DogoraSun/iStock Editorial via Getty Images

Over most of the past year, I have held a bullish view of most oil refining companies, given the prolonged increase in refining profit margin spreads. I published my long-term bullish take on Marathon Petroleum (NYSE:MPC) in August. My fundamental view is that a lack of investment in the refinery business is leading to declines in gasoline production capacity in the US (and most developed countries). As a result, gasoline and diesel prices are typically rising faster than oil prices, greatly benefiting the EPS outlook for Marathon.

However, as discussed more recently regarding Phillips 66 (PSX), I've downgraded my view on refiners due to the recent oil crash " in the "crack spread." As such, it is likely an excellent time to look closely at Marathon, considering its stock remains generally high. However, its profit outlook is waning as refinery spreads fall. Marathon's situation differs from Phillip's 66 in many ways due to differences in its business model, balance sheet, and stock valuation. Further, the problem facing oil prices shifted dramatically over the weekend due to the situation in Israel. While all relevant information regarding that situation (regarding oil) remains vague, I would not speculate intensely on its potential; it certainly adds upward pressure on oil.

A sizeable potential oil price increase could be very bearish for refiners such as Marathon, particularly if prices rise enough that gasoline demand declines. The lack of US Strategic Petroleum Reserve inventories exacerbates this risk, as that reserve was intended for sizeable geopolitical-related production cuts. Overall, investors can expect increased volatility in the oil and gas markets, potentially leading to downside risks for Marathon Petroleum, depending on how we calculate its forward valuation.

Marathon Income Outlook for Q3 and Q4

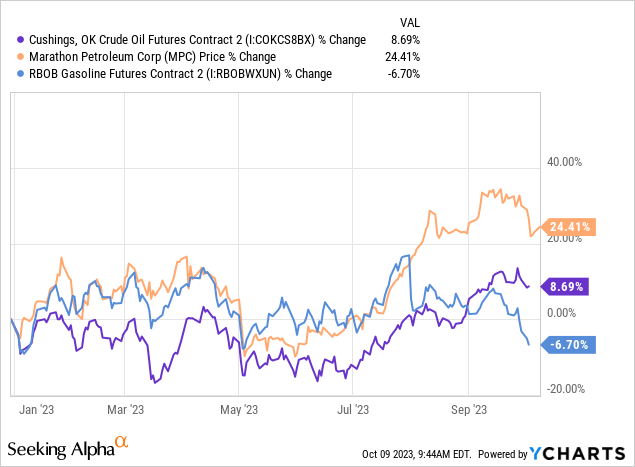

For the most part, refineries benefit from predictable and calm energy markets, where oil supplies and gasoline demand do not change too quickly. My long-term view remains that Marathon and its peers may benefit from lower competition due to a lack of refinery investments today. That said, the short-term outlook has changed as volatility mounts, raising pressure on oil prices against gasoline. See below:

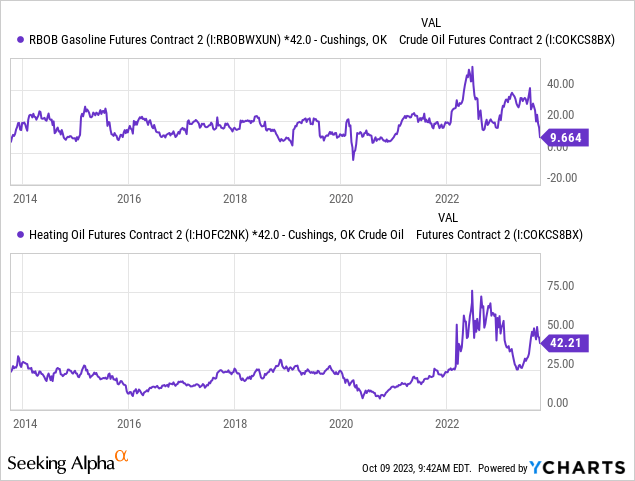

The first half of 2023 was quiet for energy markets after a volatile 2022. However, oil has risen dramatically in value since July to around $87 per barrel today. Oil prices declined last week but erased most of those gains Monday morning as the outlook for some oil supplies became threatened. Gasoline initially rose with oil over the summer but crashed since August as the demand outlook for gasoline slipped. Marathon has retained much of its value, but the differing trends between oil and gasoline threaten its capacity to earn an income. The "crack spread" is measured as the spread between gasoline and heating oil vs. crude oil has crashed, particularly for the gasoline spread. See below:

The heating oil spread remains high today, but the RBOB gasoline spread is back in its previous range. It is also falling very quickly as gasoline declines and crude oil increases, making it more difficult for Marathon Petroleum to earn a steady profit.

