David Trood/DigitalVision via Getty Images

Canada Goose (NYSE:GOOS) is a Canadian apparel manufacturer that sells luxury outerwear. The company is famous for its heavy winter parkas.

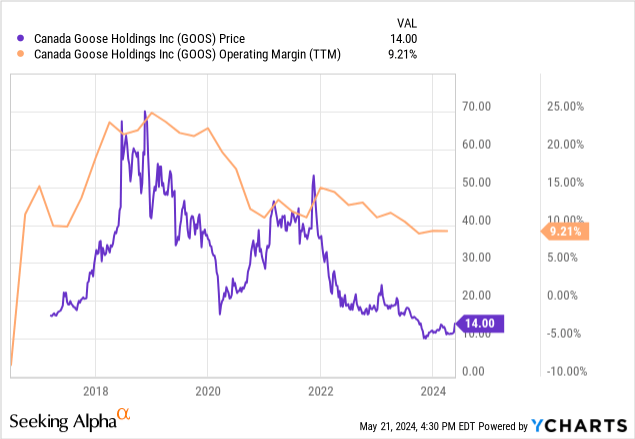

I started covering GOOS in March 2024 with a Hold rating. The rating was based on challenges in their retail strategy, fashion cycle risk, and higher competition in the luxury outerwear market. Considering these, the company's valuation did not represent an opportunity.

In this article, I analyze the company's 4Q24 results and earnings call. The results were well received by the market, with the stock jumping almost 30% since the release.

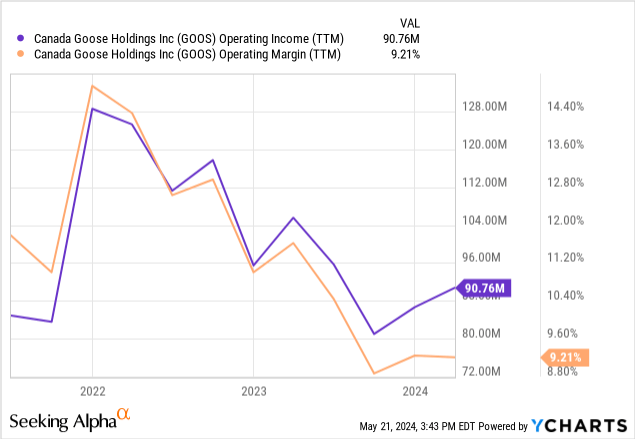

I believe there are indications for optimism in the results, mainly from an arrest in falling operating margins, a recovery in operating income, and the launch of a new optimization strategy that will prioritize profitability over growth. The company also hired its first Creative Director, in a move that I believe is intended to face competition from other luxury outerwear brands like Arcteryx and Moncler.

Overall though, I believe it is too soon to determine whether Canada Goose can turn around the challenging situation it faces since early 2022. Considering the stock is now 10% above the price at which I released my March article, I believe the stock is still a Hold.

Good overall results, not so good comparatives

GOOS' unadjusted results in 4Q24 were very good on an absolute basis. Revenue grew 27%, and adjusted EBIT rose 50%.

However, on a comparable basis, the situation is not as good. The company opened 17 stores in FY24, an increase of 33% of its fleet. This is a big boost to revenues on an absolute basis. However, sales per square foot were flat for the year, and the company's comparable sales fell in the more established markets of North America and EMEA.

On the profit front, the company's adjusted EBIT was $40 million for the quarter, but unadjusted, the figure was $23 million, thanks to $17 million in restructuring costs. Still, unadjusted EBIT was 30% above 4Q23 levels, signaling a recovery in profitability.

One of the most positive developments for the company in the release is that TTM operating margins have shown a recovery for two straight quarters. This is also evidenced in higher TTM operating profits

The new plan recognizes retail challenges

Canada Goose started a restructuring program in February 2023, which led to the firing of 17% of its workforce and 25% of its senior management.

However, in this earnings call, the company revealed a new optimization plan for FY25 concentrated on efficiencies or improving profitability margins.

