PM Images

Introduction

I initiated coverage of Sterling Infrastructure, Inc (NASDAQ:STRL) stock in July 2023 when 1 share was trading at $59.11. Today, STRL trades at $98.32 and has since strongly beaten the broader market thanks to its quality business growth (i.e. growth of the top line against a backdrop of margin expansion). The last time I looked at STRL's business was in early January 2024 and concluded that the company's qualitative growth is continuing and that the stock will most likely follow suit - and the market has indeed rewarded Sterling:

The author's last article on STRL

Today I would like to take another look at the STRL business and the growth prospects of the stock because more than 3 months have passed since my last call and a lot has changed in that time.

Recent Financials And Developments

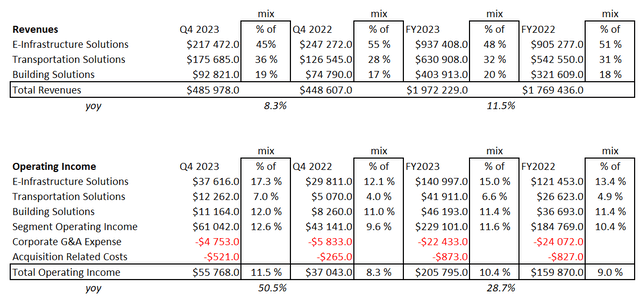

In Q4 FY2023, the company's revenue reached $486 million, which was an 8% YoY increase, fueled by several factors across its business segments. One key driver was STRL's strategic focus on project selectivity and mix: by prioritizing high-margin projects and adjusting its portfolio mix, the company was able to enhance its gross margin significantly, as the CEO noted during the earnings call (the Q4 gross margin expanded by 350 b.p. to 18.9%). Additionally, the management said some operational efficiencies and productivity improvements contributed to margin expansion across all 3 business segments. We can clearly see how the business structure became indeed more balanced and less dependent only on the E-Infrastructure Solutions segment, while the margins expansion led to a 50.5% YoY increase in EBIT - the operating leverage seems to be solid:

Author's work, STRL's press release

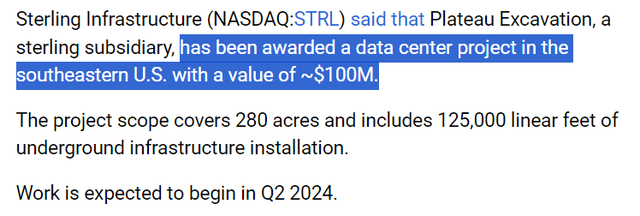

Sterling experienced strong demand in key markets, particularly in its E-Infrastructure Solutions and Transportation Solutions segments. The decline in sales in E-Infrastructure is explained by challenges from 3 delayed projects, coupled with a slowdown in small private projects in the Northeastern market. So it looks more like a one-off event to me. What's more important in my view: The data center market remained robust, with high levels of activity driven by the need for increased capacity to support emerging technologies like AI. With the recent news that STRL has been awarded a $100 million contract, I believe that the company's offering to the market is of high quality and has every chance of continuing to enjoy this strong demand from data centers.

Also, the transportation sector is still seeing broad-based demand, with significant growth in highway projects and the award of a substantial aviation project post-quarter end. The company's management now anticipates revenue growth of 10-15% in this business segment in FY2024, supported by a robust backlog and favorable market conditions.

Overall, Sterling expects revenue growth in the high single-digit to the low double-digit range for FY2024, driven by "ongoing strength in data centers, manufacturing projects, and transportation infrastructure." In addition, they expect a further increase in margins, which are going to be supported by "project selectivity, operational efficiency, and a favorable project mix" - which is exactly what has driven the stock price up in recent quarters.

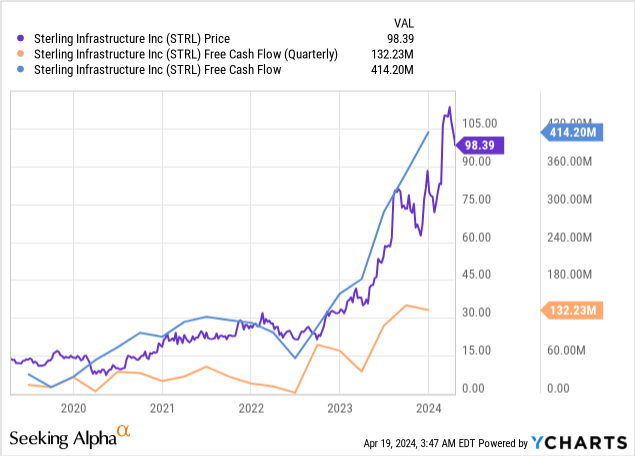

According to Seeking Alpha Premium, in Q4 Sterling had a liquidity position (cash + ST investments) of ~$471 million - that's 15.2% higher than in Q3 FY2023, and almost 160% higher YoY. The company's FCF is steadily and gradually increasing and currently accounts for about 21% of annual sales, which is quite a lot. In a way, FCF alone would be enough to explain the jump in the stock price last year:

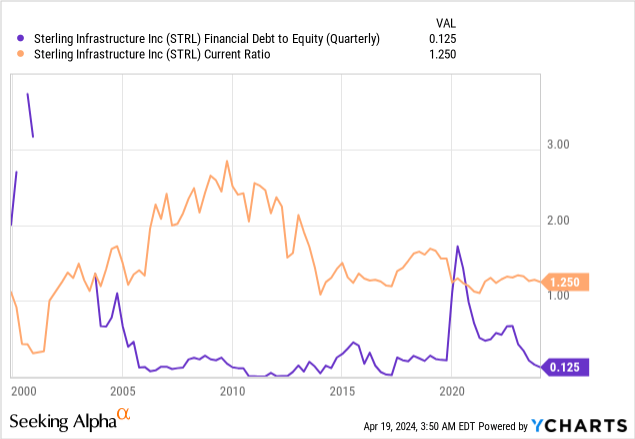

At the same time, the liquidity ratios look acceptably high (the current ratio is currently above 1), while the debt-to-equity ratio is trending lower and lower, indicating the stability of Sterling's financial position.

I believe that Sterling, with its diversified portfolio of infrastructure services and a solid backlog that provides good visibility for future revenues, should be able to capitalize on opportunities and deliver value to its shareholders this year and beyond. However, much will depend on how much fundamental growth potential STRL still has based on its current valuation. Let's try to assess it in more detail.

Valuation Update

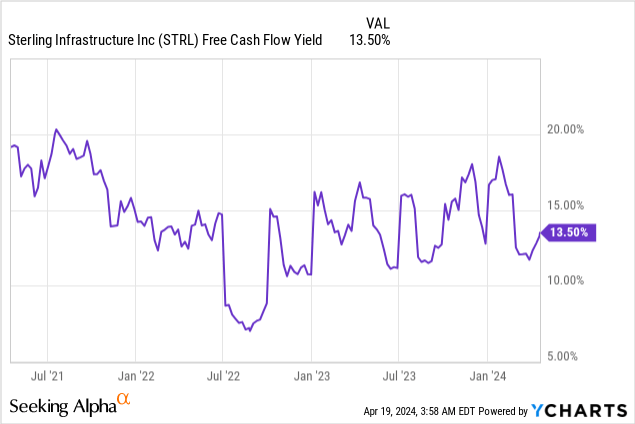

As I mentioned earlier, STRL's FCF represents 21% of total revenue. Now when we match it with the market cap, the ratio comes out to be 13.5%:

While the FCF yield is lower than the FCF margin, it's still quite substantial in absolute terms. In my view, this figure underscores the fundamental undervaluation of Sterling's stock that still exists.

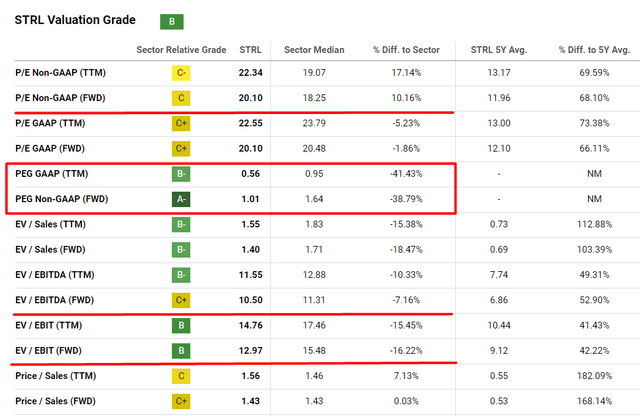

My interim conclusion indirectly confirms the "B" rating of Seeking Alpha Quant System and in particular the forward PEG ratio of 1.01, which is almost 39%below the median of the sector:

Seeking Alpha, STRL's Valuation, the author's notes

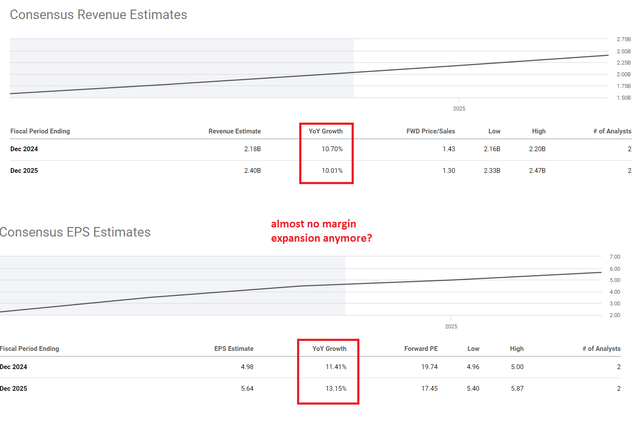

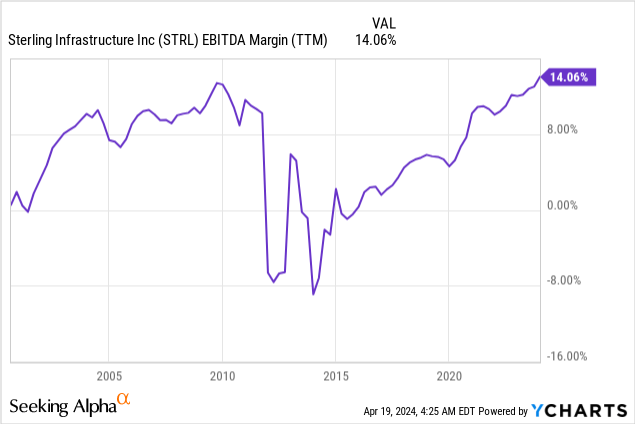

The other valuation metrics like P/E or EV/EBITDA are basically saying that Sterling's growth potential isn't that huge, but I believe the company's marginality resilience will keep it moving forward, outperforming the consensus expectations. The market consensus diverges from management's forecasts, suggesting that the margin expansion has either plateaued or is nearing completion, anticipating revenue growth of around 10% over the next 2 years amid net earnings per share following a similar growth trajectory. From my perspective, EBITDA margins of 13-14% fall considerably short of the margin potential that Sterling could realistically achieve in the upcoming years.

I therefore believe that the stock is currently quite undervalued, although its P/E ratio is tending towards the high twenties. In the last 8 quarters, Sterling has not missed the earnings consensus once but has even clearly exceeded it - if this is also the case in the coming quarters, the undervaluation should, in my opinion, be reflected in a significant rise in the stock price.

Risk Factors To Consider

One significant risk to my current thesis is the assumption of continued marginality expansion. There's a possibility that the company's business model might not facilitate a repetition of its past successes, or at least not to the same extent. This risk cannot be dismissed: after all, Sterling hasn't demonstrated higher margins previously, and the exact limit of its marginality remains uncertain.

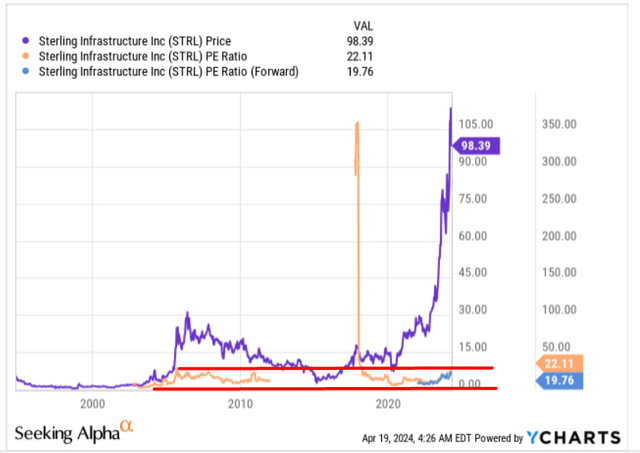

Another risk I've identified is the possibility of a relatively high valuation. In my analysis above, I wrote that STRL looked underestimated based solely on a specific set of criteria like PEG. However, if we consider the traditional P/E ratio, we observe that excluding a statistical outlier during the coronavirus period, the current levels of this indicator fall within the upper bounds of the historical norm. This observation may suggest that Sterling is actually overvalued rather than undervalued.

But this risk is easily explained by higher margins, in my view.

One more risk to consider comes straight from my previous article: Potential project delays, cost overruns, and intense competition in the construction industry, along with the geographic concentration of operations make it difficult for Sterling to grow as it did before.

The Bottom Line

Despite the multitude of risks swirling around the company at present, I examine their key indicators and realize that not all growth potential has been tapped into. While Sterling has experienced rapid growth in recent quarters, both in terms of business performance and stock price, I believe there's still uncovered growth upside for margin expansions: the current 14% EBITDA margin, theoretically, is far from its limit. So if the expansion continues, reaching at least 17-18%, the stock may be significantly undervalued at its current valuation.

Based on the above, I reiterate my previous "Buy" rating today.

Thanks for reading!

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!