felixmizioznikov

Oxford Industries (NYSE:OXM) owns and manages the brands Tommy Bahama, Lilly Pulitzer, Johnny Was, and others.

The company has managed a successful brand acquisition strategy since 2003. It has shown that it can grow acquired brands profitably in the US. On top of that, it has other quality characteristics like a long-standing management team, stable margins, and low leverage.

However, I believe the stock price is a little high. Considering more historical profit margins (not the record ones shown in 2022 and 2023), the company should deliver more than 10% CAGR growth to offer a 10% return on current prices. This seems optimistic despite the company's qualities above. I consider Oxford a Hold at current prices and would reevaluate below $90 per share.

Company intro

Brand manager: Oxford has been listed since 1965, but before 2003, it was mainly a manufacturer and licensor. Only after the 2000s recession did the company decide to change course and move into brands and retail.

In 2003, Oxford acquired Tommy Bahama, followed by Ben Sherman in 2004 (divested in 2015), Lilly Pulitzer in 2010, a series of smaller brands in 2016/17, Johnny Was in 2022, and Jack Rogers in 4Q23.

In the meantime, the company has been divesting its manufacturing and private label businesses, the last of which was Lanier Apparel in 2020.

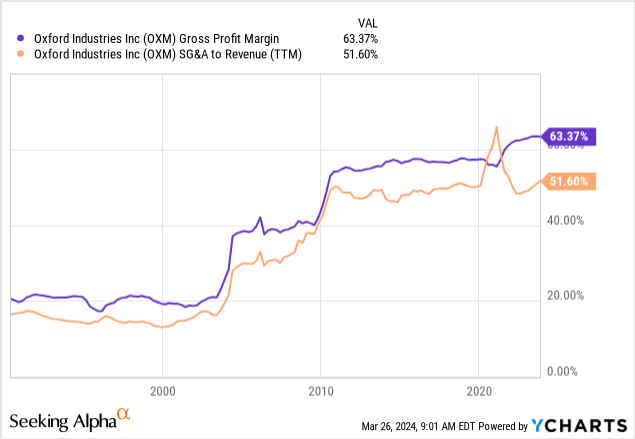

The result of this transition is evidenced in the gross and SG&A margins moving up, something common for wholesalers moving downstream.

Resort lifestyle: These brands share a similar theme: coastal resort luxury and enjoyment. TB is more oriented to adult men, LP, and JW to women, but they all design colorful pieces with floral prints.

Prices are in the affordable luxury range. LP dresses cost about $100 to $200, whereas JW dresses can cost as high as $500. TB is cheaper, with polos or shirts at $50 to $60.

In the case of TB, Oxford also manages TB restaurants and bars, some of which are located next to TB apparel stores. The brand has been recently licensed for a resort in California.

US DTC orientation: 80% of Oxford sales are DTC, almost evenly divided between stores and online. Additionally, more than 90% of sales happen in the US. The stores are primarily concentrated in warmer climate states, mainly California, Florida, Texas, and Hawaii, and adjacent in the east coast vacation areas of North Carolina, Massachusetts, and Virginia.

Successful brand nurturing: Oxford has shown with TB, LP, and the emerging brands (Southern Tide, Duck Head, and TBBC, acquired in 2016/17) that it can grow their revenues with good profitability margins, which has shown in the company's growth since 2011 (when the majority of the manufacturing business was finally divested).

For example, when acquired in 2010, LP generated about $95 million in sales at 15% operating margins. Oxford paid $70 million for the company. By 2019 LP was already generating $284 million in sales, at 18% operating margins. By 2022 sales grew to $340 million at close to 20% operating margins.

Southern Tide generated $40 million in sales at 11% margins in 2017, its first year consolidated. By 2022, it was doing $62 million at closer to 20% margins. The price paid for ST was a little higher and less accretive, at $92 million.

Not all has been a smooth road. Tommy Bahama was acquired for $250 million in 2003 and did $370 million in sales at 13% operating margins in 2004. By 2019, however, the company had doubled sales to $650 million but at half the margins, generating only $50 million in operating income again. Still, the purchase price was very accretive.

In the case of Ben Sherman, the company was acquired in 2004 for $145 million and was doing $150 million in sales at an undisclosed margin. However, Oxford ended up selling the company in 2015 for $65 million, with the brand generating only $65 million in sales at a loss.

