lucadp

According to Understanding Stock Market Corrections and Crashes:

- On average, the market declined 10% or more every 1.2 years since 1980, so you could even say corrections are common.

- However, once the market starts to turn, it can recover quickly. The average recovery time for a correction is just four months!

The history of crashes provides confidence in “staying the course” and “buying the dip” because recovery is expected to be quick. Most recently, the recovery from the 2022 stock market decline took only 4 months; it was average, fast and V-shaped.

But no one knows how long the next stock market crash will last, nor how long it will take to recover from that crash. We do know that the past 15 years of rising stock markets is the longest bull market ever and that stock prices are at all-time highs. And we also know that there has never been 78 million people in the Retirement Risk Zone at the same time -- they are the baby boomers.

Baby boomers cannot afford a “bad” crash

Baby boomers need to be concerned about the worst cases because the rest of their lives could be ruined by the next crash, and with $70 trillion at risk the stakes are high for them and their heirs. So rather than averages, let’s look at worst cases because that’s what baby boomers need to protect against.

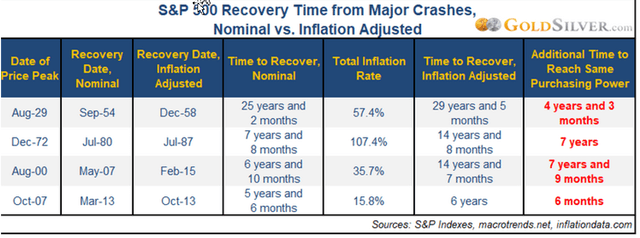

Here are the 4 worst crashes and the time it took to recover from them:

S&P Indexes

The Great Depression was the worst crash. It took 25.2 years to recover in nominal terms and an even longer 29.4 years in real (inflation-adjusted) terms. Baby boomers do not expect to live another 20 years. The other bad crashes took 14 years to recover in real terms. The average boomer is 68 years old and has a life expectancy of 84, so 16 years. Most importantly, many will bail in the face of a crash and won’t recover at all – they won’t “stay the course” as they limit their losses.

A longer historical view

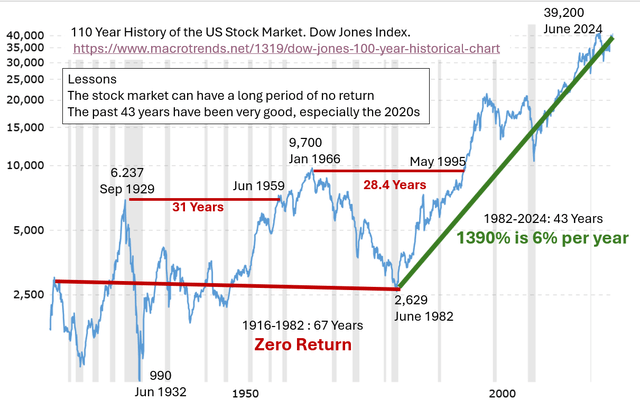

Recovery averages are based on the recent past, but a long 110-year view reveals that the early days of stock investing were very disappointing, with very long periods of no returns – it took all the running you could do to stay in the same place. It’s a hockey stick picture, with the last 43 years excelling. The time periods of zero returns are not on the horizon for baby boomers.

Dow Jones Indexes

As you can see, the “good times” began in 1982 and the really good times have been the current “Roaring 2020s” which have begun much like the “Roaring Twenties” of 100 years ago that led to the Great Depression. Stock prices are at all-time highs, drawing many in who fear missing out (momentum) when there’s reason to fear a bubble burst (crash).

The odds are on a stock market crash because it always does, and a crash is long overdue (2022 was a head-fake). The “Buffet Indicator” stands at an all-time 200% high, which is 2 standard deviations above trend: Stock Market Value of $56 trillion is twice GDP of $28 trillion. It is a very expensive stock market and becoming more expensive every day.

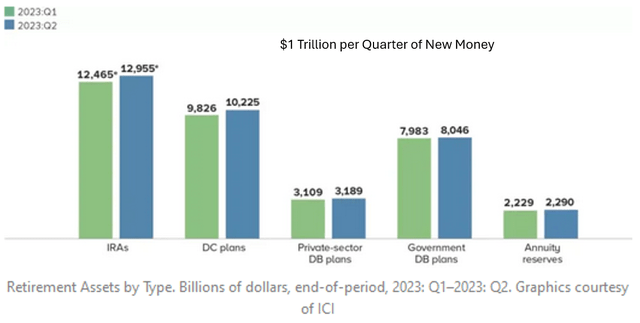

Some attribute the buoyancy of the stock market to the ongoing growth of $4 trillion per year in retirement plans because contributions just keep pouring in regardless of market values, and much of those new monies are flowing to passive stock index funds. The retirement plan faucet doesn’t care about market values. $4 trillion is 7% of the $56 trillion total stock market value, which is enough to matter. The Big 7 Megacap stocks are worth $16 trillion.

ICI

Baby boomers protect yourself

Younger people have the time to recover from the next crash. It will be painful for them, but they’ll be OK. Baby boomers, not so much. Baby boomers need to move to the safety of “cash” – low-risk assets like Treasury Bills and short maturity Treasury Inflation Protected Securities (TIPS). Baby boomers in target date funds need to get out unless they’re in one of the few that protect, like the Federal Thrift Savings Plan (TSP).

We only live once. (I’m a baby boomer). We’ll be out of the Risk Zone in 2030, so we need to defend at least until then.

Conclusion

Wharton Professor Jeremy Siegel’s Stocks for the Long Run is in its fifth edition. It is a very popular book. Stocks always win if you wait long enough. But baby boomers do not have the luxury of waiting very long. Their “long run” is very short. Baby boomers should not be in the stock market at this time in their lives. They will spend this decade in the Retirement Risk Zone when investment losses can devastate.