21AERIALS/iStock via Getty Images

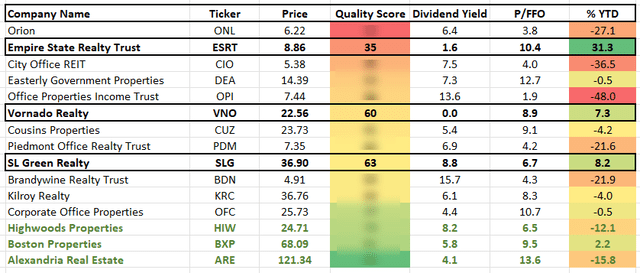

Last week, I published “The Office REIT Conundrum,” which covered three office real estate investment trusts:

We rate two of those a Strong Buy and one a “regular” Buy, while fully acknowledging how the office REIT sector – once an overall easy Buy based on its consistent demand appeal – isn’t so easy anymore.

As I stated in the first article:

“Three decades ago, I can’t think of anyone who anticipated that corporate America wouldn’t go to the office.

“Even two decades ago, as internet capabilities and dependency took giant leap after giant leap, remote work wasn’t really on anyone’s radar. Not in a this-could-kill-the-office kind of way, that is.

“Yet here we are, post-pandemic, and so very, very much has changed.”

So many of us got used to working from home during the shutdowns. Moreover, so many of us feel as if we proved how well we can work from home during the shutdowns – even better than at the office considering how we don’t have to worry about commuting’s pitfalls and perils:

Water cooler breaks turning into half-hour discussions about Carl’s mother-in-law.

And having to take elongated lunch breaks thanks to walking to the restaurant, waiting in line, and then walking back.

As a result, workers – and society at large – have been asking a giant question for three years and counting.

“Should we all just work from home for good?”

Office Space Booms Are Still Happening

That's to say people have been asking that question in some places. One of the most insightful comments my original article got was from Cpr1200r100, who noted how:

“In some growth markets (like) Tampa Bay (and) Sarasota in particular, we don’t know what you naybobs are yakking about. Those companies with employees still working from home are thankful because our office market exploded post-COVID. Sarasota (commercial business district) is almost at full occupancy. Bradenton CBD is in the same boat, and mega submarket is effectively at 100%. Med Office and a local near (billionaire) are the only office builders active.”

Other Florida office market communities also are thriving, like the Fort Myers/Naples area. As of July 19, it boasted an overall vacancy rate under 4%. And while South Florida is apparently seeing a subjective amount of subleasing, it’s still quite the hub.

In which case, it’s a far cry from New York City.

To be fair, NYC isn’t complete economic rot. For instance, commercial real estate services global leader Cushman & Wakefield released its “Marketbeat Manhattan Office Q2 2023” report, which showed that, “Despite ongoing layoffs, job growth maintains a positive trajectory.”

Believe it or not:

“New York City continued to record positive job growth through May, with total employment approaching the February 2020 peak of 4.7 million jobs… Private sector employment climbed to an all-time high of 4.1 million jobs as increased tourism pushed leisure and hospitality employment up steadily over the past four months to 456,100 jobs. With 28,900 jobs added over the past year, New York City office-using employment rose to 1.5 million, despite falling by 4,500 jobs since the first quarter of 2023.”

So there’s the economic bright spot.

Now onto the less flattering facts.

Just Maybe Not So Much in NYC

For those of you who read the previous positive report and immediately said, "So what? There are three words that render those stats null and void: Work from home."

Fair enough. And the following information won’t do much to dissuade that negative certainty:

“Manhattan office demand continued to soften in the second quarter… as new leasing activity registered an eight-quarter low of 3.9 million square feet (msf). Despite the below-average quarterly total, June was the most active month of the quarter, with 1.8 msf transacted. This was largely due to a boost in Downtown leasing as the Department for Citywide Administrative Services (DCAS) committed to lease year-to-date (YTD). New leasing activity through mid-year reached 7.8 msf, falling short of the mid-year 2022 total by 40.6%.”