The last example is recent, from 2022, with the acquisition of Johnny Was for $270 million. The company generated $200 million in sales and $20 million in operating income (ex-amortization of intangibles and impairment of goodwill for $120 million) in FY23. This is not a super acquisitive multiple, but it is ok.

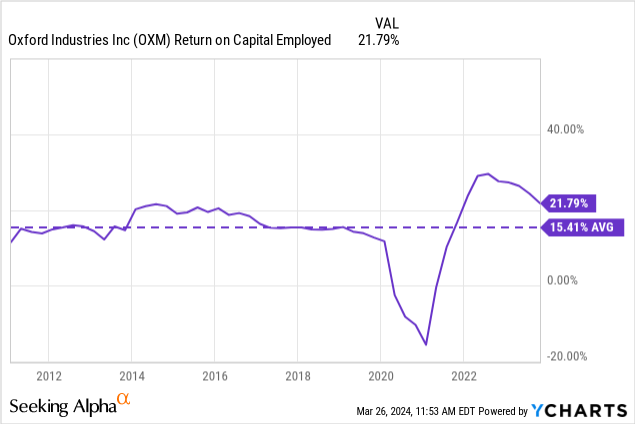

Good returns on capital: The successful brand acquisition model results in consistent margins applied over a larger capital base, with high returns on capital employed.

Long-standing management: Many of Oxford's managers have been with the company since the 2000s. The CEO and Chairman have been in that position since 2013 and with the company since 1999. The CFO has been employed since 2003. The CEO of TB has been with TB since 2001, the CEO of JW is the brand's founder, and the CEO of LP has been in the company since 2010. This information is available in the company's proxy.

No strong shareholder: On the other hand, Oxford does not have a strong or controlling shareholder who can be more vigilant about the company's operations and strategy. The company's largest shareholders are passive investors like Blackrock, Vanguard, or Invesco, with no other shareholder listed above 5% ownership, whereas the whole management team only has 6% of the shares.

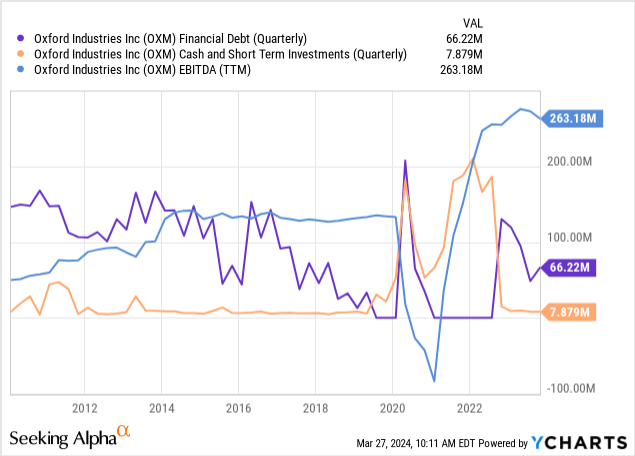

Low leverage: Oxford does not have a significant amount of debt, especially when compared to both historical and current EBITDA. The company has access to a revolving credit facility for $350 million.

Looking ahead

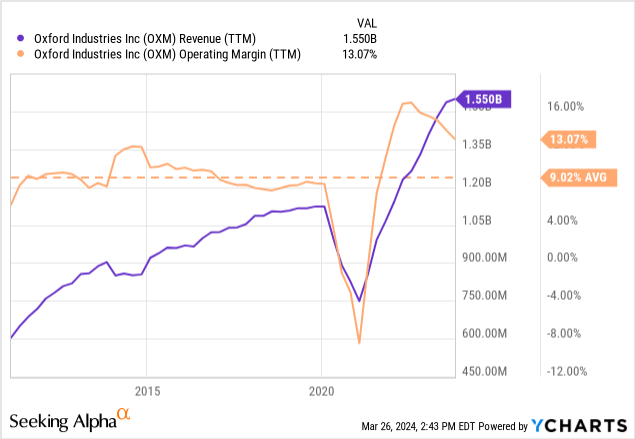

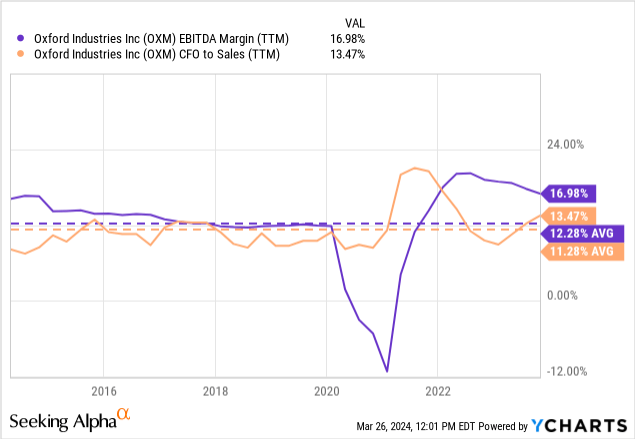

Oxford is currently posting record profitability, mainly fueled by historically high operating margins. Whereas the post-2010 average is 9% operating and 12% EBITDA margins, Oxford now posts 13% and 17%, respectively.

