Darren415

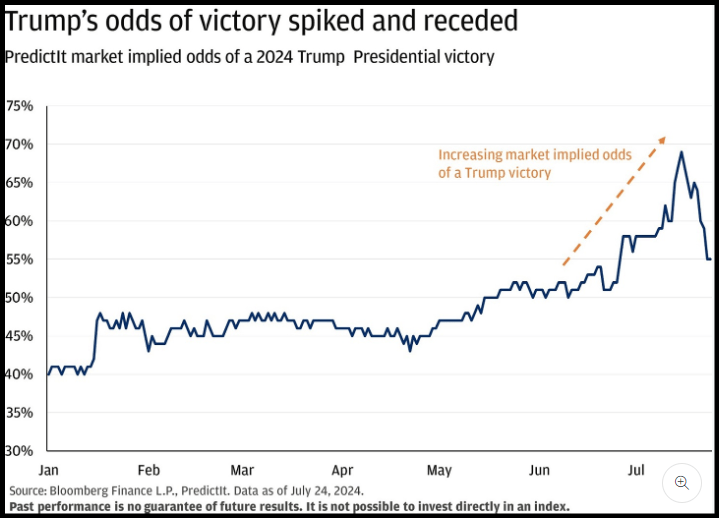

The Trump Trade retreated after Vice President Kamala Harris replaced Joe Biden as the likely Democratic presidential nominee. Investors and analysts mulled the possibility of a Silicon Valley Commander-in-Chief with more progressive leanings on green energy, electrification, and cannabis legalization. According to the Real Clear Politics (RCP) poll of polls average, Trump was up 3.1% over Biden, when the latter dropped out of the race on July 21, 2024. Since becoming the presumptive head of the Democratic ticket, Harris has narrowed Trump's lead, and the New York billionaire's odds of victory have receded from a 70% high. According to several new polls, Harris closed the gap in key battleground states.

Trump Election Victory Odds (JP Morgan)

Harris is widely expected to continue pursuing many of Biden's policies, but may differentiate her administration in three areas: technology, clean energy, and cannabis legalization.

Silicon Valley

Harris' support in Silicon Valley is high. Optimism that Harris could bring moderate policies to regulate the tech sector resulted in tech executives and moguls backing Harris, who raised over $100M. Harris has deep ties to Silicon Valley and may be more open-minded about emerging technologies than the Biden administration. Wall Street Analyst Jim Cramer predicted Harris would be good for mega-cap technology stocks.

"I'm regarding this as Mega versus MAGA. Mega tech does better with someone... who understands California, who's not against tech," said Cramer.

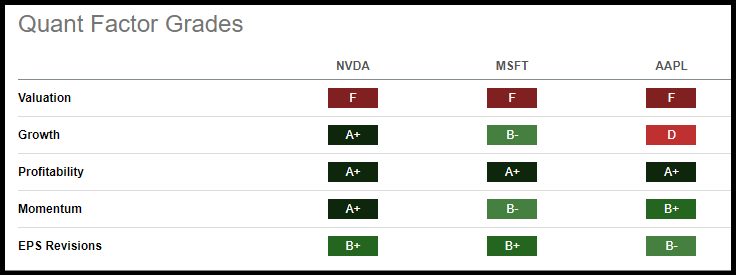

MEGA vs. MAGA may or may not be an accurate dichotomy. However, many mega-cap stocks with a market capitalization over $200B have not actually been the most attractive stocks, based on companies with strong investment fundamentals, in the tech sector according to Seeking Alpha's Quant Ratings. Only one member of the Mag 7, Nvidia (NVDA), is among the top 20 performers in the S&P 500 YTD. The three largest technology sector stocks: Nvidia, Microsoft (MSFT), and Apple (AAPL), have Hold ratings due to 'F' valuation factor grades. Nvidia is trading at ~40x earnings, a 67% premium to the tech sector, Microsoft (MSFT) 35x, and Apple (AAPL) 32x.

