Lemon_tm

In this article, we catch up on the latest quarterly results of the Golub Capital BDC (NASDAQ:GBDC). The company delivered a good quarterly result with a 3.1% total NAV return. It trades at an 11.6% total dividend yield and a 5% premium to book. Its net income yield is 12.6%.

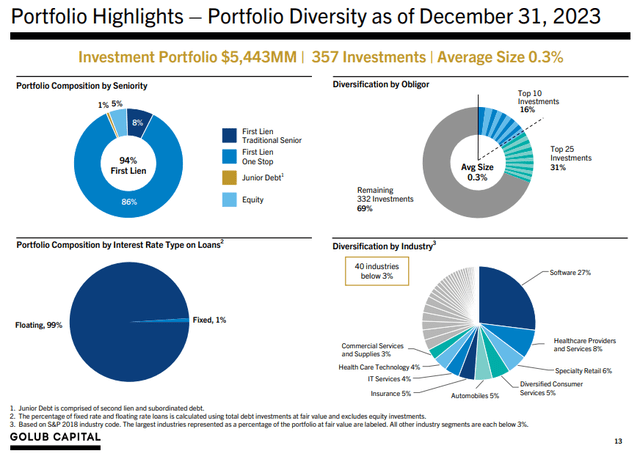

The company's loan portfolio targets primarily floating-rate first-lien loans and is very well diversified with over 300 positions. Top sectors include software and healthcare.

Quarter Update

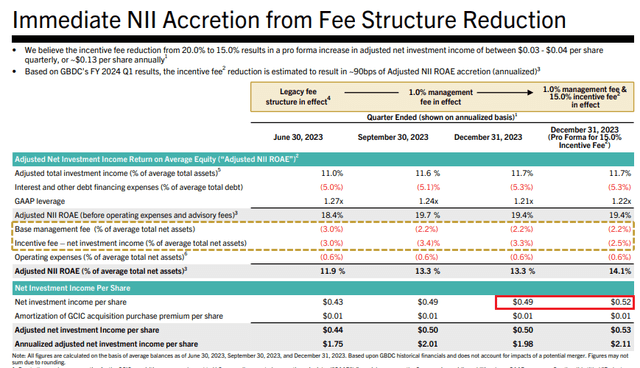

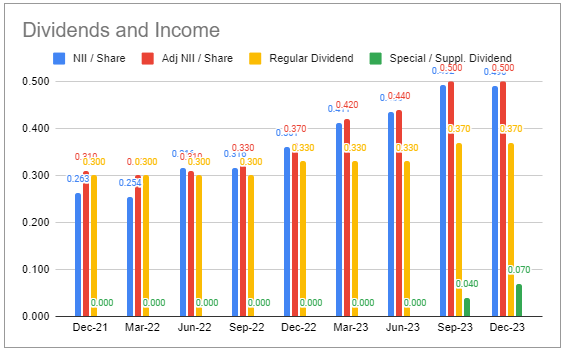

Adjusted net income for the quarter came in at $0.50 - the same level as in the previous quarter.

Systematic Income BDC Tool

The large increase in the previous quarter was, in part, due to the cut in the management fee which pushed net income higher by $0.02 or around 4.6%. We expect a decent further sustainable rise in net income next quarter by a slightly larger amount going forward due to the reduction in the incentive fee, as shown below, which will be made permanent on the completion of the merger with Golub Capital BDC 3 Inc.

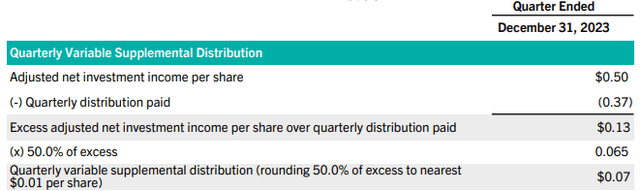

The company increased the base dividend by 5.4% to $0.39 and declared the same $0.07 supplemental as for the previous quarter. As we highlighted in previous updates, the company has a formulaic supplemental dividend - the math is shown below. The drop in the incentive fee should translate into a bump in the supplemental of at least $0.01.

The rise in the base dividend pushed base dividend coverage to 128% and total dividend coverage to 109%.

