tumsasedgars

Invesco BulletShares 2025 High Yield Corporate Bond ETF (NASDAQ:BSJP) will terminate on or around December 15, 2025, as all its holdings will have matured by then. This fund invests in USD denominated, high yield corporate bonds that as the prior sentence alluded to, mature or effectively mature in 2025. Some bonds have embedded call options, giving the issuer the choice to redeem them prior to the stated maturity date. The market can make a reasonable assessment on whether the issuer will exercise that option, based on the prevailing market conditions. The effective maturity differs from the stated maturity when the expectation is for the bond to be redeemed on the call date. That said, with the current interest rates, we do not expect a lot of effective maturities diverging from actual maturity dates.

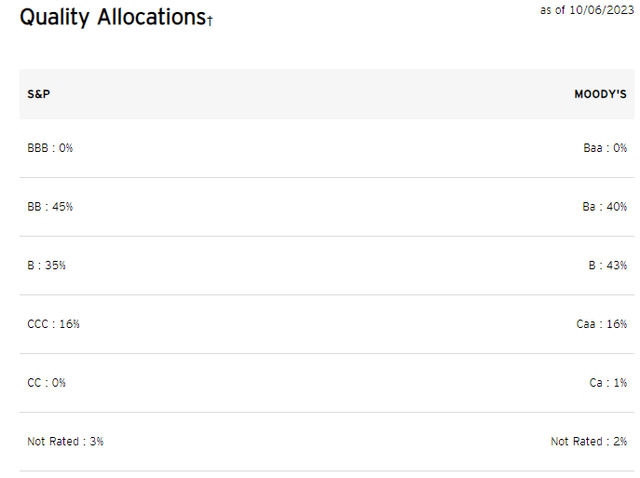

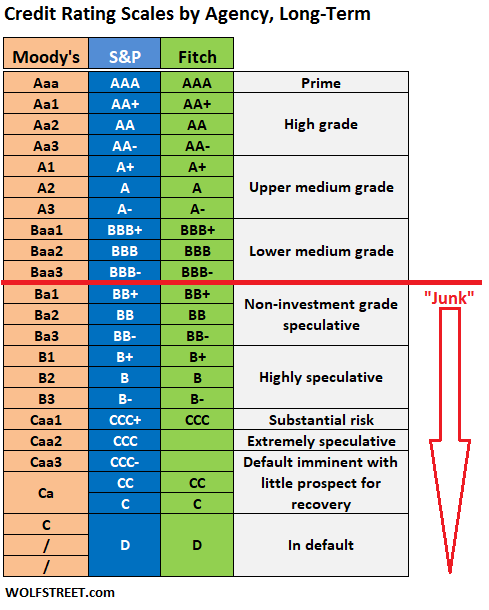

While the bonds have to be USD denominated, they can originate from Canada, Western Europe and Japan. The credit rating of the issuance should be no higher than BB+ and no lower than CCC-. The graphic below gives a good visual on where these ratings stand in the credit universe.

Wolfstreet.com

Of course below CCC- is the graveyard of junk bonds where former high yielders go to die. So that limitation does not mean much. We can see that BSJP more or less sticks to this guideline and has securities rated within that spectrum. While being cognizant of the fact that all the holdings are speculative (high yield), it is nice to see that most are "highly speculative" and do not fall under the "substantial risk" category (see previous graphic).

