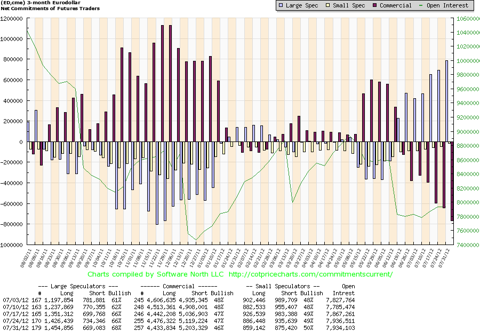

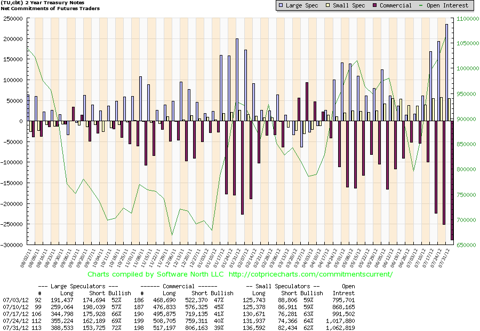

The Commercial of Traders (COT) is suggesting that the markets are far too optimistic about further short-end-of-the-curve rate cuts. Indeed given the way grains, oil and gasoline prices have rapidly lit up lately, we may be looking at actual increases in short-term rates. Further as I (and others) have suggested, ZIRP is very costly to money market funds, insurers, and even banks. Although I don't see central rate maneuvering in a debt bubble as material let alone effective, some have even argued that to get people to borrow, the Fed needs to signal that rates will move back up. In terms of Treasury supply the Fed would have to be extremely active to restrain rates at almost no return.

Additionally the bizarre trade into what I have called the Bogus AAA Sovereign Stupidity Arbitrage may have come to a head. Finally there are abundant signs of inflation on a number fronts (Walks, Talks, Looks Like Stinkin Inflation).

The commercials are now very heavy short euro dollars and 2-year Treasuries. They are short the whole Treasury curve, but especially the short end. I am short Sept eurod ollar and 2-year Treasury futures.

The latest on five-year inflation expectations: Ease ahead; hardly they need to tighten.

source: Zero Hedge

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.