olaser/E+ via Getty Images

As I explain in my REITs For Dummies book, “businesses that use excessive leverage to increase returns rarely provide long-term value,” and, of course, there’s always an exception to every rule.

Of course, I’m referring to commercial mortgage real estate investment trusts, or mREITs, that focus on financing every other property type not financed by residential REITs, including retail, lodging, office, industrial, and even solar, wind, and cannabis properties.

The sector can be further broken down into two categories:

Pure balance sheet lenders originate (purchase) and hold loans for their own balance sheets. They may sell participation units (essentially shares in an investment fund) in those loans for risk-diversification purposes, but they remain the main authority involved nonetheless.

Balance sheet/conduit lenders mix things up a bit. They originate and/or purchase loans for their own balance sheets or to be sold into conduit securitized vehicles such as commercial MBS.

iREIT® on Alpha

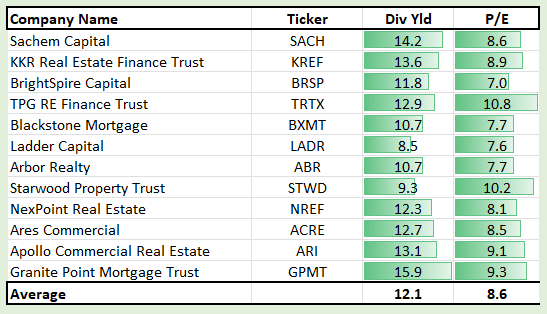

As you can see above, the commercial mREIT sector is offering up some mouth-watering dividends, averaging 12.1%, with an average P/E ratio of 8.6x.

Earlier this week the Federal Reserve said it was leaving interest rates unchanged at the end of its two-day policy meeting.

In his press conference following the meeting, Fed Chair Jerome Powell said that the Fed is taking a wait-and-see approach to possible future rate hikes, though some officials believe another hike this year will likely be needed.

So far in 2023, the Fed has increased the federal funds rate four times:

- February: +0.25 percentage points

- March: +0.25 percentage points

- May: +0.25 percentage points

- June: no change

- July: +0.25 percentage points

- September: no change.

Now, there’s no question that cracks are continuing to form in commercial real estate, as evidenced by these dividends cut announcements:

- Medical Properties Trust (MPW)

- W.P. Carey (WPC)

- Brandywine (BDN)

- Vornado Realty (VNO)

- SL Green (SLG).

Who’s next?

Most of the pain has been in the office sector, which is seeing some of the same volatility we saw within the mall sector during COVID-19.

Property sector allocation is an important part of intelligent REIT investing and that’s why I’ve been able to navigate this cycle, by paying careful attention to the fundamentals driving each category.

I don’t think anyone could have predicted the dividend cut a few days ago with W.P. Carey, but that validates the risks within the office sector.

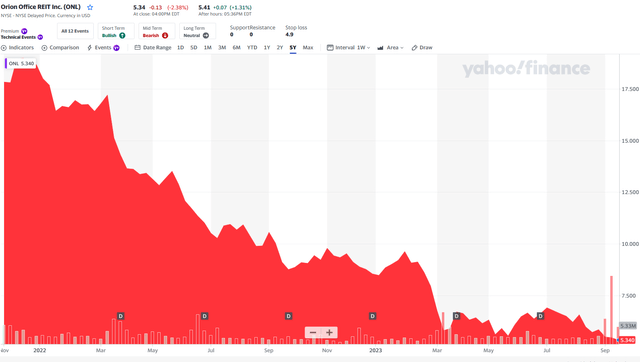

If you want to see what I’m talking about, go no further than a snapshot of Orion Office (ONL):

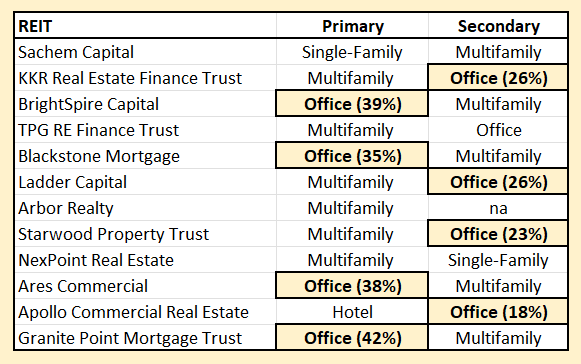

As we analyze the commercial mREIT sector, we must be cognizant with regard to the office sector exposure:

iREIT® on Alpha

As you can see, many of the mREITs have office sector exposure, and today we will focus on three of the REITs that we like with office exposure and one with no office whatsoever.

