Dan Kitwood

Investment Thesis

Our current investment thesis is:

- Barclays is an industry-leading bank in both the retail and commercial/investment banking segments. Unlike most of its European peers, it is uniquely positioned in this regard. The company has slowly improved during the last decade, finally reaching a fundamentally attractive level in our view.

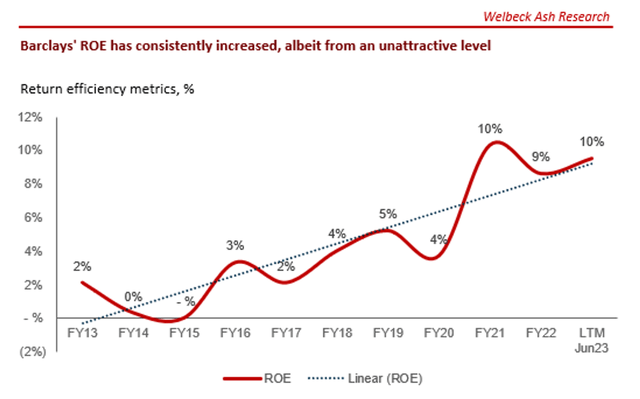

- At an ROE of >10% and a NIM in the 20% ballpark, Barclays is positioned perfectly to consistently generate shareholder returns through distributions, even if its share price remains stagnant.

- If management can improve the profitability derived from its book, which is the final step in our view, the company could be propelled materially forward. With its current level of profitability, Management has greater resources to achieve this over the coming years.

Company Description

Barclays PLC (NYSE:BCS) (OTCPK:BCLYF) is a British multinational bank, operating as two divisions: Barclays UK and Barclays International. It has commercial and investment banking operations, alongside providing a host of other financial services globally.

Barclays has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100. Barclays also has a secondary listing on the NYSE.

Barclays is one of the UK's big 6 banks alongside HSBC Holdings plc (HSBC), Lloyds Banking Group plc (LYG), NatWest Group plc (NWG), Nationwide, and Standard Chartered PLC (OTCPK:SCBFF).

Share Price

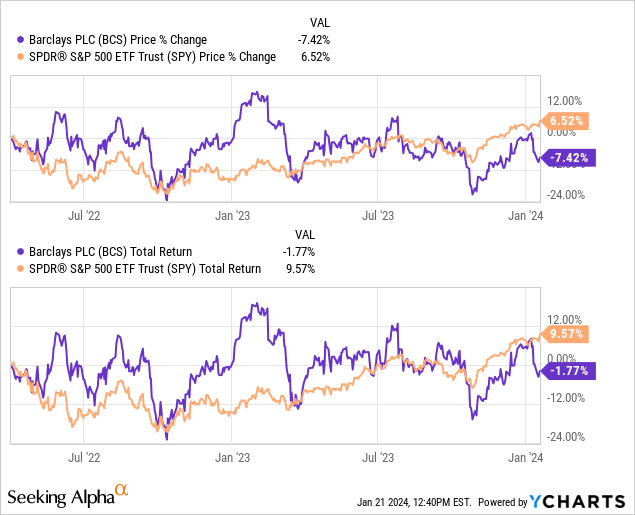

We last covered Barclays in April 2022, rating the stock a buy due to its competitive investment bank, underpinned by its strong retail banking operations, and the scope for increased returns due to rising rates.

Since then, its share price has broadly traded sideways, with numerous opportunities to breakout but miss-steps contributing to pullbacks.

Commercial Analysis

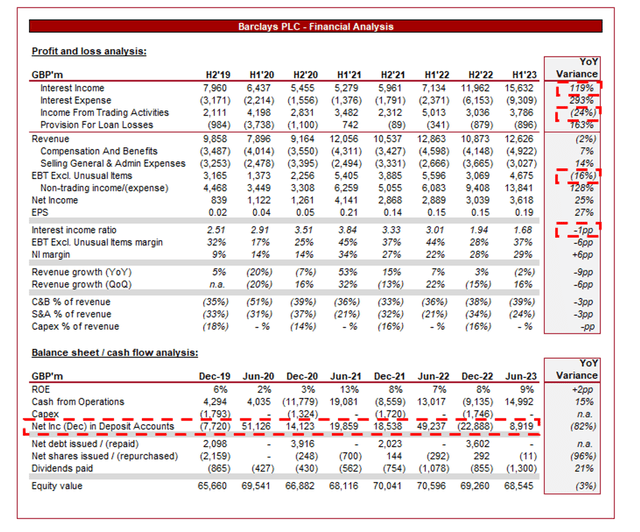

Presented above are Barclay's financial results on a half-year basis, as is the reporting custom in the UK.

