somboon kaeoboonsong/iStock via Getty Images

Dear readers/followers,

I'm not often happy when a company significantly declines in valuation. The mere notion of such a reaction could be thought of as questionable or ridiculous. I have been a "HOLD" on this company for many, many months at this point, despite owning shares (which I bought at a very low valuation). However, when it comes to Tomra (OTCPK:TMRAY), I'm thrilled at the drop we've seen in the company over the past 2 months or so.

Why?

Because this has finally pushed Tomra back into what I consider buying territory.

Seeking Alpha Tomra (Seeking Alpha)

This is obviously an update on a previously covered company, you can find the latest article on Tomra written by me found here, from July of 2023. After a double-digit 25%+ drop, my thesis for Tomra finally requires changing, and nothing pleases me more than to finally go "BUY" on this great, Norwegian company.

Bear in mind that calling Tomra "Cheap" is always a matter of perspective, and I would be extremely careful with this. However, Tomra is now certainly cheaper than it was before, and at a level where upside is very much in the realm of possibility.

Let's get going here.

Tomra - We finally have a decline and upside

Tomra's absolute main problem is the massive premium it trades at. Even at the significant decline we're seeing, the normalized P/E premium for this company is on the level with water utilities, meaning we're looking at least 28-36x P/E, no matter how conservative we're being. This in itself isn't really a problem - as long as the growth rate matches such lofty targets.

And that's what we'll look at in terms of results and where this company might go here. There's absolutely no doubt in my mind that Tomra mostly traded far too high for several years - since 2018-2019 in fact. However, it's equally clear to me that the company was also undervalued for many years prior to this, undervaluing the largest reverse-recycling company on earth.

This is a segment for the future - and I don't often invest in such things. But Tomra is an exception because I see the real potential for some attractive upside here.

In my first article, I said this.

Tomra is rarely - very rarely - anything close to cheap. The company is far too good for that. To give you a picture of where Tomra usually trades in terms of its ADR, the average 5-year P/E is close to 50x - that's a level that I would never invest in, no matter what the company.

(Source)

That still very much holds, and it shows you that when I set a target, I tend to stick to that target very closely unless something changes. Well, nothing has changed for Tomra. It's still not "cheap" as such, but it almost never is.

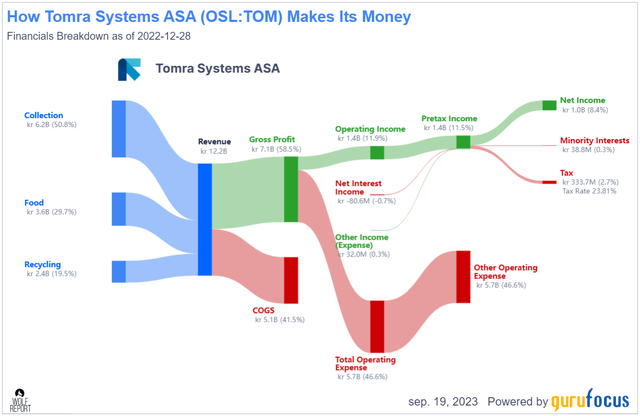

Tomra works with Collection, Recycling, and Food. It has 4,600 employees across the world, and it generates annual revenues of close to 11B NOK per year. With 20 years of age and being the market leader in what it does, Tomra deserves your attention despite the massive premium. It was Tomra's idea to begin with a sensor-based collection of recyclables, and this has now moved into segments of both other forms of recycling as well as food sorting. Tomra is expanding - and it's expanding all into what are essentially not only future-proof but future-centric segments.

Tomra IR (Tomra IR)

Tomra has, as you might expect from a company trading at this sort of premium, some of the best margins you could imagine. With over 55%+ GM's the company is better than over 90% of the other companies in waste management, and manages return metrics of over 17% in RoE. Again, a market leader. The company has almost no debt whatsoever (0.65X to equity), with interest coverage of over 10.4x, again better than the overall waste management sector. Yield is the one downside to this company. Even at today's levels, we're talking no more than 1.32%, and that's sub-par - but this is the one compromise you may have to make.

Tomra works a very sustainable (and I don't often use that word) business model that generates significant profit from a timeless and appealing set of sectors. These sectors are, furthermore, set to grow significantly going forward.

The latest quarterly results we have are 2Q23. The company saw record revenues once again, growing to a quarterly 3.5B NOK, up 14% group-wide with the most growth in Recycling, at 24%. Food continues to be a slow grower for the company. However, the company saw superb GM improvements, the highest gross margins since the froth of 2021, with improvements in both collection and recycling.

On the expense side of the statement, we have significantly higher expenses as well, which is likely part of the reason for the decline. But these are mainly driven by business expansion - and if we adjust based on FX and inflation, underlying company costs are actually stable.

Income is solid. A good EBITA, up 22%, with a very good backlog in orders combined of over 2B NOK, so the company has its work cut out for it. The company's ambitions for the 2027 period are also in line with what I would expect for the company based on my current thesis. We're talking double-digit revenue growth, good EBITA margin at 18%, and a dividend payout as high as 60%, while maintaining IG rating/equivalent balance sheet.

