PM Images

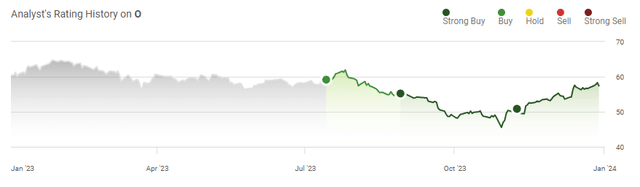

2023 has come to an end, and the Fed saved the holiday season as many sectors rallied to close out the year. Once Jerome Powell delivered the news indicating that the overall consensus from the Fed members was that rates would end 2024 at 4.6%, the Santa Clause rally was ignited. Higher for longer interest rates decimated the REIT sector as activity dried up and fears about refinancing debt at higher levels increased. During 2023, the Vanguard Real Estate Index Fund ETF (VNQ) started the year at $82.48 and declined -14.39% to a low of $70.61 at the end of October. Shares of VNQ rallied 25.14% and rose $17.75 in the last two months of 2023, finishing the year up 7.13% as the Fed gave the market what it wanted. Realty Income (NYSE:O) was hammered throughout 2023 as it started the year at $63.43 and fell -28.99% to $45.04 by the end of October. Despite climbing 27.49% to $57.42 to close out 2023 in the last two months of the year, shares of Realty Income finished 2023 down -9.48%. I was adding to my position during as shares of Realty Income crashed and added as low as $49.48. I am very bullish on Realty Income for the long term and still plan on adding to my position as I feel shares will continue to appreciate in 2024 while investors are rewarded with additional dividend increases.

Following up on my previous article about Realty Income

On November 8, I wrote an article about Realty Income (can be read here) and discussed the misconception of e-commerce in regard to physical retail, and the progress Realty Income had made despite a tough economic environment. Since that article, shares of Realty Income have increased by 13.19% compared to the S&P 500 increasing by 8.79%. When Realty Incomes dividends are factored in, its total return since November 8 has been 14.23%. I am following up on my previous article as I feel Realty Income will continue to rebound in 2024 as the sentiment toward the macroeconomic environment has shifted since the last Fed meeting. I think there is still an opportunity, and we could see capital flow into Realty Income as cash sitting in money markets flows into the markets from the sidelines.

Jerome Powell saved many portfolios this holiday season

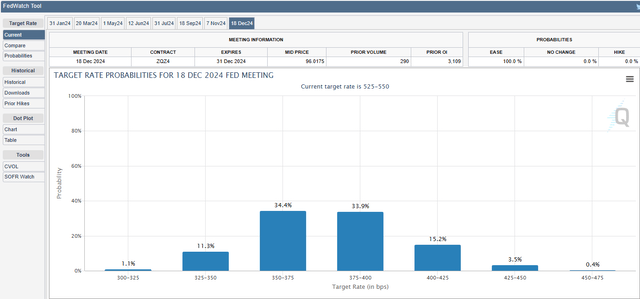

The last FOMC meeting of 2023 occurred on December 13 and Jerome Powell delivered commentary and future predictions that were more dovish than I had anticipated. Rates remained unchanged as expected, but the biggest surprise was that Jerome Powell specifically stated that the Fed believes they are likely to be near or at the peak of its tightening cycle. The entire speech can be read by clicking here. While he left the door open for another hike if the data indicates that would be the path to take, he spent a significant amount of time discussing the future of rates. All members of the Fed took an individual assessment as to what they felt would be the appropriate path going forward. The results indicated that the Fed Funds Rate was at 4.6 percent at the end of 2024, 3.6 percent at the end of 2025, and 2.9 percent at the end of 2026. This has caused a further decline in rates as the 10-year finished 2023 at 3.83% after reaching 5%, and the 2-year fell from 5.49% to 4.25%.

