Mindful Media/E+ via Getty Images

SurgePays, Inc. (NASDAQ:SURG) is one of those stocks that doesn't get wide coverage due to a relative lack of institutional interest. It positions itself as a "technology and telecom company." The company's main business is to serve the "underbanked and underserved communities." As a result, it has distribution networks embedded in the immigrant communities and generally focuses on lower-income families. Despite posting record profitability in its most recently reported quarter, the company has relatively low institutional ownership.

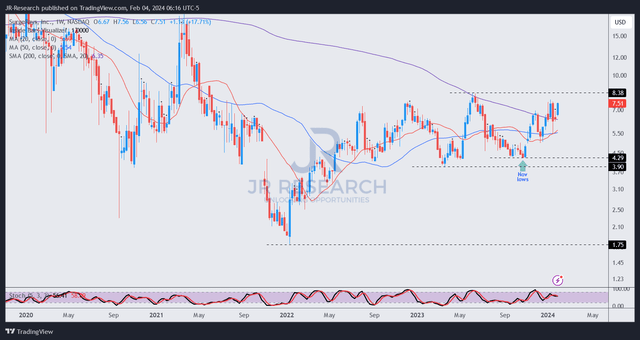

Based on its ownership structure, institutions own just above 10% of SURG's outstanding shares, with more than 60% attributed to the general public. As a result, SURG has seen significant volatility over the past years, as we can observe in my price action analysis later.

Despite that, insiders own nearly 30% of its outstanding shares, aligning their interests with those of the other shareholders. Management is also keen to attract greater institutional interest and ownership. As a result, the company recognized "the need to simplify its business structure and messaging." Therefore, the company decided to wind down LogicsIQ (its legacy mass tort lead generation segment), which led to a revenue decline in Q3. Despite that, SurgePays sees the potential for a more substantial valuation re-rating as it "aims to define a clear and understandable vision."

SURG is valued at a forward adjusted EPS multiple of just 4.17x. Seeking Alpha Quant assigns SURG a "B+" valuation grade, suggesting relative undervaluation compared to its communications (XLC) sector peers. With the comms sector assessed to be more than 10% undervalued by Morningstar, it does seem like SURG could command a higher valuation if it could convince more significant institutional interest as the company looks to attain its objective "of moving from a micro-cap to a small cap company."

However, with its narrow focus on the market, could its TAM be wide enough to suggest a higher growth valuation even as the market has yet to recognize it? SurgePays believes it sees a significant market opportunity, assessing "over 100 million adults in the United States being prepaid customers." SurgePays underscored that over "one-third of the U.S. population falls under the category of being underbanked or unbanked."

As a result, it has enhanced its reach into the community by entrenching its products and services with the convenience store strategy serving its target customers. The company's recent foray with the launch of its wireless prepaid brand LinkUp Mobile represents its key growth vector in 2024. It allows the company to upsell its ACP customers. Critically, the company believes that its services are considered essential. Therefore, it helps to mitigate macroeconomic headwinds, as it sells into a "resilient market segment that remains robust even during challenging economic times."

However, the company could still face competitive risks, which its lack of durable market advantages could compound. Notwithstanding its robust net-cash balance sheet, investors will need more time to assess whether its profitability inflection is durable. Consequently, I believe it could take a while to convince a more significant institutional ownership base to take root. Despite that, bullish SURG investors could point out that its relatively attractive valuation doesn't do justice to its best-in-class "A+" growth grade as it looks to capitalize on its focused segment.

SURG price chart (weekly, medium-term) (TradingView)

I assessed that the market seems to concur with SURG bulls, as its recovery from its 2022 lows has continued in earnest, suggesting a valuation re-rating is still underway. The valuation bifurcation against its high-growth potential indicates that the market hasn't reflected significant optimism on its business strategy.

Despite that, SURG is assessed to be highly volatile and susceptible to substantial up/down swings, as seen in its price action. Therefore, a poorly-time entry could lead to unanticipated downside volatility that could exacerbate a panic selloff, given its relatively high non-institutional ownership.

Notwithstanding the caution, I assessed SURG as looking to regain its medium-term uptrend bias, suggesting the market seems confident of its ability to execute its growth strategy.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!