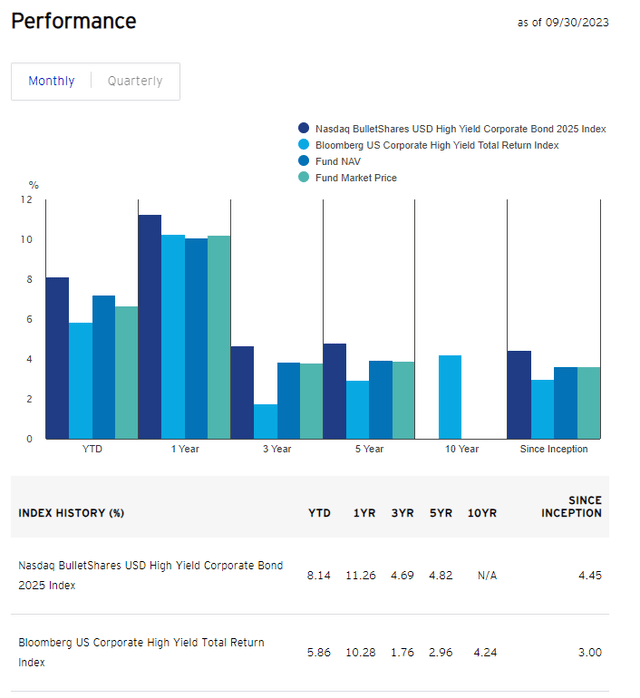

BSJP is a passive ETF and hence does not go scouting the bond market for investments that meet this criteria. Instead, it selects majority (at least 80%) of its securities from the Nasdaq BulletShares USD High Yield Corporate Bond 2025 Index, which plays the role of the fund's benchmark. BSJP does not fully replicate the index, and instead utilizes the sampling technique for its security selection. Both the fund and the index are rebalanced on a monthly basis. The sampling technique has not worked very well for this ETF, vis a vis its performance in comparison to the index.

This, even if we consider that the fund, unlike the index, has expenses. BSJP has annual expenses of 0.42%, which detract from its gross earnings. As we can see above, the underperformance of this ETF is more than we should expect after factoring the expense handicap. On the other hand, it has beaten the Bloomberg US Corporate High Yield Total Return in most time frames. This actually is to be expected as this index had a massive duration exposure going into the rate hike cycle, which the BSJP did not.

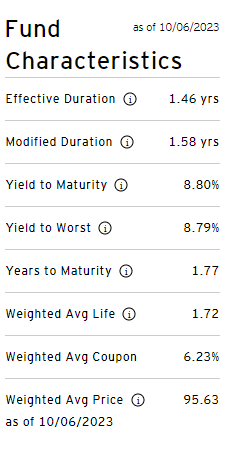

Based on the term to maturity of its holdings, it makes sense that the current duration of the portfolio is close to a year and a half.

Fund Website

The effective duration, just like the effective maturity noted at the beginning of this piece, takes into account the possibility of call option exercise by the issuer. That there is not much of a difference between the effective and modified duration is indicative of a muted expectation of this, in light of the current environment. This can also be seen in the negligible difference between the years to maturity for the portfolio and the weighted average life. Unlike the credit risk it carries, BSJP does not have much of an interest rate or duration risk. The expectation, based on the above numbers, is that with every 100 basis points rise in interest rate, one can expect the fund's portfolio value to decline by about 1.5%.

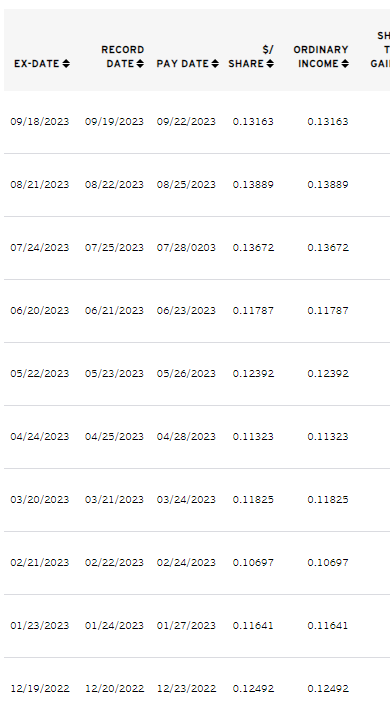

Investors buying in right now are getting a portfolio with a yield to maturity of 8.8%, which after accounting for the 0.42% in annual expenses, still leaves around 8.4% available to distribute for the fund. Based on the last monthly payout of 13.163 cents, and the current price of $22.45, the fund yields just over 7.0%. There is usually a time lag between the distributions catching up to the net income earned by the fund, and we can see that reflected in the general direction of the payouts over the last few months.

Fund Website

However, the distributions will not remain at the high level until termination. In the twelve months leading up to the termination of the BSJP, it will transition to cash and cash equivalents as the securities mature. The index and by extension the fund will stop rebalancing and just unwind.