Starwood Property Trust, Inc. (STWD): 23% Office Exposure

Starwood Property Trust is an externally managed mortgage real estate investment trust that originates, acquires, and manages mortgage loans and other real estate related investments in the United States, Australia, and Europe. STWD operates its business through 4 business segments:

- Real estate commercial and residential lending: Through this segment STWD originates, acquires, and manages commercial first mortgages, residential first mortgages, mezzanine loans, subordinated mortgages, commercial and residential mortgage-backed securities (“MBS”), preferred equity, and other real estate related debt investments.

- Infrastructure lending: Through this segment STWD originates, acquires, and manages infrastructure debt investments.

- Real estate property: Through this segment STWD acquires and manages equity interests in commercial real estate, including multifamily and other types of net-lease properties that are held for investment.

- Real estate investing and servicing: Through this segment STWD offers services to businesses that work out problem assets. STWD also runs an investment business that acquires commercial MBS and a mortgage loan business that originates conduit loans which are typically sold into securitization transactions.

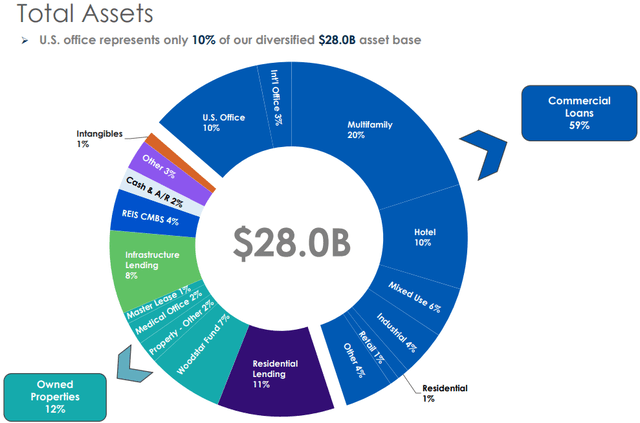

As of June 30, 2023, STWD has issued approximately $95 billion of capital since its formation in 2009 and currently manages a $28 billion portfolio containing debt and equity investments.

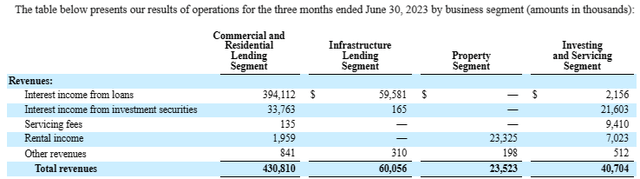

During the second quarter the majority of STWD’s revenues came from its commercial and residential lending segment, which contributed $430.8 million in total revenues.

Their infrastructure lending segment contributed $60.1 million, their property segment contributed $23.5 million and their investing and servicing segment contributed $40.7 million.

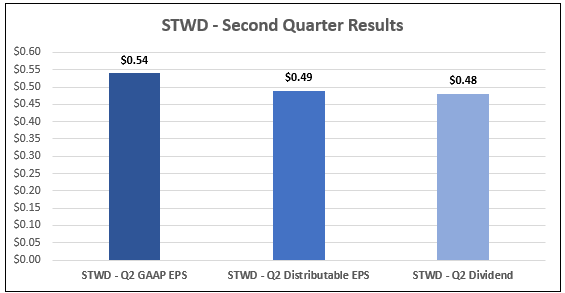

In its latest earnings release, STWD reported Q2 GAAP earnings of $0.54 per share, Q2 distributable earnings of $0.49 per share, and a second quarter dividend of $0.48 per share. Based on distributable earnings (“DE”) STWD had a DE payout ratio of 97.96% during Q2 23.

