Part I of this series focused on the continual reduction of rigs exploring for natural gas in the domestic U.S. lower 48. All the while, commodity prices continue to surge upward with futures prices even higher.

This third part will focus on the oil service providers that will benefit from what could become surging demand for services work as both oil and natural gas producers scramble for available crews.

As mentioned in Part I, the Baker Hughes (BHI) rig report on October 12th showed an interesting divergence with the commodity markets. While natural gas has jumped some 60% in the past few months, the amount of rigs drilling for natural gas plunged to lows not seen since 1999. On the October 19th report, the natural gas rig count increased 5 up to 427. A year ago, the count was 927.

Oil Service Providers

As mentioned in Part I, oil service providers stand to benefit from the higher gas prices in the domestic U.S., as it should stimulate more drilling services. A few large multi-national companies and smaller domestic only players characterize the oil services industry. Both groups of companies will benefit from increased demand in the natural gas sector, but the impact will be materially different based on the company.

Below is a list of the companies that stand to greatly benefit from higher prices:

C&J Energy Services (CJES) - the company was mostly focused on hydraulic fracturing in the domestic markets until a recent deal for Casehole Holdings, Inc. to provide inroads into wireline perforation services in the Bakken Shale play.

C&J Energy will benefit greatly from a return to growth in fracturing demand as it more than doubled horsepower in the fleet over the last year. Coiled tubing capacity also increased by 40% in the last year. While other companies stalled growth over the last year, this company has continued to grow at a significant pace.

Analysts expect a sharp decline in earnings in 2013, even though revenue is forecasted to expand by 16% over 2012. Even at the reduced earnings rate, the company trades at only 6x the earnings estimates.

Halliburton (HAL) - the company is a leading multi-national player that focuses more on the domestic plays. Halliburton saw strong growth in international markets during Q3, but the 55% focus on domestic markets has held back results. Along with Baker Hughes, the company will gain the most amongst the multi-nationals with a rebound in the domestic land drilling market.

Analysts still forecast a slight gain for 2013 earnings after a drop in 2012. The stock though only trades at 11x earnings with expectations for a nearly 15% long-term growth rate.

Heckmann (HEK) - this is a fast-growing environmental company that provides wastewater removal services for the hydraulic fracturing industry. It provides services in nearly all major shale basins, which has hurt margins. The 100% focus on the domestic markets will naturally provide a significant boost if the natural gas market recovers.

Though revenue is expected to grow by 120% this year, the company still only expects breakeven results. The recent announced deal (See Heckmann Makes Game-Changing Merger) to buy Power Fuels will provide a significant boost to profits as well as access to the Bakken shale. The estimate back in September was for a profit boost of over $0.40 per share.

The Q3 earnings report on November 9th should provide more details on the merger.

Schlumberger Limited (SLB) - the company is a leading multi-national oil services provider with expected revenue of over $40B. Domestic revenue though only hit 31% in the recently reported Q3 numbers. While the company won't benefit directly as much from a rebound in domestic land drilling, the stock will rebound strongly as that demand grows and reduces pricing pressure on service providers around the world.

With the strong international focus, analysts expect huge growth in 2013 after strong growth in 2012. The stock trades at a higher 15x forecasted earnings, but analysts expect an 18% long-term growth rate.

Weatherford International (WFT) - the company is another one of the multi-national oil service firms. It focuses more on the international markets. Similar to Schlumberger, it will benefit from the overall increased demand and reduction on pricing pressures in the domestic markets.

Weatherford has been undergoing lengthy accounting issues with taxes that have helped hold the stock back. The company only trades at 9x 2013 estimates with, analysts expecting a 33% jump over 2012 estimates. A resolution of the tax issues combined with a strong domestic market would provide two significant catalysts for the stock.

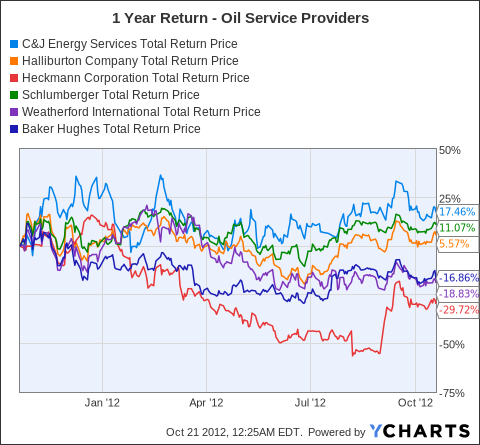

Stock Returns

Below are the stock returns over the last year for the above mentioned oil service firms:

CJES Total Return Price data by YCharts

Ironically, C&J Energy has had the strongest gains at 15%, even though the stock has gone virtually nowhere during 2012. No surprise, Heckmann and Weatherford have had the largest declines. Otherwise, the strongest two firms, Halliburton and Schlumberger, have continued to plod along with slight gains.

Conclusion

All of these leading oil service providers offer compelling investment options with or without a recovering domestic natural gas market. The ones more focused on the international markets will see the benefits of both segments being strong at the same time.

Ultimately though, the more speculative and domestically focused stocks such as C&J Energy and Heckmann will benefit the most from a natural gas recovery leading to higher demand and a shortage of drilling rigs. Both companies have remained aggressive via adding equipment and making very accretive deals for private firms. When the market returns to growth, investors in both stocks will reap huge rewards.

Disclosure: I am long CJES, HEK, WFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Please consult your financial advisor before making any investment decisions.