gorodenkoff

Investment Thesis

This article initiates my coverage of the Burney U.S. Factor Rotation ETF (NASDAQ:BRNY), an actively managed fund following a proprietary strategy that selects stocks based on size (large-cap, small-cap) and style (growth, value) cycles. Before comparisons are made with the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL), I can assure you that BRNY is different and, in my opinion, superior. It's still early, but my understanding of the fund's investment strategy means it will offer much more consistent returns than OMFL, and I look forward to explaining why this factor rotation ETF deserves a "buy" rating. I hope you enjoy the read.

BRNY Overview

BRNY is driven by a proprietary model that predicts which size segment (large or small) and style (growth or value) the market will favor next. Historically, the Burney Company has observed that small-cap value has outperformed large-cap growth but acknowledges periods when the opposite has occurred and claims the cycles are reasonably predictable. As noted in the prospectus, "the cyclical pattern of these market phases can be seen over a 36-month rolling period with regard to market cap size and a 12-month rolling period with regards to style."

The Burney Company categorizes stocks as large/small and growth/value using S&P's method, allowing analysts to see precisely which cycles the model has selected by comparing its composition against these ETFs:

- iShares S&P 500 Growth ETF (IVW): Large-Cap Growth

- iShares S&P Mid-Cap 400 Growth ETF (IJK): Mid-Cap Growth

- iShares S&P Small-Cap 600 Growth ETF (IJT): Small-Cap Growth

- iShares S&P 500 Value ETF (IVE): Large-Cap Value

- iShares S&P Mid-Cap 400 Value ETF (IJJ): Mid-Cap Value

- iShares S&P Small-Cap 600 Value ETF (IJS): Small-Cap Value

Furthermore, the prospectus lists five steps in the selection process, which I've summarized below:

1. Assess market indices and trends to determine which factors the market favors currently. For example, a downturn in large-cap growth stocks could indicate a favorable environment for small-cap value stocks. Target weights are set for each factor set (size and style).

2. The universe of potential securities is identified, screening out stocks with low market cap stocks ($1 billion market cap) and stocks with poor liquidity, measured by average daily volume.

3. The Sub-Adviser deploys proprietary analysis using fundamental metrics and "alternative data", which seeks to predict revenue beats by analyzing a company's "digital footprint" relative to its historic norms and analyst expectations.

4. According to S&P's methodology, stocks are classified as large or small or growth and value. S&P uses six factors to establish style baskets, with each company receiving a growth and value score.

S&P Dow Jones Indices

5. The Sub-Adviser uses a portfolio optimizer to select highly-rated stocks that fit its Investment Cycle targets each month. Occasionally, the Sub-Adviser may override these results in some instances (e.g., pending litigation). Typically, 80-100 stocks are selected.

While the process seems reasonable and comprehensive enough, that's not what's important, since everyone is always claiming to have designed the next big "market-beating" strategy. Instead, the crucial takeaway is in the first step, when the Sub-Adviser assigns "target weights" for the size and style regimes. Put differently, it's not an "all or nothing" approach, and uncertainty is permitted, such as when there's little evidence that small caps have the advantage over large caps or that value is favored over growth.

Please note this level of "humility", for lack of a better word, is not present in OMFL, as its model goes all-in on one regime (recovery, expansion, slowdown, contraction). In April 2023, I expressed this concern, writing:

There is no middle ground when OMFL's model assigns a business cycle phase. Probabilities could be a 51% slowdown and a 49% expansion, but the Index goes all-in on slowdown despite the apparent uncertainty."

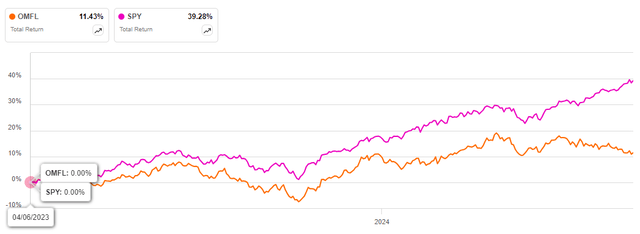

I received plenty of negative feedback on that article, as certain readers couldn't understand why I wouldn't rate this "market-beating" fund a buy. However, the most prominent critics have since come around, now that OMFL has lagged behind the SPDR S&P 500 ETF (SPY) by about 28%. Many select ETFs solely on their historical returns rather than analyzing the strategy and fundamentals, even though it's clear that performance-chasing doesn't work.

