo LIBOR/SOFR will also rise pushing the future Reset Rates for the near term FTF rate securities higher. Investors would have the opportunity to pick up shares of PFFR at a slightly reduced price with yet additional upward pressure on dividends due to the increased Reset Rates.

If the Federal Reserve aggressively raises rates over the next 2-3 meetings, it is possible that a couple of the weaker PFFR REIT holdings curtail their common and preferred dividends. I am not intimately familiar with all 105 securities held by PFFR. I did do a quick review of all and noted there are a couple I'd consider to be speculative investments; more speculative than I would hold individually. This risk is mitigated by PFFR holding a fairly diverse portfolio of securities within the REIT sector. If a couple of holdings curtail their preferred dividend payments, the impact will be limited. Readers should also keep in mind that preferred stock is a step above the common for priority of dividend payments.

Overall, I consider the risks to be limited, particularly in comparison to the potential return.

Conclusion

REIT valuations including the preferred shares held by PFFR have been hammered over the last 18 months. This has pushed up the yield from PFFR to healthy 8.8%. The pricing is unlikely to stay low and the yield is unlikely to stay this high. The Federal Reserve will eventually pivot to a loose monetary policy which will put upward pressure on PFFR's price/valuation. In addition, 25% of PFFR holdings are FTF rate securities which will convert to a higher floating rate over the next 4 years. This will also put upward pressure on PFFR's dividend payments and its share price/valuation. The risks to this investment thesis are limited. I'm accumulating shares of PFFR to hold for at least the next two years and potentially the next 4-5 years pending Federal Reserve interest rate policy decisions going forward.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.