Nvidia, Microsoft, Apple Quant Factor Grades (SA Premium)

Stocks outside mega-cap territory look attractive in other market sectors, including clean energy, widely expected to be a key plank of Harris' platform.

Clean Energy

Tech is not the only sector Wall Street and investors are optimistic about under a potential Harris regime. Praised by environmentalists as having a more progressive climate change record than Biden and Trump, the "greens" are expecting a stronger green agenda under a potential Harris administration. Four of the most prominent environmental groups endorse Harris, who, as a senator, was an early co-sponsor of the Green New Deal. As a presidential candidate in 2020, Harris unveiled an energy transition plan to invest $10 trillion in electric power grids, battery storage, carbon sequestration, EVs, solar panels, and wind turbines.

Following the July 21st announcement of Harris' candidacy, ETFs like The Energy Select Sector SPDR Fund ETF (XLE), Vanguard Energy Index Fund ETF (VDE), and iShares U.S. Energy ETF (IYE) that are heavily tied to oil fell. Conversely, renewable ETFs like iShares Global Clean Energy ETF (ICLN) and GRID First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund ETF (GRID) experienced an uptick and could suggest investors are "betting on a greener future" under a Harris administration. Speaking of a greener future, with the Department of Justice looking to reclassify marijuana as a less risky Schedule III drug, cannabis has become a hot topic, especially as more states push for legalization.

Cannabis

Equity research firm Zuanic & Associates believes a Harris victory in November would be more beneficial for cannabis stocks, given her potential to advance rescheduling and other reforms. Most cannabis stocks and ETFs closed with solid gains the day after Biden stepped down and was replaced by Harris as the likely Democratic nominee. Canopy Growth Corporation (CGC) surged by 17%, Jushi Holdings (OTCQX:JUSHF) +7%, Cresco Labs (OTCQX:CRLBF) +6%, and AdvisorShares Pure US Cannabis ETF (MSOS) +6%.

On July 15th, thematically aligned with potential investor sentiment on a Trump 2.0 administration, spanning the steel, construction, big banking, energy, and defense industries, the Quant Team named five Top Trump Trade stocks that are collectively up more than 5% in two weeks. Each stock was rated 'Strong Buy' according to the quant ratings and driven by solid investment fundamentals and earnings growth potential. Similarly, we've identified five Strong Buy stocks thematically aligned with investor sentiment about prospects in a potential Harris administration.

Kamala Harris Presidency: Stocks to Watch

As the presidential election nears, we feature five U.S. stocks spanning the tech, electrical equipment, and cannabis industries that offer meaningful earnings growth data, solid investment fundamentals and are quant-rated 'Strong Buy.'

1. Zeta Global Holdings Corp. (ZETA)

Market Capitalization: $4.59B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 7/31/24): 17 out of 550

Quant Industry Ranking (as of 7/31/24): 6 out of 188

Zeta Global provides a cloud platform that leverages AI to streamline marketing efforts for companies across 15 verticals, including retail, financial services, and telecom. It is forecasting a boost from political campaign spending. As a top quant-rated application software stock, ZETA has been up over 125% in the past year, crushing the market and tech sector (XLK).

ZETA 1Y Price Performance vs. Tech Sector

ZETA 1Y Price Performance (SA Premium)

