AsianDream

When the economies of emerging markets don't just grow but beat expectations, there's scarcely a mention. - Kenneth Fisher

The iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE), managed by BlackRock, focuses on high-dividend-yielding stocks in emerging markets, offering an attractive yield at the surface. However, as with any investment, it's crucial to delve into its performance, holdings, advantages and risks.

Understanding DVYE

DVYE follows the Dow Jones Emerging Markets Select Dividend Index, aiming to replicate the performance of this index before fees and expenses. This index measures the performance of companies in emerging market countries that have consistently provided high dividend yields over time. Its annual operating expenses stand at 0.49%, making it a competitive choice in its space. Furthermore, the fund offers a compelling 12-month trailing dividend yield of 10.05%, which can serve as a significant source of income for investors.

Portfolio Holdings and Top Investments

While ETFs inherently minimize single-stock risk due to their diversified exposure, it's still crucial to scrutinize a fund's holdings before investing. DVYE is reasonably well-diversified across countries, with investments spread across more than a dozen nations. The three largest countries, namely China, Brazil, and Taiwan, account for over 50% of the fund's portfolio. The fund also showcases substantial industry diversification, with significant investments across different sectors.

However, a closer look reveals that DVYE is overweight in traditional economy industries such as materials, energy, and utilities. Conversely, it is underweight in sectors like tech and healthcare. The fund's industry exposures could influence its relative performance, potentially underperforming when tech outshines and overperforming when traditional economy sectors take the lead.

Impact of Elevated Treasury Rates

The Federal Reserve's monetary policy significantly influences emerging markets, including those in DVYE's portfolio. An inverse correlation exists between DVYE's fund price and the U.S. treasury rate. As the Federal Reserve tightens its monetary policy, money tends to flow from emerging markets back to the United States, causing equities in these markets to drop. Therefore, persistent inflation forcing the Federal Reserve to maintain high rates for longer could continue to suppress DVYE's fund price.

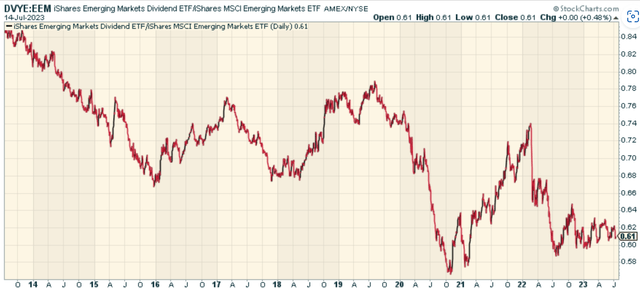

The performance of DVYE relative to EEM has been atrocious.

The Bull Case for DVYE

For risk-tolerant investors seeking high yields, DVYE presents an appealing investment option. Its dividend yield is self-explanatory, providing an incredibly strong yield on an absolute basis and significantly higher than that of most well-known equity indexes.

The Bear Case for DVYE

On the downside, DVYE's focus on high-yield emerging market equities comes with substantial risk. Emerging market equities are inherently riskier due to their comparatively weaker economies, corporate governance issues, and foreign currency risk. Furthermore, high yields often come at the cost of higher risks.

Moreover, DVYE's significant investments in Chinese and Taiwanese stocks, accounting for 21% and 14% of the fund's holdings respectively, pose a significant risk. These stocks could suffer substantial losses in the event of a military conflict between China and Taiwan, a distinct possibility given the current geopolitical climate.

Bottom Line

While the iShares Emerging Markets Dividend ETF offers high yields and potential exposure to emerging markets, its high risk and weak long-term performance warrant caution for potential investors. I believe emerging markets will have a run after the next major risk-off sequence for global assets, but even if it does, it's not clear to me DVYE will necessarily be the way to play it.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.