Nikada/iStock Unreleased via Getty Images

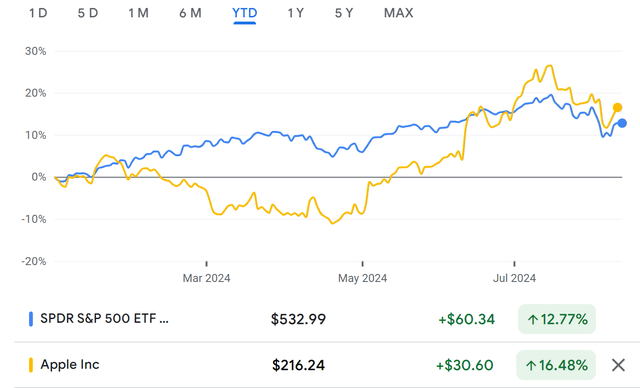

For most of 2024, Apple (NASDAQ:AAPL) was underperforming the S&P 500.

However, since May, it staged a huge comeback, returning more than 40% from the trough to the peak.

As of the writing of this article, Apple continued to outperform the S&P 500 by 3.7%.

Apple and S&P 500 comparison (Google Finance)

Where did this outperformance come from?

There are multiple tailwinds that supported this tailwind, including growing interest in Apple's AI features, improving landscape in China, amongst others.

The question is whether the stock price has gotten too far ahead of the fundamentals.

Today, I will share more about the numbers Apple reported in its FY3Q24 results, some of the commentary I have seen about Apple Intelligence and China, which will help to bring a better perspective on how the stock price relates to the company's fundamentals.

I have written extensively about Apple on Seeking Alpha, which can be found here.

First, let us go deeper into Apple's recently reported numbers.

FY3Q24 results

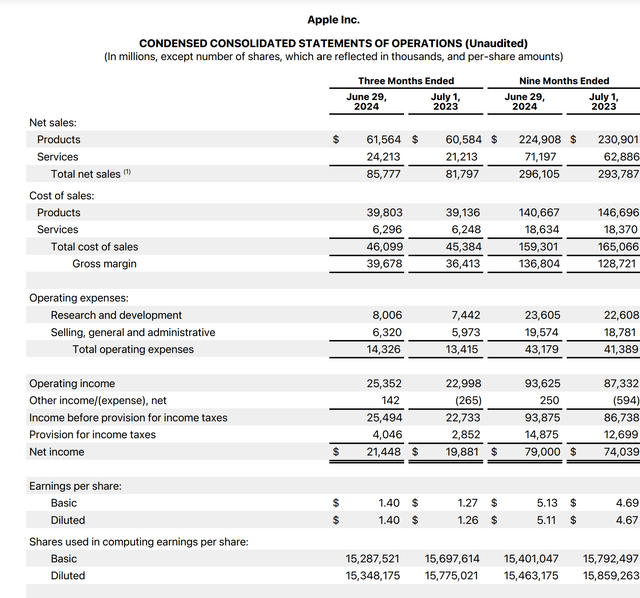

Total revenues grew 5% from the prior year to $85.8 billion, beating consensus by 2%.

Total company gross margin was 46.3%, beating consensus expectations of 46.2%, reflecting Services gross margin of 74.0% and Product gross margin of 35.3%.

EPS came in at $1.40, beating consensus by 5%. The beat in EPS comes due to operating expenses coming in at the low end of the guidance range.

3Q24 summary (Apple)

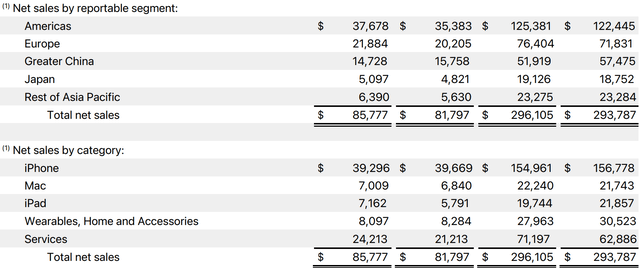

Looking into revenues by category and geography will help show us where the relative strength was in the business for the quarter.

iPhone revenues fell 1% from the prior year to $39.3 billion, 2% ahead of consensus.

Mac revenues grew 2% from the prior year to $7 billion, in-line with consensus.

iPad revenue grew 24% from the prior year, 9% ahead of expectations.

Wearables revenue fell 2% from the prior year, to $8.1 billion, 4% ahead of consensus.

Services revenue grew 14% from the prior year to $24.2 billion, in-line with expectations.

By region, Greater China revenue fell 7% from the prior year and Americas, Japan, Europe, and the Rest of Asia Pacific segment revenues grew 6%, 6%, 8% and 13% respectively.

Apple segment revenue break down (Apple)

By category, iPhone, iPad and Wearables outperformed, and by geography, Americas, Japan, Europe, and the Rest of Asia Pacific segments were the outperformers.