Moreover, “YTD, lease renewals fell by 5.3% year-over-year.”

In favor of any Big Apple office REIT bulls that might still exist, “Manhattan overall asking rents dipped modestly by $0.05” per square foot to $72.12. But “Class A rents” – the kind that REITs are most likely to own and operate – remained steady at $79.59 psf.”

In fact:

“Midtown asking rents increased by $0.11 to $77.05 psf, while the delivery of Two Manhattan West drove Penn Station asking rents up by 2.6% quarter-over-quarter (QOQ) to $110.02 psf. Midtown South asking rents grew by $0.43 psf to $75.84 as above-average priced space entered the market at 555 Broadway. Downtown asking rents dipped by $0.05 to $56.27 psf, while Class A asking rents rose $0.17 to $60.03 psf, led by pricier space additions at Four World Trade Center and 200 Liberty Street.”

Still… is that sustainable? Is there anything long-term good to be said about New York City REITs?

Let’s take a critical look and see.

SL Green Realty (SLG)

Yahoo Finance

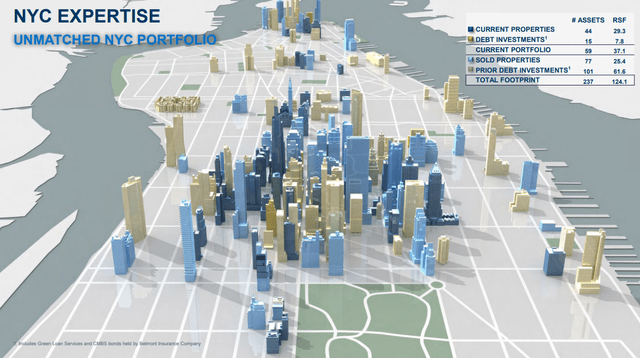

SL Green is an office real estate investment trust (“REIT”) that acquires, develops, owns, and manages office properties that are primarily located in Manhattan, but also owns or has an ownership interest in properties located in the surrounding New York metropolitan area.

As of June 30, 2023, SLG’s portfolio consisted of 60 buildings that encompass 33.1 million square feet, which includes 3.4 million square feet securing preferred equity and debt investments and ownership interests in 28.8 million square feet of real estate located in Manhattan, making SL Green the largest office landlord in Manhattan.

SLG - IR

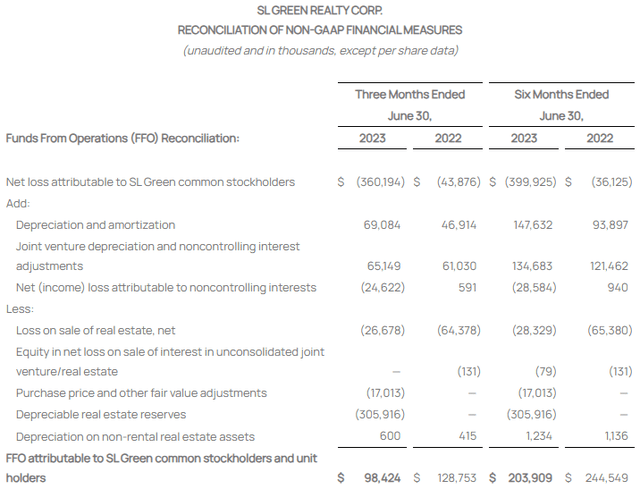

On July 19, SLG released their second quarter financial results and reported the following: Total revenue and total expenses for the second quarter in 2023 came in at $221.1 million and $228.4 million, respectively, compared to total revenue of $201.4 million and total expenses of $164.2 million in the second quarter of 2022.

Funds from operations (“FFO”) were reported at $1.43 per share compared to $1.87 per share for the same period in the previous year and same-store cash net operating income (“NOI”) for the second quarter increased by 3.6% compared to the same period in 2022.

