jewhyte

What Happened

Microsoft Corporation (NASDAQ:MSFT) stock dipped over 3% following a slight miss on Azure revenue expectations for its fiscal Q4 earnings. The sentiment was further impacted by a global outrage, triggered by CrowdStrike (CRWD)'s software update affecting 8.5 million Windows devices. Despite playing the role of “victim,” costing Fortune 500 companies $5.4 billion, MSFT's growth outlook remains strong, driven by significant capex on GenAI. However, recent comments from Google's (GOOGL) management during its Q2 earnings report have raised concerns among investors about the timeline for monetizing these billion-dollar AI investments, suggesting it may take longer than anticipated.

In my previous coverage, I was bullish on MSFT due to Azure's growth reacceleration and a faster pace of AI monetization, especially with OpenAI's launch of SearchGBT, which poses strong competition to GOOGL. Despite the slowdown in Azure revenue, I believe the post-earnings selloff was primarily driven by high expectations for continued improvement in cloud growth and margin expansion. A slight YoY growth slowdown does not indicate that the company has completely lost its growth momentum, as management expects a rebound in cloud growth in 2H FY2025. As its valuation multiples have returned to their 5-year averages after the recent pullback, I reiterate my bullish view on the stock.

Slowdown in Cloud Business; See Turnaround in 2H FY2025

Seeking Alpha

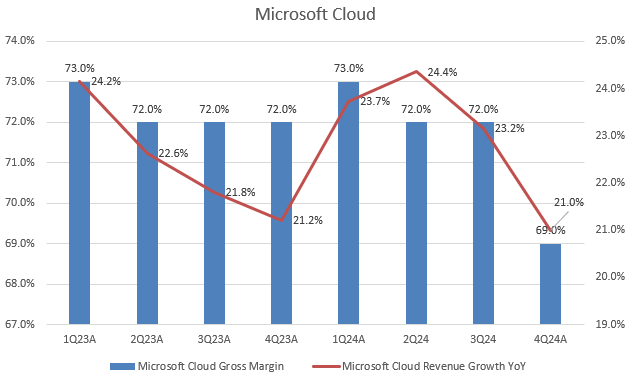

While MSFT exceeded both revenue and GAAP EPS expectations, its Azure revenue growth showed a slight deceleration, increasing by 29% YoY, which was below market estimates and the company's previous guidance. Additionally, there was a modest QoQ growth slowdown in the Microsoft Cloud segment, which grew by 21.4% YoY compared to 23.2% in 3Q FY2024.

In the 4Q FY2024 earnings call, MSFT continues to expect a double-digit top-line growth in FY2025. Particularly, Azure revenue growth in 1Q FY2025 to be in a range of 28% to 29% in constant currency, indicating a slight growth deceleration QoQ. However, management is confident that Azure's growth will reaccelerate in 2H FY2025 as previous capital investments lead to increased AI capacity to meet the growing demand.

Overall, I believe that the 4Q earnings result was still robust, as the selloff reversed from 7% to 3% after the earnings call. The negative price action of the stock might imply a strong expectation in its cloud segment, as the stock's valuation multiples have been increasing over the past year.

Margins Experience Softness

In addition, the Microsoft Cloud's gross margin contracted to 69% in the last quarter, dropping below the 70% threshold for the first time since 4Q FY2022. The result was also below the market consensus. Despite a contraction in its gross margin in the last quarter, the company mentioned 70% gross margin outlook in FY2025. Meanwhile, the operating margin was 43%, 70-bps higher than the midpoint of the previous guidance. However, this result showed a 160-bps contraction compared to the previous quarter and was 5 basis points lower than 4Q FY2023. This led to a soft GAAP EPS beat, with 4Q GAAP EPS only $0.02 ahead of estimates, implying a 9.5% YoY growth, which might disappoint some investors.

Strong Capital Spendings on AI Boosting Growth Outlook

The company model

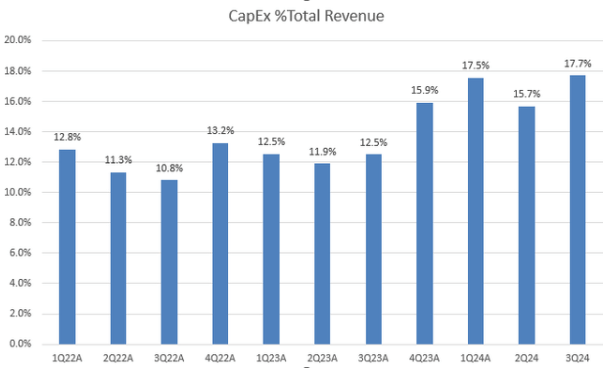

MSFT's capex as a percentage of total revenue increased to 21.4% in 4Q FY2024, up from 17.7%, reaching a record high. This demonstrates that the company is still maintaining elevated capital investments in AI compared to other peers. Despite the elevated capex, the company's FCF grew 17.6% YoY in 4Q, largely driven by strong growth in OCF. The 4Q number will contribute to a 24.5% YoY growth in FY2024 FCF, marking the highest growth rate since FY2017. This demonstrates management's excellent execution in generating significant FCF while simultaneously increasing high capex on AI to maintain strong future growth. In addition, the company also anticipates a higher capex in FY2025 compared to last year. We saw its capex as a percentage of revenue has been rising, which, I believe, is a bullish signal in the AI race, especially when compared to Google's capex outlook last week.

SearchGBT and Advertising Business

Unlike Google Search, where users type keywords and receive content based on relevance without the ability to change the sequence, SearchGBT provides relevant and more accurate summaries of each search result. It has clear citations and allows users to ask follow-up questions. This prototype collaborates with many publishers and creators, including WSJ and The Atlantic, and OpenAI is considering integrating it directly into ChatGPT, enabling cross-sharing of the user base. Although SearchGBT still in its early stages and OpenAI currently experiencing significant operating losses, the company might develop a monetization strategy, such as leveraging its advertising business to diversify its revenue mix. As GOOGL faces an antitrust trial over its dominant position in the digital advertising business, MSFT could potentially gain market share from Google in the long term. There was a selloff in GOOGL's stock following the news release last week.

Valuation

Due to the recent stock pullback, Microsoft's valuation multiples have come closer to their 5-year averages. Considering the post-earnings selloff, its P/E GAAP TTM has decreased to 33.8x, in line with its 5-year average of 33.45x according to Seeking Alpha. Factoring in street consensus on the company's EPS growth in FY2025, the multiple will be 30x, which is only 6% higher than Nasdaq 100-Index's (NDX) P/E fwd.

Currently, the stock is trading at a premium of 12.6x EV/Sales fwd compared to the software large-cap average of 10.4x according to J.P. Morgan. However, I believe the company will sustain its current growth trajectory due to its AI monetization on strong capital investments, justifying a higher-than-average valuation multiple. Therefore, the post 4Q earnings selloff creates an attractive buying opportunity.

Conclusion

In conclusion, despite a recent pullback in MSFT's stock following a slowdown in Azure revenue, the company's growth trajectory remains robust. The temporary setback in Azure growth is expected to be mitigated by substantial investments in AI and a strong capex commitment, which are likely to drive a reacceleration in 2H FY2025. The recent decline in valuation multiples to near their 5-year averages shows an attractive buying opportunity, as the market’s high expectations have been reset due to the broad-based pullback. Therefore, I maintain a buy rating on the stock, as ongoing AI monetization and significant capex investments are likely to drive long-term growth.