Apple has $153 billion in cash and marketable securities on its balance sheet after repaying $4 billion in maturing debt, returning $3.9 billion in dividends and $26 billion in share repurchases to shareholders.

Outlook

Apple's outlook for the next quarter was not spectacular.

Revenue growth for the next quarter is guided to be similar to what we saw in 3Q24, or 5% growth from the prior year.

Services revenue is expected to grow double digits, similar to what we saw in the first three quarters of the fiscal year.

Gross margin is expected to be between 45.5% and 46.5% and operating expenses are expected to be between $14.2 billion and $14.4 billion.

This could prove conservative and lead to a beat and raise quarter, but management's commentary about the iPhone upgrade cycle is something I saw as a positive from the quarter, which I will touch on later.

Commentary on each category

Apple's installed base of active devices reached a record across all products and geographies, testament to a strong brand that continues to resonate with customers.

iPhone had a decent quarter, with quarterly records in countries like the UK, Spain, Poland, Mexico, Indonesia, and the Philippines, and the iPhone active installed base continued to grow to reach another record in total and in each geographic region.

In terms of satisfaction and market share, iPhone models continued to be the top-selling smartphones globally, and according to surveys done by Kantar, the iPhone was the top-selling model in the US, urban China, the UK, amongst others. 451 Research conducted a survey on customer satisfaction and the iPhone family continues to have 98% customer satisfaction.

With the iOS 18 update, Apple expects the introduction of Apple Intelligence, redesign of the Photos app, new customization options for the home screen, along with messages over satellite to be some of the new features on the iPhone that will continue to drive demand.

iPad had a solid quarter as the launch of the new 11-inch and 13-inch iPad Air and new iPad Pro was successful. Similarly, the new iPad Pro and iPad Air models powered by the M series of Apple Silicon will be able to use Apple Intelligence capabilities.

With the Mac segment, every Mac Apple shipped with Apple Silicon since 2020 can be used to take advantage of Apple Intelligence with Mac OS Sequoia.

Both the Mac and iPad installed base reached a record this quarter, with half of MacBook Air customers being new to Mac and half of iPad buyers were new to the product. Customer satisfaction for the Mac and iPad are 96% and 97% respectively.

In Wearables, Home and Accessories, Watch and AirPods faced a difficult comparison from the prior year where we saw the launches of AirPods Pro second generation, Watch SE and Watch Ultra last year.

Within Wearables, Home and Accessories, the Apple Watch continues to be popular, with 97% customer satisfaction and almost two-thirds of Apple Watch buyers being new to the product.

Services revenue reached a record, and paid subscriptions also reached an all-time high, with most of the categories within services, like advertising, cloud and payment services, all recording all-time high revenues.

Tap to Pay on iPhone was expanded to more markets in the quarter, like Japan, Canada, Italy, and Germany, which enables businesses to use iPhone to accept contactless payments.

The services segment continued to show strong traction due to the record active devices installed base. Paid accounts grew double digits from the prior year, and paid subscriptions also grew double digits. Apple now has more than one billion paid subscriptions across the services on its platforms, more than double from the number it had four years ago, highlighting the continued expansion of its ecosystem.

China

Apple is seeing some stabilization in China, while sales were down 7% from the prior year, foreign exchange was down 3%, so the iPhone revenues in greater China actually improved. As a result, more than half of the decline is currency related, so on a constant currency basis, revenues actually fell by less than 3%.

As a result, this quarter saw an improvement in the Greater China region relative to the first few quarters.

Apple saw a record for the iPhone installed base, as well as a June record in iPhone upgrades in Mainland China.

Again, based on a survey from Kantar, in the quarter, iPhones were the top three models in urban China.

Another thing Apple is looking at is that the iPhone 15 family is outperforming the iPhone 13 family for the same number of weeks since launch, which shows that overall, the iPhone 15 is outperforming the iPhone 14 in China, which is another encouraging sign.

Lastly, a majority of the customers buying the Mac, Watch or iPad in Mainland China are buying it for the first time.

As a result, Apple remains optimistic and confident about the long-term opportunity in the Greater China region, despite the near-term volatility.

Apple Intelligence

CEO Tim Cook stated that "I would just say that with Apple Intelligence, we are very excited about the level of value that we're going to provide to users. And we believe that that presents another reason for a compelling upgrade."

Management reiterated the point about Apple Intelligence being another compelling reason for an upgrade multiple times in the earnings call.

Management is confident in the upcoming product cycle and refresh, in particular Apple Intelligence.

After launching Apple Intelligence tools earlier last week to developers, like the redesigned Siri, natural language search, writing tools, memory creation and more, the results have been encouraging thus far.

Discussions with developers indicate a positive response to AI features, particularly notification summary and reduced interruption focus.

