Editor's note: Seeking Alpha is proud to welcome Deia Capital as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Omega Speedmaster Professional Apollo XI Watch Rare White Panda Dial Mlenny

Synopsis

The Swatch Group (OTCPK:SWGAY), a highly integrated luxury watch manufacturer, has had a negative financial performance with its EPS decreasing by 35% from 2014 to 2023. Due to headwinds in China, the 2024 H1 results showed a significant, additional drop in net earnings. This negative performance was mainly driven by external factors. But, unfortunately, Nick Hayek, the CEO and main representative of the group's majority owners, did not show any willingness to turn around the group's fortune.

At current share prices, The Swatch Group offers an irresistible valuation: a 10-year trailing, net cash-adjusted PER below 9 together with a 3.7% dividend yield. This attractive valuation is combined with strong downside protection thanks to the group's assets: 1) the sum of the net assets at market value is worth 2-3x the group's total current market cap, 2) the group is debt-free, and its net liquidity represents 15% of the market cap.

Once the luxury market stabilizes, it will be easy for The Swatch Group to achieve its historical average level of profitability thanks to the current low utilization (and profitability) of its manufacturing capacity, its leading position in China, Harry Winston's fast-growing margin contribution, and the continuous strength of Omega, the group's anchor brand. The market does not believe the turnaround will be quick, but management disclosed that in June operating margin already rose again to over 15%, 2 percentage points higher than the 10-year average.

US-based investors can invest directly in The Swatch Group through an ADR under the ticker SWGAY.

Intro: A Swiss Titan With Tentacles Stretching From Clock-Hand Production To High-Street Retailing

The Swatch Group is a multi-brand Swiss watch and jewelry producer, established by the defunct Nicolas Hayek in the early 1980s. To go deeper into how he did it, I highly recommend reading this interview.

More than 4 decades after its establishment, The Swatch Group is still controlled by the family Hayek through 43% of total voting rights.

Nicholas G. Hayek - Founder of The Swatch group (Company website)

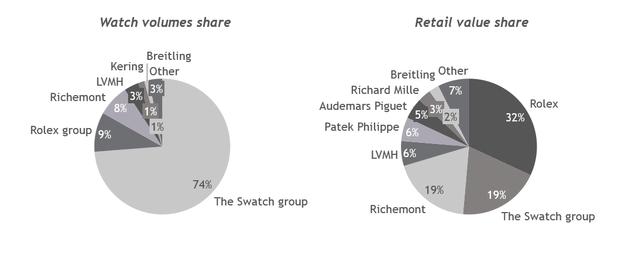

The Swatch Group is a watch juggernaut. According to data published by Morgan Stanley, The Swatch Group produces 74% of all Swiss watches and is only second in total revenues among all global watch companies after Rolex.

Watch volume and retail value shares of Swiss watch (Morgan Stanley Swiss Watch Industry Report 2023)

Moreover, The Swatch Group is characterized both by a high degree of horizontality and verticality.

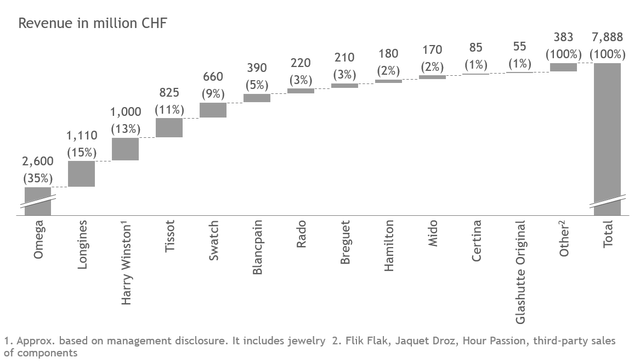

In terms of horizontality, the company covers all price segments with its 17 brands. Its kids watch brand Flik Flak retails watches for less than CHF 50, whereas the luxury brands of Blancpain and Breguet offer watches that can reach a million CHF. Across its brand portfolio, the crown jewel is Omega. According to Morgan Stanley, Omega achieved CHF 2.6b in revenues in 2023, representing 35% of the group's total revenues and positioning it as the third-largest watch brand globally after Rolex and Cartier. After Omega, Longines, Harry Winston, Tissot and Swatch are the next largest brands, generating together with Omega more than 80% of the group's total revenues.

