georgeclerk

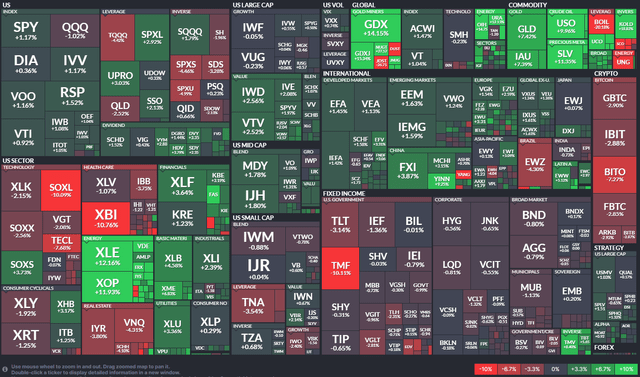

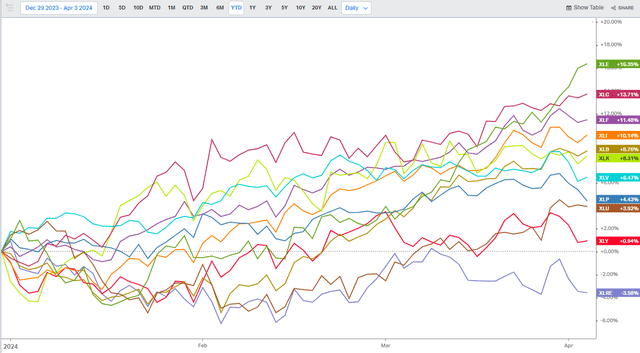

Brewing under the market’s surface is a slow broadening out. You do not see it in small caps or among foreign stocks. The expanding rally is apparent in domestic large caps away from the Magnificent Seven and Nasdaq 100 companies.

Over the past month, large-cap value has outperformed, albeit modestly, large-cap growth. Hence, the equal-weight version of the S&P 500 has outpaced the SPX. Likewise, mega-cap value has a couple of percentage points of alpha on mega-cap growth since early March.

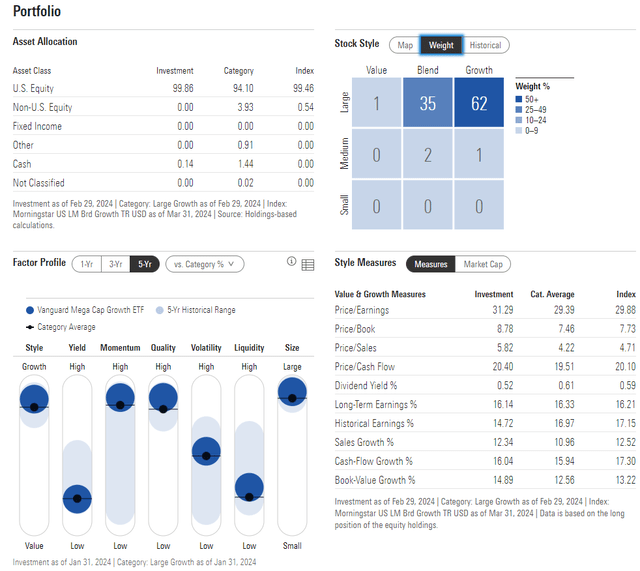

I have a hold rating on the Vanguard Mega Cap Growth Index Fund ETF Shares (NYSEARCA:MGK). I see its momentum as waning as it gives up relative strength while the fund’s P/E ratio is historically high.

1-Month ETF Performance Heat Map: Value Leading Growth

According to Vanguard, MGK employs a passively managed, full-replication approach and seeks to track the performance of the CRSP US Mega Cap Growth Index. The fund provides a convenient way to get diversified exposure to the largest growth stocks in the U.S. market. With respect to 75% of its total assets, the fund may not purchase more than 10% of the outstanding voting securities of any one issuer