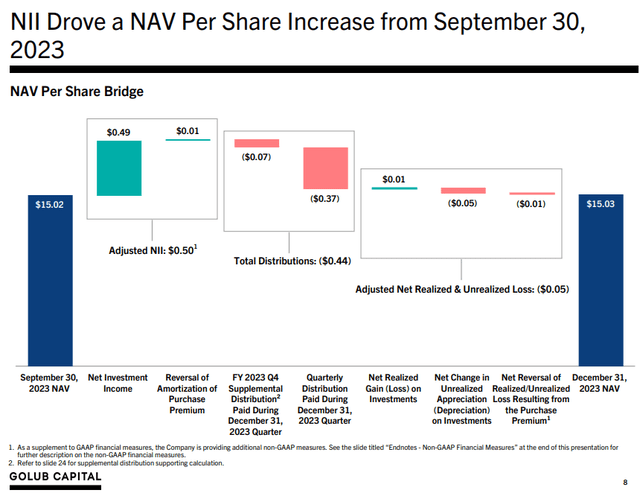

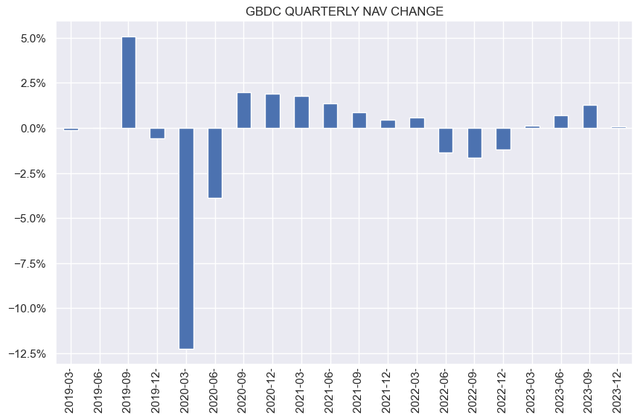

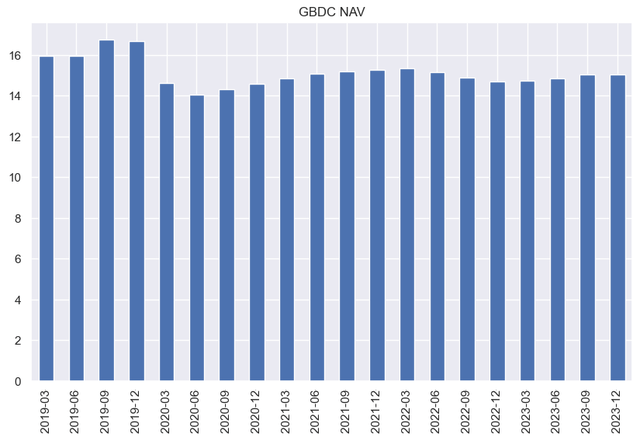

The NAV rose by a penny as retained income slightly offset unrealized depreciation.

This was the fourth quarterly rise in the NAV.

And it brings the NAV closer to its 2022 local peak.

Income Dynamics

The total reduction across both management and incentive fees works out to roughly 5 cents, or about a 12% increase in net income going forward. The new 1% base management is shared by only two other BDCs in our coverage, with no BDC having a lower fee. The new incentive fee of 15% is also at the lower end of the sector and is typically either 17.5% or 20%. The 8% hurdle for the net income incentive fee is very shareholder-friendly (only a handful of BDCs have this, and most start at 6-7%). And the total return hurdle is infinite, which is only shared by a handful of BDCs with most not having this shareholder-friendly feature. In short, GBDC has the most shareholder-friendly fee structure across each of the 4 main components of fees for BDCs in our coverage.

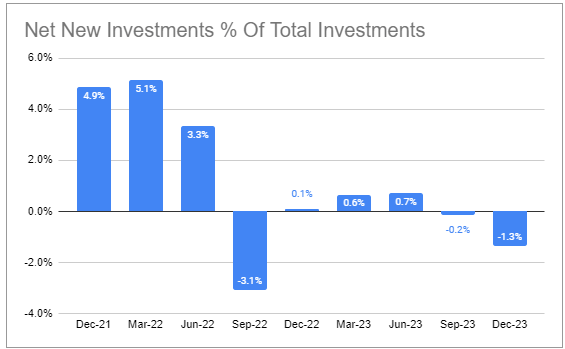

Net new investments fell as sales and prepayments exceeded new fundings.