Barclays' recent performance has been reasonable, with growth driven in part by the current interest rate environment, allowing for greater interest income. In its last four half-years, the company generated revenue (after provisions) growth of +15%, +7%, +3%, and (2)%.

Barclays has a substantial retail banking operation, primarily in the UK, with both traditional banking services alongside Credit facilities and loans. Barclays is estimated to have the largest number of global customers among the UK global banks. This contributed to ~70% growth in interest income during FY22 and a further ~113% in the LTM period, as Barclays hiked rates across its services. Despite this, revenue growth between FY21 and LTM June 2023 has been minimal.

Barclays has not managed to monetize its customer base to the same degree as its peers, mainly due to the capital it has tied up in its Corporate and Investment Banking ("CIB") segment. For example, Lloyd's generated an interest profit margin of ~79% in FY22 (Interest profit/interest income) while Barclays fell materially short at 55%.

This said, Barclays benefited from market tailwinds post-pandemic, with growth in its investment banking division as expansionary monetary policy contributed to a spending spree. Barclays is likely one of the few remaining investment banks in Europe that can compete with the leading US players (We would argue only), allowing it to benefit from these tailwinds and drive revenue growth.

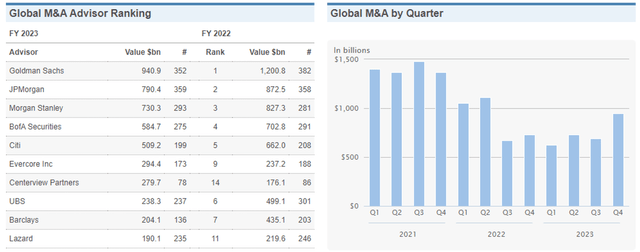

Investment Banking scorecard (WSJ)

In its most recent half-year, the company saw a reversal of fortunes, with growth declining by (2)%. This is primarily due to a combination of increased provision for losses and a decline in Corporate and Investment Banking revenue. The reason for both is the same.

With increased interest rates, the M&A market has seen a material softening, reflected above, contributing to negative volatility in revenue generation from M&A and ECM in particular. Many have criticized Barclays' choice to maintain such a large investment banking operation (only the 5 largest banks in the US generate more IB revenue), in part due to said volatility, although we remain supportive of it given the company's market-leading capabilities. For those who are not aware, Barclays purchased Lehman Brothers following its collapse. This division gives Barclays the scope to outperform during "the good years", particularly given the West will likely return to a low-interest rate environment with record levels of dry powder in the private equity market.

Further, a cost of living crisis in the West due to an extended period of heightened rates and inflation has contributed to delinquencies ticking up. Management is taking a prudent approach to risk, particularly in its credit card portfolio allowing for its arrears rate to broadly remain flat. Further, its mortgage book appears resilient, with a reasonable LTV (~53%), a high level of fixed mortgages (~80%), and a low arrears rate (~0.2%). Overall, from our analysis of Barclays' capital management and provisioning, Management appears to be conservatively operating the business with limited risks present we feel.

Finally, from a cost perspective, Barclays continues to rationalize non-core operations and reduce its headcount, primarily in its retail operations as society further transitions to online banking. This has allowed for a gradual improvement in its underlying profitability over the last decade, with additional gains expected as Management announces more restructuring costs ahead. BofA is not wholly bullish on this but appears to miss that Barclays has already progressed well, with inherently limited incremental gains.

Barclays' flash trading for Q3 further supports this view of prudency, with underlying profitability growth (+11.1% YoY EBT excl. one-off items) while its provision for losses declined (13)%.

Looking ahead, we believe Barclays is well-placed to consistently outperform its miserable post-GFC decade. We suspect the company can consistently generate a net income margin of ~17-22% (which it did not achieve once between 2013-2020), with the spread attributable to a combination of volatility in CIB and risks associated with the UK economy.