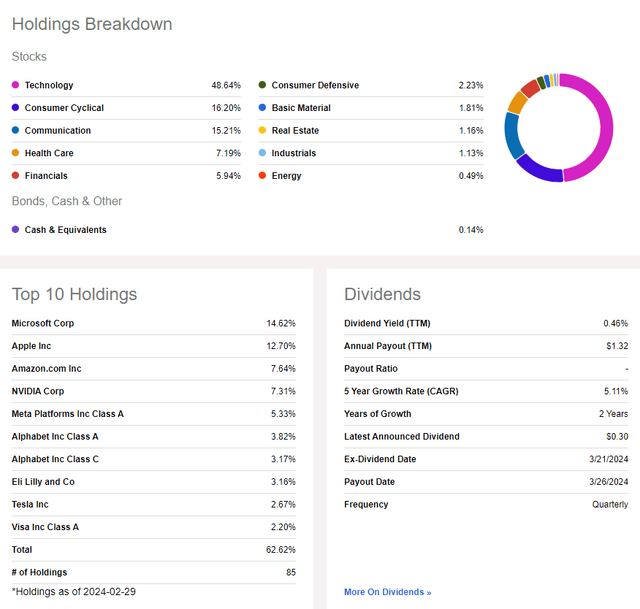

MGK is a large exchange-traded fund, or ETF, with more than $18 billion in assets under management, and it pays a small 0.5% trailing 12-month dividend yield. The fund’s share-price momentum continues to be very strong – earning MGK an A ETF Grade by Seeking Alpha, though that is down from A+ rating when looking back three and six months.

With just a 0.07% annual expense ratio, MGK is ideal for long-term investors seeking an overweight to the mega-cap growth niche. Liquidity is also healthy given average daily volume north of 333,000 shares and a median 30-day bid/ask spread of just two basis points, per Vanguard.

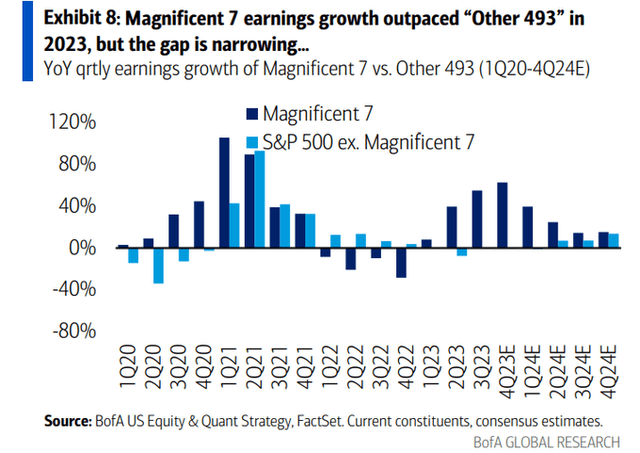

Looking closer at the allocation, MGK plots in the very upper-right corner of the style box. The 5-star, Silver-rated ETF by Morningstar notes that the fund’s price-to-earnings ratio is now north of 31. Considering that the S&P 493 is expected to have EPS growth above that of the Mag-7 names that command a chunk of MGK’s portfolio, that is a steep price to pay today.

MGK: Portfolio & Factor Profiles

Magnificent 7 earnings growth outpaced “Other 493” in 2023, but the gap is narrowing…

MGK is a major bet on the Information Technology sector continuing to lead global equities. I see that as a challenging take considering relative valuations and emerging momentum shifts.

What’s more, tech-related stocks like Amazon (AMZN), Meta Platforms (META), Tesla (TSLA), and Alphabet (GOOG) are significant holdings in MGK, so the "expanded-tech" weighting is even higher. There is hardly any exposure to the best sector so far in 2024 – Energy. Finally, not one Industrials company is in MGK, and that’s another market leader this year.