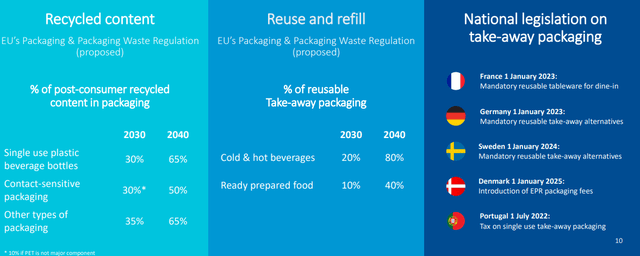

The company's machines and technologies are being installed all over the world, and government legislation of return systems is being worked on across multiple geographies, including but not limited to Australia, Romania, Hungary, Ireland, Uruguay, Austria, and Singapore.

The reason why the food market segment was so weak, which is probably one of the reasons we're seeing a decline, is due to macro. Tomra, like any business, is as prone to macro impacts as other segments - they just look differently. The upside in food is being driven by processed food rather than unprocessed food (such as fruits or vegetables), but this mix is something I expect to change as the macro environment normalizes.

The things to keep an eye on here include legislative moves - especially in the European Union, the company's main market.

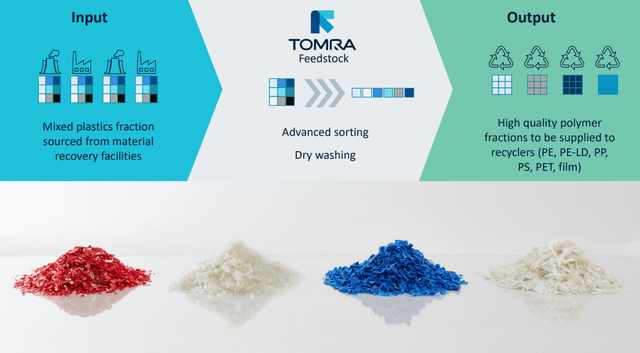

The company offers an almost full-service solution for input, feedstock, and output processing, starting with mixed plastics, moving to sorting and washing, and moving it to recyclers for new products.

With plants in Germany and Norway for feedstock, the company is expanding. The German plant is even 100% owned by the company, not a JV, and has an annual capacity of 80,000 tonnes of feedstock per year, with an operational start-up date of either next year or 2025.

These capacity additions, combined with the underlying upside of this market, combined with global trends, are what make for an extremely attractive investment here in Tomra, and one I now go positive on.

Let's look at the company valuation to see where we go from here.

Tomra - The valuation is starting to show an upside even on a conservative basis.

So, looking at where I put the company's PT prior, I realized that I actually put it a bit too high. 166 NOK isn't unattractive in the long term, but it also doesn't account for a longer drop to below 30x P/E. I'm therefore slightly adjusting my PT for the company. My adjusted PT is closer to where I've using CSPs and other options to gain exposure, which has been 127-150 NOK over the past 12 months. I don't go down to 127, but I do put the PT at 150 NOK here.

I'm willing to go as low as 30-31x P/E for this company in the long-term, that's a full 20x below the 5-year normalized P/E for Tomra. Based on such an estimate, the company now offers a 15%+ annualized upside to 2025E on a 31x P/E.

As you might imagine, if you start looking at what happens at 35-40x, which is a realistic range the company might trade at, then things can get very good very quickly. At the upper end of my accepted price target range, we can see an annualized RoR of almost 30%, which would come close to a triple-digit total RoR for Tomra, even with a yield of less than 1.4%. Even if you forecast at below 30x, this company now offers a double-digit upside on a P/E of 27x, again due to the impressive prospective EPS growth. Even a 27x P/E on a 2025E basis comes to a price target of 160 NOK - so you can see why my 150 NOK price target if we consider even half of this likely, is actually very conservative.

Analysts currently go from a 125 NOK low to a 185 NOK high - that's down from a 250 NOK high less than a year ago. The current average PT for Tomra is 155 NOK, so 5 NOK above my own. out of 8 analysts, none consider the company a "BUY" though, which is certainly interesting and showcases the absolute lack of conviction of these analysts (Source: S&P Global, TIKR). That's why you should be careful as to who you listen to, and maybe focus more on those willing to back up their stances either with clarity or with substantial investment - preferably both.

This is my current thesis on Tomra.

Thesis

- Tomra is a market-leading, world-leading reverse vending machine and recycling business. At the right price, it becomes a "MUST-BUY", with a holding target that goes beyond the usual, for a superb business model with proven reach and scalability.

- However, anything above 45x P/E is a no-go for this business, and I want it cheaper. I don't believe 30x P/E is in the possibilities, but 35-40x is the most I will pay.

- This comes to a PT of around 150 NOK conservatively, and this makes the company a "BUY" here.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.'

It's still not cheap, but I'm willing to call it a "BUY" here based on an attractive enough price target for the company.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.