STWD - IR (compiled by iREIT®)

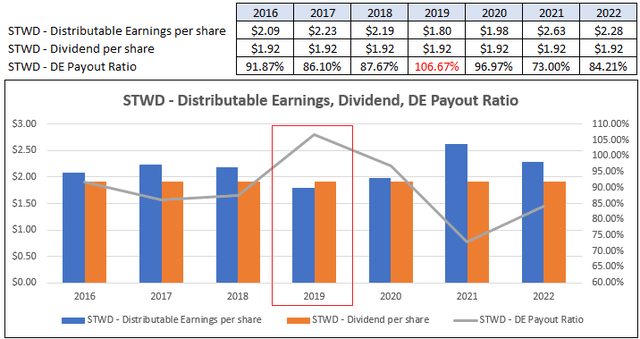

Over the last several years STWD has done a good job of maintaining its dividend of $1.92 per share while keeping a conservative payout ratio based on its distributable earnings. For mortgage REITs it's not uncommon to see a payout ratio close to 100%.

Since 2016, STWD’s distributable earnings have covered the dividend with the exception of 2019 when they had a DE payout ratio of 106.67%. The following year they improved this metric to 96.97% and reported a DE payout ratio of 84.21% as of the end of 2022.

STWD - IR (compiled by iREIT®)

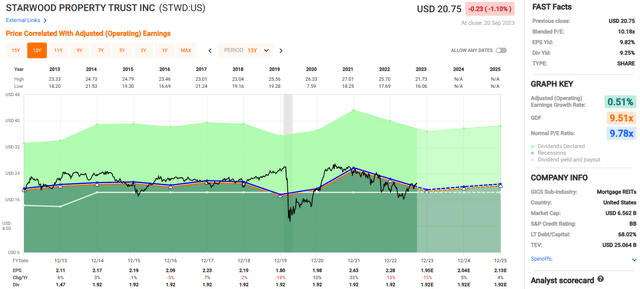

Since 2013 STWD has had an average adjusted operating earnings growth rate of 0.51% and an average dividend growth rate of 2.87%.

Their dividend growth occurred in 2014 when the dividend was raised from $1.47 to $1.92 and they have maintained the $1.92 dividend since that time.

STWD pays a high dividend yield of 9.25% that is covered by their distributable earnings and trades at a P/E ratio of 10.18x, which is slightly above their average P/E ratio of 9.78x.

We rate Starwood Property Trust a Buy and assign it a Tier 1 Rating.

Blackstone Mortgage Trust, Inc. (BXMT): 35% Office Exposure

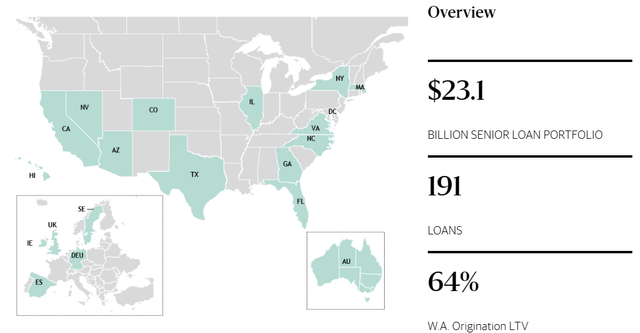

Blackstone Mortgage Trust is an externally managed mREIT that originates senior floating rate mortgage loans that are secured by commercial real estate located in North America, Australia, and Europe.

Their $23.1 billion senior loan portfolio consists of 191 senior loans that are collateralized by multiple property types, which are conservatively financed with a weighted average origination loan-to-value (“LTV”) of 64%.

Based on net loan exposure, 35% of BXMT’s collateral is made up from office properties, 26% is made up from multifamily properties, 19% is made up from hospitality properties, 9% is made up from industrial properties, 4% is made up from retail properties, and 2% of their collateral is made up from life science properties.