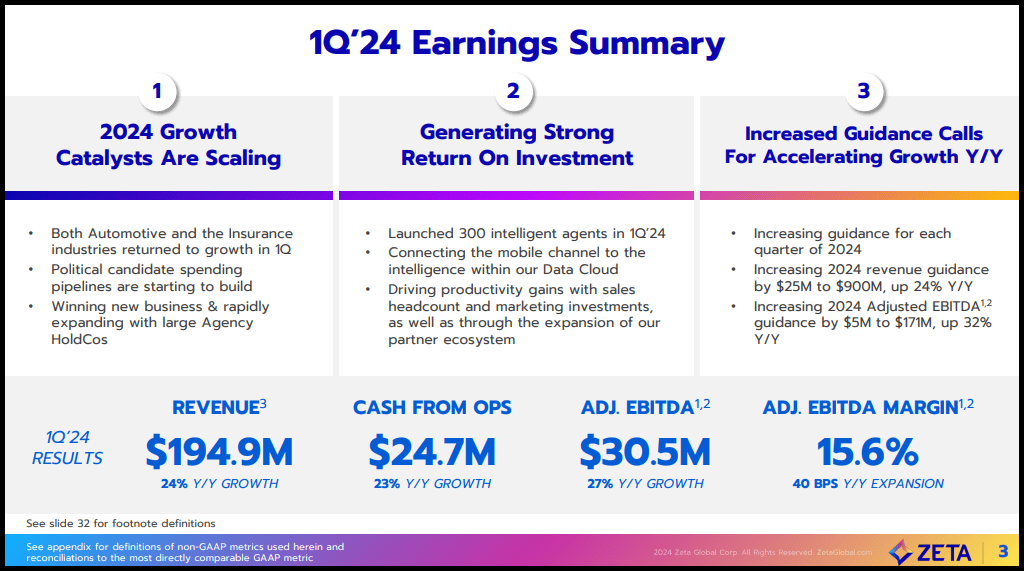

Automotive and insurance market rebounds helped drive Q1 revenue up 24% YoY, EBITDA +27%, and a ramp up in agency business and AI platform hypergrowth. ZETA raised full-year 2024 guidance by $25M to $900M, including $15M in political candidate spending revenue. Zeta is generating strong ROI by driving productivity gains with sales headcount and marketing investments as the political candidate spending pipeline develops amid an expensive 2024 campaign season, according to CEO David Steinberg, who is expecting record numbers.

"There will be more money spent on marketing in this election than any election in the history of the United States of America. And that will be, I believe, a statistical fact when people look back on this cycle," Steinberg said on the Q1 earnings call.

Zeta has an A- Growth grade driven by EPS FWD long-term growth rate (3-5Y CAGR) of +34%. Zeta P/E Growth (PEG) FWD, a heavily weighted valuation metric of 1.15x, indicates the stock is trading at a 40% discount to the sector.

ZETA Q124 Earnings Summary (Investor Presentation)

2. Zscaler, Inc. (ZS)

Market Capitalization: $26.72B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 7/31/24): 41 out of 550

Quant Industry Ranking (as of 7/31/24): 4 out of 46

Zscaler is a Silicon Valley-based technology company that boasts having the world's largest security cloud, and a top quant-rated Systems Software stock. ZS shares rose in June after announcing a partnership with Nvidia to deliver AI-powered cybersecurity innovations, including copilot technologies. Wedbush picked Zscaler among stocks projected to surge on AI capabilities as benefits broaden out from mega-caps.

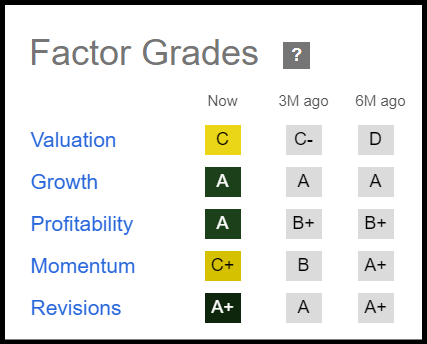

ZS Factor Grades (SA Premium)