SLG signed 43 office leases in Manhattan that cover 410,749 square feet during the second quarter and Manhattan same-store office properties had an occupancy rate of 89.8% as of June 30, 2023.

SLG - IR

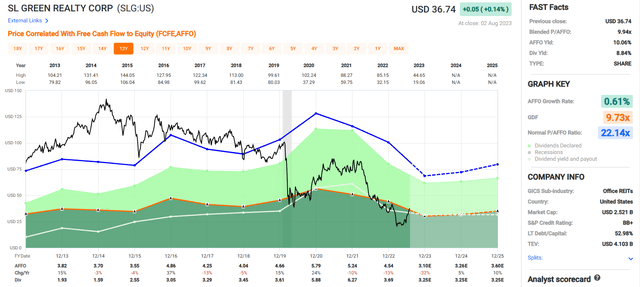

Since 2013 SL Green has had an average AFFO growth rate of 0.61%. AFFO per share fell by 10% in 2021 and then fell by 13% in 2022. Analysts expect AFFO to fall by 32% in the current year before returning to growth with AFFO expected to increase by 5% and 10% in the years 2024 and 2025, respectively.

SLG pays a monthly dividend and pays an annual dividend yield of 8.84%. The dividend is covered with an AFFO payout ratio of 81.23%, however they did cut their monthly dividend in December 2022 from $0.311 to $0.271.

Currently the stock is trading at a P/AFFO of 9.94x which is a significant discount to their normal AFFO multiple of 22.14x.

We rate SL Green Realty stock a Spec Buy.

FAST Graphs

Vornado Realty Trust (VNO)

Yahoo Finance

Vornado Realty is a REIT that primarily invests in office properties in Manhattan but also has interests in other property types located in and outside of New York.

Within New York VNO owns or has an ownership interest in 62 operating properties located in Manhattan which consists of 19.9 million square feet of office space, 2.6 million square feet of street retail space, and sic residential properties that contain 1,664 units.

Additionally, VNO is the external manager of Alexander’s (ALX) and has a 32.4% interest in the company which owns five properties in New York including Bloomberg’s headquarters building, 731 Lexington Avenue, and The Alexander which is an apartment tower in Queens that contains 312 apartment units.

Outside of New York VNO owns or has an ownership interest in theMart, which is a 3.7 million square foot mixed-use property located in Chicago and a 70% controlling interest in 555 California Street which is a three-building office complex located in San Francisco.

VNO - IR

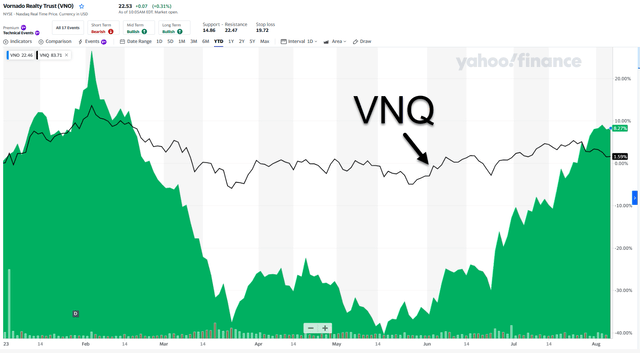

Vornado released its second quarter 2023 operating results on July 31, 2023. Revenues were reported at $472.4 million during the second quarter, compared with $453.5 million for the second quarter of 2022. Funds from operations came in at $144.1 million, or $0.74 per share compared to $154.9 million, or $0.80 per share for the same period in 2022.

During the second quarter, on April 26, VNO announced the postponement of their dividend until the end of 2023. At the end of the current year, once VNO’s 2023 taxable income has been finalized, they will pay the 2023 dividend in either cash or securities or a combination of the two.

