uschools

Introduction

CBL & Associates (NYSE:CBL) recently reported its Q4 2023 results, which I will discuss below. I will also flag the company's capitalization rate, which I estimate at 14.3%, and some risks related to the investment case. In a nutshell, I think that the shares are a buy as CBL is set to benefit from FED interest rate cuts on its floating rate debt.

Company Overview

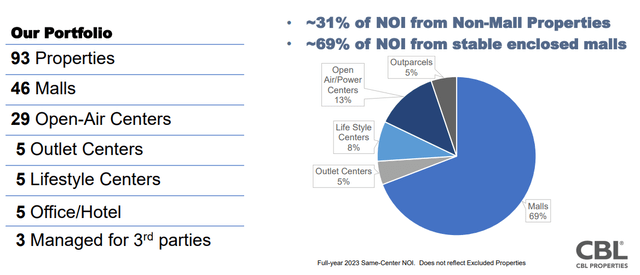

You can access CBL quarterly results here. The company derived 69% of its 2023 net operating income (NOI) from enclosed malls, with the remaining 31% coming primarily from non-mall retail properties such as open-air centers:

Portfolio Overview (CBL Q4 2023 Results Presentation)

Operational Overview

In Q4 2023, CBL reported $1.94 in adjusted funds from operations (AFFO), down 8% Y/Y (2023: $6.66/share, down 15.5%). Same-center NOI was down 1.2% Y/Y in Q4 to $119 million and 1.5% to $439 million for the full year. Occupancy was little changed in 2023, at 90.9% (2022: 91%). Tenant sales were disappointing in 2023, decreasing 4.4% Y/Y to $416 per square foot.

CBL ended the year with $2.6 billion in debt, down 2.3 Y/Y. The company is also sitting on $296 million in cash, resulting in a net debt position of $2.3 billion. 40% of the debt is floating rate, carrying an interest rate of 8.42%, while 60% is fixed rate at a rate of 5.26%, resulting in an average cost of debt of 6.54%.

2024 Outlook

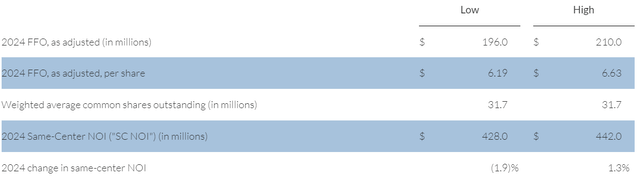

CBL expects same-center NOI to decline by only 0.3% in 2024, while AFFO is projected to drop 3.8% to about $6.41/share.

2024 Financial Outlook (CBL Q4 2023 Results Press Release)

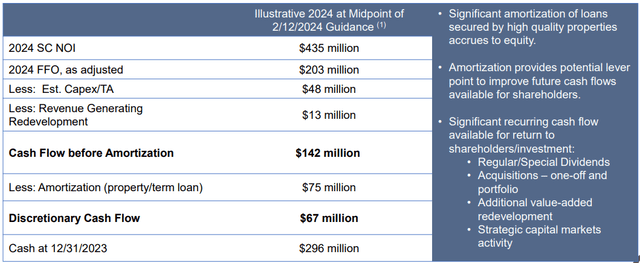

The company plans to allocate $75 million to debt principal repayments (enough to retire about 3.3% of its net debt), leaving it with $67 million in discretionary cashflow, available for shareholder remuneration:

Cash allocation outlook (CBL Q4 2023 Results Presentation)

CBL's capitalization rate

Considering that CBL has a market capitalization of about $740 million and a net debt of $2.3 billion, the company remains heavily indebted and subject to significant interest rate risk.

If we use CBL's $435 million in expected 2024 NOI to estimate its capitalization rate against an enterprise value of about $3 billion, we see that the market-implied cap rate is about 14.3%, a very attractive return proposition.

Risks

The main risk facing investors is arguably CBL's debt-heavy capital structure, with 76% of the company funded by debt. The good news here is that the Federal Reserve is likely months away from embarking on a rate-cutting cycle, with current expectations for the FED funds rate of 4.25-4.50% in December 2024, 1% lower than today.

Considering that CBL has 40% of its debt with a floating rate, the 1% move could boost 2025 discretionary cash flow by about $9-10 million, partially offset by any refinancing on the fixed-rate portion of the debt.

The other main risks are the still declining tenant sales, down 4.4% in 2023, coupled with occupancy of only 90.9% on the total portfolio. This puts CBL on a weak footing when renegotiating leases.

Busy refinancing schedule

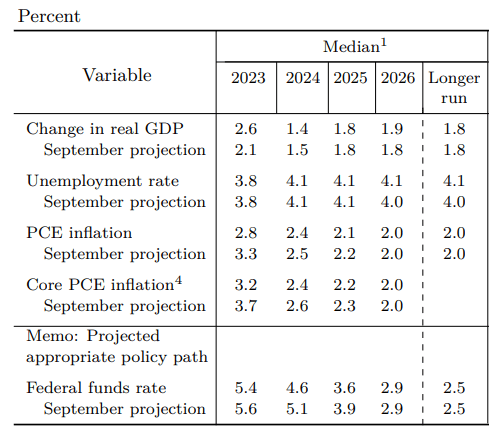

Looking through CBL's 10-K filing for 2023, on pages 41-42, we see that the majority of CBL's loans mature in 2024-2026, with limited maturities in 2028-2032. The good news is that the Federal Reserve is expected to decrease interest rates in 2025 and 2026 as well, implying that CBL will likely refinance loans on favorable terms:

FED funds rate outlook (FED summary of economic projections, December 2023)

Valuation and conclusion

While CBL's topline cap rate of 14.3% appears very attractive, it is somewhat offset by weak property-level fundamentals such as declining same-store sales (especially in an inflationary environment) and weaker occupancy. That said, I reckon that same-store sales will not decline indefinitely, helping stabilize the company's operating performance. I think that occupancy increases or smaller than the current 4.4% same-store sales decline run-rate will be perceived positively by the market.

Furthermore, the company is set to benefit from FED rate cuts, boosting its cash resources in 2025. Management is also conservative with CBL's dividend policy (the dividend currently sits at $0.40 per quarter, implying an AFFO payout of 25%), allocating surplus cash primarily to debt repayments.

All in all, while there are red flags concerning CBL's operational performance, the elephant in the room, its debt-heavy capital structure, is set to benefit from rate cuts. Furthermore, the very attractive cap rate of 14.3% makes me think that the opportunities outweigh the risks; hence, I rate the shares a buy.

Thank you for reading.