Watch brands owned by The Swatch Group (company website) Revenue breakdown per brand (2023 Morgan Stanley Swiss Watch Industry Report, Management disclosure)

In terms of verticality, the group owns companies along the entire watch value chain. This enables The Swatch Group to design, manufacture, assemble, and retail all its branded watches including their components through group-owned subsidiaries. Since the foundation of The Swatch Group, Nicholas Hayek was always determined to guarantee the independence of the group against other companies. The current footprint across the value chain leads to a high level of independence from suppliers and retailers and is the result of decades of investment decisions.

In retail, the group presence is less developed but increasing. In the H1 2024 results, management disclosed the group's retail activities already reached 45% of total sales. A significant part of these activities are carried out in monobrand boutiques in premium locations and whose real estate is directly owned by The Swatch Group. Additionally, The Swatch Group has developed its own multibrand retail concepts, Hour Passion and Tourbillon, as additional direct sales channels for its brands' portfolio. According to its website, as of 2023, the group operated 70 multi-brand boutiques worldwide, mainly under the Hour Passion concept.

Example of Hour Passion, The Swatch Group's multibrand watch retailer (company website) Example of monobrand watch boutique (Company's website)

Market Value Of The Swatch Group's Sum Of The Parts: A Liquidator's Dream

The Swatch Group is currently trading at a similar level to mid-2020, the pandemic peak. With a current market cap of CHF 9.3b, the group looks deeply undervalued.

At the end of H1 2024, The Swatch Group had a common equity or book value of CHF 12.1b, with equity representing an incredible 85% of total assets. The group does not have any relevant debt and the only liabilities are very low levels of accrued expenses, payables, and deferred taxes. I do not recall seeing any other business with such a strong balance sheet.

Currently, the market cap offers a 25% discount against book value. However, the book value clearly understates The Swatch Group's assets market value.

Firstly, The Swatch Group's balance sheet only includes CHF 150m in intangibles and has no goodwill. However, the Omega brand alone is estimated to be CHF 4b worth according to Brand Finance. The same company estimates the Longines brand equity at CHF 1b.

Additionally, Swatch Group paid around CHF 1b for Harry Winston, mainly for the brand, since around 60% of what Swatch paid became goodwill. At the beginning of 2024, Swatch management disclosed that Harry Winston was expected to reach CHF 1b, roughly 3x more revenues than when acquired. Given Harry Winston's positive development after its acquisition, we could be talking about at least an additional CHF 1b just in brand equity.

The rest of the brand portfolio includes legendary names such as Breguet or Blancpain that also carry significant additional brand equity. We could conclude that The Swatch Group has at least CHF 6b in brand equity not included in the equity book value.

Secondly, the group has been investing for decades in its retail network. It has acquired properties in premium locations in London, Paris, NY, Zurich, Tokyo, Geneva. As an example, only in 2023 the group acquired two properties for CHF 210m on Bond Street, arguably the most prestigious luxury shopping street in London. Management disclosed in the 2023 financial report that in total, the group has paid CHF 3b accumulatively for real state acquisitions over the years.

However, the net book value after depreciation of these real estate properties is just CHF 1.8b. Given the high increase in real estate valuations, the company management estimates the market value of the company's real estate is higher than CHF 4b. So, another CHF 2b to be added to the equity book value.

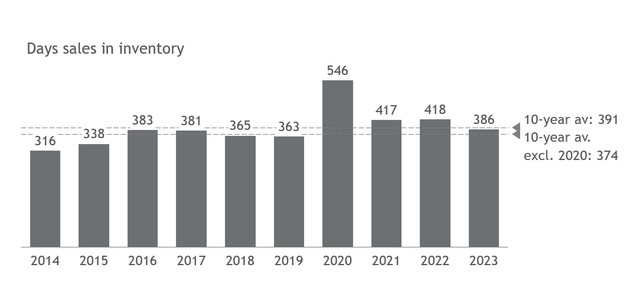

Finally, its balance sheet has CHF 7.7b in inventory, representing over 50% of total assets. Historically, The Swatch Group has been carrying a bit above a year of days sales in inventory. This is very high in comparison to other industries but quite common in the Luxury Watch and Jewelry industry. Watches are a slow-moving, long-lasting consumer good. Watch companies offer a wide selection of watches to cater to different consumer tastes: watch models, dial sizes, materials…

