Gerasimov174/iStock via Getty Images

Investment Thesis

Civitas Resources, Inc. (NYSE:CIVI) reported the acquisitions of Vencer, Hibernia, and Tap Rock, which I think could accelerate future crude oil production in the coming quarters. Besides, with 2024 exploration expense of $15-$20 million and capital expenditures of $1.8-$2.1 billion expected in 2024, I would be expecting new reserves and production capacity increase. I think that investors did not take into account the total number of shares repurchased recently, the 2024 FCF expected to be close to $1.3 billion, and the total amount of dividends distributed. Given the ongoing unlevered FCF growth, production track record reported, and the distributions to shareholders, CIVI, in my view, appears very undervalued.

Target Price: My discounted cash flow model implied a valuation of $111 per share, and most analysts reported a buy note or a strong buy note.

Civitas: 2024 Net Sales Growth Could Reach 58% YoY

Civitas is an exploration and production company with expertise in the acquisition as well as the production of crude oil and gas in the DJ Basin in Colorado and the Permian Basin in Texas and New Mexico.

In my view, reviewing the company's profile today makes sense because of the outlook given for 2024. According to the last presentation given to investors, The company expects to deliver 2024 FCF of close to $1.3 billion and intends to report a reinvestment rate of close to 50%. There is more. The company also reported $600 million of expected dividends and $388 million remaining on buyback authorization.

It is also worth noting that according to the last presentation, the company repurchased common stock worth ~$462 million since the beginning of 2023. Given these figures and the previous track record, I would expect an acceleration in the demand for the stock in the coming quarters.

It is also worth reviewing the net revenue expectations for 2024 and EPS expectations. According to Seeking Alpha, analysts are expecting 58% net sales growth in 2024, 27% EPS growth in 2024, and 15% EPS growth in 2025. In my view, as soon as new financial figures are reported in 2024 and 2025, the stock price could trend higher.

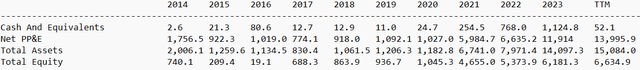

Previous Cash, PP&E, And Equity Growth

A quick look at the growth in the total amount of cash, net PP&E, assets, and equity reveals significant business growth and proven expertise in the business model.

Cash in hand increased from $2.6 million in 2014 to 1,124.8 million in 2023. 2014 Net PP&E stood at $1.7 billion in 2014, and it was close to $13.9 billion in 2014. In addition, by multiplying total assets by 7x from 2014 to 2024, total equity increased from $740 million in 2014 to $6.38 billion in 2024. The numbers are quite impressive. In my view, if the company grows like in the last decade, the total valuation would most likely increase.

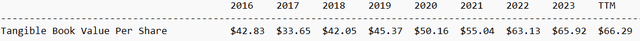

The current book value per share is close to $66 per share, which is not far from the current price mark. If we buy today, we would be buying the net PP&E, and making money out of the free cash flow reported by CIVI.

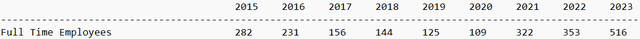

The growth in the number of employees from 2015 to 2023 is also quite impressive. In addition, it is worth noting that the company saw a significant increase in its headcount in 2023. In 2022, 353 employees were reported. In 2023, the headcount was 516.

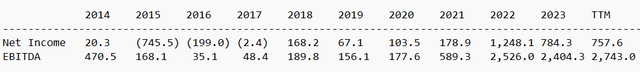

EBITDA Growth

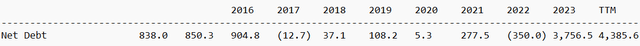

Looking at net income growth from 2014 to 2024 and EBITDA growth also reveals increases in profitability. From 2014 to 2024, EBITDA increased by more than 5x. Given these figures, I am not really concerned about the total amount of net debt of close to $4.3 billion, which is approximately 1.5x the total amount of TTM EBITDA.

In order to finance the company's developments, CIVI is using a combination of debt and equity. The total number of shares and net debt increased in the last decade. Given that the current equity reported in the balance sheet increased, I am not concerned about the potential equity dilution of leverage.

