anyaberkut/iStock via Getty Images

First, I know I write incessantly about private mortgage insurers. I can’t help it. I just think they are generally ignored and frequently misunderstood when not ignored. Most importantly, I am confident they remain quite cheap to their likely outcomes for the next 5+ years.

Second, a shout-out to me. Yes, pretty obnoxious. But my last piece on MGIC (NYSE:MTG) was a compare-and-contrast piece versus Redfin (RDFN), a related company in the housing space. Seeking Alpha published my article Buy Housing Stock MGIC, Sell Redfin, Seriously Skewed Valuations on July 12, barely four weeks ago. Since then, MGIC is up 10% and Redfin is down 34%. Hopefully this fact will get you to read further down in this article.

“The Mortgage Bankers Association (MBA) reported that the mortgage delinquency rate fell to its lowest level since it began tracking this metric 43 years ago…”

43 years! So the current state of mortgage credit is pretty different from what we have experienced during our investing lives. It is safer than it has ever been. Which puts MGIC and its peer mortgage insurers in a different operating environment than they have ever experienced. It is different this time for this combination of reasons:

- A housing shortage

- A labor shortage

- Excellent underwriting

- MGIC’s capital excess

The housing shortage

Mortgage defaults rise when some combination of three events occur:

- Home prices fall materially.

- Unemployment rises significantly.

- Mortgage lending standards get too loose.

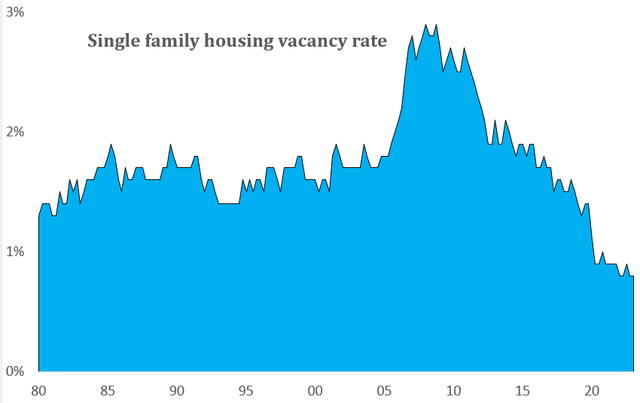

I’ll address the home price decline risk first. The law of supply and demand says that prices of any product fall when there is an excess of supply. In housing, a supply excess is indicated by a high vacancy rate. You judge from this chart whether single-family housing has excess supply:

Source: The Census Bureau

The exact opposite of excess supply. Housing vacancies haven’t been this low in our investing lifetime! It would take many years of overbuilding to create excess housing. So the risk of a sharp decline in home prices seems remote. Even the dramatic rise in mortgage rates from 3% to 7% over the past 1½ years barely dented home prices.

The labor shortage

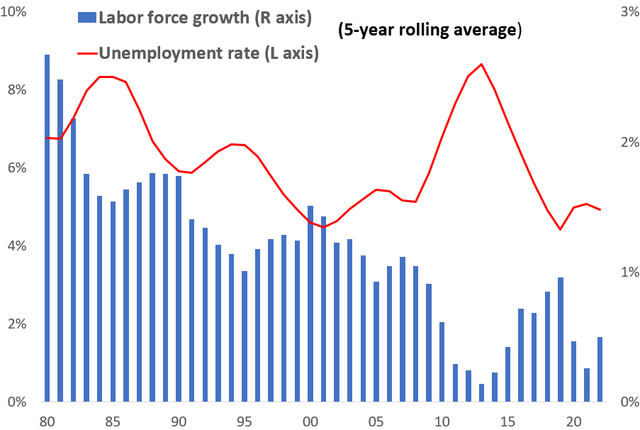

Again I rely on the supply/demand law. A sharp fall in demand for labor always creates the risk of rising unemployment. But we also need to keep on eye on growth in the supply of labor. So let’s do that. This chart shows changes in the U.S. rate of change in the labor force, measured as 5-year rolling averages to smooth out temporary blips. I then added the unemployment rate, against using a 5-year average:

Sources: FRED, for the labor force and the unemployment rate.

The chart clearly shows that labor force growth has slowed a lot over the past four decades, helping the unemployment rate trend lower. In fact, unfilled jobs currently total nearly 10 million, about double the average over the last few decades.

So yes, a rise in unemployment due to a sharp decline in demand will be a risk for mortgage insurers. But that risk is lower than average now because of a material labor shortage.

Excellent underwriting

Perhaps the most important risk of rising mortgage defaults is caused by weak mortgage lending standards. And this is the best news yet.