Boutiques need a wide selection of models in stock for customers to try, and many models are offered in expensive raw materials such as diamonds or gold. Moreover, watch manufacturers also need to service old models, so they must have sufficient stock of not only new but also old watch components. Richemont, one of the group's main competitors, has carried an average of 450 days sales of inventory over the last 10 years, above The Swatch Group.

Is the CHF 7.7b inventory excessive? From a historical perspective, this level of inventory seems reasonable. At the end of 2023, days sales in inventory (386) were between the 10-year average (391) and the average when excluding 2020 (374), an uncommon year. Inventory at the end of every H1 has normally increased because of seasonality effects. In 2024, the increase was CHF 500m, equivalent to <30 days sales in inventory. This increase is higher than the historical average, but still not sufficient to ring the alarms.

Historical evolution of days sales in inventory (Company financial reports)

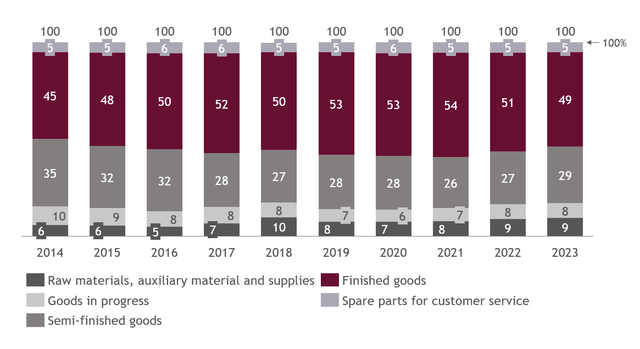

Looking at the 2023 EOY inventory breakdown, 49% was finished goods, 5% were spare parts for customer service, and the rest was inventory in production. The different weights have been very stable over the years and the part most prone to a write-off, finished goods, was in 2023 slightly below the historical average of 50%.

Historical inventory breakdown (Company's financial reports)

It is important to remember that the finished goods have a market value significantly higher than their book value. Over the last 10 years, the ratio of COGS to revenue has averaged 20%. So even if sold at a considerable discount, let's say 50%, the CHF 3.6b of finished goods are still worth more than double. Therefore, several billion CHF would be added to the equity book value when adjusting to market value.

Combining the additional value from brands, real estate, and inventory would result in a market-adjusted equity 2-3x higher than the group's current market cap. The 70% decrease in share price from 2013's peak has created such a deep undervaluation that shareholders would make a huge return just by liquidating the company and selling the pieces.

How The Market Valuation Got There: 1) A History Of Financial Underperformance

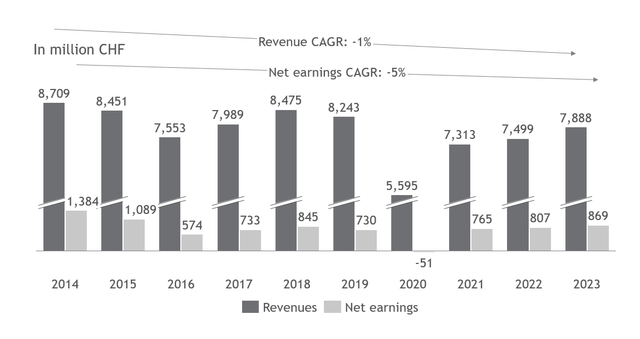

The Swatch Group has performed poorly from a financial perspective. In 2014, revenues and net earnings reached CHF 8.7b and CHF 1.4b, respectively. In 2023, a record year for the Swiss watch industry, the group just made CHF 7.9b in revenues and CHF 0.9b in net earnings (-1% and -5% CAGR, respectively). In H1 2024, a period showing a clear market slowdown vs 2023, revenues dropped by more than 14% vs 2023 and net earnings collapsed to CHF 147M, more than 70% down vs. 2023.