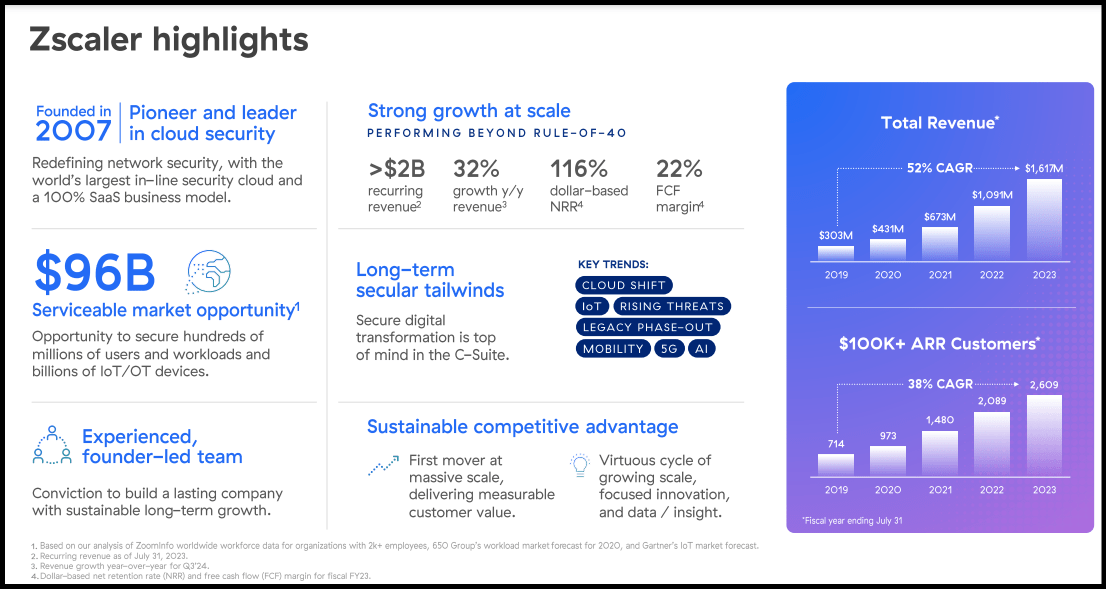

ZS, estimating its total serviceable market at $96B, sees potential growth opportunities driven by long-term secular tailwinds and secure digital transformation being a top priority for executives. Strong growth in Zscaler's most recent quarter was driven by continued demand for its Zero Trust Exchange platform, designed to secure communication among users, workloads, and devices. Zscaler expects demand to remain strong as an increasing number of enterprises are planning to adopt the ZS platform.

Zscaler Financial Highlights (Investor Presentation)

ZS EPS long-term growth rate forward is a whopping 39%, driving Zscaler's 'A' Growth Grade. ZS beat earnings for eight straight quarters, and FY24 EPS is projected to grow +68% to $3.01. Zscaler has an astounding 36 upward revisions in the past three months and is trading at a 10% discount to the sector based on a forward PEG ratio of 1.73x.

3. ACI Worldwide, Inc. (ACIW)

Market Capitalization: $4.51B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 7/31/24): 23 out of 550