The question is whether they are sustainable.

Store productivity: Fortunately, Oxford reports detailed information by brand, including revenues, gross margins, operating margins, store count, and total square footage.

At the company level, we can see that Oxford was selling about the same ($1.15 billion in revenues) in FY21 and FY19, with about the same number of stores (220). However, operating margins were six percentage points higher in FY21 (14.5% vs 8.5%). I use FY21 because FY22 has the effect of the acquisition of Johnny Was.

At the brand level, the big winner was Tommy Bahama. The brand made $675 million in sales at 7.8% margins in FY19, with 162 retail points (stores, restaurants and outlets). By FY22, however, it had made $880 million at a margin of 19.5% with 157 stores. The $120 million in additional operating income explains most of the operating income difference at the Oxford level between FY22 and FY19 ($125 million). All of the improvement was driven by higher store productivity. The brand sold $205 million more, whereas SG&A only went up $35 million between FY19 and FY22.

Final divestments: In 2022, Oxford divested Lanier apparel, a segment it had been shrinking since 2020. Lanier was the last manufacturing segment at Oxford, one of the largest tailored suit manufacturers in the US. Unfortunately, it was a low(er) margin business, posting operating margins of 7% at the beginning of the 2010s but decreasing to 1.5% by 2019. If Lanier had not been consolidated, Oxford would have posted operating margins 0.7 percentage points higher in 2019.

Expectations and valuation

From the analysis above, I believe the primary driver of margins going forward will continue to be sales productivity. We can consider several sales scenarios. From these, assuming fixed gross margins at the current 63%, plus fixed SG&A at about $780 million and income taxes at 25%, we derive NOPAT and an EV/NOPAT multiple for 2024 earnings (based on the current $1.7 billion EV).

Finally, I added a 'growth requirement' for each multiple. The growth requirement is the growth rate for the next five years that the company has to post to generate a 10% return on its current EV. This assumes that the company is sold at an EV/NOPAT multiple of 10x at the end of the five years. This is a multiple-shrinking assumption and, therefore, conservative.

| Scenario | -10% | -5% | Stable |

| Sales | $1.4B | $1.47B | $1.55B |

| Op margin | 7.2% | 10% | 12.6% |

| NOPAT | $76.5M | $109M | $147M |

| EV/NOPAT | 22 | 15.5 | 11.5 |

| Growth req. | 20% | 10% | 3% |

What the above table says, summarily, is that the company is trading based on a no-growth expectation (3% is GDP or inflation growth). This means that the lower revenue scenarios require a higher growth rate but only to return to approximately the current profitability.

To bring some perspective on the figures, Tommy Bahama has only had three negative revenue growth years: 2020 because of COVID and during the GFC, between a peak in 2007 and a bottom in 2009, when sales fell 22%, and operating income fell 55%, but never reached negative values (in 2008 impaired goodwill generated the losses, not the actual operations). The recovery (higher net income from the peak) took one year for COVID, and five years for the GFC (until 2012). However, the post-GFC recovery was never complete; in 2013, TB posted $73 million in operating income, still below the $81 million in 2007, and from there, it would lose profitability again into the $55 million range, despite growing sales. Full recovery had to wait until post-COVID.

So, in my opinion, the company is currently sold on a five-year flat assumption. This assumption is not super conservative, given that Oxford indeed had a 'lost decade' after the GFC.

On the other hand, the company has many quality characteristics, including a profitable DTC plus product development model, experience and a successful track record in brand development, a more focused structure now that no manufacturing segments are part of the company, and tenured management.

Overall, I think Oxford's current valuation is fair but not an opportunity. The company has reached stock prices of $90 or $80 many times in the past two years, consistent with EVs of $1.4 to $1.25 billion. At those prices, the assumptions needed for a 10% return under a lower sales scenario do not even include full recovery in five years. Therefore, at those prices, the company's stock could be an opportunity, and I prefer to wait.