chinaface

Despite significant geopolitical turbulence, crude oil has remained in its range since 2022. The market fundamentals are relatively stable today. Output growth has improved, rising above pre-COVID levels in the US, notwithstanding relatively low drilling levels. Although crude oil prices have not increased significantly this year, producers such as Canadian Natural Resources (NYSE:CNQ) have rallied. Even the crude oil E&P ETF (XOP) is up by around 10% this year.

I have had a bullish outlook on CNQ since 2022, last updating my view in February of this year with "Canadian Natural Resources: Hedging Geopolitical Risks With This Quality Oil Producer." The stock has delivered a total return of ~20% since that article was published, despite no significant changes to the price of crude oil. I believe CNQ is both overvalued and likely to benefit from a rise in crude oil. Since CNQ has increased in value despite little changes to the price of oil, it may be that the company is now trading closer to its fair value.

Canadian Natural Resource's Profit Outlook

My longstanding view on crude oil is bullish because I believe most global producers have chronically low capital investment levels. Most producers seem to think that oil demand will fall, causing them to avoid drilling or, more often, seek to raise production by utilizing previously completed wells instead of newly drilled ones. That may mean that crude oil production levels in the US (as well as other areas) will not remain as high as demand.

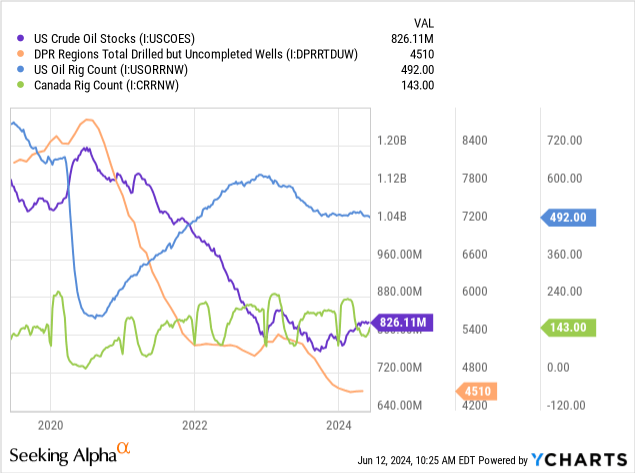

Although the Canadian and US markets differ, they are increasingly similar as the US solidifies itself as a net exporter. The US market is enormous, so changes in the US will drive Canada's market. US oil storage levels (public and private) are historically low after the 2020-2022 shortages. Total US oil production is just above pre-COVID levels but has stagnated recently. Crucially, the US oil production recovery is not driven by drilling, which remains well below pre-2020 levels, but by the completion of previously drilled wells (drilled but uncompleted). As the inventories of these "pre-drilled" wells dry up, US oil production should fall unless there is a spike in the drill level (rig count). See below:

Most North American oil companies I've analyzed are highly reluctant to raise CapEx, instead focusing on using profits for deleveraging (after their solvency crises in the late 2010s) and increasing dividends. Although it is unlikely that gasoline demand will collapse to rising EVs soon, that should happen eventually, and gasoline demand is likely near a peak in the US and Europe. Hence, it is wiser for oil producers to avoid excess output investments.

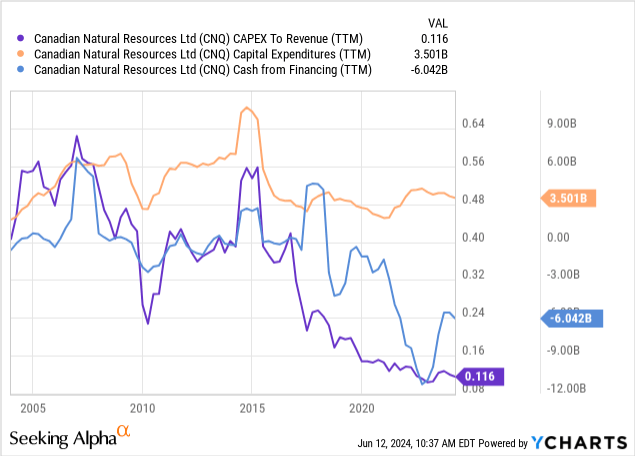

Canada Natural Resources is an excellent example of this shift. Its CapEx spending compared to sales declined significantly after the 2015 oil bust and has not recovered, as further output growth would not necessarily deliver sustained profit growth. Further, as its cash flows have risen since 2020, it's devoted far more to negative cash from financing. See below:

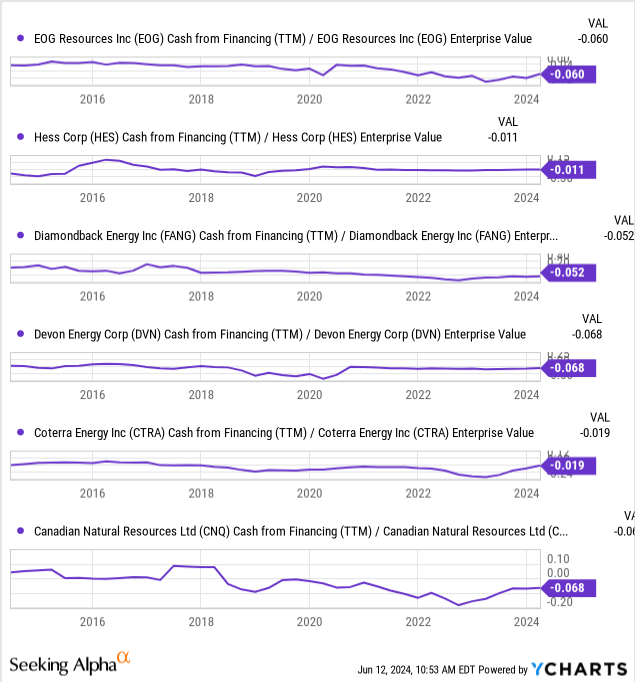

One of my favorite investment metrics is cash from financing to enterprise value. For CNQ, that ratio is 6.8% today on a TTM basis. This metric is akin to dividend yield but instead focuses on the company as a whole (Enterprise Value, including its net debt) and all the ways it can return money to shareholders and creditors, including dividends, share buybacks, and debt repayment. Everybody likes dividends, but if those dividends are driven by excess leverage or, worse, equity dilution (which is occasionally the case), those dividends are more akin to principal repayment as they devalue the equity.

A company with a consistently high (negative) cash-from-financing to EV will likely be able to sustain a high dividend yield much longer by not compromising on its leverage or outstanding shares. To me, a "-CFF/EV" over 3% is great, and over 5% is exceptional. So, at 6.8%, CNQ is poised to provide great value to investors. That said, it is an oil company exposed to commodity volatility, so it may not manage the same consistency seen in other sectors.

CNQ shares a spot with its peer Devon Energy (DVN) at a 6.8% return for this metric, though it was superior last year following CNQ's leveraging. Since this is a non-standard metric, I had to custom chart the data on peers, making for an admittedly dense chart. That said, it is worth seeing how CNQ's metric compares to its peer group:

These data tell us two important takeaways. Canadian Natural Resources is in the top tier for dividend yield reliability. Further, across the board, we see a significant improvement from 2016 to today, showing how these mid-sized E&P's have shifted toward shareholder returns instead of capital growth. That implies the E&P sector is likely a safer investment than in the past, as oil output should not grow faster than demand, offering solid dividends in most E&Ps.

Global Oil "Price Floor" Risen to $80 Per Barrel

On top of that, there are numerous geopolitical issues around oil production and transportation areas in the Middle East and Central Asia. Though I do not seek to speculate on those issues, there is little doubt that a more considerable escalation could result in immense global crude oil shortages. To me, this black swan risk creates a hedge opportunity for North American producers like Canadian Natural Resources that can act as a backup supply source to Europe.

Lastly, I like oil producers because the risk of a significant decline in the price of crude oil is likely low today. That stems from the Biden administration's desire and need to refill the Strategic Oil Reserve, which was drained mainly around 2022. Crucially, the administration raised its buying target to $79.99 per barrel, meaning they plan to buy oil if it reaches that price. Interestingly, OPEC is also looking to create an $80 price floor, threatening to cut output further should prices drop below that level.

In the case of a surprise recession that lowers oil demand, we could see oil temporarily cross below that $80 floor. However, unlike in 2020, global oil storage tanks are generally low, meaning there should be a fair amount of buying potential (mainly from the SPR) should demand falter. In my view, this dramatically lowers CNQ's risk (as well as other North American producers) by essentially guaranteeing continued profitability. A 2022 report from the company showed its breakeven oil In Situ Oil Sands at around $41 per barrel. Its more recent reports do not appear to show an updated estimate, as it is likely rising with inflationary pressures, but is certainly well below $80 per barrel.

