JHVEPhoto

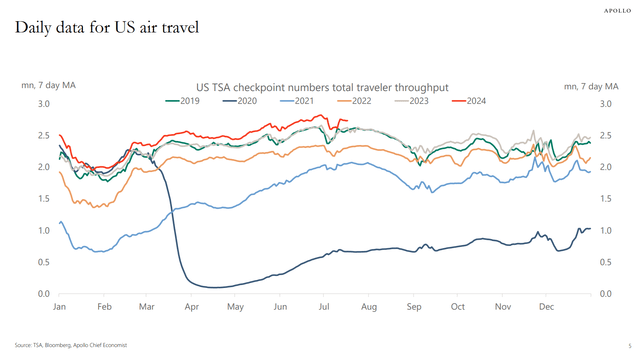

Cheaper airfares and a still-solid labor market combine to make a significant tailwind for international hotels. Marriott International (NASDAQ:MAR) has not surprisingly returned nearly 40% from when I last analyzed the stock in the second quarter of 2023. Revenge travel trends may be over, but individuals, businesspeople, and families continue to fly the friendly skies and enjoy the amenities of quality hotels around the world.

I am downgrading MAR from a buy to a hold, however. I see the stock now fully valued while its technical trends have become less impressive following a healthy run-up into the first part of this year. With earnings on tap, we could see volatility perk up later this month and into August.

TSA Checkpoint Numbers Continue to Print Record Highs

Back in May, Marriott reported a mixed set of quarterly results. Q1 non-GAAP EPS of $2.13 missed the Wall Street consensus estimate of $2.16 while revenue of $6.0 billion, up 6.4% from a year earlier, was a modest beat. The $70 billion market cap hotel operator reported weaker than expected comparable systemwide RevPAR (revenue per available room) of 4.2% worldwide, but just 1.5% in the US and Canada. Growth was impressive across its APAC (ex-China), EMEA, and CALA regions. With solid international growth, I expect similar solid ex-North America trends to be reported in the quarter just finished.

Its adjusted EBITDA verified at $1.14 billion in Q1, a modest boost from $1.1 billion last year. Marriott added 46,000 net rooms during the first three months of 2024, many of those coming from its new partnership with MGM Resorts International. What was particularly encouraging was that its management team raised FY earnings guidance while committing to returning more than $4 billion to shareholders this year, raising its expected capital return by $100 million with the potential for further increases. Shares traded 1% lower in the session that followed, however.

As for the Q2 report due out next week, analysts expect $2.48 of operating EPS, which would be higher than the $2.26 reported in the same period a year ago. The options market has priced in a modest 3.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the report.

Key risks for investors to consider are a deep global economic slowdown which would result in less travel spending and hotel demand, increased labor costs, global terrorism or other geopolitical threats, and supply chain disruptions that could lead to slower hotel development.

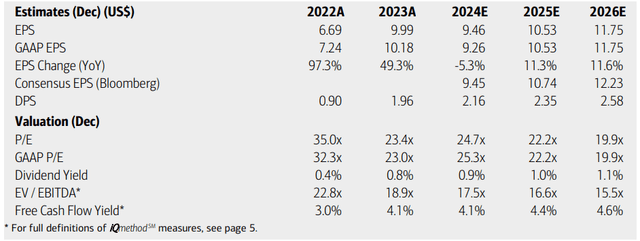

On the earnings outlook, analysts at BofA see non-GAAP EPS falling 5% this year but then bouncing back sharply in the out year and through 2026. The current Seeking Alpha consensus numbers are about on par with what BofA projects, and a bit more sanguine when looking out several quarters. Marriott’s revenue growth is forecast to be solid in the mid-single digits.

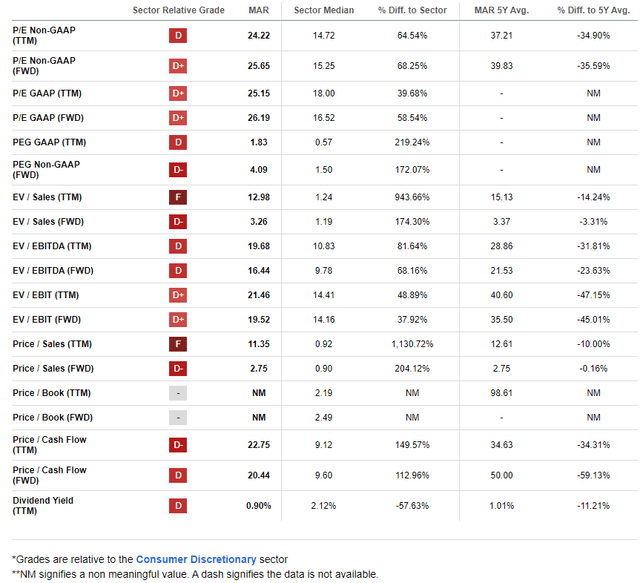

The company recently hiked its quarterly dividend, but the yield today is barely more than 1%. Still, with share buybacks ongoing, shareholder-friendly moves are encouraging if you are a bull. But now with an earnings multiple well into the 20s, the valuation case is less compelling.