Systematic Income BDC Tool

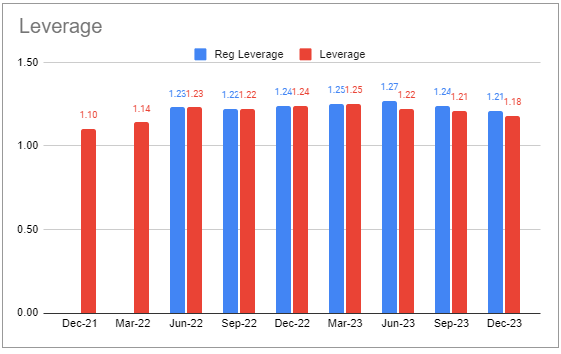

As a result, leverage fell further towards the company's target of 1.15x. This would put it in line with the average of BDCs in our coverage.

Systematic Income BDC Tool

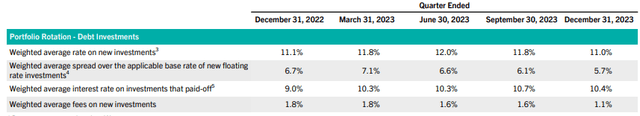

The spread and, hence, yield on new investments fell for the second quarter in a row. However, it remained above the yield of investments that paid off. This trend will continue to marginally boost net income.

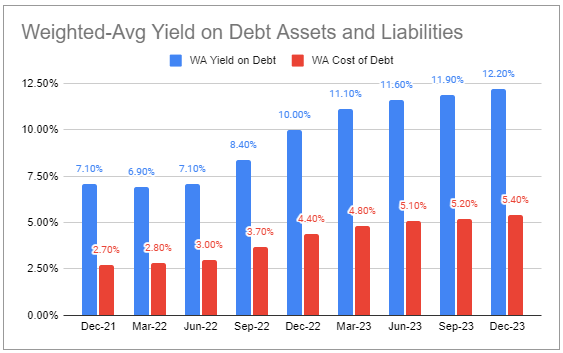

Both asset yield and interest expense increased by about the same amount, keeping the net interest margin relatively stable. Overall, this will modestly increase overall net income, as the increase in debt only applies to those assets financed with borrowings.

Systematic Income BDC Tool

GBDC has a $500m 3.375% 2024 bond maturing soon. Late last year, it issued a $450 7.05% 2028 bond. Although the bond was priced after the drop in yields from their recent peak, it was still somewhat unlucky as both Treasury yields and credit spreads continued to fall since then. We have not seen a BDC bond issued at a higher coupon in the last 3 months, at least from companies in our coverage.

A further drop in yields may have caused the company to tap the bond market again with a 6% $600m 2029 issuance. This trend of refinancing lower-coupon bonds (GBDC has around $1bn of 2-2.5% coupon bonds maturing over the next couple of years) to higher coupons will take a toll on net income. However, the situation is the same across the rest of the sector as well. The company's cost of debt remains one of the lowest in the sector.

An interesting element of these last two bonds is that the 2029 bond and half of the 2028 bond were swapped to a floating rate at a weighted average rate of SOFR + 2.68%. Apart from the bonds issued below 3% prior to 2022, GBDC has tended to swap its issuance. The immediate impact of the swap is that GBDC will pay a higher rate, for a little while at least, than it would have on the bond given the inverted yield curve (for example, the cost of the 6% 2029 bond goes from 6% to 8%). However, its view appears to be that the yield curve disinverts in the future, allowing it to save money by paying a floating rate.

Portfolio Quality

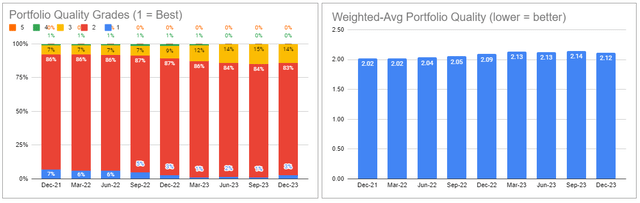

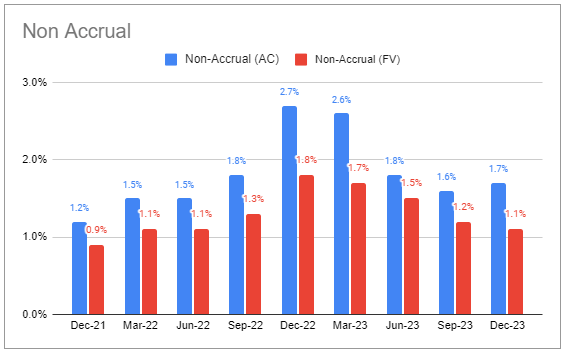

Non-accruals continued to fall, descending to 1.1%. The total number of companies on non-accrual remained flat at 9.

