jetcityimage

The MNST Stock Is One With Monstrous Returns

Monster Beverage Corporation (NASDAQ:MNST) is a stock that requires no introduction, with its energy drinks often featured in multiple convenience stores across the US, popular amongst long-distance drivers and college students pulling all-nighters.

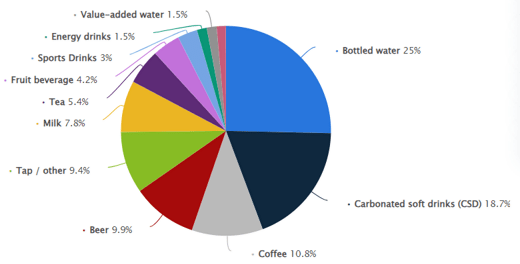

Consumption Share Of Beverages In The US In 2022

Statista

While energy drinks may only comprise a small percentage at 1.5% of the US overall beverage consumption share, it is apparent that MNST's energy drinks are well-loved, with it commanding a 30% market share in the segment, second only to Red Bull's 52% share in 2022.

Its profitable growth trend has also been promising, with MNST reporting a top and bottom line CAGR of +12.9% and +9.4% between FY2016 and FY2022, with it well exceeding the two titans in the carbonated soft drinks market.

This includes PepsiCo's (PEP) top and bottom line growth at a CAGR of +5.5%/ +5.8% between FY2016 and FY2026, and Coca-Cola Company's (KO) at +0.5%/ +4.4%, respectively.

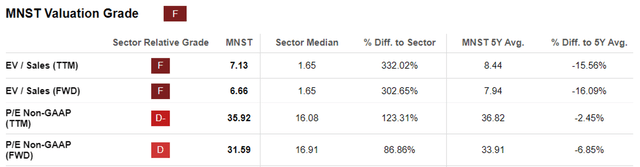

MNST Valuations

Perhaps this is why MNST has been awarded an immense growth premium compared to its peers and sector median. For example, the stock trades at a FWD P/E of 31.59x near to its historical averages, but way above the sector median of 16.91x, KO's 20.28x, and PEP's 21.34x.

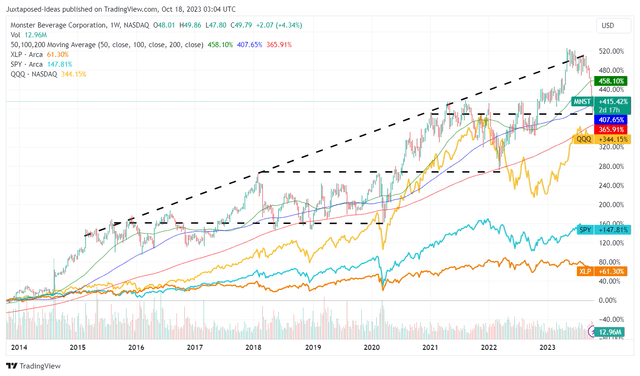

MNST 10Y Stock Price

The same has also been observed in the MNST's stock prices, with it charting an impressive total stock returns of +415.42% over the past ten years, well exceeding the Consumer Staples Select Sector SPDR Fund (XLP), the SPY, and QQQ at the same time.

While MNST currently does not pay out a dividend, we believe its returns have been impressive indeed.

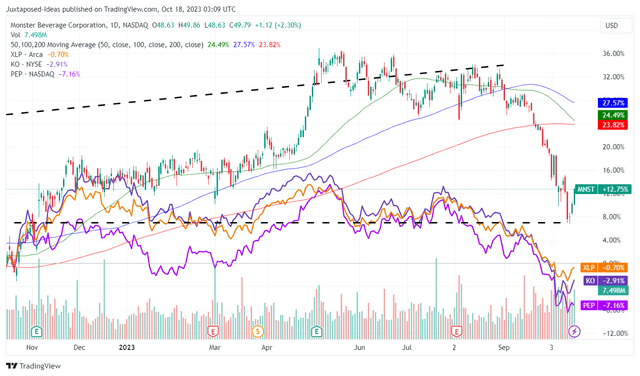

MNST 1Y Stock Price

Based on MNST's 1Y chart, the stock appears to be well-supported at current levels as well, with the recent sell-off only attributed to Mr. Market's pessimism surrounding consumer staples as the macroeconomic outlook remains uncertain.

On the one hand, the US labor remains robust with wages growing and unemployment still moderate in September 2023. The month's consumer CPI for nonalcoholic beverages and beverage materials is still stable MoM while rising by +4 points YoY.

On the other hand, Mr. Market seems to believe that the US consumers' discretionary spending is already stretched, thanks to the restart of the US federal student loan repayment from October 2023 onwards and the sustained inflationary price hikes thus far.

For example, MNST has embarked on aggressive pricing actions to mitigate inflationary pressures, in an attempt to maintain its profit margins.

These efforts have been largely successful, with the beverage company reporting a top-line expansion to $1.85B (+9.4% QoQ/ +12.1% YoY) and stable gross margins of 52.5% (+5.4 points QoQ/ -0.3 YoY) in the latest quarter, though still lower than FY2019 margins of 60% (-0.3 points YoY).

Despite the raised prices, MNST's case sales for energy drinks have also increased to 163.39M units (+8.1% QoQ/ +4.6% YoY), with a higher average net sales per case of energy drinks at $9.00 (inline QoQ/ +2.5% YoY) at the same time.

While the management does not usually offer forward guidance, we believe that its execution thus far has been highly promising, with consumer demand remaining robust, implying its strong pricing power.

With practically zero debt, MNST's balance sheet continues to grow to a net cash position of $3.28B (+7.5% QoQ/ +33.3% YoY) by FQ2'23, thanks to its rich Free Cash Flow generation of $1.34B over the LTM (+134.2% sequentially).

These factors suggest that the recent sell-off has been overly done, providing interested investors with an improved entry point.

So, Is MNST Stock A Buy, Sell, or Hold?

Based on the consensus forward estimates, MNST is still expected to generate an impressive growth trend through FY2025, with a top and bottom line CAGR of +11.8% and +22.09%, justifying its premium FWD valuations.

Based on the consensus FY2025 adj EPS estimates of $2.07 and its FWD P/E of 31.59x, we are looking at a long-term price target of $65.39 as well, implying an excellent upside potential of +31.3% from current levels, thanks to the recent -15% dip from the August 2023 peak.

As a result of the attractive risk/ reward ratio at current levels, we are cautiously rating the MNST stock as a Buy.

Naturally, there are risks to investing here, since the stock boasts a monstrous valuation compared to its peers. The premium may be a double-edged sword, with the stock potentially experiencing a painful correction if the company ever misses the consensus estimates moving forward, as it has in the FQ2'23 due to the forex headwinds.

In addition, we believe that there is a limit to MNST's price hikes, with the management still planning for further hikes in the recent earnings call.

As a result, investors may want to size their portfolios accordingly, since we may see its volume growth decelerate, or worse, decline moving forward, similar to that of PEP's by -3% over the past few quarters.