Economic & External Consideration

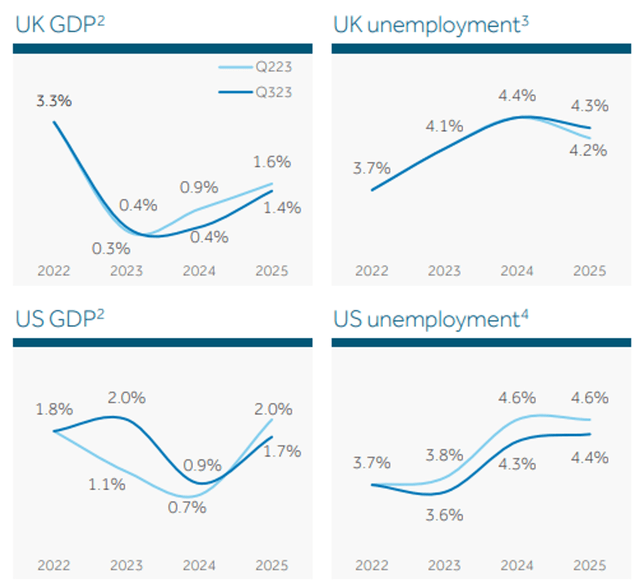

Economic conditions in the West have been dominated by elevated interest rates and inflation, with a reversal in policy following a decade of expansionary monetary policy. We are expecting conditions to remain difficult, primarily due to the risk of a recession prior to a decline in rates. Central Banks are attempting to avoid a recession while reducing inflation, but the task was always going to be extremely difficult. The US recession probability indicator has exceeded 50% while we feel the UK could follow suit (although current estimates imply this will not be the case).

The UK's GDP growth is expected to slightly lag the US into 2025 based on Barclays' expectations, while unemployment will broadly align, which we consider moderate for both. The key is the degree to which UK rates can decline quickly, as they are expected to lag behind.

Further, we see opportunities for the UK economy to improve through a reduction of the tax burden (currently at record levels) and Brexit deregulation with the express objective of benefiting financial services.

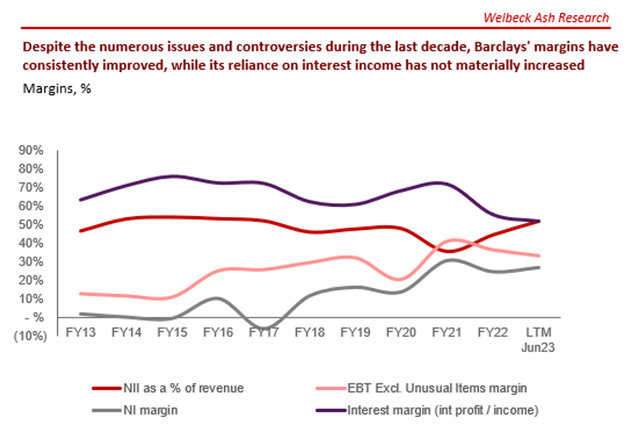

Margins

As previously touched on, Barclays' profitability has improved over time, with net income margin expected to exceed 20% for three successive years. With the company's interest margin broadly remaining flat, this reflects the operational improvements achieved by Management. The post-GFC period has been incredibly difficult for European banks, with Barclays recovering well but likely only now finally reaching an attractive level.

We do believe the company is still slightly lacking from its optimal potential, however. With net interest income ("NII") broadly flat across the last decade, the expectation is for profitability per £1 lent to increase over time, which we discussed above has not been the case. This will likely contribute to relative weakness compared to its peers.

Balance Sheet & Cash Flows

Barclays currently has a Common equity tier 1 ratio of 14.0%, a UK leverage ratio of 5%, and a tangible net asset value per share of 316p. The company's balance sheet is in the best position it has been in for a long period, with Barclays now primed to accelerate returns to shareholders.

As the following illustrates, ROE has exceeded 10% for 3 successive periods, with Management targeting a >10% level. With our NIM target of ~17-22%, we consider this achievable.

