Matteo Colombo/DigitalVision via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco California Value Municipal Income Trust (NYSE:VCV) as an investment option at its current market price. The trust's investment objective is to "provide current income exempt from federal and California income taxes".

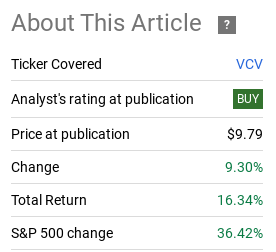

It has been a while since I covered VCV, but my followers know I have spoken positively about the fund in the past. This was true in my last review when I said a strong buy case inherent in this CEF. Looking back, this optimism appears to have been well-supported, with VCV pumping out a solid gain in the interim:

Fund Performance (Seeking Alpha)

The fact is a double-digit return for a municipal bond fund in a year and a half is a pretty strong record. This led me to consider whether or not the momentum has run its course or if VCV still has room to move higher.

After review, I continue to believe VCV can push higher in the short term. There is plenty of bullish momentum for the muni sector and I think this particular CEF is priced right for value. I will dig into the supporting background for this "buy" call in detail below.

Valuation Still Enticing

One of the best ways to find value in the municipal bond space is to target CEFs trading at a discount to NAV. This was indeed the case with VCV when I first started covering it, and it remains the case today. To be fair, the valuation story is not quite as attractive at this moment as it has been in the past. Consider that in my 2023 article, VCV had a discount to NAV in excess of 12%. Today that metric has narrowed considerably:

| NAV | Current Market Price | Discount to NAV |

| $11.38/share | $10.70/share | (6%) |

Source: Invesco

To be fair, investors in VCV today are not quite getting the same deal they would have gotten a year ago. But that is the case with most investments! We have to consider the value we are getting at the current price and whether or not that is worth it. I believe it is. While a narrower discount is not as attractive, it still represents a decent bang for your buck. Considering VCV has offered a return above 16% since the discount was in double digits, I am okay with that trade-off.

The bottom line for me is that VCV has plenty of momentum, a favorable macro-backdrop, and offers investors a discount to NAV. Even though the discount is a bit smaller than I'd like, it is still much preferable to the funds out there trading at par or at a premium. This supports the "buy" case for me.

Yield Curve Is Normalizing, A Boon For Leveraged CEFs

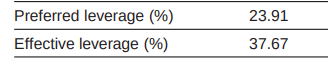

The next attribute I am going to look at is the fund's use of leverage. VCV is not unlike many muni CEFs in that it employs quite a bit of leverage in order to amplify its distribution rate. This fund is certainly on the high end of the leverage spectrum, with an effective leverage rate of over 37%:

VCV's Use of Leverage (Invesco)

In the right environment, this can be very beneficial for the fund. The challenge in the past few years has been that leverage costs have spiked for two reasons. One, interest rates have risen, which naturally makes the cost of borrowing higher. Two, the yield curve has been inverted, meaning that short-term borrowing costs are rising faster than the yields offered by longer-dated securities. This dynamic has caused many leveraged CEFs to plummet in value because their borrowing costs were too elevated for the macro-backdrop.

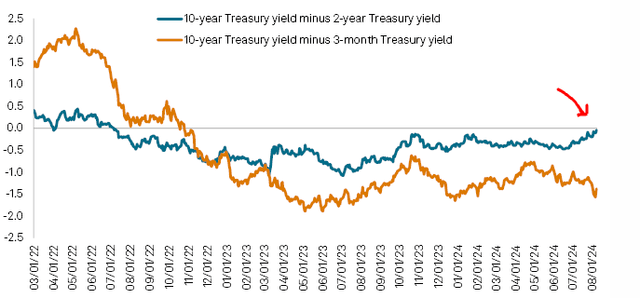

Fortunately, for VCV and for most other muni CEFs, there is a respite on the horizon. With the Fed expected to cut interest rates at some point this year, the yield curve has finally started to normalize. The 2-10 year treasury yield curve (probably the most closely watched) has become very close to un-inverting, as shown in the graphic below:

Treasury Yield Curve (S&P Global)

This is a major win for leverage muni CEF investors because it is removing what has been one of the biggest headwinds facing this corner of the market. This is helpful for VCV - but also the plethora of other funds in this space. Given VCV's extensive use of leverage, I see this as a big positive for the fund and support my continued buy rating.