VNO stated that they intend to use cash retained from dividends or asset sales to reduce debt and/or to fund their share repurchase program. Year-to-date VNO has repurchased 1,722,295 shares at an average price of $13.48.

VNO also highlighted that they signed 279,000 square feet of New York office space and 205,000 square feet of New York retail space during the second quarter. Outside of their New York properties, VNO signed 29,000 square feet at TheMart, and 6,000 square feet at 555 California Street during the second quarter.

VNO - IR

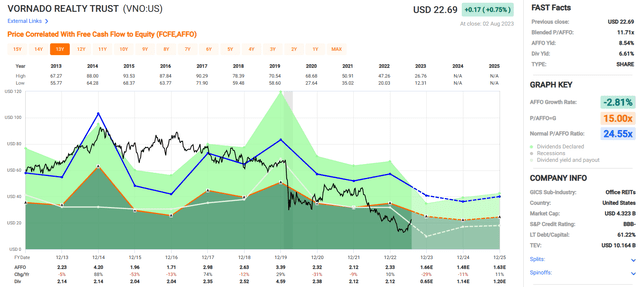

Since 2013 Vornado Realty has had a negative AFFO growth rate of 2.81%. AFFO fell by 31% in 2020 and then fell by 9% the following year. AFFO increased by 10% in 2022, but analysts expect AFFO to fall by 29% and 11% in the years 2023 and 2024, respectively.

VNO’s divided yield is listed at 6.61%, but as previously mentioned it has been suspended for the remainder of 2023. The company is investment-grade with a BBB- credit rating and currently trades at a P/AFFO of 11.71x which is a significant discount to their normal AFFO multiple of 24.55x.

We rate Vornado Realty Trust stock a Spec Buy.

FAST Graphs

Empire State Realty Trust (ESRT)

Yahoo Finance

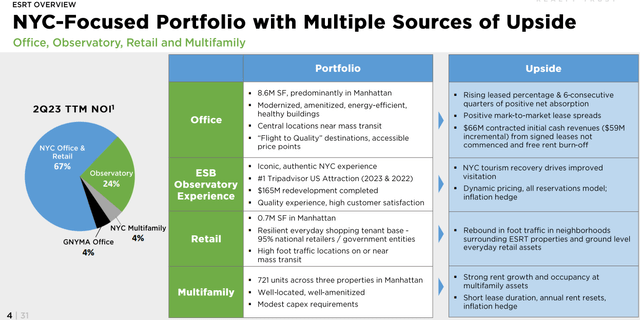

Empire State Realty is a REIT that has a portfolio of office, multifamily, and retail properties in Manhattan and the surrounding New York metropolitan area. ESRT owns the Empire State Building, which is possibly the most iconic, trophy property in the world, as well as the Empire State Building Observatory which was named the number one attraction in the U.S. in 2023 by Tripadvisor’s Travelers Choice Awards.

As of June 30, 2023, Empire State Realty’s portfolio consisted of roughly 8.6 million rentable square feet of office space, three multifamily properties that contain 721 residential units, and 718,000 rentable square feet of retail properties.

The majority of their net operating income (“NOI”) is derived from their New York office and retail properties which combined contributed 67% of their NOI, followed by the Observatory which contributed 24%.

ESRT - IR

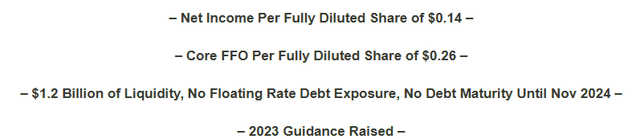

Empire State Realty reported 2023 second quarter results on July 26. Total revenues for the second quarter came in at $190.5 million compared to $198.0 million in the second quarter of 2022.

Core FFO during the second quarter was reported at $69.2 million, or $0.26 per share vs $79.2 million, or $0.29 per share for the same period in 2022. ESRT signed 336,314 square feet of new, renewal, and expansion leases during the quarter and their Manhattan office properties leased rate increased 330 basis points from 88.3% as of June 30, 2022, to 91.6% as of June 30, 2023.