Additionally, their collateral is well diversified by location with 65% of their loan exposure coming from multiple states within the U.S., 14% coming from the United Kingdom, 15% coming from Western Europe, and 6% coming from Australia.

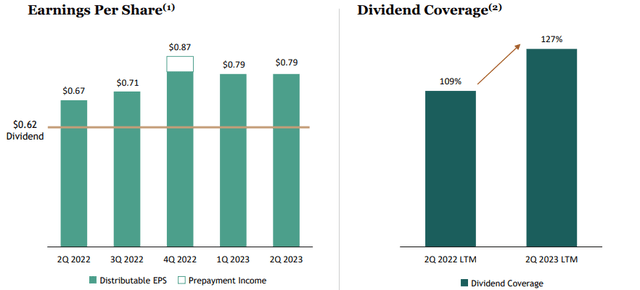

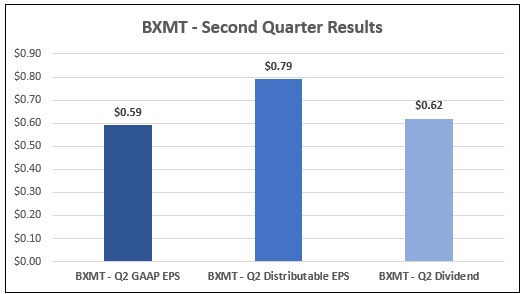

In its second quarter earnings release, BXMT reported Q2 GAAP earnings of $0.59 per share, Q2 distributable earnings of $0.79 per share, and a second quarter dividend of $0.62 per share.

Based on distributable earnings BXMT had a dividend payout ratio of 78.48%, or dividend coverage of approximately 127% during the second quarter.

BXMT - IR (compiled by iREIT®)

On a year-over-year basis, BXMT’s distributable earnings increased 18%, from $0.67 per share in Q2 22 to $0.79 per share in Q2 23.

Similarly their dividend coverage improved from 109% in the second quarter of 2022 to 127% in the second quarter of 2023.

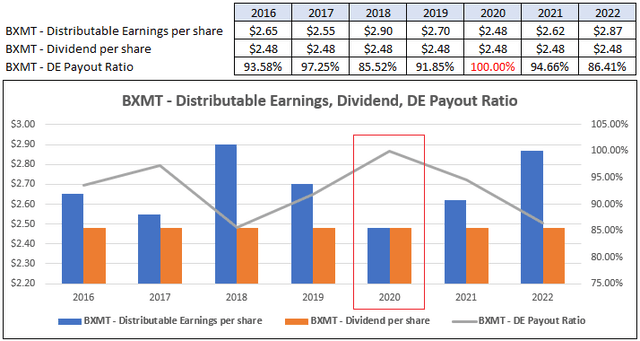

BXMT has paid a quarterly dividend of $0.62 per share for the past 32 consecutive quarters. Since 2016 they have maintained their annual dividend of $2.48 while keeping a conservative DE payout ratio that has been under 100% every year, except for in 2020 when their DE payout ratio came in at 100%.

Since that time the DE payout ratio improved to 94.66% in 2021 and improved to 86.41% as of the end of 2022.

BXMT - IR (compiled by iREIT®)

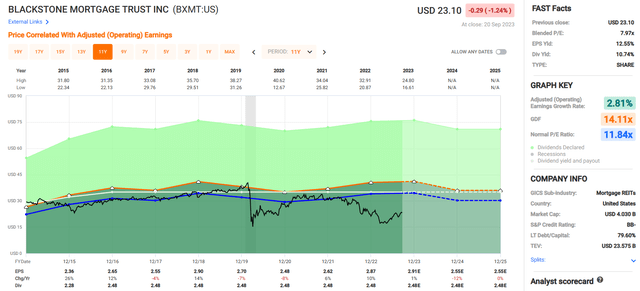

BXMT has had an average adjusted operating earnings growth rate of 2.81% since 2015. Analysts expect earnings per share (“EPS”) to increase by 1% in the current year, but then fall by -12% in 2024.