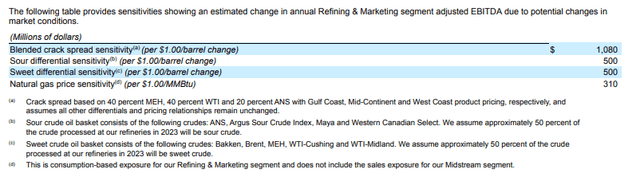

Luckily, Marathon publishes its expected EBITDA sensitivity to changes in the crack spread. See its most recent analysis below:

Marathon Petrol. Crack Spread Sensitivity (MPC 10-Q Q2. 2023)

Since the end of June, the blended crack spread has declined from a Q2 average of ~$32/barrel to ~$19/barrel today. That figure is a combination of the gasoline and heating oil spreads above. All else being equal, this $12/barrel decline in the spread equates to an expected EBITDA change of -$12.96 annualized ($3.24B quarterly). Sour and sweet oil differentials have only changed marginally over this period. Natural gas has also hardly changed, so the shift in the blended crack spread is likely the only significant factor impacting Marathon's refining margins.

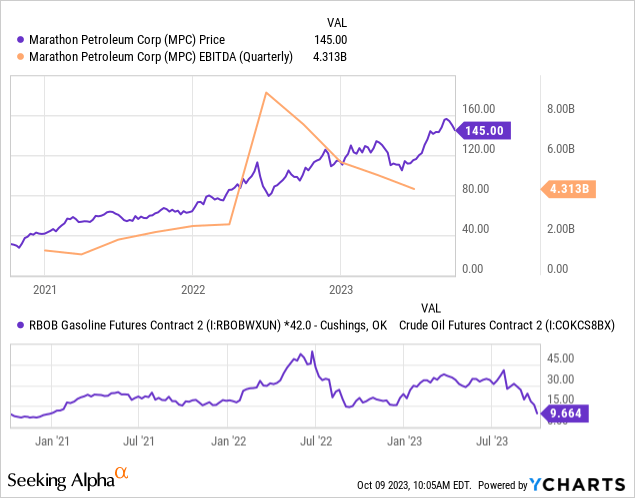

The company was already under pressure following the decline in crack spreads over 2023. However, this most recent crash in the crack spread threatens to erase most of Marathon's current EBITDA. See below:

Historically, Marathon does not have a positive EBITDA if the gasoline crack spread is below around $15, depending on changes in other operating costs. Today, that spread is below its typical range before COVID-19, indicating a sharp deterioration in refining margin profitability. The company usually generates a steady EBITDA of around $1.5B per quarter from its Midstream segment. In comparison, its refining margins can vary from negative to nearly $8B (seen in the 2022 gasoline shortage). Its refining segment EBITDA was $3.16B in Q2 and may be as low as -$80M in Q4 should the crack spread remain constant. Combined with an expected +$1.5B from Midstream, I anticipate its Q4 EBITDA at ~$1.42B, given limited changes in commodity prices and volumes.

Marathon will publish its Q3 EPS at the end of this month. I expect its Q3 EPS will be much more robust due to the elevated crack spread over that period. The spread averaged around $37 during most of that period, or about $5 greater than the previous quarter. All else being equal, that equates to a ~+$1.35B EBITDA in Q3 compared to Q2, giving us a Q3 expected EBITDA of ~$5.66B.

Marathon's Depreciation and Amortization has run around $830M, and its interest is currently around $142M quarterly. Together, this creates an extra $972M added quarterly cost. Considering this, I project Marathon's Q3 pre-tax income at $4.67B, or ~$3.7B after taxes (~21% historically). The company usually has ~$350M in income attributable to non-controlling interests, giving a final net income estimate of $3.35B or an EPS of $8.38. This estimate is on the high end of the latest analyst consensus, averaging at $7.48.

For Q4, based on current prices, its EBITDA outlook is much lower at $1.42B due to the extreme change in the refining margin outlook over the past month. That equates to an estimated pre-tax income of $448M, or $353 after tax, and almost zero after non-controlling interest (~$4M, or a $0.01 EPS). The latest analyst EPS consensus for Q4 places its income at $4.53 EPS; however, those estimates likely do not consider the latest extreme changes in the crack spread as the last week or two has seen tremendous downside.

These estimates do not account for one-off costs, gains, or changes in realized prices and expenses compared to the futures market. I believe it is generally reasonable to assume Marathon's volumes will also remain constant. With hurricane season in full swing, refinery outages and related issues can be a problem in estimating income levels. Further, the crack spread measure used by Marathon differs to an extent from the futures index I've used. The overall degree of change does not vary dramatically, so that should not significantly change the degree of fluctuations in its EBITDA; however, it is reasonable to assume that slightly more minor total EPS changes may be seen than my estimates, potentially indicating a Q3 EPS closer to $7.5 and a Q4 nearer to $1.