My Free Cash Expectations, Production, And DCF Model

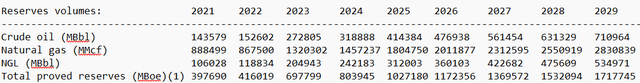

For the assessment of future production and financials, I took into consideration the company's total oil guidance for 2024 of close to 155-165 MBbl/d, total cash opex of $9-$10, exploration expense of $15-$20 million, and capital expenditures of $1.8-$2.1 billion. The following numbers are based on my own expectations and previous numbers reported by CIVI.

For the assessment of the WACC, I studied the company's debt agreements. In the last presentation, the company reported senior unsecured notes including 5% and 8.6% interest rates. Given the debt agreements, I believe that assuming a WACC of 7.5% makes sense.

On October 17, 2023, we issued a $1.0 billion aggregate principal amount of 8.625% Senior Notes due November 1, 2030 (the "2030 Senior Notes"). Source: 10-K.

On June 29, 2023, we issued a $1.35 billion aggregate principal amount of 8.375% Senior Notes due July 1, 2028 (the "2028 Senior Notes"). Source: 10-K.

On October 13, 2021, we issued $400.0 million aggregate principal amount of 5.000% Senior Notes due November 1, 2026 (the "2026 Senior Notes").

I would be expecting an increase in production thanks to the acquisition of Vencer in 2024 for close to $1.0 billion in cash and 7.3 million shares. Given the recent track record, I think that acquisitions will continue to be successful in the next four years.

On January 2, 2024, we closed on the Vencer Acquisition. The Vencer Acquisition included approximately 44,000 net acres in the Midland Basin and certain related oil and gas assets with an average production of approximately 49 MBoe/d in exchange for aggregate consideration of approximately $1.0 billion in cash, 7.3 million shares of our common stock paid at the closing of the Vencer Acquisition, and $550.0 million in cash to be paid on or before January 3, 2025. Source: 10-Q.

In the last quarter, we saw how the recent acquisition of Hibernia and Tap Rock significantly improved product revenues. If there are no large changes in the crude oil price, I think that we could see a further increase in product revenue driven by M&A.

Product revenues increased by 103% to $1.3 billion for the three months ended March 31, 2024, compared to $654.8 million for the three months ended March 31, 2023. The increase was primarily due to a 113% increase in crude oil equivalent sales volumes driven by the Hibernia Acquisition and Tap Rock Acquisition that closed on August 2, 2023, and the Vencer Acquisition that closed on January 2, 2024. Source: 10-Q

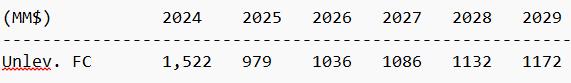

My DCF model includes unlevered FCF from $979 million in 2025 to $1172 million in 2029. I also used a cost of capital of 7.5% and a terminal multiple of 12x unlevered FCF, which is in line with the long-term EV/FCF reported by CIVI. The results also include a total enterprise value of $14.57 billion, a net debt of $4.3 billion, and a target price of $111 per share. I think that my numbers are quite realistic.

Source: My Expectations

The following are the results I obtained in my DCF model:

- NPV of future FCF: $5,458.87 million.

- NPV of TV: $9,115.38 million.

- Total: $14,574.24 million.

- Net Debt: $4,385.60 million.

- Equity: $10,188.64 million.

- Shares: 91.70 million.

- Target Price: $111.11.

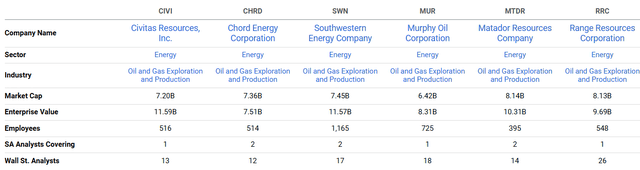

Competitors Trade More Expensively Than CIVI

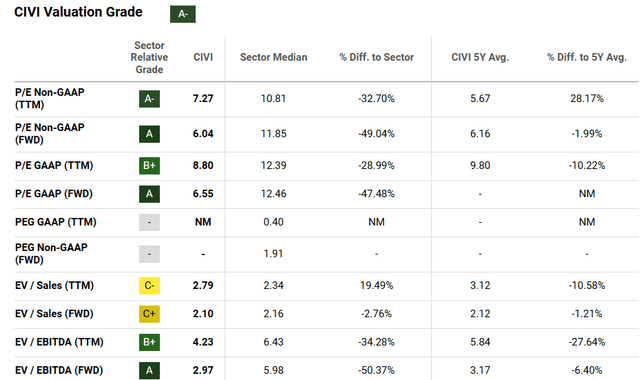

I invite readers to review the current valuation of competitors. As of July 18, 2024, according to Seeking Alpha, peers traded at 12x forward GAAP earnings and 5.9x forward EBITDA.