If the analysts’ projections are on the mark, the estimated EPS in 2024 of $2.55 per share would still provide approximately 103% dividend coverage, assuming the $2.48 dividend remains unchanged.

Currently BXMT pays a 10.74% dividend yield that is well covered by their distributable earnings and trades at a P/E ratio of 7.97x, which is a significant discount compared to their average P/E ratio of 11.84x.

We rate Blackstone Mortgage Trust a Buy and assign it a Tier 1 Rating.

Ladder Capital Corp. (LADR): 26% Office Exposure

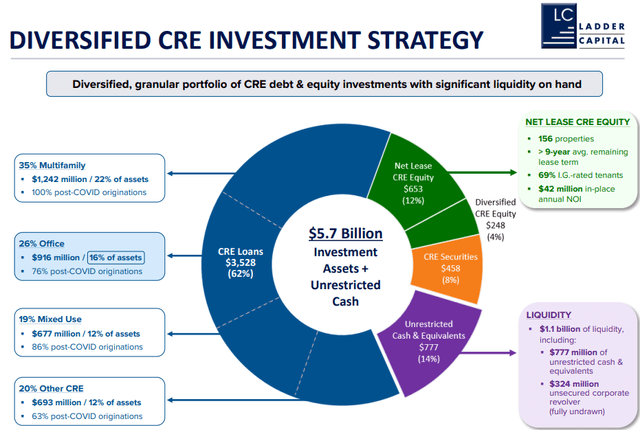

Ladder Capital is an internally managed mREIT that specializes in originating floating and fixed-rate senior first mortgage loans that are secured by commercial real estate (“CRE”). In addition to loan origination, LADR owns and operates net leased commercial properties and invests in securities that are backed by first mortgage loans.

The company is focused on middle markets with an average loan size of $25.0 million and offers multiple forms of financing including senior mortgage loans, conduit first mortgage loans, mezzanine loans, and equity investments in net-lease properties.

LADR has a $5.7 billion portfolio of investment assets and unrestricted cash. 62% of their asset base consists of commercial real estate loans, 12% of their asset base is made up of equity interests in net-lease properties, 8% of their assets consists of CRE securities, while 14% of their assets are made up of unrestricted cash and cash equivalents.

The largest property type securing their loans is multifamily, which makes up 35% of their CRE loans, followed by office properties which makes up 26%, mixed-use properties which makes up 19%, and other commercial real estate which makes up 20% of their CRE loans.

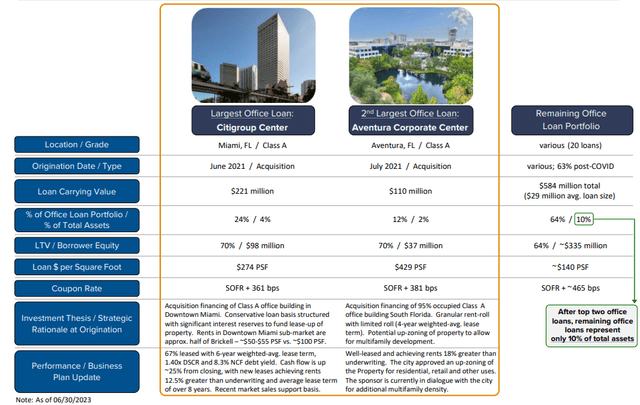

Ladder has two loans that are over $100 million. One in Miami, FL that has a loan value of $221 million (70% LTV with $98 million of borrower equity) and another one in Aventura, FL that has a loan value of $110 million (70% LTV with $37 million of borrower equity). The remaining office loans (20) represent 10% of total assets in the Ladder portfolio.

