kali9/E+ via Getty Images

Enterprise Products Partners (NYSE:EPD) has offered investors a two-part gift. First, management has increased their growth project pipeline, which in theory should lead to faster growth rates. Second, that same announcement has led to weakness in the stock price, sending the distribution yield slightly higher. If this were any other midstream operator, I would have been concerned by the change in rhetoric. But the company maintains a conservatively managed balance sheet and this management team has a long history of exemplary execution of invested capital. Investors should be cheering management's ability to ramp up growth investment activity in spite of the higher interest rate environment. I reiterate my strong buy rating as EPD remains one of my top long-term yield-focused picks.

(Reminder: EPD issues a K-1 tax form which may complicate tax preparation.)

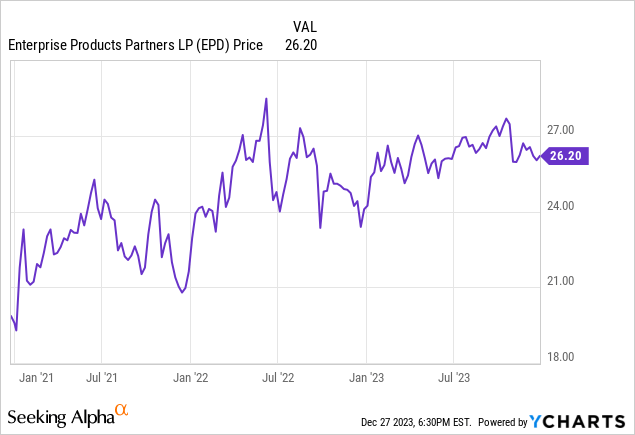

EPD Stock Price

EPD has been a totem pole of stability during a volatile year.

I last covered the stock in October, where I rated the stock a strong buy and noted that "I wouldn't be surprised if 2024 eventually sees growth CapEx matching or even exceeding this year's number." That prediction turned out to be correct, and Wall Street responded negatively. Given management's track record and the company's defensive positioning, I view this to be a strong buying opportunity.

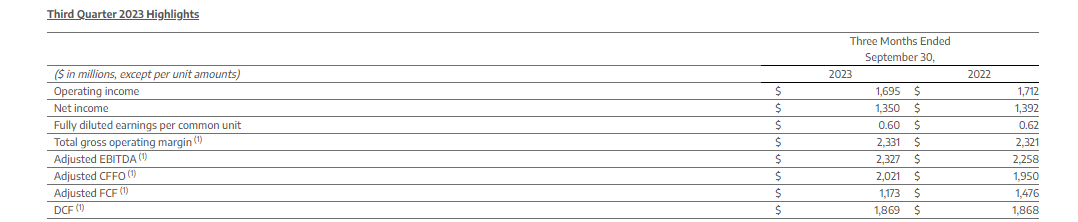

EPD Stock Key Metrics

In its most recent quarter, revenue declined 22.5% to $12 billion. EPD however still earned roughly level net income and distributable cash flow as in the year prior.

2023 Q3 Release

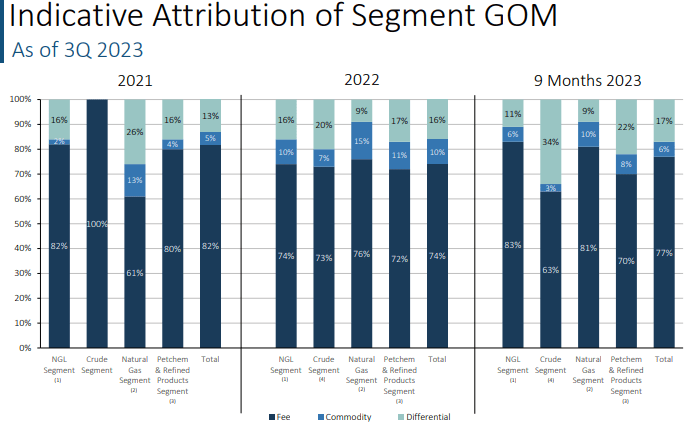

That is due to the company earning 77% of its gross operating margin from fee-based revenue sources, helping to insulate the company from fluctuations in commodity prices. The company does have some commodity exposure, which can be a source of upside (as in 2022) or downside (as in 2023).