Historical evolution of revenues and net earnings (Company financial reports)

Given the share count has only dropped by 4% since 2014, the results per share have undergone a similar underperformance. This underperformance was partially driven by the market, but also The Swatch Group's fault.

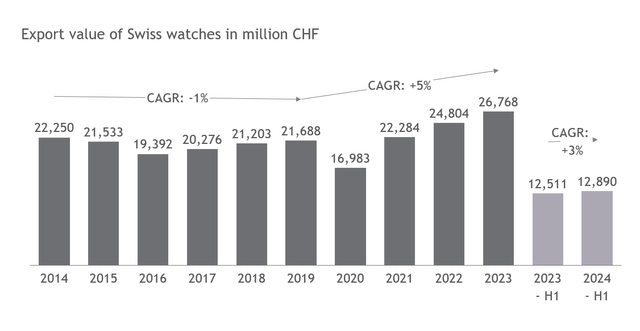

Over the last 10 years, the Swiss watch industry, as a whole, has done relatively well. According to data from Federation of the Swiss Watch Industry, exports of Swiss watches have been growing at 2% CAGR since 2014. Pre-pandemic, industry exports were flat. After a substantial drop in 2020, sales quickly rebounded to a higher level than pre-pandemic. 2023 was a record year with CHF 26.7b in export value. The first six months of 2024 continued the positive trend, even if at a slower rate, with +3% in export value vs. 2023 H1.

Export value of Swiss watches (Federation of the Swiss Watch Industry)

However, The Swatch Group did not benefit from the market tailwind because it was overexposed to the wrong price segment and wrong markets.

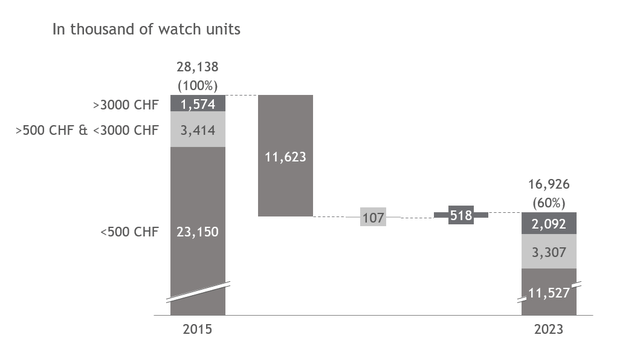

The group is a titan in watch volumes, with a volume share in Swiss watches of 74%. The second Swiss watchmaker group, Rolex and its sister brand Tudor, only sold a bit above a tenth of watches compared to The Swatch Group. However, the average watch retail price of The Swatch Group's brands is estimated to be around CHF 820, considerably lower than the Swiss industry average of CHF 3,100 and Rolex group's average of CHF 12,000.

This overexposure to the most affordable price segments has had terrible consequences. While watch exports grew at 2% CAGR, different price segments moved in opposite directions. Since 2015, the volume of watches below CHF 500 has collapsed by 50%, the volume of watches between CHF 500-3,000 has kept constant and the volume of watches above CHF 3,000 has increased by more than 30%.

Watch volumes evolution by watch price segment (Federation of the Swiss watch industry)

The most affordable segments, where watches have more functional value as a timekeeper, lost appeal against the smartwatch. By contrast, the priciest segments benefitted from the tailwind seen in other luxury sectors: the explosion of global wealth. This watch "luxurization" trend negatively impacted the relative position of several key brands. According to Morgan Stanley, Longines, whose watches are positioned in the CHF 500-3,000 price category, was the 3rd most important Swiss brand in 2014 with 6.2% of the retail value share. In 2023, Longines dropped to the 7th position with just 3.4% share. Tissot, whose watches are mostly positioned in the same price category, dropped from the 6th to 10th position.

In addition to the overexposure to lower price segments, The Swatch Group has been very reliant on China and underexposed to the US. The group entered China aggressively in the 2000s and positioned its brands as leaders in different price segments. Based on estimations from LuxeConsult, Omega is the overall retail value leader in China and Longines is third. Last year, Omega is estimated to have sold 30% of its watches in Greater China vs 15% and 12% of Cartier and Rolex, respectively. More pronounced is the exposure of Longines with a whopping 69% of global sales.