Industry Analysis

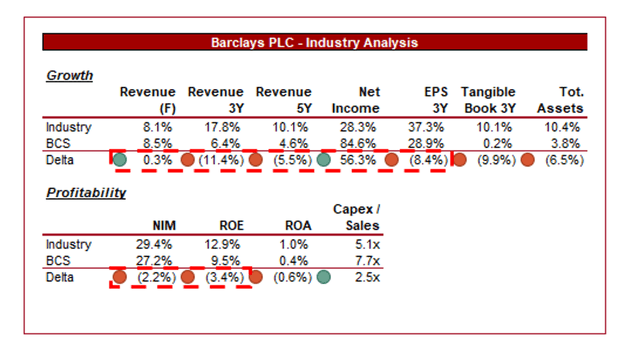

Presented above is a comparison of Barclays' growth and profitability to the average of its industry, as defined by Seeking Alpha (65 companies).

Barclays is lagging behind the average of its peers, although we note the gap has been periodically closing over time. The revenue growth delta is partially due to the mix effect of challenger banks such as Nu Holdings Ltd. (NU), although is also driven by Barclays' more diversified business model, with consumer banks fairing far better (such as Lloyd's and NatWest).

Further, the company's profitability is slightly below its peers. As discussed, the final piece of the puzzle for Barclays' resurgence is to further optimize the profitability of its book to limit the downsides associated with operating a significant CIB offering.

With its increased profitability, Management could theoretically turn bullish, choosing to reinvest in CIB rather than optimize as a means of improving profitability. Regardless of strategy, this will be how the company can close the gap.

Valuation

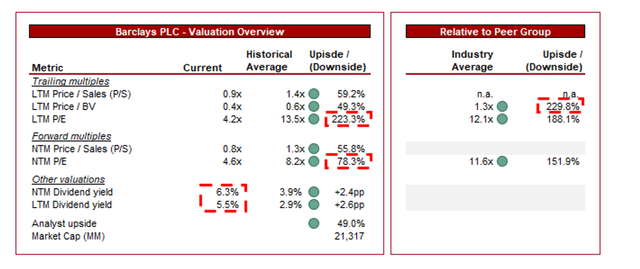

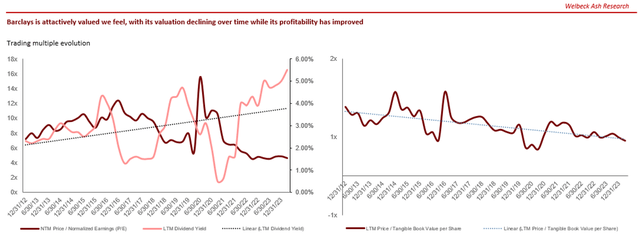

Barclays is currently trading at 4x LTM P/E, 0.4x book value, and 5x NTM P/E. This is a steep discount to its historical average.

Consideration of the company's historical average is difficult due to the noise associated with the post-GFC period. This said, the company had seen a degree of stability, allowing a reasonable comparison to be made. We feel a small discount is appropriate, as this balances the fundamental improvements with the near-term risks ahead, alongside its potentially heightened historical valuation as investors expected a resurgence.

Further, Barclays is trading at a deep discount to its peers, with a ~230% book value discount and an NTM P/E discount of ~152%. This is bordering on ridiculous in our view. Numerous issues and scandals aside, Barclays is a premier global bank. The company has a market-leading position in its core markets with limited risks to its fundamental position. Its profitability is comparable to its peers, while growth is not a million miles away. We do not see a 150-230% difference.

Based on this, we believe Barclays is significantly undervalued.

Valuation evolution (Capital IQ)

Key Risks With Our Thesis

The risks to our current thesis are:

- Performance of the UK economy.

- Timing and extent of rate declines.

- Recession.

- FX as 40-45% of revenue and 30% of costs are in USD.

Final Thoughts

Barclays is a high-quality bank that has been shrouded by scandals and mismanagement. Following a decade of rebuilding, we believe the company has finally turned a corner, with ROE exceeding 10% and its long-term fortunes improving.

We do see further progress required, but at its current valuation, it is difficult to bet against Barclays outperforming at its current price. The company is trading at a P/BV of less than 0.5x, a bizarre valuation given its sustainable profitability levels and market position.

We maintain our buy rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.