2023 Q3 Presentation

EPD covered their distribution by 1.7x by distributable cash flow and more critically retained $773 million after paying the distribution available for growth capital spending.

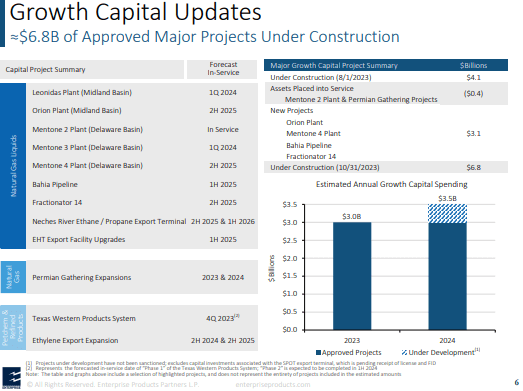

The major development in the quarter was related to the growth CapEx pipeline. Management increased their 2023 growth capital spending outlook to $3 billion, up from $2.8 billion, and in 2024 to $3.5 billion, up from $2.5 billion.

2023 Q3 Presentation

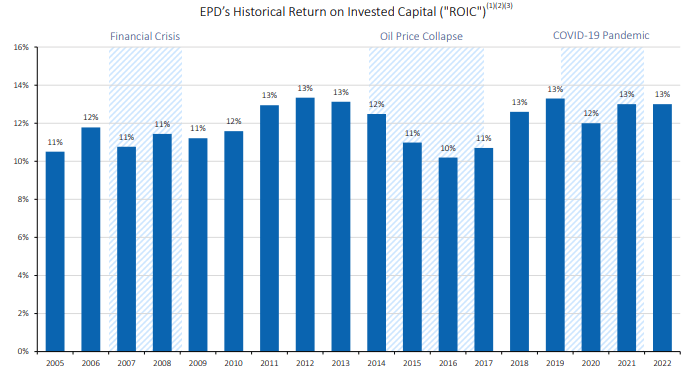

That is a huge shift in capital allocation strategy, given that EPD had previously been signaling an increasing desire to prioritize unitholder returns over growth projects. Moreover, it appears that the company might not be able to internally fund its growth ambitions in the next year. The company generates $5 billion in free cash flow over the trailing twelve months (based on roughly $2 billion in growth CapEx) while paying out $4 billion in distributions - by my math, I see the company needing to tap the debt markets for around $500 million in additional capital next year. On the conference call, management noted that leverage would tick up to the 3x to 3.5x range next year. There may have been some investors who were hoping for a continued transition to lower capital intensity and increased unit buybacks and were disappointed by this development especially given that many peers are doing the same to poor investor reception. However, we must make two important distinctions. First, EPD stands head and shoulders over midstream peers in maintaining an exemplary return on invested capital.

2023 Q2 Presentation

Second, EPD has one of the strongest balance sheets in the sector. 96% of the debt was fixed rate and only 13% of debt matures through 2026. EPD ended the quarter with a 3x debt-to-EBITDA ratio, one of the lowest in the sector. Many peers are seeing significant headwinds from higher interest rates, but EPD's low leverage and staggered maturity schedule have insulated it from such pressures. Management reiterated that their target ratio remains in the range of 2.75x to 3.25x, even if it may trend up temporarily in 2024.

I found it interesting that in spite of growth CapEx is expected to pick up sharply through 2024, management made a point of stating that they "fully expect to be back in the market doing buybacks in the fourth quarter." Management appears to still want Wall Street to give credit for their buyback activity over the past few years, highlighting that they "remain focused on improving our cash flow per unit metrics." While this may seem like just words to some, investor sentiment can be the missing element to unlocking multiple expansion. Management went on further to note that in an internally conducted survey of the largest midstream companies, they found that they are one of only two companies to have reduced their unit count since 2019, and the only one to have done so without material asset sales - an apparent dig at peer Kinder Morgan (KMI). Management even has guidance for 2024 to see between $200 million and $250 million in buybacks. The message is clear: growth CapEx is rising, but management remains committed to unit level returns.