According to Seeking Alpha's tool, as of July 18, 2024, CIVI trades at 2.9x forward EBITDA and 6.5x forward earnings. Besides, CIVI is also trading at only 2x forward cash flow, and competitors trade at 5.45x cash flow. In sum, I think that there is significant upside potential.

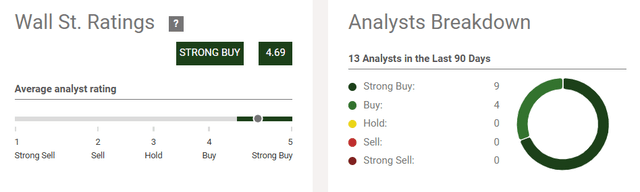

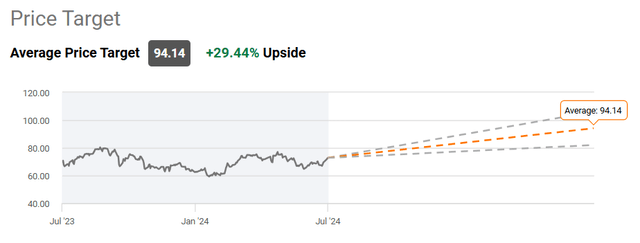

The valuation given by other analysts is also remarkable. As of July 17, 2020, the average target price given was close to $94. Besides, 13 analysts in the last 90 days reported a strong buy rating or a buy rating. No analyst out there reports a sell mark.

Source: Seeking Alpha Source: Seeking Alpha

Risks

In my view, the largest risks for CIVI would come from volatility in the price of crude oil and gas. As a result, CIVI may see lower net sales growth, and FCF expectations may also decline. In such a scenario, I think that the company could suffer from a decline in the demand for the stock and stock price declines.

Reservoir engineers and geologists could also make mistakes about the total production or proven reserves found. The company could also buy companies that report an overestimated amount of reserves. As a result, I think that future unlevered free cash flow could be lower than expected. In the worst-case scenario, we could see a decline in the stock price as soon as new financial numbers are delivered.

Inflation and a supply chain crisis could destroy the company's FCF margin growth. Besides, an increase in salaries demanded by employees or drastic changes in the labor markets could also diminish the company's free cash flow growth. As a consequence, I think that we could see lower demand for the stock.

I also believe that an eventual increase in the interest rate could affect future operating results. In the last quarter, the company noted a credit facility, which may be subject to a fluctuating rate that is tied to an Alternate Base Rate or Secured Overnight Financing Rate.

As of March 31, 2024, and on the filing date of this Quarterly Report on Form 10-Q, we had $400.0 million and $850.0 million, respectively, outstanding on our Credit Facility. Borrowings under our Credit Facility bear interest at a fluctuating rate that is tied to an Alternate Base Rate or Secured Overnight Financing Rate, at our option. Any increases in these interest rates can have an adverse impact on our results of operations and cash flows. Source: 10-Q

Among other expenses, I am a bit concerned about the gathering, transportation, and processing expenses, which increased significantly in 2024. In my view, further increase in these expenses could affect future FCF growth, and lower the implied valuation of CIVI. In this regard, investors may want to read the following lines.

Gathering, transportation, and processing expenses increased 32%, to $88.9 million for the three months ended March 31, 2024, from $67.4 million for the three months ended March 31, 2023, and decreased 38% on an equivalent basis per Boe. All gathering, transportation, and processing contracts contain annual price escalations, which have contributed to the aggregate increase. Source: 10-Q.

Conclusion

In my view, in 2024 and the next four years, we may see an increase in production coming from the acquisition of Vencer, Hibernia, and Tap Rock. In addition, further capital expenditures and exploration expenses announced for 2024 will most likely bring new reserves and capacity increases. Besides, the incoming $600 million of expected dividends, $388 million remaining on buyback authorization, and previous stock repurchases could soon accelerate the demand for the stock. In sum, considering the previous track record, headcount growth, increase in PP&E, equity growth, and my own expectations about future production, I think that CIVI does trade undervalued. My DCF model implied a valuation of $111.11, which is significantly higher than the current market valuation. The average price reported by other analysts is close to $94.