Crack Spread Outlook for 2024 and Beyond

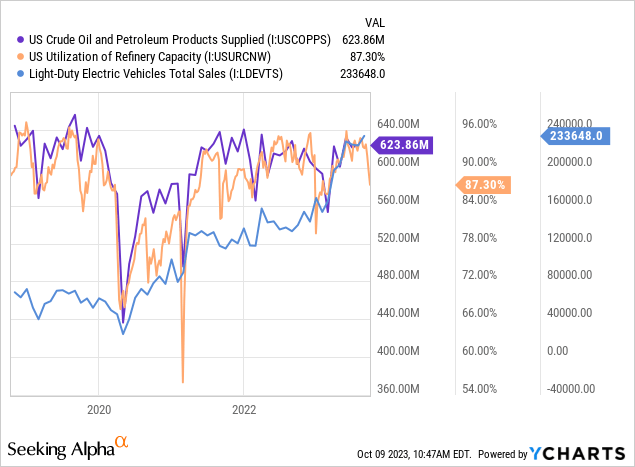

On Monday morning, both crude oil and gasoline futures rose by around 3-4%, indicating no change in the crack spread related to the Middle East oil price shock risk. While issues negatively impacting oil and gasoline supplies should affect both commodities, I suspect the crack spread will decline if oil rises enough to lower gasoline demand. As mentioned in my previous article on Phillips 66, the spread is likely falling due to a decline in gasoline demand associated with lower refinery utilization and product supplies. Potentially, the significant increase in EV sales may be a causal factor. See below:

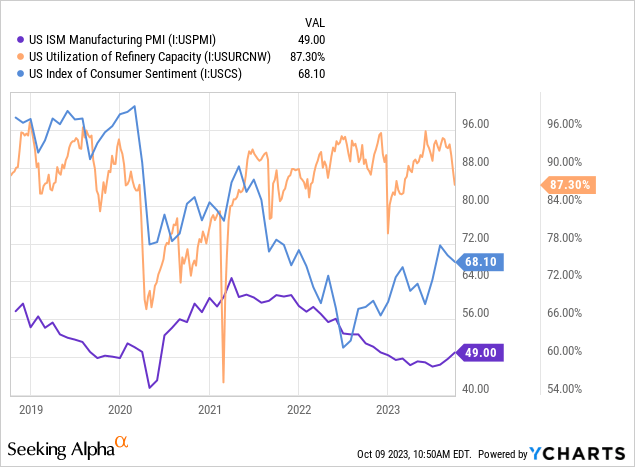

EV and hybrid vehicle sales will be necessary to watch because even if they lower gasoline consumption by 1%, that will have an ample price impact because the commodity is so sensitive. Further, the US economic outlook is not particularly strong today, with the manufacturing PMI and consumer sentiment pointing toward weaker activity in both supply and demand. While the correlation of the economy to gasoline demand is imperfect, it appears to be a potential factor in pushing gasoline demand lower. See below:

Again, a slight decline in gasoline demand combined with a minor increase in oil production could dramatically move the crack spread. In my previous article regarding Marathon, my long-term view was that weak capital investments into the refinery segment over the past decade (and today in particular) would lead to gasoline production being generally slow to oil, contributing to a permanently higher crack spread. Electric vehicle demand is very strong today despite household economic strains, partially due to lower EV prices.

In the long run, I still suspect that refineries will underproduce gasoline, leading to higher crack spreads. However, the short-term situation has changed dramatically since summer as gasoline demand has shown a stronger correlation to the economic strains. Further, the sharp rise in oil prices may add significantly to this issue, particularly if oil rises for geopolitical reasons.

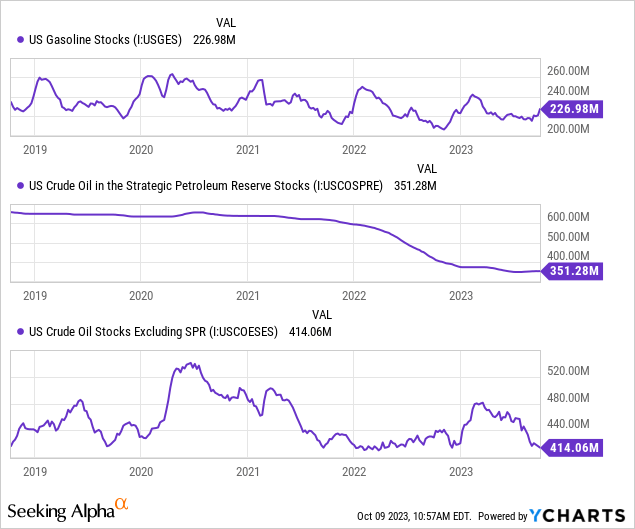

Gasoline stocks are roughly at normal levels, while distillates are a bit low but are rebounding. That is an indication that the shortages in the refining market may be turning into a small glut. However, oil stocks excluding the SPR are now back at the same low levels before the SPR release. Of course, no more reserves will come out of the SPR, which has lost around half its previous storage levels. See below:

We must remember that the SPR was created to offset losses in oil imports due to geopolitical issues. Currently, it is very unclear how or if the conflict will escalate, and most lack the information relevant to make that determination. Still, if it does grow to include significant oil producers throughout the Middle East and those key transport lanes become blockaded or threatened, then an extreme decline in global oil supplies could occur. This potential "domino effect," exacerbated by the lack of US domestic oil reserves (both strategic and commercial), could likely quickly push US oil prices into the hundreds of dollars per barrel, considering it is an inelastic commodity. Gasoline should keep up with oil for some time. Still, gasoline demand will eventually fall due to higher prices, mainly if it is already falling with the economy today.

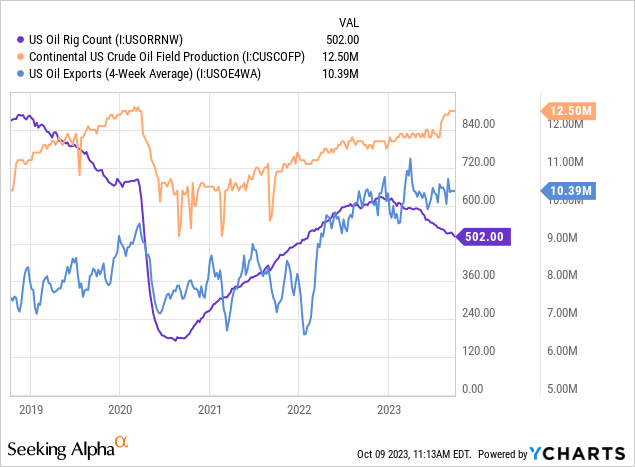

The US is already exporting far more oil due to OPEC+ production cuts, offsetting the recovery in US oil production. That said, the rig count has steadily trended lower because oil prices have generally been lower this year than last. See below:

As the rig count declines, future oil supplies should trend lower. That can positively impact the price of oil but will not necessarily aid gasoline if demand continues to decline. Further, a sufficiently significant decline in the rig count will usually harm midstream profits and fees change with lower supplies, potentially harming Marathon's steadier income stream.

At this point, it is unclear if US oil exports will continue to rise or if production levels will fall on the lower rig count. Further, should global oil supplies decline enough, the US could reenact its export ban to restore the domestic market. That said, I doubt that would occur outside of an emergency scenario that would already be problematic for Marathon. I believe oil's bullish case has become much stronger, while gasoline is not nearly as solid, pointing toward a lasting decline in the crack spread.

The Bottom Line

At today's commodity prices, I believe Marathon's EPS may be near zero or slightly positive for some time. Its cash flows will be more robust due to its depreciation, and its free cash flow should remain decent due to its lower CapEx levels. In the long run, I still suspect that low refinery capital investments will lead to a stronger gasoline market than oil. However, in the short term, I believe MPC has ample 12-month downside risk associated with the sizeable refinery-margin profit decline shock.

Looking forward, I expect MPC's Q3 EPS will be good and potentially better than expected due to the great crack spreads over the summer. However, from Q4, I believe its profits will be near zero until we see a solid turnaround in the crack spread. In my view, depending on how the oil market's situation changes, an even lower crack spread may occur if oil becomes too expensive on insufficient global supplies. For this reason, I am bearish on MPC on a 12-month outlook basis. Its EPS may be around $-1 to $2 per quarter with crack spreads where they are today, potentially making MPC overvalued at a projected 2024 forward "P/E" of ~30X.

I rarely alter my view from bullish to bearish in such a short period, but the dramatic change in the oil market over the past months makes a sharp negative revision very reasonable. I still like the stock from a long-term perspective, but not at its current price, given the immediate profit decline. To me, the issue is not necessarily current crack spread levels but the possibility that a war, combined with global recession, causes that spread to remain low for a year or longer. If MPC operates in a "highly sensitive " environment today, it must maximize free cash flow to give it cash to reinvest into an electric vehicle world. Thus, if it fails to maintain a high FCF over the coming years, as I've expected, its long-term potential would also be minimal.