MGK: Holdings & Dividend Information

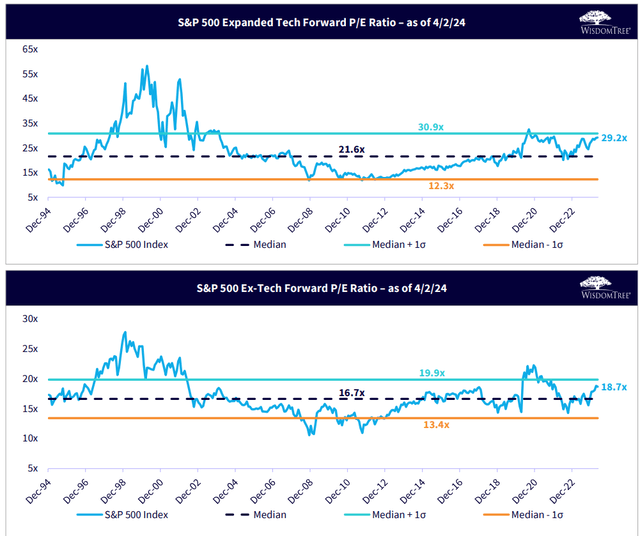

"Expanded Tech" P/E About One Standard Deviation to the Expensive Side

Energy Leading in 2024, Industrials Strong

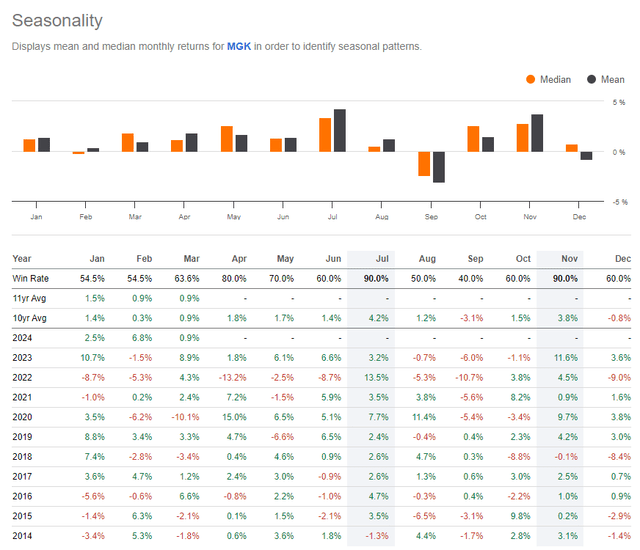

Seasonally, MGK tends to perform very well now through July. The historical average total return during this stretch is more than 9% with modest gains even extending into August, according to data from the last 10 years. So that is an absolutely bullish indicator.

MGK: Bullish Q2 Seasonal Trends Last 10 Years

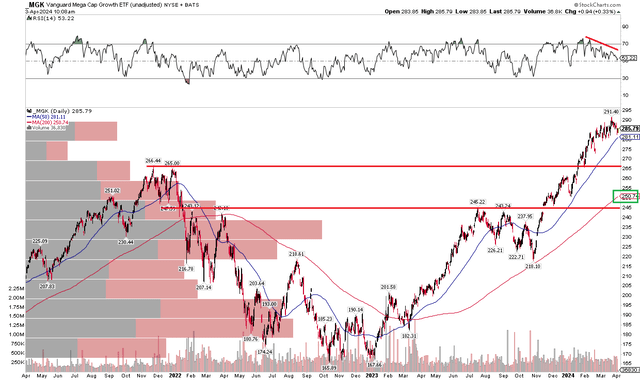

The Technical Take

With a high valuation, concentrated portfolio, and bullish seasonality at hand, the technical situation is mixed. Notice in the chart below that shares have recently notched fresh all-time highs, but the upside move came amid weakening RSI momentum. That's a bearish signature, but if price climbs above the late-March high just below $295, then bearish momentum divergence could be negated.

When looking for downside levels of support, the first obvious price point is the late 2021 high around the mid-$260s. That would also have confluence with a 38.2% Fibonacci retracement level from the October 2023 low to the March all-time high. Further down, the rising 200-day moving average comes into play above $250 while the summer 2023 high at $245 would be a spot to buy if we see a protracted pullback.

Overall, MGK’s momentum is clearly slowing as other areas of the large-cap universe carry the bull market’s torch.

MGK: Bearish RSI Divergence, Spotting Downside Support Spots

The Bottom Line

I have a hold rating on MGK. I see its valuation as high considering where EPS growth trends are likely to unfold as 2024 progresses. Furthermore, MGK’s has concerning technical features though seasonality is very bullish now through much of the summer.