champpixs

Verastem Reevaluates Strategy After Disappointing Cancer Trial Results

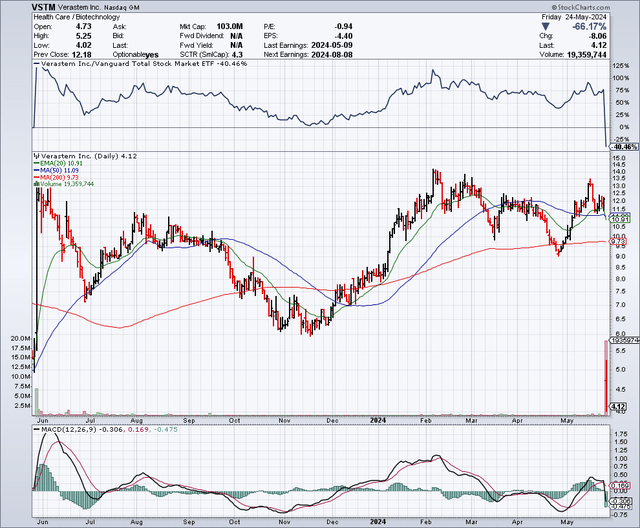

Verastem's (NASDAQ:VSTM) stock has cratered 60% since my "speculative buy" recommendation in August. Back then, I was interested in the company's prospects in ovarian cancer with their unique RAF/MEK clamp, avutometinib, in combination with their FAK inhibitor, defactinib (RAMP 201 clinical trial). The combination achieved a 45% objective response rate (ORR) in 29 patients, with a minimum follow-up of 12 months, in recurrent low-grade serous ovarian cancer (LGSOC), which is difficult to treat.

A 66% drop occurred Friday after Verastem revealed some key clinical and regulatory updates in LGSOC.

Verastem provided an updated ORR (as of February 2024) for the RAMP 201 trial. The ORR appears to have fallen since the May 2023 update.

In the RAMP 201 trial, 115 patients with recurrent LGSOC were treated with the combination of avutometinib and defactinib, of which 109 patients had measurable tumor masses at baseline and were eligible for formal efficacy evaluation as of the data cutoff (February 2024). As of the data cutoff, all patients had a minimum follow-up of five months since enrollment. Confirmed objective response rates by blinded independent central review for patients evaluable for efficacy were 27% in all patients (...)

There are some nuanced observations to make from the decline. In the latest update, the patient population is significantly larger (115 vs. 29). Moreover, the follow-up period is shorter (minimum follow-up of 5 months vs. 12 months). The drop in ORR with a larger sample size indicates the treatment's efficacy may not be as robust as once thought. I have seen some folks on social media claim that the ORR is lower in the latest update due to the 5-month follow-up. This is, however, not necessarily true. It could work both ways (a shorter follow-up could inflate or deflate ORR). For example, early responses are not always durable. Responders at five months are not always responders at twelve months. Furthermore, patients who initially respond might experience disease progression or relapse, lowering the ORR. On the flip side, yes, a shorter duration does not, by nature, take into account "late responders." But my point is to express that follow-up periods can impact ORR in multiple ways. Taking this into account, the news is definitely bad and merits lowering expectations.

As such, Verastem also announced its intention to seek accelerated approval in patients with "recurrent KRAS mt LGSOC who received at least one prior systemic therapy." KRAS mutant LGSOC is a narrower market, although the company believes "KRAS mt represents over two-thirds of the revenue opportunity, compared with combined KRAS mt and KRAS wt, without any differential pricing."

Back in May, Verastem did differentiate between KRAS mt (9/15, 60%) and KRAS wt (4/14, 29%) ORRs. So, it does not appear that the company is reaching for something that isn't there, although the ORR dropped for both populations (37% and 15%, respectively). Now, depending on how the data matures, the regulatory filing could be amended to include wt patients, but I wouldn't count on this (due to the major differences in ORRs).

So, the key takeaways seem to be that Verastem's target market has decreased by 1/3 and their combination therapy is less compelling with, seemingly, lower ORRs. In an efficient market (and I am simplifying here), the stock should drop by at least 33% plus whatever one attributes to a "less compelling efficacy."

Financial Health

As of March 31, the company reported $81.3 million in cash and cash equivalents and $28.8 million in short-term investments. Total current assets were $117.67 million, while total current liabilities were $26.7 million. This is good for a current ratio over 4, which indicates that Verastem can reasonably meet their short-term obligations.

Operating expenses (R&D and SG&A) were $28 million for Q1 (cash burn). The company did not record any revenue. Since Verastem operates at losses, I will now estimate cash runway based on historical figures. If we divide their most liquid assets by the quarterly cash burn, it comes out to around four quarters, or one year, of cash runway.

Because pre-revenue biotechnology companies prefer not to wait until the last minute to extend their cash runways, I believe Verastem has a good chance of raising cash (via debt or share offering) within the next twelve months.

Risk/Reward Analysis and Investment Recommendation

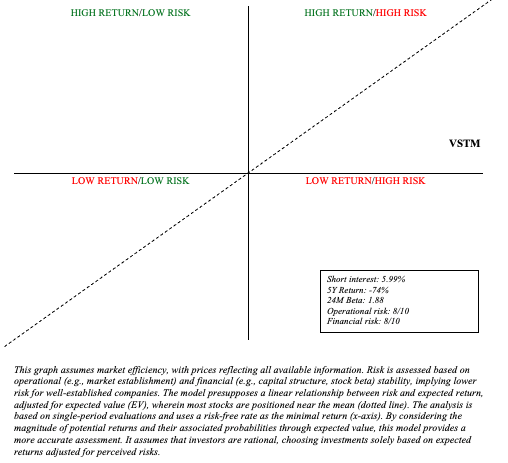

In terms of risk and reward, Friday's news has certainly increased Verastem's operational risk. We must also keep in mind that the stock's decline is bad news in and of itself. With a market capitalization of only $103 million, Verastem, for example, would have to dilute nearly all of its shares to raise $100 million (another year of cash runway). This is a significant financial risk that frequently goes overlooked. As a result, much of the upside potential may be limited due to the risk of significant dilution.

Author's visual representation

In conclusion, the news merits a rating downgrade, from speculative buy to hold. Moreover, VSTM's microcap status presents nuanced risks as well. For example, microcap stocks often experience greater volatility and liquidity challenges, making them especially susceptible to dramatic price swings and funding difficulties. So, while the potential for high rewards remains, the risks have significantly increased, warranting increased caution.

Moving forward, investors should keep a close eye on how the company manages its cash runway, regulatory updates in ovarian cancer, and prospects in other indications (e.g., pancreatic and NSCL cancers).