Quant Industry Ranking (as of 7/31/24): 11 out of 188

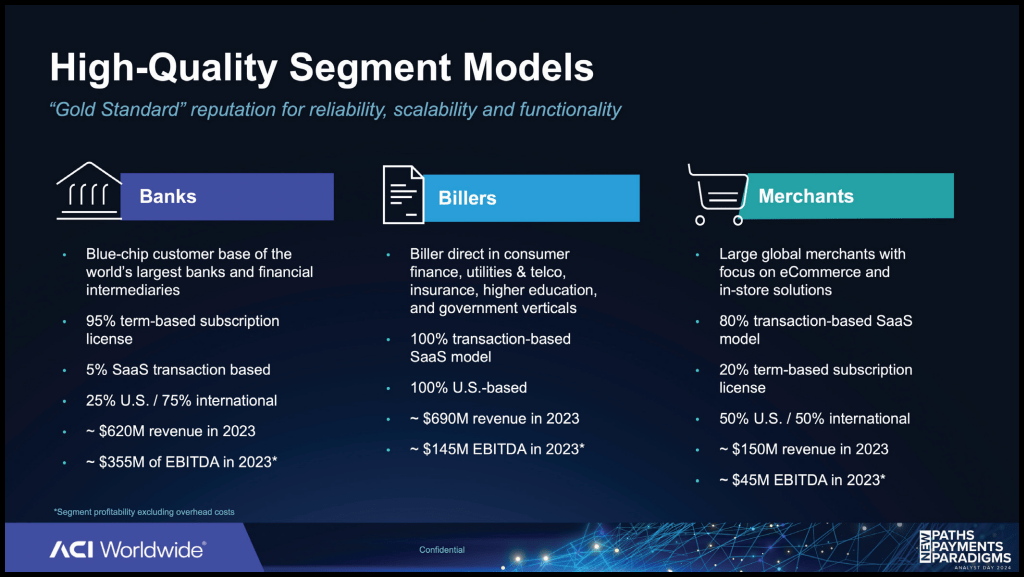

ACI Worldwide develops software solutions for facilitating digital payments in the United States and internationally, up 85% in the past year. On July 10, 2024, ACI was named to the CNBC/Statista list of the world's top fintech payment companies. ACI revenue derives from three business segments in Q124:

Billers (55%)

Banks (33%)

Merchant (11%)

ACI provides SaaS-based bill payment services, serves major banks worldwide with high-margin licensed software, and offers scalable payment platforms to merchants.

ACIW Business Segments (Investor Presentation)

Banking revenue grew 20% YoY in Q124, merchant sales by 3%, and biller revenue by 5%. Banking is a key focus area, with a rise in sales driven by a renewal of a large regional bank contract, new contract expansions worldwide, and international real-time payments demand from regulatory mandates. ACI 'B' in Profitability is driven by EBIT margin of 18% vs. the sector's 5% and levered FCF margin of 14%. ACIW is trading at 19x earnings, an 18% discount to the sector, and has a PEG FWD of 1.32. FY24 EPS is projected to grow 16% to $2.17 and revenue +7% to $1.56B.

