solidcolours

Introduction

In a January 6, 2024 speech, Lorie K. Logan, President of the Dallas Federal Reserve Bank, indicated it may be time to reduce the roll-off of U.S. Treasury securities. She said, "... given the rapid decline of Fed overnight reverse repurchase agreements (ON RRP), I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level." While she is currently not a voting member of the Federal Reserve's Open Market Committee, she carries great weight as past manager of the Fed's open market activities (SOMA) from 2019-2022.

Background

On May 4, 2022, the Federal Reserve announced that it would begin to reduce the size of its balance sheet by instituting a roll-off of U.S. Treasury "UST" and Mortgage-Backed Securities "MBS". Its stated goal was to reduce its Treasury holdings by $30B/month and MBS by $17.5B/month for three months starting June 1, 2022, and to double those roll-offs beginning September 1, 2022. This Fed policy became known as Quantitative Tightening (QT).

Goal Accomplishment

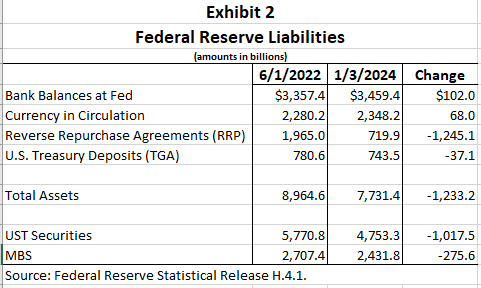

The total assets of the Federal Reserve on the day it implemented QT was $8.879 trillion. Its holdings included $5.771T in UST securities and $2.707T MBS. Those assets were primarily supported by $3.357T in bank reserves deposited at the Fed, $2.280T in currency in circulation, $1.965T in reverse repurchase agreements "RRP", and $781B in U.S. Treasury deposits "TGA". Those major liabilities totaled $8.383T and equaled 94.4% of the Fed's total assets.

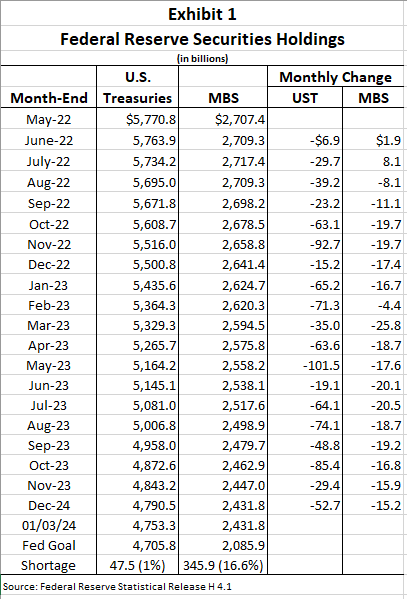

January 3, 2024 marked the 78th week (1.5 years) of QT. Exhibit 1 shows that during that time the Fed reduced its holdings of UST securities by $1.0175T, which amounted to 99% of its stated goal. The reduction in MBS of $275.6B, however, amounted to only 44.3% of its roll-off goal.

Fed Securities (Federal Reserve Release H.4.1)

Fed's failure to reach even 50% of its stated roll-off goal in MBS was due to a precipitous decline in prepayments. Homeowners with low mortgage rates decided to stay in their existing homes, which were rising in price. Borrower behavior and the inability of homeowners to refinance at lower mortgage rates significantly extended the duration of MBS beyond what had been assumed by the Fed.

Despite the Fed's roll-off of more than a trillion dollars in UST securities, the U.S. Treasury was able to fund the federal deficit without major disruptions, albeit at higher interest rates. The reluctance of banks to raise interest rates on deposits encouraged disintermediation and an increased appetite for UST securities by bank depositors.

Future of QT

The total assets of the Federal Reserve are normally dictated by the amount of liabilities available to support those assets. Liabilities in the form of bank reserve balances at the Fed, currency in circulation, domestic reverse repos, and U.S. Treasury deposits equal more than 90% of Fed total assets. Accordingly, it is essential to understand the size and volatility of those liabilities.

Exhibit 2 shows the aforementioned liabilities at the beginning of QT and for the latest week. It also shows the Fed's total assets along with its securities holdings.

Federal Reserve Liabilities (Federal Reserve Release H.4.1)

As noted in Exhibit 2, bank reserve balances held at the Fed represent the largest Fed liability currently amounting to about $3.5T. The second largest liability is currency in circulation followed by reverse repos then U.S. Treasury deposits. These four liability categories were responsible for funding about 94% of the Fed's total assets during the past two years.

The Fed recently conducted a Senior Financial Officer Survey to determine if banks were satisfied with the level of reserve balances they held at the Fed. Respondents held more than 75% of all the reserve balances. Based on that survey, the Fed concluded that bank reserve balances could be expected to equal about $3.4T, which is the amount that has prevailed for the past year.

The Fed's second-largest liability, currency in circulation, has also remained relatively stable. In recent years it has amounted to about $2.3T.

About the same time the Fed's survey results were released, the U.S. Treasury announced it planned to have $700B in its Fed checking account by the end of 2023. It also indicated it would like to keep its TGA around $600B. During the debt ceiling crisis in 2023, its TGA balance fell below $100B.

The volatility in reverse repurchase agreements is readily observable in Exhibit 2. The $1.245T decline in domestic reverse repos equaled 101% of the $1.233T decline in the Fed's total assets. The decline in RRP equaled 96% of the decline in holdings of UST and mortgage-backed securities.

For the past six (6) months, the decline in domestic RRPs has averaged $177B per month. A continuation of that decline will reduce RRP's to zero on the Fed's balance sheet by May 1, 2024.

The decline in the Fed's total assets caused by any decline in RRPs could be offset if the decline in RRPs leads to an increase in bank balances at the Fed. An examination of the Fed's balance sheet shows that while RRPs declined by $886B during the most recent six months, bank balances at the Fed increased by only $242B. Accordingly, the Fed's total assets should be expected to decrease as long as RRPs continue to decline.

Conclusion

Investor attention is focused on the number of times the Fed will cut its targeted federal funds rate in 2024, when it will cut, and the size of those cuts. Very little attention is being devoted to the Fed's QT roll-off program.

This brief analysis of the Fed's balance sheet strongly suggests that the Fed will very soon have to reduce the size of its roll-off program. A reduction in the MBS roll-off goal of $35B per month would simply represent a belated recognition that the current goal is totally unrealistic and would likely have a negligible impact on market prices.

Any announcement that the Fed is reducing its roll-off of U.S. Treasuries is likely to be greeted enthusiastically by Janet Yellen, Secretary of the Treasury. It should cause a decline in shorter-term U.S. Treasury securities commensurate with the extent of the roll-off reduction.

There is a risk that market participants view any reduction in roll-offs as a sign that the Fed is reverting to its inflationary ways. If that view gained traction, then long-term interest rates and precious metal prices would rise.