What was a strength has become a weakness, since the Chinese market for Swiss watches has been flat for the last 10 years. In 2014, China incl. Hong Kong imported CHF 4.9b in Swiss watches, representing 22% of retail value share globally. In 2023, imports were just CHF 5.1b or 19% of global value share. In the same period, the US, where the group historically had a relatively low penetration, increased its import share by almost 50% to 16%. The first half of 2024 accelerated the evolution disparity between China and the US, with Swiss watch imports dropping in the former by 21% while the latter experienced an import increase of 4% vs. 2023 H1.

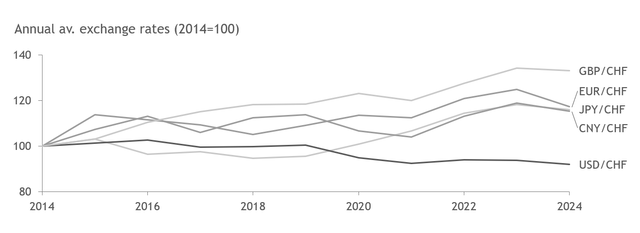

Finally, the Swiss franc's revalorization has also negatively impacted the group's financial performance. Since 2015, the Swiss franc has experienced an upward trajectory against all major currencies but the US dollar. The exchange rate of the Swiss franc increased by 18%, 19%, 25%, 34% against the yen, the yuan, the euro and the British pound, respectively. All The Swatch Group's brands except two small German ones, Glashutte Original and Union Glashutte, are headquartered and have their production in Switzerland, so the vast majority of the group's incurred costs are in linked to the Swiss franc. By contrast, more than 95% of the group's revenues come from international markets in currencies other than the Swiss franc.

Evolution of exchange rates of the Swiss franc against major currencies (Google Finance)

For luxury watch brands, the revalorization of the Swiss franc did not have a significant financial impact, since they were able to pass the cost increases to their customers. Their customers are typically more inelastic, and the main competitors were also Swiss manufacturers. However, Tissot, Swatch, Certina or Hamilton, all below what is typically considered luxury, have more elastic customers and non-Swiss competitors mainly from Japan such as Seiko. So, these brands of the group struggled to pass on the cost increases without losing market share to its Japanese competitors.

Nevertheless, despite clear "external" headwinds, The Swatch Group missed an incredible opportunity in the very high price segment and has not adjusted its cost structure to the new volume reality.

Breguet, The Swatch Group stronghold in the highest price segment, has massively underperformed the market, especially within its price segment. Breguet's average watch retail price is several times the average Swiss watch retail price, and considerably above Rolex's. According to The Swatch Group CEO, a Breguet's watch costs on average CHF 30k. In this price segment, you find what is known as "the holy trinity" of watchmakers: Patek Philippe, Audemars Piguet, and Vacheron Constantin. These three brands are considered by many the pinnacles of haute horology and tradition. Based on their prices and revenue evolution, they are most probably also at the pinnacle of profitability.

Between 2014 and 2019, Morgan Stanley estimated that Breguet had annual revenues of CHF 500m, similar to the smallest member of "the holy trinity", Vacheron Constantin. From 2019 to 2023, the same company estimated that the "holy trinity" increased their total revenues by 85%. Having Breguet as part of the group's brand portfolio could have enabled The Swatch Group to benefit from this watch explosion. But, in the same period, Breguet collapsed by 60%. Breguet's underperformance against its peer group has caused the group to miss CHF 720m in revenues. Given the incredible margins, most of that revenue would have ended up in the bottom line. Remember, the group's net income in 2023 was just CHF 870M. All things equal, if Breguet had performed like "the holy trinity", the group could have reached a similar level of net earnings in 2023 vs. 2015 peak.