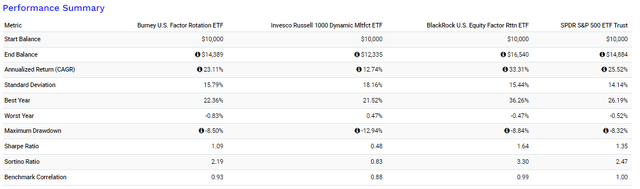

Caution regarding performance-chasing also applies to BRNY. Since November 2022, it's easily outperformed OMFL, but that alone doesn't make it a better choice. If OMFL selects the right regime, as it did several years ago, it could substantially outperform. In this analysis, I've also included the BlackRock U.S. Equity Factor Rotation ETF (DYNF), another actively managed fund with a similar investment objective.

BRNY Analysis

Current Composition

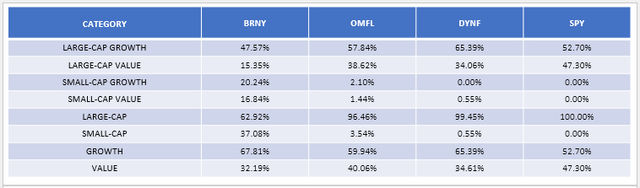

Using the six size and style ETFs listed earlier, I classified each of BRNY's selections as either large- or small-cap and growth or value. Below are the results alongside OMFL, DYNF, and SPY.

With these target weightings, we can infer the model predicts large-cap stocks will outperform small-caps, per its 63/37 split for those two segments. The model also expects growth stocks to outperform value stocks, per its 68/32 split for those two factors. OMFL also favors growth stocks, but it has no allocation to small-caps, which, for its purposes, would roughly include stocks 501-1000 in the Russell 1000 Index. DYNF may hold large- and mid-cap stocks, while SPY only has large-cap stocks, as reflected above.

I want to emphasize again that, unlike OMFL, BRNY will likely always have a mix of stocks across all four categories, which makes a lot of sense. There's no way any model can accurately predict the future, and even if there were, it would be kept secret. Instead, BRNY is just looking for an edge over SPY but isn't betting the farm. Still, beating SPY is no easy feat, especially since SPY ranks average or better on most factors. I'll review these results later, but first, let's look at the sector composition differences between the four ETFs.

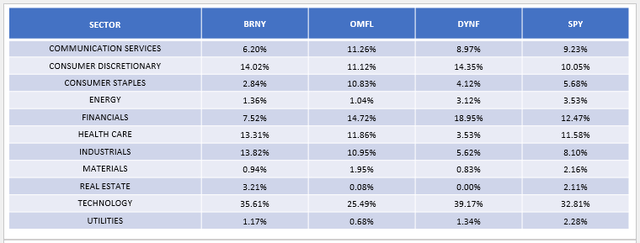

BRNY's largest sector is Technology, at 36%, followed by Consumer Discretionary, Industrials, and Health Care at 13-14%. Like SPY, it has minimal allocations to Energy, Materials, Real Estate, and Utilities. Along with underweighting Financials by 5%, it aligns well with BRNY's growth-lean described earlier. In other words, it's somewhat aggressive, and I expect these allocations will change gradually with each monthly rebalancing rather than the sudden changes you might be used to with OMFL.

BRNY Fundamental Analysis

The following table highlights selected fundamental metrics for BRNY's top 25 holdings, totaling 76.63% of the portfolio. I've also included summary metrics for OMFL, DYNF, and SPY at the bottom.

Here are four observations to consider:

1. BRNY's growth metrics are terrific. Over the last five years, its constituents have grown sales by an annualized 18.06%, easily the best of the group. One-year estimated sales growth is also the strongest at 13.73%, as is one-year estimated earnings per share growth at 17.69%. These numbers make sense, given how BRNY has the highest allocation to growth stocks of the four, and the growth is spread out nicely among large- and small-caps. In addition to mega-caps like Alphabet (GOOGL) and NVIDIA (NVDA), BRNY also has high allocations to Texas Roadhouse (TXRH) and Lantheus Holdings (LNTH) in the small-cap space.