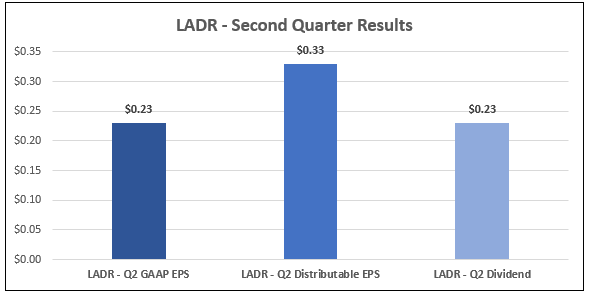

Ladder Capital released its Q2 23 operating results on July 26 and reported GAAP income before taxes during the second quarter of $28.1 million, diluted earnings per share of $0.23, distributable earnings of $41.5 million, or $0.33 of distributable earnings per share, and they paid a dividend of $0.23 per share during the quarter.

As a percentage of their distributable earnings LADR had a dividend payout ratio of 69.70% for the second quarter of 2023.

LADR - IR

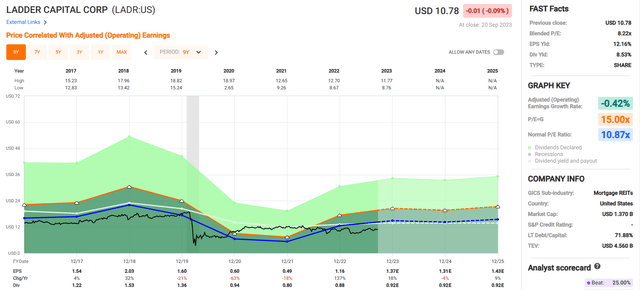

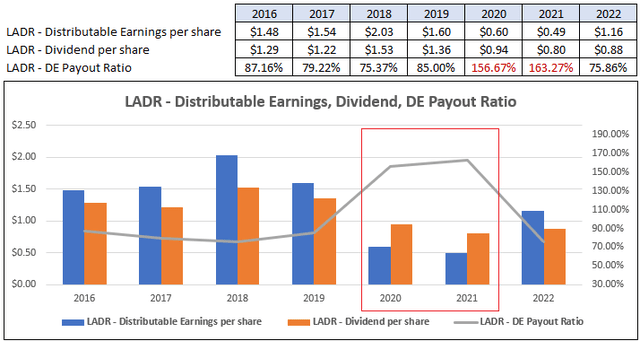

LADR’s dividend history is not as consistent as the previous two companies discussed. They cut their dividend by -5.45% in 2017 but then raised it by 26.34% in 2018. They cut their dividend for the next 3 consecutive years by -11.40%, -30.88%, and -14.89% before increasing it by 10% in 2022.

The dividend cuts can be attributed to the decline in their adjusted operating earnings, in particular in 2020 when EPS fell by -63%, from $1.60 per share in 2019 to $0.60 per share in 2020. EPS fell by -18% in 2021 to $0.49 per share but then increased by 137% to $1.16 per share in 2022.

The dividend followed suit and was cut from $1.36 per share in 2019 to $0.94 per share in 2020, and then cut again to $0.80 per share in 2021. Since 2016 LADR has maintained a conservative distributable earnings payout ratio with the exception of 2020 and 2021 when the payout ratio rose to 156.67% and 163.27% respectively.

The low payout ratio is in part due to the multiple dividend cuts LADR has made over the last several years, but the company was able to increase their dividend by 10.00% in 2022 while maintaining a conservative dividend payout ratio of 75.86%. LADR’s Q2 dividend of $0.23 annualized comes to $0.92 which would represent a 4.5% increase over the dividend paid in 2022.

LADR - IR (compiled by iREIT®)

Ladder Capital pays an 8.53% dividend yield that is well covered by their distributable earnings and currently trades at a discount to their normal earnings multiple. Currently the stock is trading at a P/E ratio of 8.22x which is a discount compared to their average P/E ratio of 10.87x.

We rate Ladder Capital a Buy and assign it a Tier 1 Rating.

Arbor Realty Trust, Inc. (ABR): 0% Office Exposure

Arbor Realty Trust is an internally managed mREIT that originates and services loans for multifamily, single-family rental, and other types of commercial properties. Arbor has two main business segments that they operate through: Structured Business and Agency Business.