Finally, until the beginning of 2024 management had not undergone any cost structure optimization to adjust to the new "revenue" reality. With the advent of smartwatches, it has become clear the demand is lower for "traditional" watches. In 2023, The Swatch Group employed the same number of people as in 2014. By contrast, watch volumes had gone down by 60%. This oversized structure has had a negative impact on the P&L. Total operating expenses have gone up from 59% of revenues in 2014 to almost 70% in 2023. The lack of cost optimization has resulted in an operating margin drop of 20% in 2014 to 15% in 2023 despite the very strong watch market.

How The Market Valuation Got There: 2) Hayek's Indifference To Fixing The Lagging Financial Performance

An underperforming leader operating in a positive market would not be happy with decreasing levels of profitability. Both management and owners would act visibly disappointed with the results and would have presented (and after so long probably already carried out) a performance improvement plan, maybe executed by a new CEO.

The Swatch Group has done things differently. In addition to having 43% of voting rights, the Hayek family runs the group by holding key management positions. Nick Hayek, the son of The Swatch Group's founder, is the CEO of the whole group and Nayla Hayek, his sister, is the group chair. In the last results presentation meeting in January, Nick was asked by a minority investor about the shares' lagging performance. These are direct quotes from his answer:

"The family is very happy with the performance of The Swatch Group..."

"We are in the business of selling watches, not shares..."

"…If investors don’t like the company or the way it’s managed and governed, they can invest elsewhere."

Here is an article on the presentation. In my opinion, this Q&A was the last straw for the investor community. It reinforced the feeling that The Swatch Group's CEO and main owner is completely indifference towards the group's performance, providing little hope for a significant improvement in its future profitability. The bearer shares in CHF have performed terribly in 2024 with a 5% share drop just during the results' presentation day. As of July 19th, after the H1 result announcement, the shares are 20% down YTD.

What You Get At This Price: A Sound Luxury Business At A Low PER With A Decent Dividend Yield

The probability the Hayek family liquidates the company to unlock value for the minority shareholders is virtually zero. However, at this share price, what you get as a minority stakeholder from The Swatch Group's operations is a bargain.

With an average retail watch price of 820 CHF, The Swatch Group does not look like a "luxury" player. However, in 2022, Morgan Stanley estimated that Omega provided more than 60% of the group's operating margin contribution. With an average watch retail price of 6,600 CHF, nobody would argue that Omega is not a luxury brand.

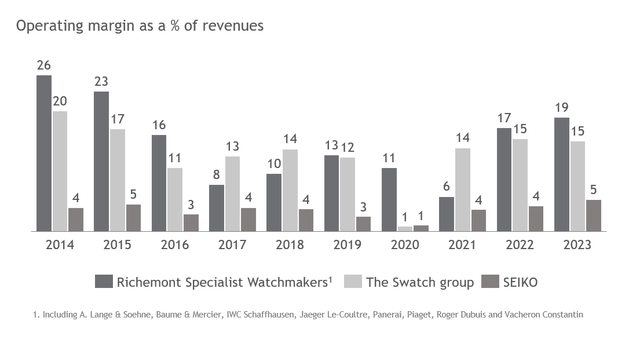

Additionally, both Harry Winston and Blancpain, brands significantly more upscale than Omega, are increasingly bigger and contributing to the group's operating profit significantly. The "luxury" nature of The Swatch Group's business can also be seen in its margins. With a 13% historical operating margin, The Swatch Group is comparable to Richemont specialist watchmakers (15%), even if Richemont's subsidiary sells watches at an average CHF 7,900. By contrast, Seiko Holdings with an average watch retail price of just CHF 150, operates with an average margin below 4%.

Historical operating margin (Companies' financial reports)

The Swatch Group, as a luxury player, is trading at net cash-adjusted 2023 PER of almost 9. If you consider the historical average earnings since 2014 incl. terrible year of 2020, the net cash-adjusted PER is below 9. Considering the earnings peak of 2014, it is trading at a PER below 5. Despite a recent drop in its shares prices, Richemont and LVMH, two luxury titans, are trading at trailing PER above 20 and historical 10-year trailing values above 30.

