Melena-Nsk

Lumber may be the most illiquid commodity futures market, but it's still a critical industrial raw material with the highest correlation to interest rates. All commodities are rate sensitive. Higher rates increase the cost of carrying inventories, causing prices to fall, reflecting declining demand. Lower rates encourage buying as consumers can stockpile supplies with attractive financing rates. Lumber is a market that exacerbates the relationship as it's a primary material in new home building and construction. Higher rates that increase mortgage expenses weigh on lumber demand, while falling rates encourage new home purchases and building, increasing wood demand.

With U.S. interest rates remaining higher for longer, physical lumber futures fell 22.99% in Q2 and were 21.24% lower over the first six months of 2024. Nearby lumber futures settled at $450.50 per 1,000 board feet at the end of June and were around the same level in mid-July as the market waits for the Fed’s pause to end.

While lumber futures are illiquid, Weyerhaeuser Company (NYSE:WY) operates as a REIT with a lumber call option attached.

I last wrote about lumber and WY on Seeking Alpha in early 2024. I concluded:

A soft landing in the U.S. economy could cause new home demand and construction to rise in 2024, increasing lumber demand and prices. Rising lumber prices are bullish for WY and other lumber-related assets. Weyerhaeuser Company stock is a liquid proxy for those seeking lumber exposure without venturing into the illiquid lumber futures arena.

Nearby physical lumber futures prices were more than $100 higher at $580.50 per 1,100 board feet on Jan. 4, 2024. WY shares at $33.73 were higher than the current $29.50 level. WY has followed wood lower and should move higher when the illiquid lumber market finally finds a bottom and turns higher.

Lumber prices follow interest rates - A decline from over 7% could ignite new homebuilding

While lumber is the most illiquid industrial commodity, wood prices may have the most significant correlation with changes in the interest rate environment. The path of least resistance of lumber prices is a function of mortgage financing rates. Moreover, illiquidity in the lumber futures market magnifies trend changes and price moves as bids to purchase wood often disappear during bearish trends, and offers to sell evaporate when lumber’s price rallies.

Physical lumber futures have been in a bearish trend since the mid-2022 high when the CME replaced random-length futures with physical futures.

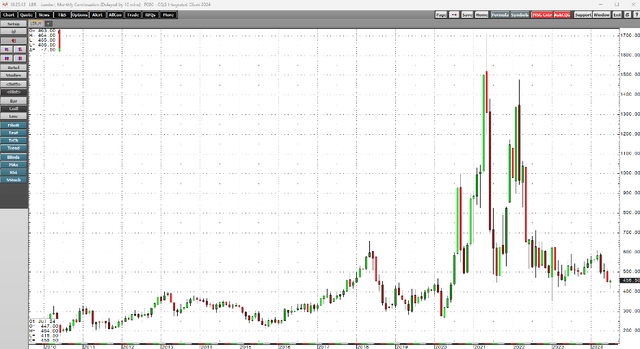

Five-Year Physical Lumber Futures Chart (Barchart)

The monthly physical lumber futures chart shows the decline from $712 in August 2022 to under $460 per 1,000 board feet in July 2024.

Monthly Random-Length and Physical Lumber Futures (CQG)

Including the old random-length contract, lumber's price action has been in almost lock step with the Fed’s hawkish monetary policy. The central bank began increasing short-term rates from zero in March 2022, with rate increases pushing the Fed Funds Rate to a midpoint of 5.375%. The chart illustrates that lumber prices fell from $1,477.40 per 1,000 board feet in March 2022 to below $460 on the nearby futures contract.

The hawkish monetary policy path pushes 30-year conventional fixed-rate mortgages from below 3% to over 7%. The increase in monthly payment on a $400,000 mortgage is over $1,300, precluding many potential home buyers from purchases. As the addressable market for new homes declined, the demand for lumber fell. Lumber prices followed interest rates like an obedient puppy.

Republicans favor energy independence and exports - Oil at $40 would likely reduce inflation

While the leading core inflation indicators exclude “volatile food and energy prices,” crude oil and traditional energy prices are critical inputs in all goods and services. Production and transportation require significant energy consumption.

Crude oil prices above the $80 per barrel level remain inflationary factors above the Fed’s pay grade. Petroleum prices are a function of geopolitical factors. Given the bifurcation of the world’s nuclear powers and OPEC+’s dominance in international pricing, high crude oil prices continue to support higher inflationary readings for longer.

Meanwhile, fossil fuels are on the ballot in the November 2024 U.S. presidential election. The incumbent administration and Democrats favor alternative and renewable fuels to combat climate change. The green energy initiatives inhibit hydrocarbon production and consumption. A second term for Democrats will continue these initiatives, likely supporting elevated oil prices. Moreover, the U.S. Strategic Petroleum Reserve at 373.1 million barrels remains over 43% below the June 2020 level at 676 million barrels. The current administration has limited ammo to combat rapidly rising oil prices over the coming months and years.

The former president and Republicans favor a return to a “drill-baby-drill” and “frack-baby-frack” energy policy. They argue that tapping U.S. reserves will push oil prices back to pre-pandemic and pre-inflation levels at the $40 per barrel level, achieving U.S. energy independence and increasing revenues through exports.

The bottom line is that falling energy prices would push inflation to or below the Fed’s 2% target, justifying rate cuts and lower mortgage rates, supporting new home purchases and lumber demand.