Same-store property cash NOI had a year-over-year increase of 1.1% and their Empire State Building Observatory generated roughly $25 million of NOI during the quarter. Additionally, Empire State repurchased $7.4 million of common stock during the quarter and through July 25 and raised their 2023 full year Core FFO per share guidance from $0.80 - $0.84 to $0.83 - $0.86.

ESRT - IR

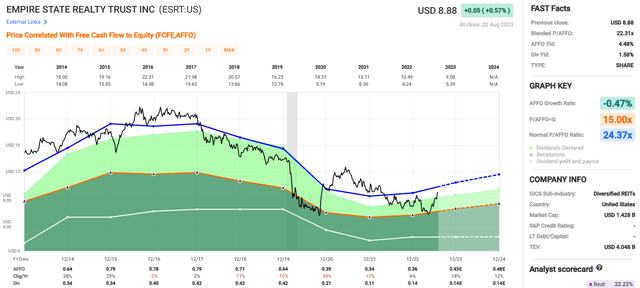

Empire State Realty Trust has had a negative AFFO growth rate of 0.47% since 2014. AFFO per share fell for four consecutive years (2018-2021) but increased by 6% in 2022. Analysts expect AFFO to increase by 18% in 2023 and by 12% in 2024.

ESRT pays a 1.58% dividend yield that is well covered with an AFFO payout ratio of just 38.89% as of the end of 2022. It is worth noting that they suspended their third and fourth quarter dividend in 2020 and cut their quarterly dividend from $0.105 to $0.035 per share once it was reinstate in 2021.

Currently ESRT is trading at a P/AFFO of 22.31 which is a slight discount to their normal AFFO multiple of 24.37x.

We rate Empire State Realty Trust stock a Hold.

FAST Graphs

Alexander's, Inc. (ALX)

Yahoo Finance

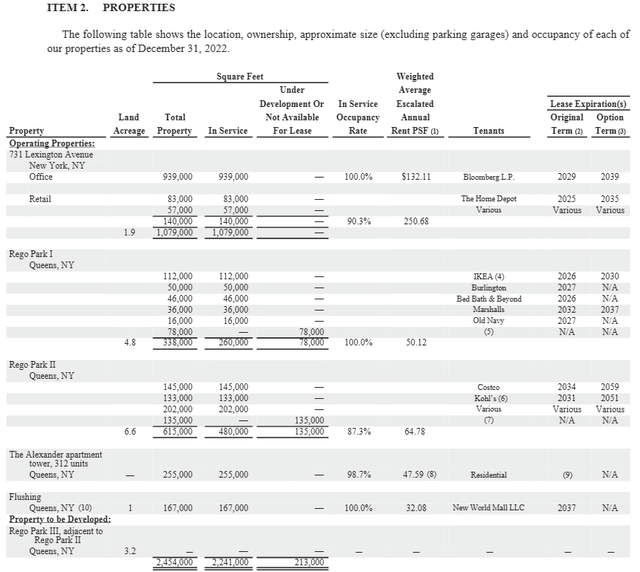

Alexander’s is an externally managed diversified REIT that is managed by Vornado Realty Trust and has a portfolio of five operating properties in New York City which include:

- 731 Lexington Avenue, a mixed-use property covering 1.1 million square feet that contains 939,000 square net rentable square feet of office space and 140,000 net rentable square feet of retail space. Bloomberg L.P. leases all of the office space while Home Depot is the primary retail tenant.

- Rego Park I, a shopping center covering 338,000 square feet located in Queens. The shopping center is anchored by several large tenants including Burlington, Bed Bath & Beyond, and Marshalls.

- Rego Park II, a shopping center located in Queens that covers 615,000 square feet and is anchored by Costco and Kohl’s.

- The Alexander apartment tower, which covers 255,000 square feet and contains 312 apartment units.