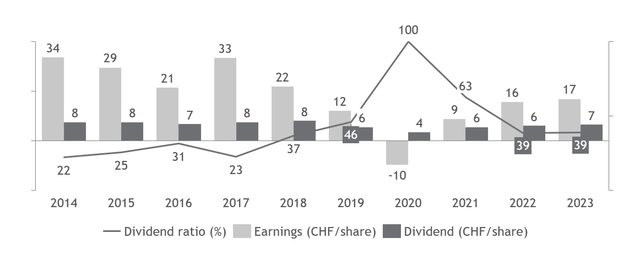

Moreover, the trailing dividend yield is currently 3.7%, similar to the dividend yield considering the average 10-year dividend. The company has paid dividends every single year including 2020, when the company posted negative net earnings. Historically, the dividend remuneration has varied according to the net earnings and on average, the payout ratio has been a perfectly rounded 35%.

Historical earnings, dividends, and dividend ratio of bearer shares (UHR) (Company's financial reports)

On top of the low valuation and decent dividend yield, let's not forget that almost 20% of Swatch group's market cap is net liquidity and has been cash-generative every single year since data became available.

What The Market Might Be Getting Wrong: The Swatch Group's Positive Outlook

The current valuation implies that The Swatch Group's historical underperformance will continue. 2024 H1 was, for many, a sign of what is still to come. That is the reason why the market offers a leading luxury company underpinned by an extremely strong anchor brand like Omega and unparalleled economies of scale in watch components and movement production at a third of the current S&P 500's PER or at less than half of the company's liquidation value.

However, there are 4 main reasons to believe that after the recent downmarket for watches, The Swatch Group's net earnings will rise back to at least its historical average.

Firstly, despite the strong CHF, The Swatch Group has had some momentum before 2024. In 2023, net earnings were the highest since 2015 thanks to the success of brands beyond Omega. Swatch with the Moonswatch, Tissot with the PRX and especially Longines with its heritage models were key drivers of The Swatch Group's strong results.

It seems that Gen Zs are becoming avid buyers of watches and are reversing the decrease in watch volumes. After a 50% reduction in watch volume exports, the group's manufacturing plants are clearly underutilized (thanks also to the lack of cost-cutting efforts from our unbeloved Nick). So, if the watch volume destruction from smartwatches has finally come to an end, the margin contribution from growing volumes will be easy to leverage without heavy investments.

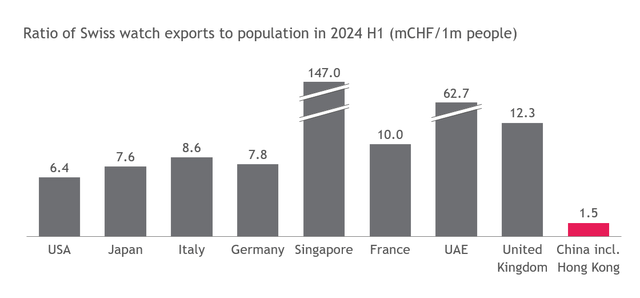

Secondly, there is little doubt that China will be back and will again become a main growth driver for Swiss watch imports. In H1 2024, the value of Swiss watch annual exports to China incl. Hong Kong was around CHF 1.5M per million inhabitants. This ratio is more than 6 times smaller than the US, more than 7 times smaller than Japan, and 12 times smaller than the UK.

Given the high affinity to luxury of Chinese consumers, it is highly probable that this gap will get smaller as the GDP per capita of China continues to catch up with the most developed nations. As explained, Omega and Longines are the second- and third-largest watch brands in China, boasting incredible brand equity built over decades. When the Chinese appetite for luxury resumes, The Swatch Group will be one of the companies that benefits most.

Ratio of Swiss watch exports to population for key export markets (Federation of the Swiss Watch Industry)

Thirdly, let's talk about the hidden gem in The Swatch Group portfolio: Harry Winston. In 2013, the Swatch Group paid an equivalent of CHF 1.15b for Harry Winston (HW), a US luxury jeweler colloquially known as "King of diamonds". At the time, HW's business was mainly focused on the US, its home market, and reached revenues of CHF 380m.

