M. Suhail/iStock Editorial via Getty Images

Ahold Delhaize (OTCQX:ADRNY, OTCQX:AHODF) is one of those stocks that can be classified as utterly boring. Admittedly that has not always been the case. Long term investors will surely remember the consternation arising from the U.S. Foodservice fraud. Nevertheless, ever since this case was settled in 2014, both the share price and dividend doubled. Since 2016, the year of the merger between Ahold and Delhaize, the compound annual growth rate of the dividend was nearly 11%.

As this company is very consistent, I only look into the stock annually to determine the course of action. Last year I argued shareholder returns would grow in the coming years as the company would continue to grow without taking on too much debt. While this is still true, it's time to reassess the outlook as sales are growing fast, but cash flow growth is lagging.

It’s estimated the dividend will increase by approximately 4% in 2023, compared to the 10.5% increase of last year. Consequently, the forward dividend yield is estimated to be 3.6%. Since this is less than the yield on T-bills, and given the current outlook for the macro-economic environment, consider the stock a ‘Hold’ for now.

Performance

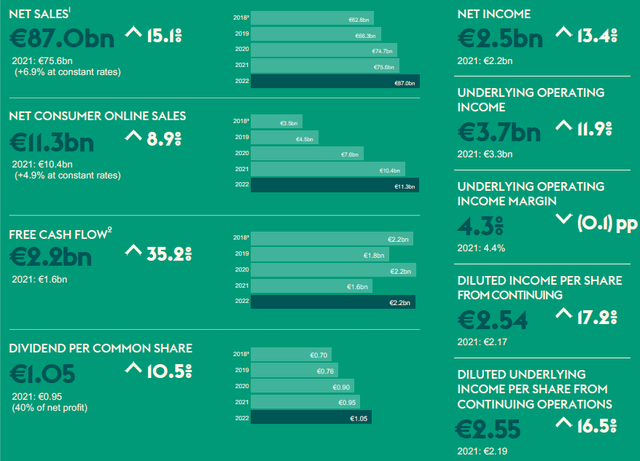

In 2020 Ahold Delhaize showed superb performance as a result from lockdowns and the inability of people to dine out. This effect was expected to taper off in 2021, but especially last year when virtually all restrictions were absent. As can be seen in figure 1, the company has been able to maintain sales growth even as society has returned to normal.

Figure 1 - 2022 Group highlights (AR22, aholddelhaize.com)

The continued sales growth can be explained by the fact new stores were opened consistently. A total of 207 new stores were opened in 2022 (2021:315) and the amount of pick-up points expanded to 1812 (2021: 1642).

Focus on customer journey

Next to an expansion of stores, growth has been enabled by the continued attention of Ahold Delhaize on what it calls the ‘customer journey’, from the AR22:

Customers take a journey with our brands every day (…). Our brands work to make this journey as seamless and convenient as possible through our omnichannel offering of interconnected online and offline channels. We’ve found that this is the shopping experience customers prefer because it enables them to shop on their terms: when and how they want.

The company has gained a lot of experience in online offering through its subsidiary Bol.com. The knowledge gained with this online platform is directly applicable to grocery shopping, meaning the company has a head start compared to competitors.

But not all comes down to the online experience. Even before online was a channel to interact with customers, the company had loyalty programs to keep track of customer behavior. For example, one could think of loyalty programs such as Hannaford Rewards or Albert Heijn Miles. The latter program was introduced in the mid-90’s meaning the company has a huge database it can use to understand the preferences of its customers.

Tracking trends

Maybe more important, Ahold Delhaize has shown the ability to quickly recognize trends and make these part of the journey of its customers. A few notable trends the company has integrated in its business are for example the offering of local produce and organic products.

More recently, demand for package free shopping has been growing. In New York for example Precycle has been getting quite some press coverage, and in Europe similar efforts are going on. Therefore, at several of its stores in the Netherlands, Albert Heijn has implemented the same concept to gauge interest of its customers.

The upside of Albert Heijn is that it can copy ideas from competitors, albeit at a smaller scale and in its existing stores. This makes the company can test these ideas against very low capex requirements, and if an idea does not work out, the process is reverted instantly. This is a huge advantage compared to start-ups that have to invest in literally everything. In this respect a reference to Pieter Pot, a plastic-free online supermarket, is in place. Whereas this start-up was heralded by Forbes to ‘bring the circular economy to grocery delivery’, merely 14 months later the company was on the verge of bankruptcy.

Ratios

Ahold Delhaize has shown the ability to retain customers and actually grow revenues. What needs to be taken into account as well is that the company has experienced tailwinds from a strengthening dollar in the last years. This does not negate the fact the performance has been good in a highly inflationary environment, but factors beyond the influence of management have supported performance.

The development of the debt profile however is within the sphere of influence and this has been managed quite well. As stated, the company is opening up stores and pick-up points, spending capex, without taking on much debt. Admittedly debt is growing, but it is very manageable, see figure 2.