4. NewLake Capital Partners (OTCQX:NLCP)

Market Capitalization: $406.37M

Quant Rating: Strong Buy

Quant Sector Ranking (as of 7/31/24): 1 out of 179

Quant Industry Ranking (as of 7/31/24): 1 out of 12

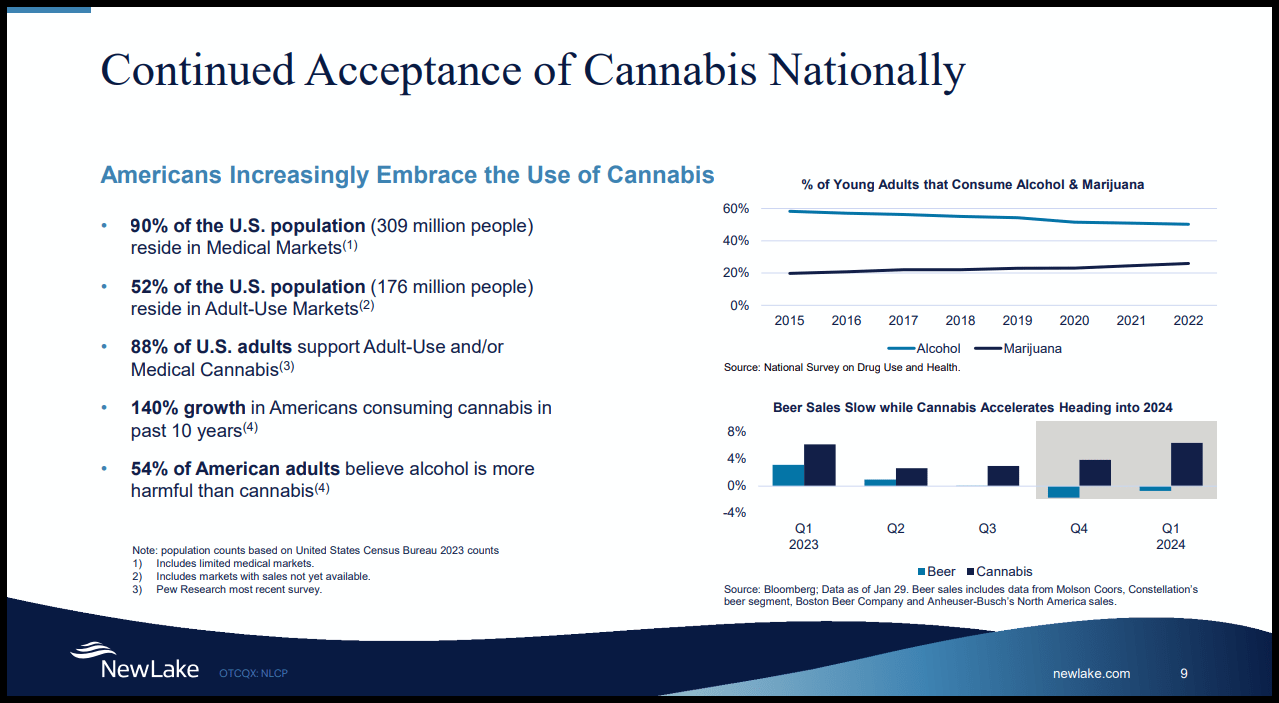

NLCP provides real estate capital to state-licensed cannabis operators, with a portfolio of 31 properties, including 14 cultivation facilities and 17 dispensaries. NLCP is #1 among Real Estate stocks, the #1 industrial REIT, up 55% in the past year. NLCP is looking to capitalize on expansion in a high-growth industry - a market projected to rise by a CAGR of 10% to 2027.

National Cannabis Trends (NLCP Investor Presentation)

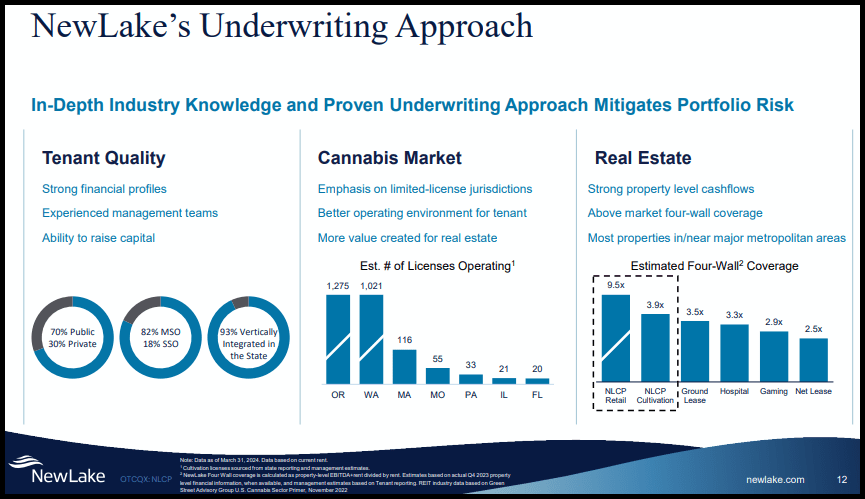

As highlighted in the visual above, Americans are increasingly embracing the use of Cannabis and NLCP sees growth catalysts in medical states expanding programs and strong medical markets transitioning to adult-use. NLCP's underwriting approach mitigates risk, with a wide tenant/borrower composition and 100% triple net leases with 15 to 20-year terms.