2. BRNY trades at 27.61x forward earnings using the simple weighted average method and 19.63x using the harmonic weighted average method, which is close to what you'll find on sites like Morningstar. By comparison, OMFL, DYNF, and SPY have the following forward P/E ratios (simple / harmonic average):

- OMFL: 31.13x / 26.39x

- DYNF: 29.25x / 22.02x

- SPY: 29.53x / 23.20x

These results still indicate that BRNY is the most attractively valued, and I reached a similar conclusion when comparing other valuation ratios listed below. In particular, I was pleased with BRNY's sector-adjusted value score, which I derived from Seeking Alpha Factor Grades. This score accounts for the composition disadvantages BRNY has, such as its low allocation to Financials and high allocation to Technology. For those wondering, BRNY's sector-adjusted growth score is also the best at 6.38/10.

3. BRNY has an 8.95/10 sector-adjusted profit score, the lowest of the four. However, this is mainly because it holds small-cap stocks, which, naturally, are less profitable. To illustrate, when I last reviewed OMFL in April, its weighted average market cap was only $12 billion, and the ETF had a 7.08/10 profit score, far different than its $974 billion and 9.75/10 figures today. In addition, IJT and IJS, which represent the small-cap growth and value segments, have 6.61/10 and 5.47/10 profit scores, respectively. Quality is just something small-cap investors must sacrifice in exchange for higher scores on other factors like growth and value.

BRNY's small-cap growth and value selections have 8.10/10 and 7.26/10 weighted average profit scores, respectively, so they're higher quality than their respective benchmarks. This is a great feature and one piece of evidence that BRNY emphasizes quality, a feature missing from most small-cap funds.

4. BRNY's holdings have strong price and earnings momentum, evidenced by these weighted average metrics:

This table illustrates how BRNY's holdings are trading 21.91% above their 200-day moving average prices, have gained 376.18% over the last five years, and have the best sector-adjusted momentum scores. Notably, solid sales and earnings surprise figures for the previous quarter support these price momentum statistics. Finally, BRNY's 7.75/10 EPS Revision Score indicates Wall Street analysts are bullish on its holdings.

Why SPY Works

We saw earlier how BRNY has still lagged behind SPY since its inception due to poor returns last year. One reason is its hefty 0.79% expense ratio, which probably needs to be lowered to attract a large shareholder base. Another is that SPY does a lot of things well that often go unnoticed. While proponents of "smart beta" ETFs claim to focus on the fundamentals, it's amazing how they underestimate SPY's fundamental strengths that go beyond past performance and its "simple" market-cap-weighting scheme. To illustrate, consider how SPY ranks on seven fundamental factors against its large-cap blend peers.

- Diversification: #67/251

- Risk: #123/251

- Growth: #95/251

- Value: #165/251

- Quality: #64/251

- Momentum: #70/251

- Sentiment: #75/251

SPY ranks average or better on six factors, with value as its central weak spot. However, only 18 of the remaining 250 large-cap blend ETFs also score average or better on six factors, with most being S&P 500 Index ETFs or something very similar, including:

- iShares Core S&P 500 ETF (IVV)

- Vanguard Mega Cap ETF (MGC)

- SPDR Portfolio S&P 500 ETF (SPLG)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Large Cap ETF (VV)

No large-cap blend ETF scores average or better on all seven factors, and when you consider the low fees, high assets under management, and excellent liquidity S&P 500 Index ETFs offer, they're probably as good as you're going to get. BRNY is a possible complement due to its stronger growth, value, momentum, and sentiment features, and since it doesn't go all-in on any factor, I don't think investors are taking too much additional risk.

Investment Recommendation

BRNY is a U.S. factor rotation ETF that attempts to predict which size segment (large or small) and style (growth or value) the market will favor next. Compared to other factor rotation ETFs like OMFL, BRNY is sensible because it acknowledges uncertainty and will likely never go all in on a particular size or style. That approach should lead to reasonably consistent long-term returns and a potential edge over SPY due to superior stock selection. Right now, I'm pleased with BRNY's growth and value metrics, but I caution this is likely to change. BRNY reconstitutes monthly and had a 119% portfolio turnover rate for the eight months ending July 31, 2023, per its annual report.

Another concern is BRNY's 0.79% expense ratio, which makes the already difficult task of outperforming SPY even more daunting. Still, I like the approach, and while I don't support making BRNY the cornerstone of your portfolio, I think it makes for a solid satellite position, and I have decided to assign it a "buy" rating. Thank you for reading, and I look forward to your comments below.