JamesBrey

All values are in CAD unless noted otherwise. The ownership of this stock is generally restricted to Canadians. If you are wondering "What Is That Aboot?", you can read more here.

In our last coverage of Alaris Equity Partners Income Trust (TSX:AD.UN:CA), we made the case that this was severely mispriced and the big yield plus price appreciation should easily give you 10% plus annual returns. Specifically, we said:

You are very likely to get at least a 1.0X price to tangible book value multiple at some point in the next cycle. We continue to rate this a buy and think this is one of the lower-risk yield plays. The debt side is even more attractive as total debt to EBITDA has been maintained under 2.5X. Alaris has two sets of debentures trading on TSX and the ones maturing in May 2027 have a yield to maturity of over 9%. We own those primarily (93% of our dollars) and also have a small stake in the common equity (7% of our dollars).

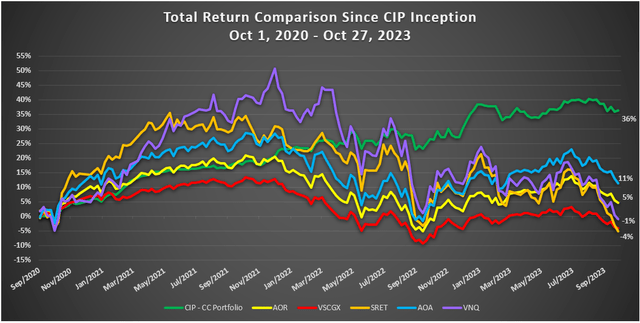

The stock has done well and kept up with the broader indices, despite having no bubble-like properties.

Seeking Alpha

We go over what we have done since then and give our outlook for the upcoming annual results on March 14, 2024.

Our Bond Position

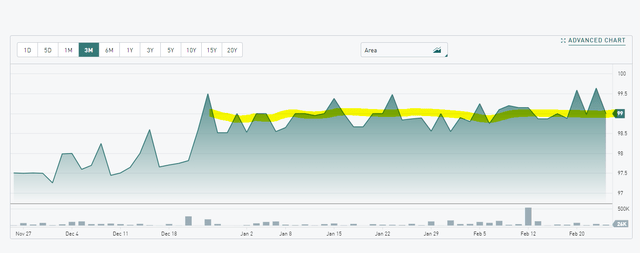

As mentioned above, the bulk of our dollars was in the 2027 maturing exchange traded debentures, Alaris Equity Partners Income Trust 6.25% Senior Unsecured Debentures (AD.DB.A:CA). The symbol is currently missing in Seeking Alpha, but you can find it on TMX. One of the reasons we were pounding the table for this was that it was trading in the low 90s in late 2023 and was dirt cheap relative to the risks. You were getting over 9% yield to maturity on a safe bet.

As can be seen at the far end of the picture above, the bond approached par value, and we were happy to lock out our gains at nearly $99.00. At that price, the yield to maturity was closer to 6.6% and while that bond is still safe, we did not think that was a great risk-adjusted bet for the long run. There are plenty of places you can do better than 6.6% while taking even less risk. Here is one example of 7.5% yield, which we still think is even less risky than this one. We will give you another one in this article.

The Equity

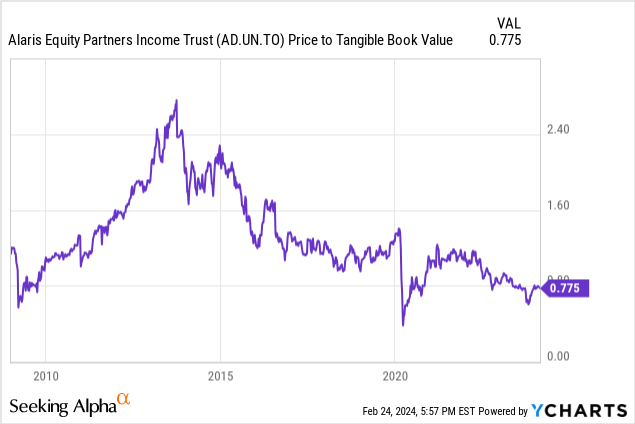

We still own the common shares (tiny position) and think they represent an opportunity to at least their tangible book value.

Note how expensive this was trading during the 2013-2014 era. Of course, we don't think we will get there now, but at 0.775X tangible book value, there is some value to be had. The results that are upcoming should further cement this. The US economy has done well over Q4-2023, with a healthy mix of real GDP growth and inflation. Alaris is a top-line royalty play and the companies it gives money to, reset their distributions to Alaris based on their own revenue changes. Those revenue changes move pretty much in line with nominal GDP, and the bulk of Alaris' investments are in the US. Hence, we expect a strong finish for the company for 2023 and healthy resets for 2024 partner distributions.

The Other Bond

Since we disposed of 93% of our position (which was the bonds) and are still bullish on the company, why did we not jump right into the equity? The reason for that is we actually found a position in third place in the same company's capital structure. As we sold our longer-dated bonds for nearly $99.00, the company's second exchange-traded debenture was trading slightly below that. Alaris Equity Partners Income Trust 5.50% convertible unsecured subordinated debentures (AD.DB:CA) were trading at $98.8. While 20 cents is not exactly a reason to switch bonds, these mature on June 30, 2024. The 5.5% yield is nice, but when combined with the capital appreciation to par, these yield over 9% to the near by maturity. Patient buyers have had plenty of opportunities to buy this below $99.00 in the last two months, and we have highlighted these in our MP service.

The debenture total amount is only $100 million, and the company's tangible equity is worth close to $1.0 billion. Alaris was last seen running a 1.9X debt to EBITDA, and its diversified portfolio of investments was firing on all cylinders. 9% for such a safe setup is extremely impressive on a risk-adjusted basis, and we parked a large amount of cash there.

Verdict

We tend to control our position size in a single company and for that, we count all investments within it, be they stock, preferreds or bonds. Since we are heavily invested in the near-term bonds, we chose not to add more equity here. The company is doing well and is definitely cheaper relative to the BDC valuations we see. Unlike BDCs, it won't be impacted by rate cuts as the distributions it earns, move independently of that. The bulk of its partners also have very low leverage. Some actually have no other form of liability other than the royalty share with Alaris. Most BDCs lend to companies with 5X plus debt to EBITDA. This remains a nice prospect for investors, and we might buy more common equity post the maturity of AD.DB bonds.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.