The CME Group Fed Watch Tool is now indicating there is a 15.5% chance a rate cut will be announced at the first Fed meeting of 2024 on January 31, and an 84.5% chance rates remain where they are taking a hike off the table. By the June 12 meeting, there is a 0% chance that we haven't pivoted already, with the most likely scenario with a 56% chance is that the target rate is between 450 bps and 475 bps. The market is currently pricing in more drastic cuts than the Fed indicated in their projections, as the market believes there is a 68.3% chance rates ending somewhere between 350 bps and 400 bps.

This is important for REITs in particular because Bloomberg reported that the commercial real estate market has roughly $1.5 trillion in loan maturities due from 2023 to 2025. The fear has been that active loans would turn into defaults and landlords would turn over the keys to real estate assets to their lenders. This would leave lenders with assets that they aren't necessarily equipped to manage, and Morgan Stanley (MS) has speculated that commercial real estate values could fall as much as 40% in the process. In 2023, we saw Unibail-Rodamco-Westfield and Brookfield Properties stopping payments on their $588 million loan on a 1.2-million-square-foot shopping center in downtown San Francisco's Union Square as they prepared to give the keys back to their lender. Regional banks are holding roughly $1.2 trillion of real estate debt, while the large money centers have been pressured to reduce their exposure to real estate.

If the doomsday scenario played out the way some had predicted based on how the information was evolving, many real estate assets would have been defaulted on as the rate at which the debt would have been refinanced at wouldn't have worked for the operator's business models. This would have left unwanted assets in the hands of lenders, primarily regional banks, who would have been forced to sell these assets at discounted prices to get them off the books, and significant losses would have been recognized. The Fed commentary and path for rates have decreased the chances of this scenario, and as rates decline, refinancing debt on real estate assets will come at terms that work for both the lenders and operators.

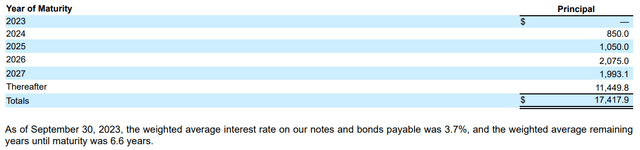

Realty Income's debt was structured favorably, where the higher rates weren't impacting them as much as other REITs, but the shift in the Fed's commentary is bullish for them. Realty Income has a weighted average interest rate on its bonds and notes of 3.7% with a maturity average of 6.6 years. Realty Income paid $159.7 million in interest payments during Q3, and the amount of interest incurred on its debt in the first three quarters of 2023 has been $434.1 million. In the TTM, Realty Income has generated $3.44 billion in EBITDA, and they currently have $344.1 million in cash on hand. Realty Income should have no problem retiring the $850 million of debt obligations they owe in 2024 and refinancing its longer-term debt at favorable rates as rates come down over the next two years. This will put Realty Income in a position where they can acquire assets from struggling operators that weren't as financially sound if opportunities present themselves or reduce the amount of income being allocated toward interest payments and increase earnings in the future.

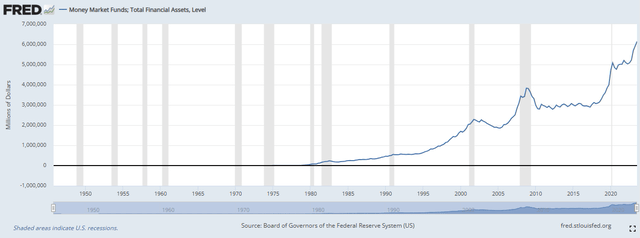

As capital moves into the markets, Realty Income could be a clear winner

As of December 7, the ST Louis Fed showed that there was a total of $6.14 trillion sitting in money market accounts. The latest numbers from the Investment Company Institute indicate that $256.78 billion or 4.18% of the December 7 totals have exited money market accounts as there is now $5.89 trillion held between institutions and retail in money markets. Investors look to be frontrunning rate cuts and allocating capital back into the markets. In December 2023, the SPDR S&P 500 Index (SPY) saw inflows of $37.5 billion, and that's just one ETF. As the risk-free rate of return declines, there will be less of a reason to keep capital in money markets as the capital isn't protected against falling rates. I think there will be trillions of inflows into the capital markets over the next year, and a portion of that capital will be looking to recreate the risk-free rate of return they had become accustomed to receiving. The combination of the impacts of declining rates on debt and yield could be powerful tailwinds for Realty Income.