- Flushing which is a 167,000 square foot building that is sub-leased to New World Mall, LLC.

ALX - IR

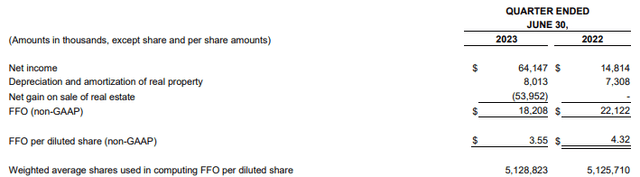

Alexander's released their second quarter financial results on July 31. Total revenues came in at $53.7 million during the second quarter compared to $49.8 million during the second quarter of 2022.

Second quarter funds from operations were reported at $18.2 million, or $3.55 per share vs $22.1 million, or $4.32 per share during the same period of 2022. There was no leasing activity or guidance provided in the earnings press release.

ALX - IR

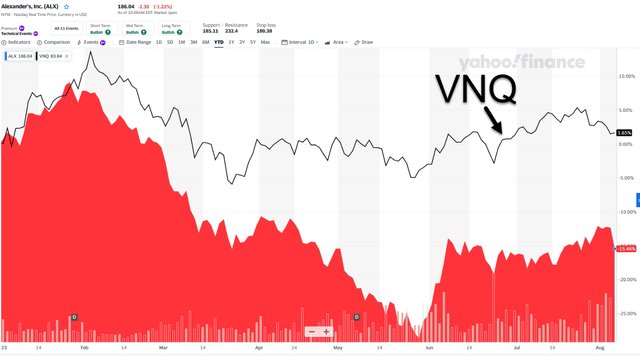

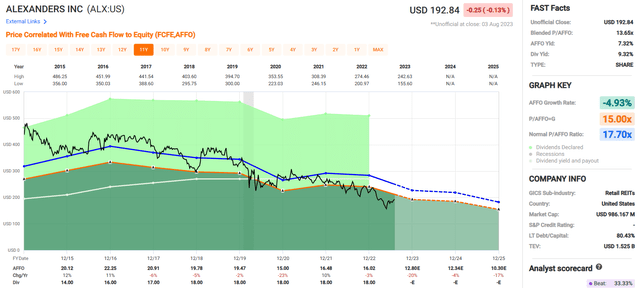

Since 2015 Alexander’s has had a negative AFFO growth rate of 4.93% and since 2017 their AFFO per share has fallen each year except for in 2021 when it increased by 10%.

Analysts expect AFFO per share to continue its downward trajectory with projected declines of 20%, 4%, and 17% in the years 2023, 2024 and 2025 respectively. ALX is already paying more in dividends than the AFFO they are generating so further declines in AFFO could spell trouble for the dividend.

Since 2020 ALX has had an AFFO payout ratio over 100% and had a 112.36% AFFO payout ratio as of the end of 2022.

Additionally, the company is loaded with debt with a long-term debt to capital ratio of 80.43% and a total debt to equity ratio of 411.0%. ALX pays a 9.32% dividend yield and trades at a P/AFFO of 13.65, which is a discount to their normal AFFO multiple, but given their earnings history and unsustainable dividend payout ratio we rate Alexander’s stock a Sell.

FAST Graphs

In Closing

Much like the West Coast markets (i.e. San Francisco and Portland), iREIT® maintains a bearish view of New York City real estate. While most of these REITs I referenced in this article have outperformed Vanguard Real Estate Index Fund ETF Shares (VNQ) year-to-date, we’re extremely cautious in our outlook of the "Big Apple."

We favor sunbelt markets and within our geographic portfolio blueprint we’re more attracted to markets like Texas, Florida, the Carolinas, Georgia, Tennessee, Virginia, and Arizona.

I look forward to your opinion and feedback.

As always, thank you for the opportunity to be of service.

iREIT on Alpha

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.