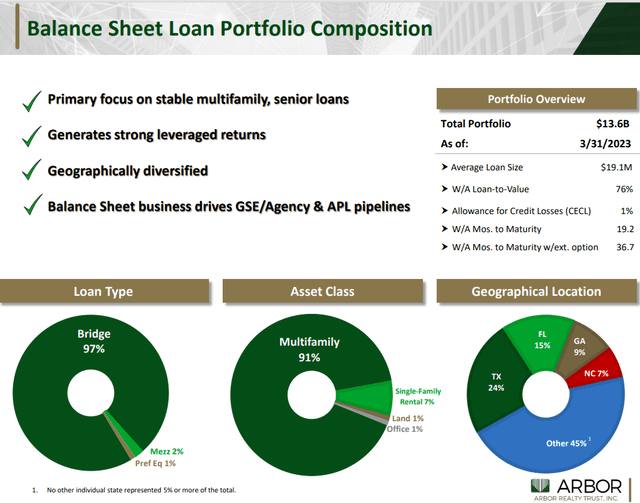

ABR’s Structured Business invests in a portfolio of structured assets in the multifamily and single-family rental markets primarily through bridge loans, but also through mezzanine loans and preferred equity. As of the end of the first quarter, ABR had a $13.6 billion balance sheet loan portfolio with an average loan size of $19.1 million and a weighted average LTV of 76%.

Bridge loans made up 97% of their Structured Business loans, while mezzanine loans and preferred equity investments made up 2% and 1% respectively. The vast majority of the loans in their balance sheet loan portfolio are for multifamily properties at 91%, followed by single-family rental at 7%, and office properties & land at 1% each.

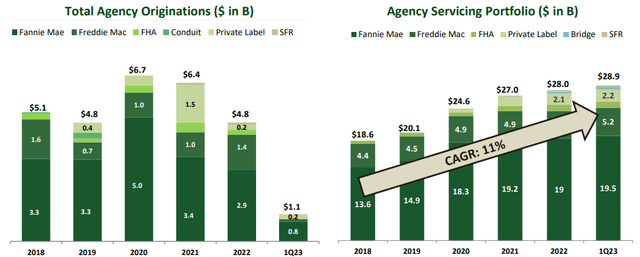

Arbor’s Agency Business specializes in originating, selling, and servicing multifamily agency loans through government sponsored enterprises (“GSEs”) such as Fannie Mae and Freddie Mac as well as the U.S. Department of Housing and Urban Development (“HUD”).

ABR retains the servicing rights on substantially all of the loans they originate and sell under the HUD and GSE programs and also originates private-label loans which are typically pooled and securitized into mortgage-backed securities (“MBS”) and sold to third-party investors.

ABR retains the serving rights on their private-label loans and retains the bottom tranche (highest risk) certificate of the securitization.

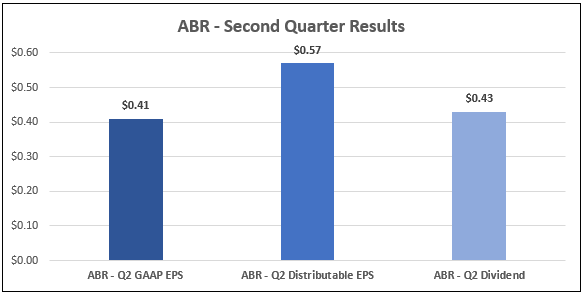

Arbor released its Q2 23 operating results on July 28 and reported GAAP net income during the quarter of $76.2 million, or $0.41 per share, and distributable earnings for the quarter of $114.0 million, or $0.57 per share. ABR also announced it raised its quarterly dividend by 2%, to $0.43 per share, which would represent a distributable earnings dividend payout ratio of 75.4% for the second quarter of 2023.