Verdict

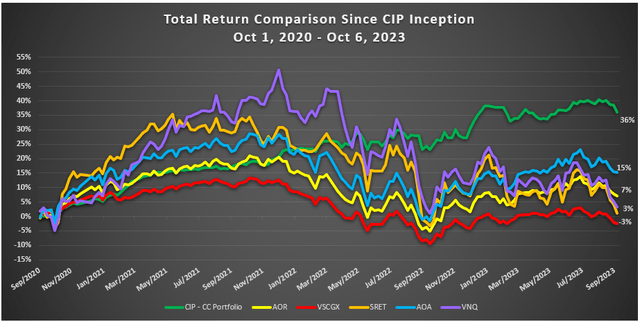

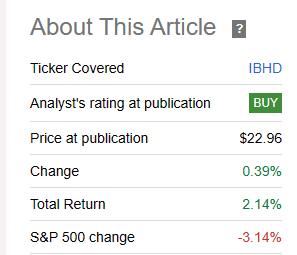

We have previously backed iShares iBonds 2024 Term High Yield and Income ETF (IBHD) and that has worked with a modest total return.

Seeking Alpha

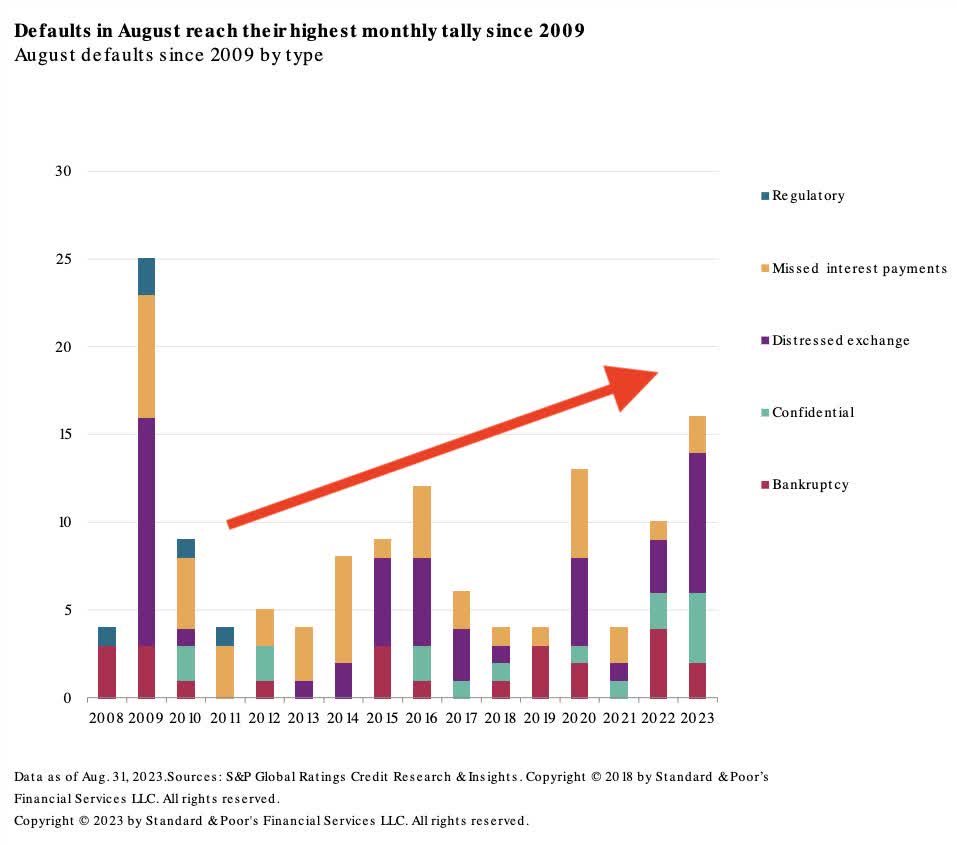

So 2025 maturing junk bonds might be a natural extension of that logic. Or so it might seem. Defaults take time from when the cracks start showing in the façade and while 2024 might be ok, 2025 is pushing up the risk another notch. So far it is the smaller companies, those without access to capital markets that are feeling the heat.

S&P Global

The next round which likely begins soon will move to the official junk bond sector. There is also the question of relative risk-reward here. We are getting solid 7.5% yields from multiple sources where we see zero risk of default. In some case the duration is extremely small and in some cases modest. So why stick out our necks for a junk bond ETF for an extra 1%? We rate this a hold and we might buy this if things really tank in the capital markets. In the interim, this might make sense for those very bullish on the economy.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.