courtneyk

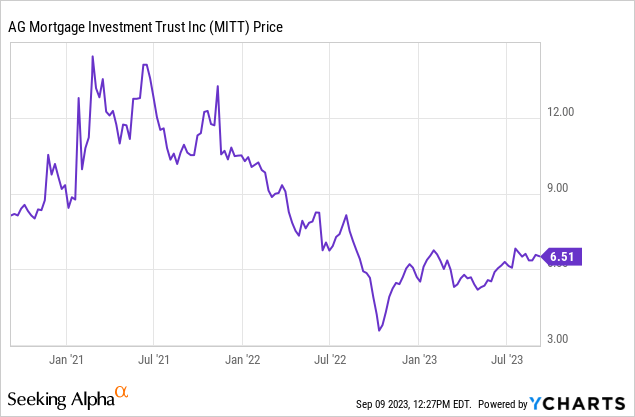

AG Mortgage Investment Trust, Inc. (NYSE:MITT) is an actively managed mortgage real estate investment trust, or mREIT. The stock has quietly approached 52-week highs, and has been in rally mode for a year while other mREITs have struggled. Investing in this sector has long been difficult, as income thirsty investors often buy in, only to see book values erode, dividends be slashed, portfolio mishaps, etc. Wildly volatile interest and by extension mortgage rates are particularly challenging, but AG mortgage has actually done well in this recent climate. As such we rate shares a buy. More advanced investors may wish to consider the preferred shares in this space generally, but for now we will stay with the commons. The chart long-term reflects the struggles of operating in this space, but money can be made near-term. We think shares will head higher as rate hikes from the Federal Reserve are near completion.

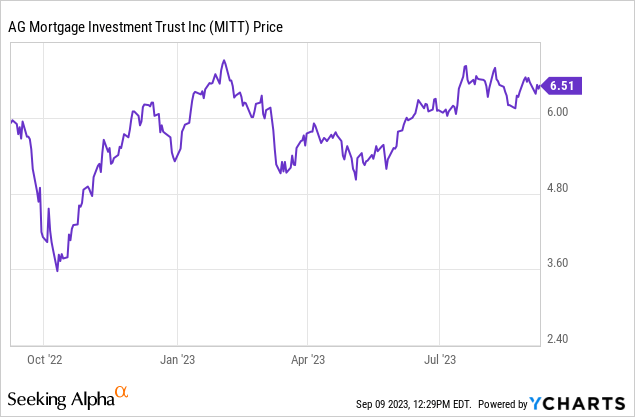

Shares have never recovered from the COVID crash, but made a bottom in the fall of 2022, and the stock has demonstrated strength. We believe shares will approach $8 which is our one-year price target, and investors can enjoy some dividends along the way. Strength is clear on the one year chart.

With that said, let us discuss some of the performance metrics that that has just reported its earnings and you need to be aware of this flying under the radar name. The company has a diversified portfolio of assets and is constantly adapting to the ever-changing economic climate in which mREITs operate. The company consistently alters its holdings in an attempt to maximize returns for shareholders. While this has been a volatile sector and MITT has not been immune, we suggest that you consider AG Mortgage Investment's key metrics when examining your existing holdings.

In the recently reported Q2 2023, MITT saw $3.5 million or $0.17 of net income per share, a drastic turn from the $53.3 million or $2.27 per share in losses a year ago. However, this is a GAAP earnings metric, and while it has value it doesn't really inform us regarding dividend coverage. The company pays a dividend of $0.18 quarterly. It is important to note that this name has seen cuts for many years to its payout, but things have stabilized. A better proxy for dividend coverage in the sector are the so-called earnings available for distribution. AG Mortgage covered its dividend on this metric. Earnings available for distribution was $0.18, so the payout was covered.

Still, the dividend could be in jeopardy if the company fails to continue bringing in earnings that cover the payout. For now, it is safe. Why is that? One key to remember is that to avoid taxes and remain a REIT, the company needs to pay out at least 90% of its taxable income to shareholders. That is a basic in this space, but as we have diverse followers who read our work, we felt it necessary to explain that. Many competitors are fighting to keep their dividends maintained at this point. With AG Mortgage earning its dividend, it is strong.

We like this company in part because is actively managed by a solid team, and has made strategic acquisitions and investment decisions in this climate. The key metrics are pretty strong, and improving. Let's look at the net interest rate spread. Looking at the average yield on interest earning assets (about 5%) and the cost of funds (4.2%), the net interest rate spread was 0.8% in Q2. While the margin has certainly narrowed from the past, as cost of funds have caught up with yields, it has allowed for consistent income. Further, the constant prepayment rate has declined since refinancing activity has dried up in this rate environment.

What about risk exposure? We think this is best measured by the leverage ratio, or the debt the company takes on relative to its equity to magnify returns. In Q2 2023, AG Mortgage was levered at 1.6X on their economic leverage ratio. On a GAAP basis the leverage is 8.9X, so we would consider this moderately risky should the investments falter. Now, perhaps the most attractive risk-reward point that you should be aware of is that the common stock is trading at an immense discount-to-book value.

While much of the sector still trades at a discount-to-book, some of the stronger names trade near book. Let us be clear. We don't like to buy mREITs at a premium-to-book, or even at book. In the case of MITT, there is a massive gap in the price of shares and the book value. Shares are priced at $6.51. Thus, at these levels AG Mortgage trades at a significant discount to its book value as of the end of Q2, which was $11.52 per share. That was a 0.3% rise from Q1. This is also a $5.01 or a 43% discount-to-book.

Take home

As book value holds up, shares are on sale. We think the risk that comes with the leverage is accounted for in this discount. Shares have been rallying this year. The dividend has been covered. The company has made strategic acquisitions and has made strategic investments that we believe justify an investment at these levels. Our price target is $8, which would still be a huge discount to book. Considering the performance of the company, we think you can trade this stock for a gain and earn some dividends along the way. Income investors may consider playing the preferreds which is often a prime strategy in this sector, but with this discount, we think common stock can work.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and one-on-one attention