Management stated that they "see the period where we're investing the $3 billion to $3.5 billion a year is pretty limited," hinting that they may see stronger free cash flow generation starting in 2025. For this point I may actually carry a dose of skepticism given that management has been saying similar comments for many years already - I again find it likely that elevated growth CapEx activity persists even after 2024 as management continues to identify attractive investment opportunities.

Is EPD Stock A Buy, Sell, or Hold?

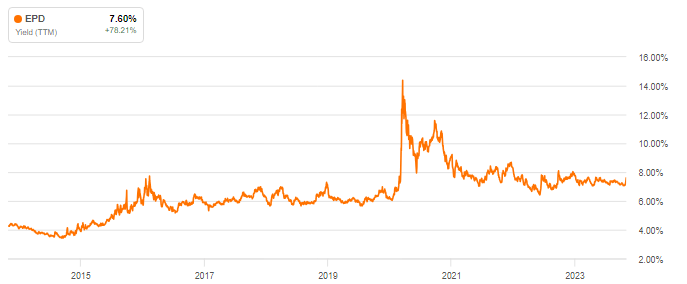

EPD continues to offer a protracted buying opportunity, with its yield hovering near decade highs.

Seeking Alpha

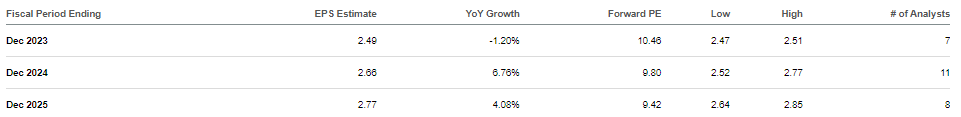

Yes, interest rates are at higher levels, but the company has an A- rated balance sheet, low leverage, and retained cash flow is far higher than at the beginning of the decade. While the rise of renewable energy has cast "traditional" energy stocks in a poor light, I'd argue that the restrictions placed on new pipelines have only made EPD's assets even more valuable. I view EPD as being an attractive investment vehicle for long term investors in large part due to the company's ability to continually invest growth capital into expanding its existing asset base at high ROIs due to the high barriers to entry. Often times companies have to choose between high ROI and high amounts of capital employed - investors get the best of both worlds here. Consensus estimates call for mid-single-digit earnings growth for the company, which looks achievable given the company's aforementioned ability to reinvest retained cash flows at high ROIs.

Seeking Alpha

At recent prices, EPD trades at just around 10x EV to EBITDA, a cheap valuation on an absolute basis and cheap relative to C-corp midstream peers. Regarding that last point, I can make the argument that the K-1 tax form can warrant some premium due to the tax-deferred treatment of distributions, but that point is admittedly offset by the reduced unitholder voting rights.

I continue to expect EPD to re-rate over the long term to around a 6% to 6.5% yield. Even without multiple expansion, I can see EPD delivering solid annual returns from its 7.6% yield and 4% to 5% annual growth (mainly from growth projects and also from unit buybacks). This is one name I am more than happy to be patient on waiting for multiple expansion as I am paid generously to wait.

What are the key risks? It is possible that growth CapEx in the future does not yield the same ROI as in the past. This might occur if commodity prices weaken. EPD has a reputation for operational excellence, including only beginning projects where they have committed customer contracts prepared ahead of time. However, a deteriorating macro environment may prevent even the best operators from delivering on target ROI. Another risk stems from the limited partnership status. Unitholders are not able to choose the general partner. If the general partner leadership changes for the worse, then unitholder returns may decline without much recourse. Unitholders are investing with the faith that the large insider ownership will translate to long-term operational excellence.

I reiterate my strong buy rating for the stock, as the shift in capital allocation strategy should not have come as a surprise and may yield solid rewards given management's track record.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!