NLCP Underwriting Approach (Investor Presentation)

NLCP has A's across four factor grades, a 'B' in Growth, with bullish ratings from SA and Wall Street analysts. NLCP Dividend Scorecard showcases an A+ Dividend Safety Grade, offering an astounding 8.8% yield. Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) growth and margins are crucial metrics in assessing REIT performance. NLCP FFO has grown 12% YoY vs. 1% for the sector, and AFFO to revenue margin is a whopping 84%, about 40% above the sector median. NLCP is trading at price/AFFO FWD of 9x, a 40% discount to the sector.

5. Powell Industries, Inc. (POWL)

Market Capitalization: $1.60B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 7/31/24): 16 out of 627

Quant Industry Ranking (as of 7/31/24): 2 out of 67

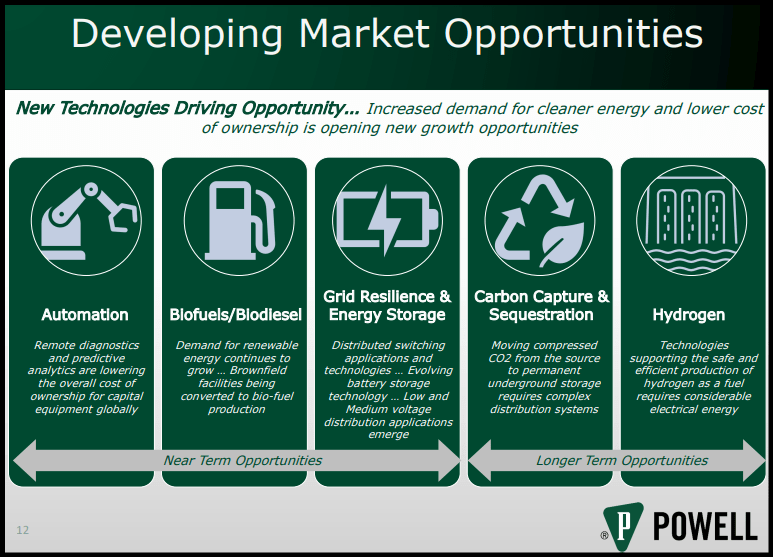

While Powell is not an energy company per se, it is dedicated to providing reliable power distribution, from industrial to oil and gas, liquid natural gas (LNG), petrochemical, and renewables. It is pushing to be more sustainable and could benefit from green energy. Powell builds complex custom-engineered electrical solutions for clients in the industrial and energy sectors including utilities, transportation, oil, and LNG end markets. Powell's focus on developing new technologies to meet growth opportunities from increased demand for electric grid resilience, distribution applications, battery storage, carbon capture and sequestration, biofuels, and hydrogen applications stands to benefit from a boom in energy transition projects and renewables.

POWL Target Markets (Investor Presentation)

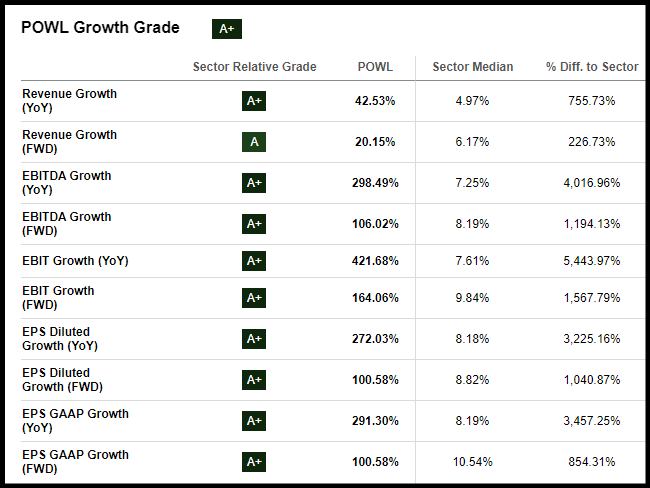

Powell is #2 among quant-rated electrical component and equipment stocks, up 125% in the past year. POWL skyrocketed to +35% after beating top and bottom line expectations for Q3 of its FY 2024, with revenue soaring +50% YoY and gross profit +92%, driven by strong growth in the oil and gas sectors, and a significant increase in new orders from the electric utility sector. Q3 EPS of $3.79 beat by $1.63 and revenue of $288M (+50% YoY) beat by $65.82M.

