J Studios/DigitalVision via Getty Images

Tencent Music Entertainment Group (NYSE:TME) is China’s largest online music and audio entertainment platform. TME owns and operates China’s most popular music app QQ Music as well as other popular online music, audio, karaoke, and music-centric live-streaming apps including Kugou Music, Kuwo Music and WeSing. Although TME’s revenue has declined over the past 3 years, the company has achieved record earnings in FY 2023 as gross margin expanded and operation efficiency improved. However, TME trades at a significant premium over other Chinese ADRs. I believe TME’s fairly valued at this price, and there might be a re-rating on the downside due to geopolitical risks. Therefore, I’m giving TME a “hold” rating.

China’s online music market

According to the report by CIC (China Insight Consultancy), in 2023, China's online music market increased 33% to approximately RMB 32.2 billion ($4.5 billion). CIC predicted that China's online music market will reach RMB 49.5 billion ($6.9 billion) by 2025 driven by higher penetration rate and higher ARPU (average revenue per user). In the same report, CIC estimates that China has 744 million of online music users. However, there are only 150 million paying users (mostly TME and NetEase Music), or about 20% of the total online music users.

TME absolutely dominates China’s online music market. There are very statistics regarding TME’s dominance. For instance, Statista estimated that TME has a market share of rough 60% in terms of monthly active users (MAU) as of February 2024. According to another report, TME’s market share of the paid online music market is even higher, at more than 70%.

TME’s early monopoly

Investors who are familiar with Tencent Holdings (OTCPK:TCEHY) should know Tencent’s playbook in its core gaming business. In a nutshell, Tencent Games achieved its dominance through internal competition, acquiring the best global game developers, and channel dominance. With TME, Tencent almost repeated the exact same playbook.

According to this detailed report, back in the early 2000s when the music industry underwent the seismic shift from traditional music players to online music platforms, Tencent developed its famous QQ Music app. Baidu (BIDU), Sina and Kugou all entered the market with their own online music apps. However, back then, China’s online music industry was characterized by a wide-spread lack of awareness about copyright. Therefore, pirated music, which was free to download, made it impossible for the online music apps to monetize their products.

After the initial money-losing stage, a senior executive from Sina Music who had good relationships with numerous copyright holders and the four major international music rights players (Universal Music Group, Sony Music, Warner Music Group, EMI), acquired both Kugou Music and Kuwo Music and established CMC (China Music Corporation). CMC quickly became the dominant player in China.

The turning point for the industry came in 2015, when Chinese regulators cracked down on online music copyrights and required the removal of all pirated music content from all major online music apps. As a result, copyright prices skyrocketed. In 2016, Tencent acquired CMC and merged it with QQ Music to form a new group called Tencent Music Entertainment Group, namely the TME Group. In 2017, TME reached a strategic agreement with Universal Music Group, becoming its exclusive copyright licensee in mainland China. After the agreement with Universal Music, TME essentially monopolized the market because TME had secured exclusive music copyrights from the world's largest three major players (Universal, Sony, and Warner) in mainland China. Other companies had to pay a sublicensing fee and distribution fee to TME in order to distribute content from TME’s music library on their own platforms.

The break-up of TME’s monopoly

TME’s days of monopoly didn’t last too long. With the rapid growth of platform companies such as Alibaba (BABA), Baidu (BIDU) and Tencent, the Chinese government became increasingly alert. Finally, in November 2020, China’s State Administration for Market Regulation (SAMR) issued the draft of the Guidelines for anti-monopoly in the Platform Economy “in order to prevent and stop monopolistic behavior in the platform economy, guide operators to operate in compliance with laws and regulations, and promote the sustainable and healthy development of the online economy”.

A few months after the introduction of the anti-monopoly guidelines, the SAMR ordered TME to give up its exclusive rights to music labels in 30 days to "restore market competition". Shortly, Sony signed a new direct China digital distribution deal with NetEase Cloud Music while extending its existing agreement with TME for a multi-year period.

Ironically, the end of TME’s exclusive rights has actually helped TME to improve its margins as the bargaining power of the big three players actually weakened as they now have to negotiate with both TME and NetEase Cloud Music. TME’s gross margin improved from 30% in 2021 to more than 35% in 2023. And NetEase Cloud Music’s gross margin increased to 26.7% in 2023 from merely 2% in 2021.

Not only did TME and NetEase Cloud Music’s content acquisition cost declined, their ARPU have increased as well as users are more willing to pay for the content. NetEase Cloud Music disclosed that its monthly ARPU has increased from RMB 6.6 at the end of 2022 to RMB 6.9 at the end of 2023. Similarly, TME’s monthly ARPU increased even more from RMB 8.9 at the end of 2022 to RMB 10.7 at the end of 2023.

Financial projections and valuation

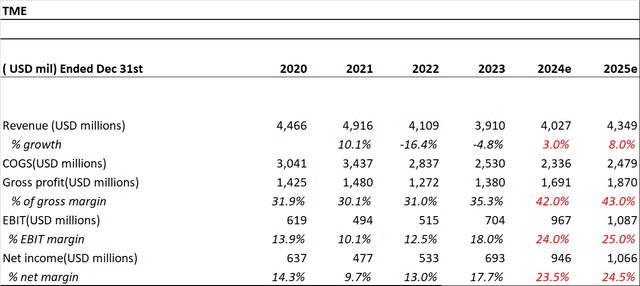

In my model, I assumed that the TME’s revenue will 3% in 2024 and 8% in 2025, which is consistent with the sell side’s estimates range. I also assume that TME’s margin will continue to expand in FY2024 and FY2025 as TME continues cost optimization. Combining these assumptions, I arrive at my own estimate of TME’s 2025 net income of $1,066 million.

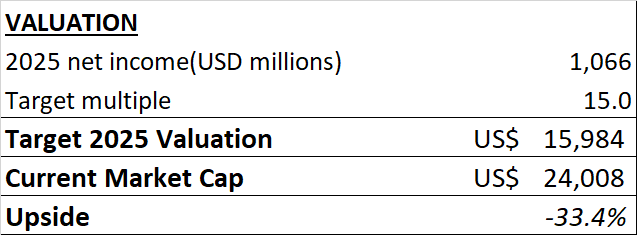

On the valuation side, I applied 15 times TTM PE multiple, which is a big discount to TME’s current multiple to reflect the China risk.

author's estimate

Based on my assumptions, TME appears to have at least 30% downside risk at this price.

Conclusion

As the dominant player in China's online music market, TME is likely to get back to revenue growth in the next few years. Meanwhile, its gross margin and net margin are likely to further expand as operation efficiency continues to improve. However, TME’s significant valuation premium over other Chinese ADRs poses a risk of valuation downgrade. Therefore, I’m giving TME a “hold” rating.