Systematic Income BDC Tool

Portfolio quality, as gauged by internal ratings, was stable. Investments in the worst two rating buckets represented 0.4% of the total portfolio.

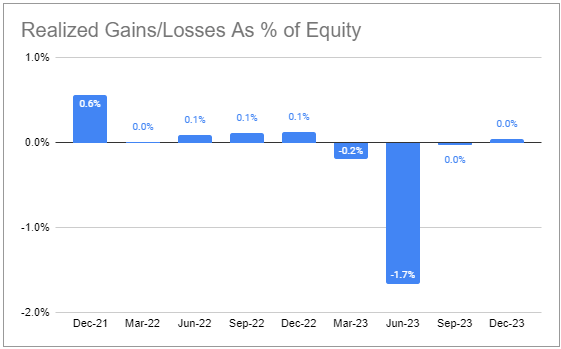

Net realized gains/losses were fairly flat for the second quarter in a row.

Systematic Income BDC Tool

Valuation And Return Profile

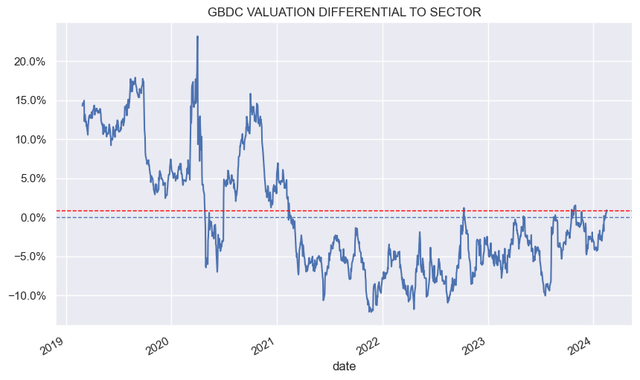

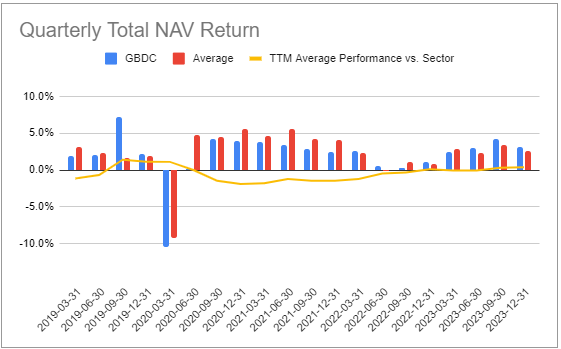

After underperforming the sector in the risk-on environment of 2021, the company has done better, slightly outperforming the sector in a more challenging post-2022 period. As we discussed above, the double-barreled drop in fees should allow the company to continue to outperform the broader sector.

Systematic Income BDC Tool

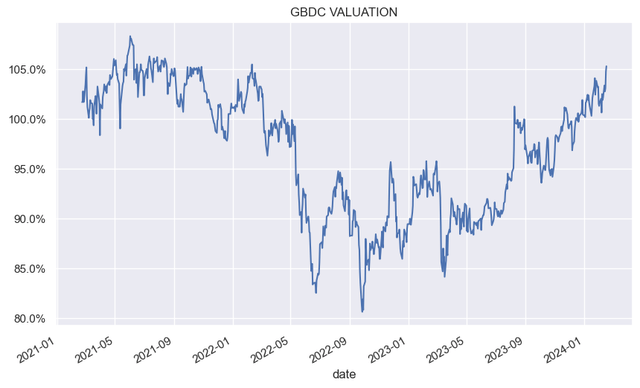

The company's valuation has made a roundtrip, returning to the 100%+ level after falling as low as around 80% in 2022.

After trading at a lower valuation than the sector average for close to three years, the company has clawed its way back and now trades at a slight premium to the sector average. This looks fair to us given the sustainable double-digit step-up in the company's net income.

Stance and Takeaways

We recently added to our GBDC position when it was trading at a valuation roughly in line with the sector average. The double-digit sustainable increase in the company's net income has not translated into a similar increase in its valuation. We would look to add to our position if its valuation dips below the sector average.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!