Since then, HW has expanded successfully to other geographies, especially Japan and mainland China. HW does not disclose revenues per geography, but anecdotally the combined number of sales points in China and Japan is 50% higher than in the US. Management disclosed that sales were expected to reach CHF 1b in 2024, 2.6 times the level at the acquisition. During the same time period, the leading Jewelry Maisons of Richemont incl. Cartier and van Cleef & Arpels, arguably the most prestigious jewelry brands, "only" increased their organic revenue in CHF by 2.1. Branded jewelry has become one of the fastest-growing luxury segments and, given it has reached 10% of the group's total revenues, HW will start to have a significant impact on the group's overall performance.

Finally, Omega, the crown jewel and anchor brand of The Swatch Group, has a positive future. As we discussed, Omega is estimated to contribute more than 60% of The Swatch Group's operating margin. The moon, the Olympics, James Bond… Omega has entered into pop culture as a luxury brand as no other in the watch industry but Rolex. Omega's collections offer hundreds of variations to cater to every taste. It offers sports watches like the legendary Speedmasters and Seamasters, but also dress watches in the De Ville collection and some Aqua Terras. This wide range of options provides Omega with a high level of resilience against trends or hypes. In my view, this anti-trend resilience combined with a huge fan community, a strong position across all major markets, and superb in-house movements is unique across watch brands.

While its main rival Rolex exploded (est. retail value share: 30.8% in 2023 vs 18.3% in 2017), Omega was able to increase its average retail prices, diversify away from the Chinese market (its stronghold) while moderately increasing revenues from CHF 2,500M to CHF 2,600M despite an appreciating currency. Considering Omega's successful past, a single-digit increase in operating margin contribution from this brand in the coming years seems very plausible.

What Should Keep You Awake At Night: Nick Hayek, The Bear Case

Despite the clear undervaluation, extremely solid balance sheet, and positive long-term outlook, I would like to point out the largest risk(s) for this investment.

Greater China had always been a major risk (as well as opportunity). However, The Swatch Group has been diversifying away and management published that "only" 33% of its net revenues in 2023 came from this market. In 2024 H1, management disclosed an overall revenue drop of 14.3% while sales outside of China were constant. By using the average sales in China in 2023, you can calculate that the sales in greater China in 2024 were down by a whopping 75%.

At this point, I see a huge opportunity in this market. There is always a risk that due to geopolitics the Chinese market becomes inaccessible to Western companies as happened in Russia. Nevertheless, I think this scenario is radically less probable in the coming 5 years than a massive recovery of Chinese demand for luxury goods incl. watches.

Desirability for watches has also been another major risk for me. Wearing a mechanical watch based on an anachronic technology feels completely outdated. The Swatch Group is almost a pure play in watches and would suffer massively from a marked reduction in the appeal of watches. After looking at the resilience of the watch industry after the quartz crisis, the mobile phone penetration, and the introduction of smartwatches, I have become convinced that the incredible marketing minds and budget of the Swiss watch companies will continue to convince us to buy a multi-thousand watch timepiece for virtually the same functionality as a CHF 10 watch.

On the other hand, Nick Hayek and his family would keep me awake at night. The Swatch Group exhibits clear signs of poor capital allocation (extremely high inventories, an absurd amount of net cash, 17 individual brands,…), which results in a historically moderate ROCE of 10% despite Omega's strong position in a highly profitable price segment. Moreover, the Hayek family has neglected legendary brands such as Breguet, missing out on a maybe once-in-a-generation explosion of sales in its price segment, and have avoided a cost structure optimization to improve profitability.

Nick Hayek, the CEO, always speaks about their long-term focus and no debt policy. However, the basic EPS has decreased by 35% since 2014. Considering the results of 2024 H1, the trend has been even worse. Unfortunately, this performance would not be adequate even for the most patient of investors and just feels like poor, long-term track record. However, the Hayek family's voting rights majority enables them to run an extremely undervalued listed company without being threatened by external investors.

However, after the terrible half-year results, even the Hayek family is starting to be unhappy with their company's performance. The CEO has launched a cost-cutting program, something he only temporarily did at the peak of the pandemic. This program might be bearing fruits. Management disclosed that the group's operating margin returned to 15% in June, 2 percentage points above the 10-year historical average. This time, the Hayek family is putting their money where their mouth is: By mid-July, they had already bought shares worth more than CHF 31m in 2024.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.