Marriott International: Earnings, Valuation, Free Cash Flow Forecasts

MAR’s P/E is indeed pricier compared to when I last looked at the stock. Nearly a 26x operating earnings multiple, I see the company as fully valued. Given 12% long-term EPS growth, if we assume a PEG of 2.0, then the P/E should be about 24x. If we go with $10.20 of EPS over the next 12 months and use the 24x multiple, then we are talking about a stock worth around $248, near where it trades today.

To be fair, MAR’s long-term average P/E is close to 40, though that includes values from the distorted pandemic era. The stock is also a big cheap on a price-to-sales basis.

Marriott: Weak Valuation Metrics

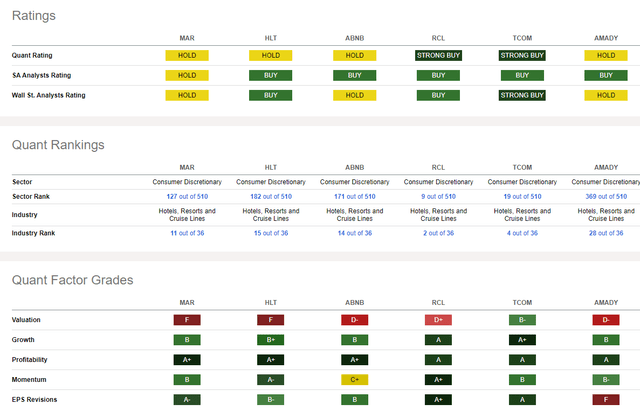

Compared to its peers, MAR features a weak valuation rating while its growth trajectory is high-quality. Profitability trends are likewise impressive, though the free cash flow yield is not particularly high. Still, share-price momentum is decent and there have been a slew of sell-side upward EPS revisions in the past 90 days.

Competitor Analysis

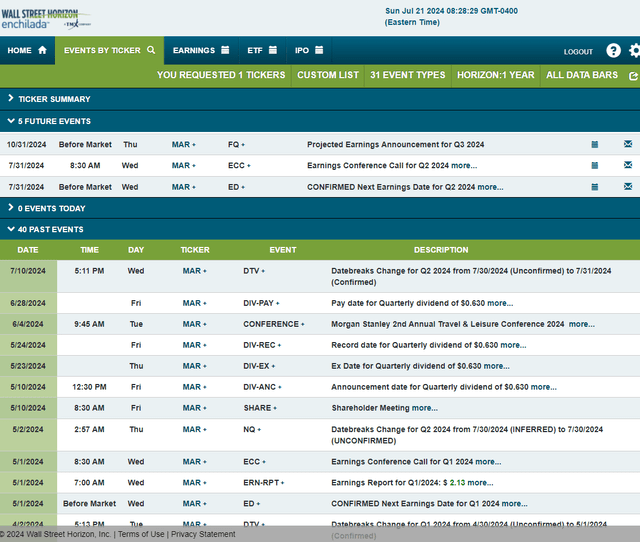

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Wednesday, July 31 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The Technical Take

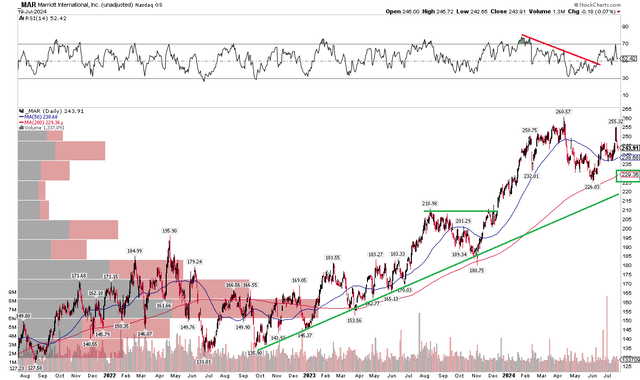

With a fair valuation and earnings growth ahead, MAR’s chart is generally sound. Notice in the chart below that the primary feature is an uptrend dating back to the middle of 2022. Shares traded down to $131 that year and went on to nearly double to a peak above $260 in the most recent quarter. The April and May stretch was a period of downside price action, though, as the RSI momentum oscillator turned lower. But that gauge broke out during the middle of last month as the stock price rallied.

Shares failed to make a new high, however, so the bears do have a say today. But with a long-term 200-day moving average that is positively sloped, the bulls control the primary trend. I see support in the $226 to $229 zone – the low from the second quarter and where the 200dma comes into play. Resistance is apparent in the $255 to $260 range – the two most recent highs.

Overall, the technicals are solid, but the uptrend has certainly slowed considering that shares are about unchanged since January while the broader market has advanced.

MAR: Uptrend Intact, but Momentum Slowing

The Bottom Line

With the stock near intrinsic value and an uptrend that has eased in its momentum over the past six months, I have a hold rating on Marriott International ahead of its Q2 report next week.