![Figure 2 - Debt development [AR22, aholddelhaize.com]](https://static.seekingalpha.com/uploads/2023/6/24/53878029-1687636762518955.png)

Figure 2 - Debt development (AR22, aholddelhaize.com)

At first glance, combining the info from figures 1 and 2, the growth in debt supports sales growth and increasing earnings per share. While undoubtedly this is positive, as an investor one would want to see cash flow growing rather than earnings per share as this metric is affected by for example buybacks and therefore is a less suitable indicator of underlying performance.

As visualized in figure 1, net sales grew from €62.8Bn in 2018 to €87Bn last year. Over the same period the maximum generated free cash flow stayed constant. Therefore, in figure 3 the free cash flow-to-sales ratio is shown in the top graph. The trend over the last decade is clearly pointing downward. In other words, the company has massively grown its sales, but became relatively less efficient converting sales into free cash flow.

![Figure 3 - Cash flow ratios [aholddelhaize.com; chart by author]](https://static.seekingalpha.com/uploads/2023/9/5/53878029-16939341508108895.png)

Figure 3 - Cash flow ratios (aholddelhaize.com; chart by author)

Next to free cash flow, the figure shows the operational cash flow relative to total liabilities of the company in the bottom graph. This graph indicates total liabilities are growing at a slightly faster pace than operational cash flow. So, increasing debt is converted into higher sales, but the growth in cash flow is lagging thus far. While the ratios and their trend are not alarming, they should be taken into account as investors may have gotten the impression the only way is up.

Outlook

The 2023 targets are shown in figure 4. Top of the list is the underlying operating margin which is set at the well-known 4%, a value management has referred to more often, and continues to focus on as was shared during the 1Q23 earnings call.

![Figure 4 - 2023 targets [AR22, aholddelhaize.com]](https://static.seekingalpha.com/uploads/2023/6/24/53878029-16876367628292015.png)

Figure 4 - 2023 targets (AR22, aholddelhaize.com)

Overall the 2023 targets are in line with the those from last year. More notable is that all targets point up apart from FCF. Considering free cash flow, it must be stressed once more the company experienced tailwinds due to covid in 2020, and in 2022 ‘favorable foreign currency translation’ supported the results and thus free cash flow. In both years free cash flow of €2.2Bn was achieved. Apparently management expects it will be harder this year to maintain the cash flow level and, in spite of elevated sales and cost saving programs, to control margin pressure.

Considering shareholder returns, the buybacks remain constant at €1Bn and the company commits itself to an increase in dividend but retains flexibility by not sharing a target amount.

Shareholder returns

Figure 5 displays the shareholder returns, in dividend and buybacks, over the last decade. For clarity the free cash flow is plotted as well. This visualization shows free cash flow needs to be at a level of approximately €2Bn to support the buybacks and increasing dividend.

![Figure 5 - Free cash flow versus dividend and buybacks [aholddelhaize.com; chart by author]](https://static.seekingalpha.com/uploads/2023/6/24/53878029-16876367626845899.png)

Figure 5 - Free cash flow versus dividend and buybacks (aholddelhaize.com; chart by author)

This representation does not entirely do just to the performance the company has shown in relation to growing shareholder returns, see figure 6. The dividend has consistently been raised while the number of outstanding shares has been reduced nearly every year. The only deviation is 2016, but this is explained by the fact Ahold took over Delhaize in that year.

![Figure 6 - Development of shares outstanding and dividend [aholddelhaize.com; chart by author]](https://static.seekingalpha.com/uploads/2023/6/24/53878029-16876367624096873.png)

Figure 6 - Development of shares outstanding and dividend (aholddelhaize.com; chart by author)

The compound annual growth rate of the dividend over the last decade is 9.1%. This quite a big number, but it gets even better if the timeframe since the Delhaize merger is taken, then the CAGR jumps to nearly 11%.

As the company currently has 977 million common shares outstanding, the €1Bn buyback program will reduce this amount by approximately 3.4% based on the current share price. To maintain a relative constant cash outflow resulting from dividends, it is estimated the dividend increase will be around 4%. With a current dividend per share of €1.05, this will rise to €1.09 implying a forward dividend yield of 3.6%.

Conclusion

Over the last years, Ahold Delhaize performed well as its results were buoyed by lockdowns during the pandemic and subsequently it enjoyed favorable foreign currency translation which boosted the numbers.

Although these factors are not under the influence of management, the company has been working diligently to improve the customer journey by further integrating online and offline channels, a subject which it does control. In addition, the company is able to quickly recognize and test trends in consumer behavior.

Even though Ahold Delhaize has shown consistent dividend increases, share buybacks and an appreciation in stock price, it must be noted the presented ratios of cash flow growth do not keep up with that of sales and liabilities. While not alarming, the deterioration of these ratios means sales growth needs to continue to maintain the growth of the shareholder returns.

To maintain a relative constant cash outflow due to dividends, its estimated the dividend increase will be around 4% in 2023, implying a forward dividend yield of 3.6%. Since this is less than the yield on T-bills, and given the current outlook for the macro-economic environment, consider the stock a ‘Hold’ for now.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.