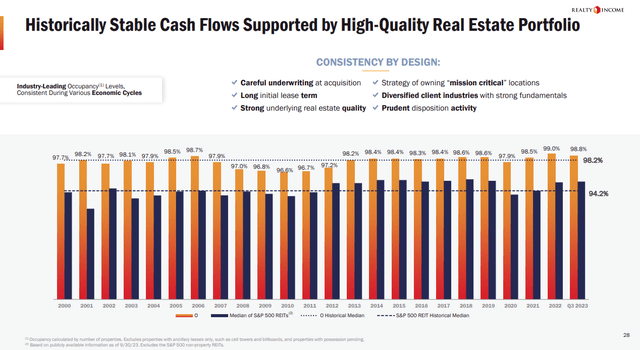

Realty Income is one of the largest equity-focused REITs, with 13,282 commercial real estate properties. Realty Income is part of the S&P 500 index and is part of the highly regarded Dividend Aristocrat club. Realty Income has a world-class portfolio of real estate assets with a 98.8% occupancy level spread across 1,324 clients and 85 industries. Realty Income is the landlord to companies such as Dollar General, Dollar Tree, 7-Eleven, FedEx, CVS, Walmart, and LA Fitness. Its diversification has helped mitigate risk and generated sustained levels of growth across its funds from operations.

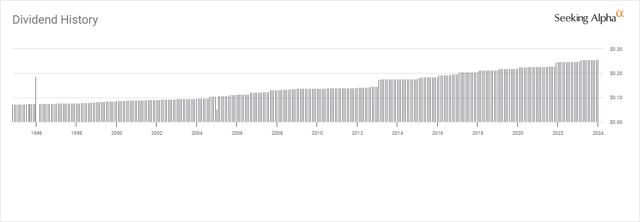

Realty Income has generated substantial value to shareholders through its monthly dividend. Since going public in 1994, Realty Income has declared 644 monthly dividends and provided 105 consecutive quarterly dividend increases. The dividend has grown at a compound annual growth rate of 4.3%, and as of 9/30/23 Realty Income has had a 13.4% compound annual total return since going public. Today, Realty Income is paying $3.07 per share, which is a 5.36% yield. I think Realty Income will continue to rebound as investors will be able to recreate the yield from risk-free assets with Realty Income and get roughly four dividend increases on an annual basis rather than declining rates. Investors could also see significant appreciation as real estate assets appreciate in value as the cost of capital declines, which could push Realty Income's book value higher.

Risks to my investment thesis and investing in Realty Income

While I am a shareholder and bullish on Realty Income, there are risks associated with my investment thesis. The macroeconomic data could change and cause the Fed to divert to a higher for longer stance. If this occurs, the markets could experience additional volatility, and the real estate sector could sell off as fears about refinancing debt at unfavorable levels resurface. There is also a risk of Realty Incomes operators needing less space and not renewing leases or going out of business and turning the keys back over to Realty Income. If the economy faces a recession or other macroeconomic headwinds, it could also impact Realty Incomes leasing efforts and impact occupancy levels. While Realty Income has operated throughout every type of business cycle, it's not immune to external factors and has declined in value many times throughout its history of being a public company. These are all things to consider as all equity investments come with a level of risk, and shares of Realty Income continuing to rebound has a lot to do with external factors that are outside of their control.

Conclusion

I think the REIT trade is going to do well in 2024, and Realty Income is one of my top picks in the space. This is a company that has established one of the best portfolios and dividend track records. As capital comes back into the market, I think its monthly dividend track record and quarterly dividend increases will attract many investors. As the Fed starts to cut rates, I think real estate value on the commercial side will start to appreciate, and this should drive Realty Income's book value higher, which could correlate to an increased share price. I feel shares of Realty Income are still undervalued and will generate a combination of ongoing income and capital appreciation in 2024.