Powell's explosive profitable growth is expected to continue, with consensus estimates projecting FY24 EPS to rise 123% and revenue +30%. Powell outperforms industrial sector profitability with a net income margin of 12% and levered FCF margin of 23%. PEG FWD of 1.36 indicates the stock is trading at an attractive valuation, a discount of about 23%.

POWL Growth Grade (SA Premium)

Bonus Stocks For a Potential Harris Presidency

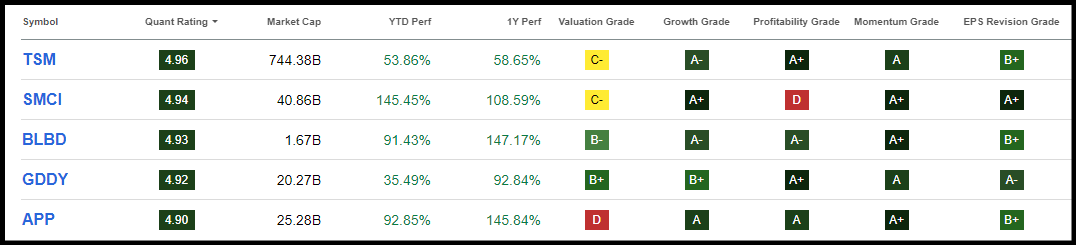

We want to highlight some oldies but goodies quant Strong Buy stocks we've covered this year in tech and industrial sectors, aligned with investor sentiment on prospects under a potential Harris administration. The top tech and industrial stocks all have A's in Momentum, solid growth track records, and nearly all have high projected earnings targets.

Bonus Harris Trade Stocks (SA Premium)

Taiwan Semiconductor Manufacturing Company Limited (TSM) - TSM is #1 among quant-rated semiconductor stocks, up 58% in the last year, and the only Strong Buy mega-cap stock. TSM is not based in the U.S. but struck a deal with the Harris-Biden administration to build chip factories in Arizona, although it faces geopolitical risks amid U.S. tensions with China.

Super Micro Computer, Inc. (SMCI) - SMCI is a Silicon Valley company that provides high-performance server and storage solutions to tech giants like Nvidia, up ~108% in the past year, and listed among our Top 10 Tech Stocks for 2024 and a top H2 2024 stock.

Blue Bird Corporation (BLBD) - Blue Bird rallied in July after winning a DOE grant to expand EV manufacturing capabilities as part of the Biden-Harris administration's effort to meet the rising demand for clean student transportation nationwide. BLBD is the #1 quant-rated heavy machinery and truck stock, up over 140% in the past year.

GoDaddy Inc. (GDDY) - GDDY is the #1 quant-rated Internet Services and Infrastructure stock, named a top tech stock for 2024, and is up more than 90% in the last year.

AppLovin Corporation (APP) - APP, another Silicon Valley-based company, provides AI solutions for businesses to reach, monetize, and grow audiences, named among SA Quant's Top 10 Stocks for 2024.

Concluding Summary

Politics can play a large role in the markets. Investors are weighing in on Democratic presidential front-runner Kamala Harris who, if elected, is expected to embrace a more tech-friendly approach than Biden or Trump, and pursue more ambitious clean energy and cannabis policies. As Wall Street feels the effects of the rotation out of the Magnificent Seven while mulling the prospect of a Silicon Valley president and which stocks would benefit from a 'Trump or Harris Trade', the Quant Team identified five Strong Buy stocks in industries aligned with investor sentiment under a potential Harris administration. Each stock possesses strong investment fundamentals and momentum along with earnings growth potential. We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Consider using Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. Or, if you're seeking a limited number of monthly ideas, consider exploring Alpha Picks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.