The new plan implies slower store growth. The company opened 17 new stores in FY24 but plans to open only 3 of them in FY25. Throughout the call, management recognized that store count growth has to be paired with store efficiency to result in higher profitability.

In my initiation coverage article, I criticized the company's aggressive DTC strategy, which had resulted in its margins falling from the low twenties to high single-digit levels. I explained that the company showed signs of channel cannibalization, with higher revenues generated by higher-margin DTC sales offsetting lower-margin wholesale sales but worsening the bottom line.

One sign of such an aggressive strategy was the comment in the call of new stores opened in Honolulu, Hawaii, and Melbourne, Australia. These cities have warm climates, with Honolulu's and Melbourne's winter temperatures rarely below 65 and 45 degrees Fahrenheit, respectively. It is unclear how many heavy-winter parkas could be sold in these locations to justify opening large and expensive luxury stores.

Still, I believe recognizing the problem is the first step in solving it, and therefore, I see the strategic change with optimism.

On a more negative tone, the company announced it would stop issuing quarterly guidance. It also canceled its 2028 targets ($3 billion in revenues and $1 billion in adjusted EBIT), which had been proposed as recently as February 2023. Finally, the company guided for 20% lower wholesale sales in FY25, arguing that it would rationalize inventories in the channel.

I believe these announcements signal that management is less confident about the company's future. In particular, the fall in expected wholesale sales can be framed as a strategic move but can also be seen as a challenge in its end markets.

For example, Google Trends reveals that the company is falling behind Moncler and Arcteryx. In this respect, the company moved to address the competition from these more fashion-oriented luxury outerwear manufacturers.

Goose announced its first Creative Director, Haider Ackermann, a French designer with a haute-couture background. The CD position is normal in luxury brands that want a more assertive fashion message in apparel design and media content. Goose, which had focused its marketing on high performance and quality, had never had a CD. This is compared to much more innovative designs from Moncler and Arcteryx.

It is unclear whether Ackermann will be a good fit for the company, given Goose's conservative fashion stance compared to Ackermann's very avant-garde style. If the transition to more nonconformist designs and messaging is done haphazardly, the company risks alienating its current customer base. The famous Business of Fashion magazine was critical of the move.

Still, I believe the company is doing the right thing in increasing investment in intangibles like design and brand messaging. The CD choice might not be the best, but that is yet to be determined. It is good to see that Goose is moving in the right direction.

Revisiting the valuation

The company's guided low single-digit revenue growth for FY25, given the slower store expansion program and a mixed macro outlook. This is already a significant decrease compared with 10% revenue growth in FY24. As mentioned, one of the factors is an expected 20% fall in wholesale revenues, offset by higher pricing and some store openings in DTC.

On the margin front, the company expects to be challenged on gross margins given that it will try to decrease inventories and, therefore, will face lower occupation on its owned manufacturing facilities. SG&A is expected to be flat as the company redirects savings from restructuring programs into brand investments (for example, a new Parisian office for the CD team).

This will result in an adjusted EBIT margin of 12% for the year. Adding all this together yields guided revenue of about $1 billion and adjusted EBIT of about $120 million. From the adjusted EBIT figure, we must remove about $30 million in interest and 25% income taxes to yield an expected adjusted net income of about $68 million for FY25.

With a market cap of about $1.3 billion, Canada Goose trades at a P/E ratio of 19x FY25E adjusted net income. I believe this multiple is exaggerated and does not represent an opportunity.

A multiple of 19x earnings is generally high and only reasonable for the highest-quality companies with growing profits, deep moats, very capable management, and a history of excellent capital allocation. Even in those cases, a high multiple leaves little room for error.

Canada Goose does not have a deep moat, and its capital allocation history is questionable, given the operating profit and margin destruction of the past six years. Readers should remember that GOOS' operating profit for FY24 was lower than when the company went public in 2017.

The current strategic changes are in the right direction. The company needs to improve store efficiency and focus on building its brand and intangibles. However, it is still early to determine if these efforts will prove successful.

For that reason, I believe Canada Goose is not an opportunity at these prices.