ABR - IR

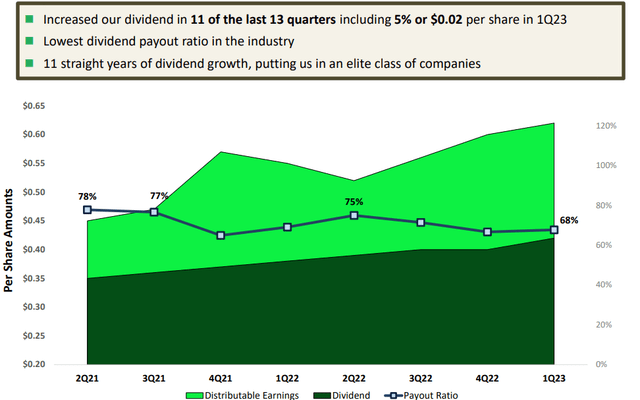

Arbor has 11 consecutive years of dividend growth and has increased its dividend in 11 out of the last 13 quarters while maintaining a conservative dividend payout ratio based on their distributable earnings. Going back to the first quarter of 2021 their DE payout ratio has never exceeded 80% and was as low as 68% in the first quarter of 2023.

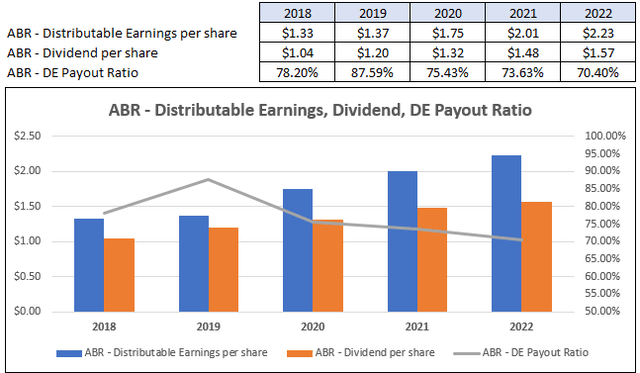

The same can be said for ABR’s DE payout ratio over the past several years. The DE payout ratio went as high as 87.59% in 2019, but then improved to 75.43% the following year and was reported at 70.40% as of the end of 2022.

Additionally, as seen below, ABR’s distributable earnings and dividend have increased each year since 2018; while the same cannot be said for the other mortgage REITs we’ve looked at today.

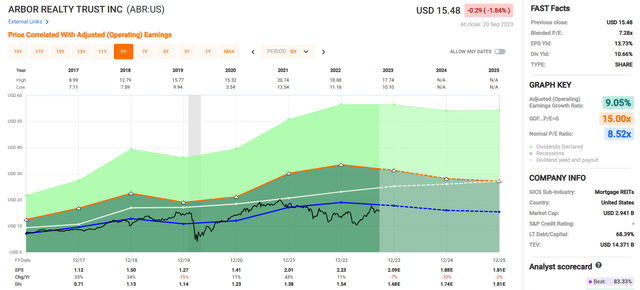

Since 2017 Arbor Realty has delivered an average adjusted operating earnings growth rate of 9.05% and an average dividend growth rate of 17.71%.

The stock pays a well-covered dividend yield of 10.66% and trades at a slight discount to its average earnings multiple with a current P/E ratio of 7.28x compared to its average P/E ratio of 8.52x.

We rate Arbor Realty Trust a Buy and assign it a Tier 1 Rating.

Here's my Take...

I'm sitting here in my office right now, typing this article....

However, I know that many of my friends in New York City are working from home (it's Friday)...

I also know that many companies are still allowing their employees to maintain a flexible work schedule in which working from home is acceptable.

While office receives the most attention, it represents just 17% of income-producing property loans vs. 44% for multifamily.

And 16% of loans mature in 2023, more than a quarter of which are office.

Various lender types provide capital to the sector, with banks & thrifts and government-sponsored enterprises having the greatest share of the lending market at ~38% and ~21%, respectively.

Although office sector loans (16.7% of the total) receive the most attention, multifamily loans represent the most significant exposure (~44%).

While the office sector is obviously volatile, we're not running away...

We see opportunities with the four mREITs that I reference in this article.

I certainly understand those who have no interest in investing in office properties...

Different strokes, for different folks, right?

I look forward to your comments below.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.