What is CNQ Worth Today?

From a long-term perspective, I believe CNQ offers solid value. The oil market is robust, and Canadian Natural Resources is in a great spot to benefit from a price rise. That said, because the oil price has an effective long-term floor at $80 per barrel, CNQ's track record of profit stability is not necessarily as valuable as before. Its dividend yield is exceptionally high compared to peers, causing increased investor interest.

However, there are others like Devon that are paying the same overall cash-flow returns to shareholders and creditors, and have similar geopolitical stability benefits but trade at a much lower valuation stemming from its lack of a dividend yield. While I think dividends are great, I do not see them much differently than deleveraging or share buybacks, and I will not pay a huge premium for them.

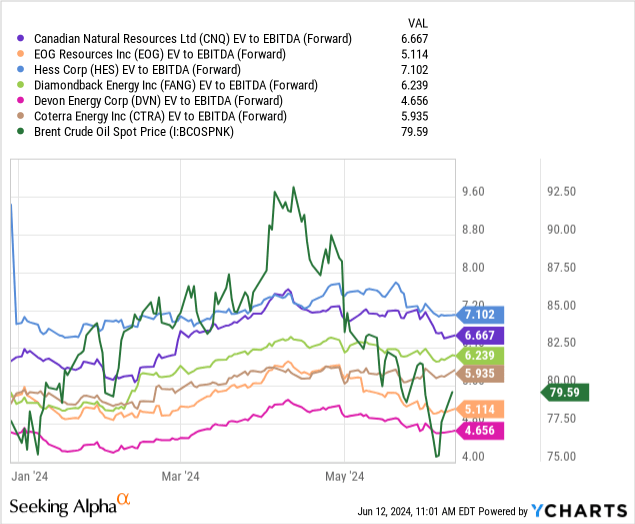

Considering Hess's valuation is the highest due to its likely sale to Chevron (CVX), CNQ has effectively the highest valuation in its peer group. See below:

As noted in my last article, some premium for CNQ is reasonable, but I take issue with the fact that its share price and valuation are rising while crude oil prices are falling. That is not to say its recent gains are not supported by fundamentals, but that continued outperformance likely is not.

CNQ's peers, excluding Hess, have a mean "EV/EBITDA" of ~5.48X, giving CNQ a ~22% EV premium. Converting CAD to USD, CNQ's EV is $83B based on Ycharts data. Adjusting its EV target to 5.48X of its EBITDA implies an EV target of ~$68.3B, pointing to a market capitalization decline of ~$14.7B, or 20% of its current market capitalization.

To me, an effective stock price premium of 20% may be justified by CNQ's higher dividend yield, particularly if we consider its overall well-run balance sheet and operations. That said, it is now on the high end of where I'd feel comfortable remaining bullish. I expect that crude oil will eventually rise to over $100 per barrel, requiring a decline in output or a geopolitical issue. To me, an output decline is likely given how low the drilled-but-uncompleted well count is, but that still may not occur for a year.

Further, if gasoline demand falls due to a recession, oil may take longer to recover from a shortage. I believe this shortage is inevitable, but the timeline remains unclear and highly dependent on the Biden administration's goals with the SPR reserve.

It must be pointed out that the administration recently decided to release more of the SPR reserve to push gas prices lower ahead of July 4th. Since crude oil is at the price where they said they'd buy oil, I do not see an economic reason for their decision to sell more. Gasoline prices were elevated from March to May due to refinery issues that led to a higher "crack spread" (gasoline vs. oil price), not an oil shortage.

The Bottom Line - Look To Cheaper Peers

Overall, I must downgrade my near-term outlook on CNQ to neutral due to its valuation compared to peers. I love the stock, but I don't think its price is low enough that continued outperformance is likely. Investors looking to gain bullish exposure to oil may find better performance in Devon and EOG, which have notably lower valuations. While those two do not have as high of dividend yields, they're both focused on improving cash reserves or lowering debt, paving the way for an eventual dividend increase. I expect their evaluations will rise should they raise their dividend near that of CNQ's.