skynesher/E+ via Getty Images

Introduction

Roivant (NASDAQ:ROIV) is a biopharmaceutical firm focusing on inflammation and immunology treatments, with products like VTAMA (tapinarof) for psoriasis and other medicines targeting autoimmune conditions. They expedite drug development via nimble subsidiaries ("Vants") and also support health tech startups and discovery-stage companies.

In my previous analysis, I highlighted Roivant's promising portfolio, emphasizing RVT-3101 for its significant Phase 2b trial results and potential in the ulcerative colitis [UC] market. I noted its potential for licensing deals and the importance of its upcoming Phase 3 trials. I recommended a "Buy" for Roivant. Since my recommendation, the stock has risen by 16%.

The following article discusses Roivant's financials, strengths in drug development, particularly VTAMA for dermatology, and recommends a "Buy" for the company's stock.

Q2 Earnings Report

Looking at Roivant's most recent earnings report, as of June 30, 2023, the company held a cash position of $1.4B. R&D expenses saw a decrease of $10.7M to $125.1M primarily due to a drop in program-specific costs, notably the discontinuation of several programs and a decrease in share-based compensation. Acquired in-process R&D expenses amounted to $12.5M related to batoclimab's milestones. SG&A expenses rose by $7.1M to $156.2M largely due to increased activities at Dermavant. The net loss for the quarter was $327.8M, a slight improvement from $353.8M the previous year.

Cash Runway & Liquidity

Turning to Roivant's balance sheet, as of June 30, 2023, the company holds assets in the form of 'Cash and cash equivalents' amounting to $1.434B and 'Investments measured at fair value' of $296.2M. Combining these, the total liquid assets stand at $1.73B. The "Net cash used in operating activities" for the three months ended June 30, 2023, is $249.9M, which translates to a monthly cash burn rate of approximately $83.3M. Given this rate, Roivant's liquidity, as represented by the combined assets, provides a cash runway of approximately 20.7 months. It's imperative to note that these values and estimates are based on past data and may not be indicative of future performance.

Roivant's liquidity status appears robust with a substantial cash position and investments. The company also has current and long-term debt amounting to $44.4M and $385.1M respectively, leading to total debt of $429.5M. Given the healthy liquidity, if required, the company might be in a favorable position to secure additional financing. However, it's important to consider market conditions, interest rates, and the company's strategic initiatives when evaluating financing prospects. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

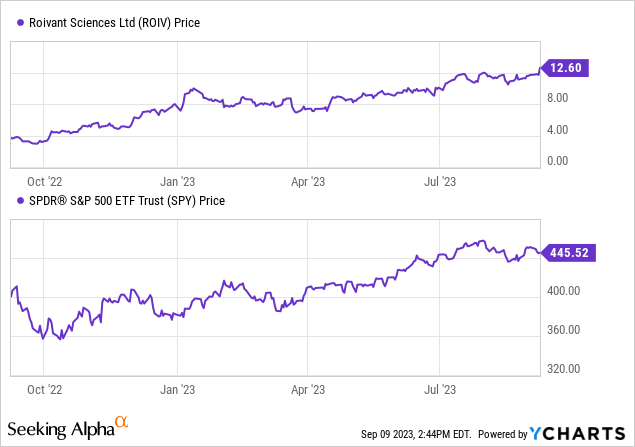

According to Seeking Alpha data, Roivant displays a substantial enterprise value of $9.21B when accounting for its cash and debt. Roivant is notably advancing through its developmental phase, with analysts projecting significant revenue growth: from $135.91M in 2024 to a massive $611.34M by 2026. Roivant's stock momentum is commendably strong, outperforming the S&P 500 consistently over the past year with an impressive 1-year gain of +241.46%.

Given the current data and company's focus on promising treatments like VTAMA for psoriasis, Roivant appears to be strategically positioned for substantial growth in the upcoming years.

Roivant's Strategic Vision: Leading in Dermatological Solutions

During Roivant's recent earnings call, the company showcased a determined mission that goes beyond mere drug development. With VTAMA garnering significant attention, Roivant aims to transform the treatment methodologies in dermatology. Their Q2 net product revenue for VTAMA reached $16.7M, a notable achievement backed by nearly 200,000 prescriptions issued by approximately 11,500 unique healthcare providers since its introduction. The gross-to-net yield for VTAMA for the same quarter stood at 26%. By August 2023, VTAMA's coverage expanded exponentially, reaching 129 million US commercial lives and an additional 87 million government lives.

Furthermore, VTAMA's success in the ADORING 1 trial, the second of its two pivotal Phase 3 studies focusing on moderate-to-severe atopic dermatitis, reaffirms Roivant's position in this domain. The drug not only met its primary endpoint, but all secondary endpoints without revealing any new safety or tolerability concerns, even in younger populations, including children as young as 2 years old.

Roivant isn't just on a quest to introduce drugs, but is aiming to lead in areas with significant market needs. With the escalating demand for potent treatments in atopic dermatitis – a market with massive potential – Roivant's strategy signifies a broader vision of dominating dermatological solutions.

My Analysis & Recommendation

In conclusion, Roivant's journey in the biopharmaceutical domain has certainly been one marked by optimism, innovation, and adaptability. A stock momentum that surpasses the S&P 500 coupled with a promising growth projection speaks volumes about its strategic market positioning. The company’s portfolio, primarily VTAMA, is experiencing well-deserved recognition, showcasing not just the success of their research but also their commitment to addressing genuine gaps in the medical landscape, particularly in dermatology.

However, investors should remain cautious. While Roivant's clinical milestones, particularly with VTAMA, offer a promising trajectory, the biopharmaceutical realm is known for its inherent risks and uncertainties. It's essential to keep an eye on the continuation of positive trial results, potential regulatory challenges, and the company's ability to maintain or enhance its cash burn rate while pursuing aggressive R&D.

The expanding coverage of VTAMA to over 200 million lives in the US is not just a testament to its efficacy but also a signal of its potential market capture. If Roivant continues to navigate the waters with its current acumen, it is well on its way to not just introducing transformative drugs but reshaping treatment methodologies in significant medical areas.

Given the company's undeniable stock, clinical, and market momentum, and the factors laid out in this analysis, I maintain my recommendation of a "Buy" for Roivant. For investors with a long-term perspective and a risk appetite aligned with the biopharmaceutical industry's nature, Roivant presents a compelling opportunity driven by robust clinical outcomes and a clear strategic vision. As always, diversification remains key, and investors should ensure that Roivant fits into their broader portfolio strategy, aligning with their risk-reward balance. The coming weeks and months will be pivotal in observing how the company navigates its next phase of growth and how it leverages its current successes to further cement its position in the market.

Risks to Thesis

In crafting my investment recommendation for Roivant, I may have overlooked certain regulatory hurdles or potential side effects that might arise from VTAMA. My assessments could have been influenced by recent industry trends, potentially causing over- or underestimation of Roivant's unique position. I may have overemphasized the promise of VTAMA without adequately considering competitive drugs or therapies. My biases, whether stemming from recent success stories in the biopharmaceutical sector or personal investment beliefs, might have clouded an objective view. Additionally, any mistaken opinion or undervalued risks could influence the accuracy of this recommendation.