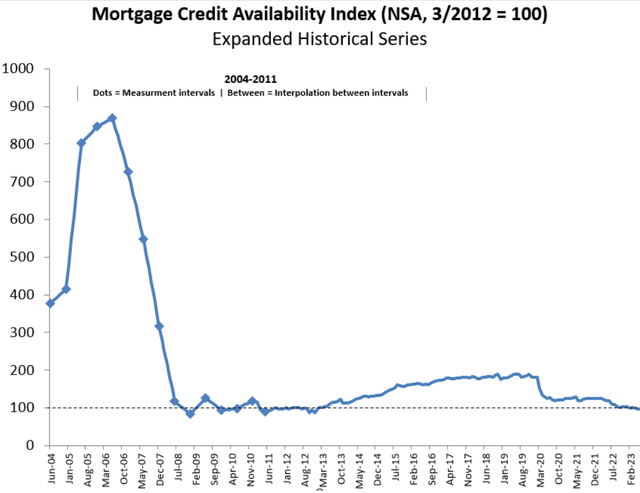

Excellent underwriting standards by the mortgage industry. The mortgage industry and the MI’s in particular have generated outstanding quality home loans for well over a decade. For proof, I turn first to more MBA data, this time a historical index of mortgage lending standards:

Source: MBA

More evidence of conservative lending standards is supplied by looking at the share of mortgage debt outstanding underwritten by the private sector, not the government – Fannie Mae, Freddie Mac and the FHA/VA. You might expect that government programs would be looser than private business loans, but that was not the case during the early ‘00’s housing bubble; the risky subprime and other whacky loans were very largely private sector products. Private sector credit was 33% of total home loans in ’09. That percentage is now below 20%

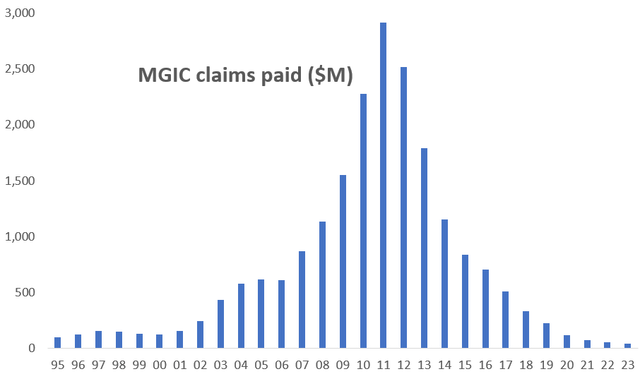

Excellent underwriting standards maintained by MGIC. MGIC’s shift to more conservative lending has been radical, as shown by this history of paid claims on mortgage defaults:

Sources: MGIC financial reports

This chart is stunning. Claims payments this year will be the lowest since at least 1995, as far back as currently available data. And compare the $45 million or so of claims payments this year to 2005, the peak of the early ‘00’s housing bubble. Default payments in ’05 were $612 million. Fifteen times larger!

And if the economy takes a big hit? 86% of MGIC’s risk is covered by reinsurance that pays in the event of a material recession.

Again, home loan quality is different this time.

MGIC’s Q2 results highlight the “this time is different” theme. Plus more good news

MGIC’s operating EPS was $0.60, after my adjustment for loss reserve accounting, which added $0.08 to MGIC’s reported operating EPS. That compares to $0.53 (my estimate) a year ago. The results were good enough to cause Wall Street analysts to raise their average ’23 EPS estimate to $2.31 from $2.15.

Claims paid were a mere $12 million on a $292 billion insurance book. That is a tiny 1.6 bp loss rate. But nearly 70% of the claims MGIC paid were from loans originated prior to 2009! That means the insurance MGIC wrote since 2009 had a Q2 loss rate of a miniscule 0.7 bp. This time is really different.

Two more pieces of good news from Q2:

- Revenues are showing signs of turning up. MGIC’s revenues have been under pressure for a number of years because (A) MGIC has been sacrificing insurance premium income in order to reduce its default risk, and (B) lower interest rates reduced yields on its $5½ billion of fixed income assets. But MGIC’s net premium yield of 33.2 bp was flat for the second quarter in a row. And new investments are clearly yielding more.

- Stock buybacks were 5 million shares, or nearly 2% of shares outstanding. Versus a year ago, MGIC had 8% fewer shares outstanding. That drove more than half of MGIC’s operating EPS growth year-over-year.

MGIC’s valuation far from reflects the “this time is different” environment

MGIC will generate about $700 million of cash flow this year, or about $2.50 per share. That is a 14% return on the stock price. And basically all of that cash flow can be paid to shareholders. That’s because MGIC has $1.3 billion of excess capital above its regulatory capital requirement plus a 40% capital cushion.

In fact, during the first half of this year MGIC paid shareholders $59 million in dividends and $150 million in share repurchases, for an 8% annualized return to shareholders. I expect it to return more to shareholders.

MGIC can very comfortably use $350 million of cash flow per year to buy back stock. At the current price, that means a 7% decline per year to shares outstanding, and a therefore a 7% annual increase in cash flow per share without any increase in dollar earnings. Not bad for a stock with a 14% current cash flow yield.

I believe that $25 is a conservative valuation for MGIC. Its cash return would then be 10%, with a 5-7% growth rate for the foreseeable future. That’s a 40% upside.