Apple will roll out AI tools more broadly this fall, and it will add ChatGPT integration by the end of the year and more languages and regions over the course of next year.

If you recall, Apple stock was recently rerated in 2024 as a result of hopes that the company's launch of new AI features in what it calls Apple Intelligence, will result in an upgrade cycle for its iPhone category in particular.

With interest in Apple Intelligence features available in only limited models of the iPhone 15 family, most current users of iPhones would have to upgrade to enjoy the Apple Intelligence features.

This sparks the debate about whether this upgrade cycle will occur, and if so, what will the magnitude of this upgrade cycle look like.

Apple CEO Tim Cook seems confident in Apple Intelligence appealing to consumers and thus resulting in an upgrade.

I do think that the release of Apple Intelligence will drive an upgrade cycle as Apple has not really launched any significant hardware or software features in a while, and the interest and significance of Apple Intelligence indicates that this could be the pivotal new feature that drives interest in the upgrading of iPhones.

Foxconn checks

Foxconn is one of the most important supply chain partners to Apple.

The company currently makes 80% of iPhones for Apple.

While Apple is expected to gradually shift more iPhone model production to India, Foxconn is still a key partner to Apple for the iPhone 16 lineup.

Apple has reportedly decided to increase production by 10% this year, with a total output for iPhone 16 models at 90 million units.

This is supposedly in expectation of strong sales.

As a result, Apple has recently intensified production efforts with Foxconn to ensure it gets the supply it needs to meet demand.

Based on some checks, Foxconn is said to have hired another 50,000 more workers in the last two weeks in its Zhengzhou factory, which is now operating at full capacity.

Foxconn typically sees peak iPhone production start in August, and this continues through December.

This increased hiring by Foxconn is an important indicator that the company is indeed trying to meet the demand of higher required iPhone output by Apple.

In fact, Foxconn had to significantly increase wages and bonuses to attract these additional 50,000 workers, with an advertisement in late July showing the hiring bonus was raised from 6,000 yuan to 7,500 yuan and the hourly wage was increased to up to 25 yuan.

I think this move by Foxconn is an encouraging sign that Apple is expecting strong demand for its iPhone 16 lineup, with supply correspondingly increased to meet that demand.

Valuation

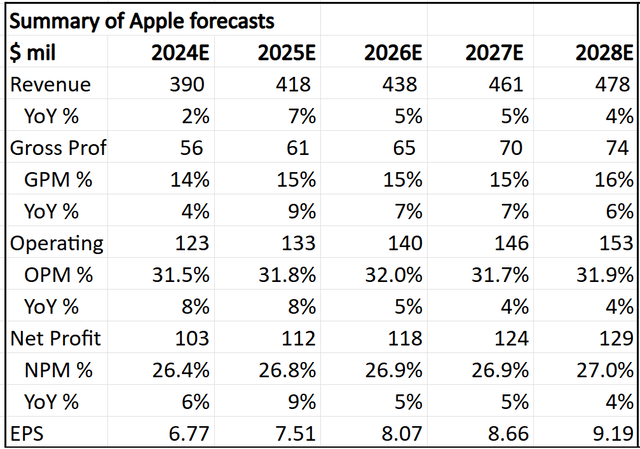

My 5-year forecasts for Apple are summarized below.

The business has been growing relatively slowly due to the lack of an upgrade cycle, but if Apple Intelligence results in a greater upgrade cycle than expected, this could result in a greater acceleration in revenues for Apple.

My 5-year financial forecasts for Apple (Author generated)

My intrinsic value for the company is $187.

The key assumptions embedded in the financial model are a 30x terminal multiple and 9% cost of equity.

My 1-year and 3-year price targets are $225 and $260, implying 30x 2025 and 2027 P/E multiples, respectively.

In my opinion, these multiples are not necessarily conservative, which suggests Apple shares may be currently fairly valued unless we do see an acceleration in demand with Apple Intelligence.

Conclusion

Apple continued to deliver and execute well in the quarter, beating on the top and bottom-lines.

The company seems to be seeing an acceleration in the Greater China region, with the degree of revenue fall narrowing from the prior quarter, and other trends and metrics showing that Apple remains in a strong position in the region.

This was a strong quarter for the services segment, as the installed base of active devices continued to reach new records, consumers are increasingly using more of Apple's services like advertising, cloud and payment services.

The iPad's successful launch drove some upside in the quarter, with new products helping to drive revenue growth and beat consensus numbers.

Apple Intelligence is closely watched by consumers and investors alike, with the new capabilities added to new products likely to drive better user experiences, and potentially lead to an iPhone upgrade cycle for Apple.

That said, I think it is quite hard to justify buying the company at current valuations unless the extent of the increased demand for the iPhone 16 lineup is significant.

With my valuation assumptions not being the most conservative, this leaves the risk reward for Apple fair at current levels, in my view.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.