But I wanted to make it clear that this benefit is not unique to VCV. Many other funds employ similar levels of leverage and this is a positive catalyst for them too. So keep that in mind when evaluating VCV against the other muni CEFs that are out there before deciding which one to put in your portfolio.

Still In The Sweet Spot For Bonds

My next topic has more of a macro-focus. This still makes it relevant for VCV, but it is also a positive attribute for most (if not all) fixed-income bonds at this moment. So I see this as a supporting factor for buying VCV, but I want to be upfront in that investors could use this as a bullish catalyst if they are considering other bond options outside of California munis.

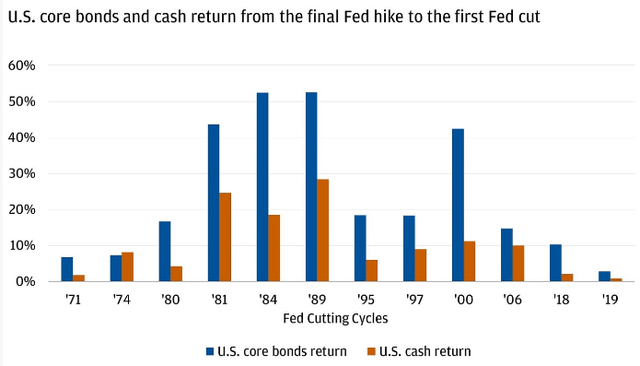

What I am referring to here is the interest rate environment. As readers are surely aware, the Fed has been on "pause" for quite a while. After embarking on a rate hiking program starting in 2022, the Fed has kept rates steady and is likely going to cut rates at some point before the end of the year. This type of macro-environment, where rates are on hold and a cut (rather than another hike) is expected, is very positive for fixed-income bonds. In fact, bond returns out-perform cash in this scenario in almost every cycle historically:

Returns During Fed "Pauses" (JPMorgan)

I bring this up because this environment continues to this day. The market is hoping for a Fed cut by September, but that is not a foregone conclusion, and it may come later than that. Regardless, we are still in a cycle where rates are on hold and that is positive for bonds.

Cash returns are probably not going to beat bonds as long as yields remain relatively high and investors continue to rotate into the sector to front-run eventual rate cuts. This means there is inherent value in the sector, whether through VCV or any other number of options. This adds up to a "buy" case in my view.

Credit Quality For Munis Is Strong

Sticking with the macro-themes, another positive is the backdrop for municipal bonds overall. Again, this is relevant for VCV but also for the plethora of muni funds out there on the open market. But, either way, this supports my continued bullishness for the municipal bond sector as a whole.

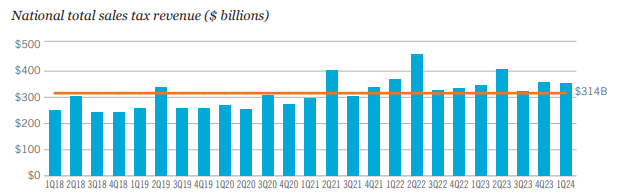

Some attributes that have caught my attention are as follows. First, national sales tax revenue has been robust coming out of the Covid-19 lockdowns. This is being driven by strong consumer spending and also inflation. Because as prices go up, so too does tax collections, all other things being equal. The reason is that sales taxes are flat rates, so those rates are applied to higher amounts and, thus, bring in more revenue for the municipality.

The numbers themselves are quite clear. Recent quarters show tax receipts are above long-term averages, helping to support the credit quality of the underlying issuers of muni bonds. These are the taxing authorities or state and local government municipalities:

National Sales Tax Revenue (Aggregate) (US Census Bureau)

As long as these figures come in strong, that bodes well for the credit quality of General Obligation (GO) muni bonds because those are backed by the creditworthiness of the state and local government issuing the bond. When tax collections are robust, the chances of these municipalities defaulting on their debt are low.

