tum3123

Emerging markets (EM) debt performed well in the first quarter of 2024, and we anticipate more of the same in the next quarter, thanks to a benign global macro backdrop, solid EM credit fundamentals, improving technical conditions, and still-decent valuations.

We continue to believe that there are attractive opportunities for investors to increase exposure to long-duration securities to lock in attractive real and nominal yields.

Despite strong performance this year, we also see selective value in high-beta, high-yield credit because we believe the global market environment will be conducive to its outperformance.

We also continue see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding (including frontier and distressed credit).

Meanwhile, the corporate credit space continues to exhibit a combination of differentiated fundamental drivers, favorable supply technical conditions, and attractive relative valuations to select sovereign curves. We are seeking investment opportunities where corporate credit fundamentals and attractive spreads coincide. Short-maturity bonds have outperformed, but opportunities in longer bonds are appearing. We continue to focus on issuers with low refinancing needs, robust balance sheets, and positive credit trajectories.

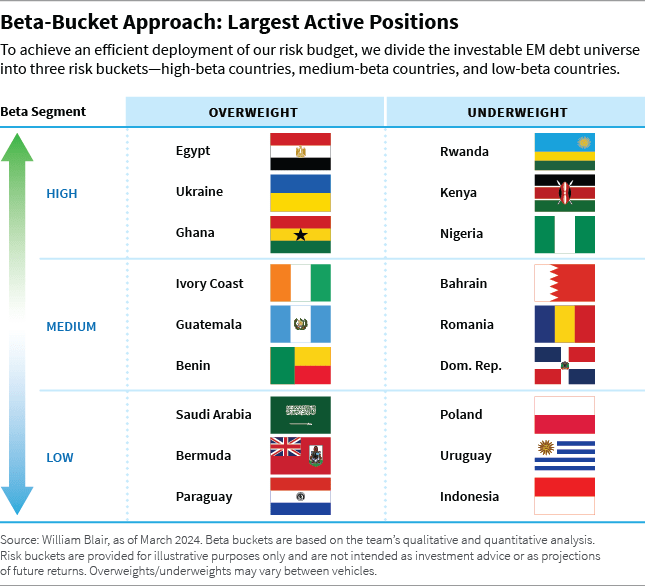

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

A View of the Potential Opportunities: Overweight/Underweight

High-Beta Bucket

In the high-beta bucket, our largest overweight positions are in Egypt, Ukraine, and Ghana, and our largest underweight positions are in Rwanda, Kenya, and Nigeria.

Egypt (overweight): Significant external financing - which was unlocked through the recently announced International Monetary Fund (IMF) package and foreign direct investment (FDI) deal - is more than adequate to meet Egypt’s needs. The external sector could also prove resilient following the sharp depreciation of the Egyptian pound. We also believe there is room for further spread compression toward peers in the high-beta bucket and curve steepening.

Ukraine’s potential restructuring could be more favorable to eurobond holders than previously anticipated.

Ukraine (overweight): We have increased our overweight based on a potential restructuring that we have interpreted as more favorable for eurobond holders than previously anticipated. Multilateral and bilateral support also remains strong.

Ghana (overweight): We believe the restructuring process is regaining momentum. The prospect of lower core rates and the rally in high-yield names could support recovery values.

Rwanda (underweight): Imbalances in the external sector and unattractive valuations make Rwanda vulnerable.

Kenya (underweight): Spreads have tightened to levels at which we believe there is better value in other high-beta names.

Nigeria (underweight): Valuations are tight relative to peers.

Medium-Beta Bucket

In the medium-beta bucket, our largest overweight positions are in Ivory Coast, Guatemala, and Benin, and our largest underweight positions are in Bahrain, Romania, and Dominican Republic.

Ivory Coast (overweight): We believe valuations are favorable relative to peers. The country’s debt is also supported by strong fundamentals and support from development partners, including the IMF. We also believe Senegal’s peaceful post-election political transition will bolster confidence in the Ivory Coast’s political process ahead of its own elections next year.

Benin (overweight): We believe the country’s bonds will continue to be supported by strong fundamental performance and prudent macroeconomic policies. The country will also receive further support from the IMF under the Resilience and Sustainability Facility in late 2024.

Guatemala (overweight): Macroeconomic conditions are strong and valuations are attractive, and although President Bernardo Arévalo will likely face political obstacles, we believe strong leverage ratios and low fiscal deficits will keep Guatemala a strong credit.

Dominican Republic’s valuations are at their tightest levels since 2007.

Bahrain (underweight): Weak fiscal reform efforts, a deterioration in regional geopolitical risks, and tight valuations make us cautious.

Romania (underweight): We are concerned about deteriorating fiscal risks and political noise ahead of this year’s elections. Romania has already been a prolific issuer this year and is running the risk of an abundance of supply.

Dominican Republic (underweight): Although fundamentals continue to be among the strongest in the region, valuations are at their tightest levels since 2007.

Low-Beta Bucket

In the low-beta bucket, our largest overweight positions are in Saudi Arabia, Bermuda, and Paraguay and our largest underweight positions are in Poland, Uruguay, and Indonesia.

Saudi Arabia (overweight): Efforts to diversify the economy away from the energy sector remain largely on track. Oil prices are supportive of the current investment spend, and we see value in Saudi Arabia relative to some of its regional peers.

We believe Paraguay is on an improving fundamental trajectory.

Bermuda (overweight): Bermuda’s bonds have similar valuations to those of Peru and Chile, but we believe the country has a stronger fundamental trajectory with less institutional uncertainty.

Paraguay (overweight): Although Paraguay has lagged year-to-date, we believe the country is on an improving fundamental trajectory and has attractive valuations for the low-beta bucket.

Poland (underweight): Although the medium-term policy framework looks more favorable under the new government, we remain cautious near term due to an increase in political noise following last year’s elections.

Uruguay (underweight): Credit fundamentals in Uruguay remain strong, but bond prices have compressed materially since the COVID-19 pandemic, and we believe this results in limited scope for additional spread tightening.

Indonesia (underweight): Valuations are unappealing. The country’s fundamental outlook became murkier after presidential elections in February, and there is risk of fiscal slippage should the new government increase spending. In addition, a slowdown in the windfall from commodity exports and a persistently strong U.S. dollar could weaken external positions.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.