The former President could change the Fed’s independent dynamics

According to the U.S. Fed, inflation has been a nagging issue, causing interest rates to remain higher for longer. With the economic condition above the Fed’s 2% arbitrary target, the Fed Funds Rate has remained at the 5.375% level throughout 2024. While the central bank reduced its quantitative tightening starting in June 2024, the impact of balance sheet reduction continues to filter through the economy.

Another difference between Democrats and Republicans appears to be the incumbent’s support for an independent Fed and the challenger’s statements that the central bank has not responded to changing economic dynamics. A new Fed Chair and appointees, or in the most extreme case, dissolving the central bank, would make rate policy more political than economic, resulting in lower rates. Some economists argue that removing power from the Fed will stoke long-term inflationary pressures. However, in the short term, a Republican victory could mean rates will drop much faster than under the Democrats.

Existing homes remain tight - A housing enigma over the past years as home prices rose with rates

Another factor supporting new homebuilding is that the market for existing homes remains exceptionally tight. Even if rates decline, homeowners with sub-3% mortgages will likely retain the low-cost financing and not upsize or downsize. Rates are not likely to fall to levels seen during the pandemic when many mortgagees rushed to refinance and other purchase new and existing homes at lower prices with lower rates.

The housing enigma that caused home prices to rise alongside increasing interest rates is a function of the shortage of existing homes on the market. While lower rates will likely cause home prices to increase further, it could loosen the existing home supplies, keeping prices stable and encouraging new home demand. In an environment with growing pent-up demand, the market for new home construction could experience a boom when rates decline.

WY is a REIT with a call option on lumber

I will never buy or sell one lumber futures contract as the liquidity does not support speculative or investment risk positions. However, I follow lumber’s price like a hawk and use lumber proxies when the price falls to levels where risk-reward favors the upside for wood prices. At below $500 per 1,000 board feet, lumber is less than one-third the price at the 2021 record peak. Weyerhaeuser is a REIT that owns or leases timberlands in the United States and Canada. At $29.50 per share, WY had a $21.17 billion market cap that trades an average of over 3.9 million shares daily. The $0.80 annual dividend translates to a 2.71% yield.

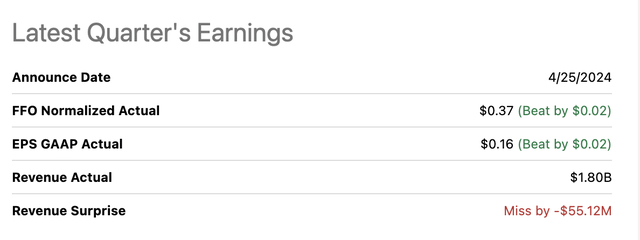

WY Q1 2024 Earnings (Seeking Alpha)

While WY beat earnings estimates for Q1, the company missed on revenues, likely because of falling lumber prices.

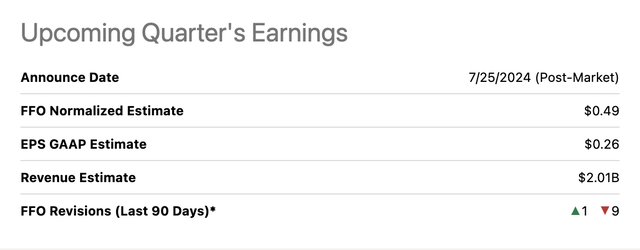

WY Q2 Earnings Forecasts (Seeking Alpha)

As the chart shows, WY will report Q2 earnings on July 25, and the forecasts are for higher EPS and revenues. However, the price action in lumber could cause disappointing results later this month. I'm a buyer of WY if the earnings disappoint and the shares slump because the prospects for falling interest rates support new home building and lumber demand in the medium-to-longer term. I will leave plenty of room to buy on a scale-down basis as WY is a company that adds liquid lumber exposure to my portfolio.

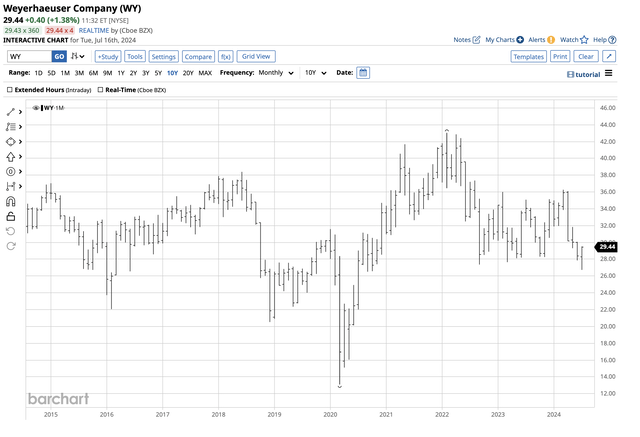

Ten-Year WY Chart (Barchart)

The chart highlights WY’s sideways recent price action with a bearish bias since the early 2022 high. WY made a lower low at $26.73 in early July, and the next technical support level is around $20.50 per share.

Lumber is another commodity, along with traditional energy products, on the November 2024 U.S. ballot. Rates are likely to fall under either administration, supporting lumber prices. The extent of the rate decline could depend on the election results, the Fed’s future as an independent body, and traditional energy’s impact on inflation.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls, directional trading recommendations, and actionable ideas for traders and investors. I am offering a free trial and discount to new subscribers for a limited time.