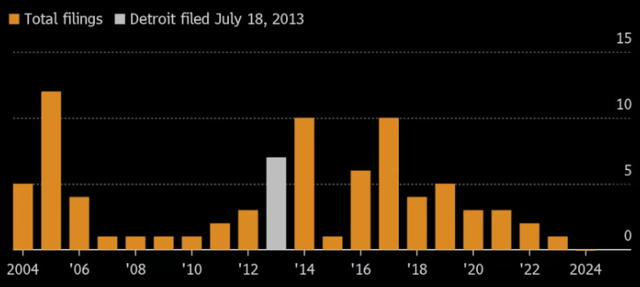

And that isn't just my prediction, it is reality. With sales tax and income tax collections up in aggregate across the country, delinquencies and bankruptcy filings for muni bond issuers are at multi-year lows. This is a continuation of a trend that has been ongoing since 2019, as shown in the graphic below:

Bankruptcy Filings By Year (US Municipalities) (Bloomberg Law)

The takeaway for me is that municipal bonds are well-supported at the moment and the overriding lack of credit delinquencies reflects this story. As long as tax authorities are collecting high tax receipts and making good on their credit obligations, the muni sector's rally is likely to continue. This provides a nice tailwind for VCV and other muni bond CEFs.

California's Budget Provides Some Confidence

I will now shift to the fiscal picture in California because that is where VCV's focus is. As a predominately single-state CEF, VCV has concentration risk in that it is heavily reliant on the performance of one state and the local governments within this state. This risk can certainly be worth it, especially for in-state residents, since the tax savings are significant. But that doesn't change the fact that VCV is exposed to negative headlines regarding the Golden State in a way that multi-state, national CEFs are not.

This should be top-of-mind for investors because often the headlines coming out of California do not seem too rosy. Examples are as follows:

Headline News - California Budget (Associated Press) Headline News - California (NYT) Headline News - California (Yahoo Finance)

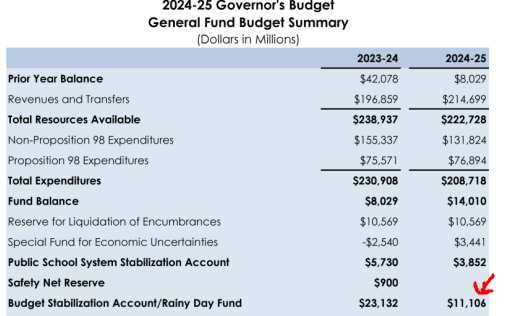

As you can see, focusing on headlines can be a bit sensational at times. But I won't sit here and say that California doesn't have its share of problems. After building up an impressive "rainy day" fund, the state embarked on some ambitious spending programs that have left a big budget deficit, requiring cuts and hard decisions to be made.

Fortunately, the most recent budget reduces ongoing spending by $16 billion to better align expenditures with anticipated revenues. Further, the state tapped its reserves in the rainy day fund to plug the gaps in the immediate term. This limits the risk of any late payments or delinquencies by state and local governments for the time being:

Budget Summary - California (S&P Global)

Ultimately, this is good news for muni bondholders. But I would caution anyone from getting too complacent here. While the state legislature has shown it is willing to make changes (new taxes, cutting spending, etc.) to adjust to fiscal reality, the state isn't out of the woods yet so to speak. There will need to be more sustainable and structural changes in the future to balance the budget, rather than relying on the implementation of one-time measures.

So the name of the game here is to be an avid follower of what is going on in the state and within local governments that back the bonds within VCV's portfolio. For now, I see quality bonds backed by municipalities that can pay their debts. But longer term I will keep my eye on California with a critical lens and I suggest my followers do the same.

Bottom line

VCV has been pumping out strong gains and I see that continuing. The fund still trades at a nice discount to NAV, the tax-adjusted yield is very attractive - especially for California residents - and the recent budget out of California shows that the GO bonds backed by the state are in no danger of default or delinquency. To me, all of this adds up to a continued buy case for this fund and I would encourage readers to give the idea some thought at this time.

Consider the Income Lab